In September of 2017, I received slightly over $100K from my former employer, representing the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

Performance in Review

Let’s start with the numbers as of July 5th, 2023 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $221,603.75

- Dividends paid: $4,666.82 (TTM)

- Average yield: 2.11%

- 2022 performance: -12.08%

- SPY= -18.17%, XIU.TO = -6.36%

- Dividend growth: +10.83%

Total return since inception (Sep 2017-July 2023): 103.75%

Annualized return (since September 2017 – 70 months): 12.98%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 12.48% (total return 98.61%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 8.72% (total return 62.83%)

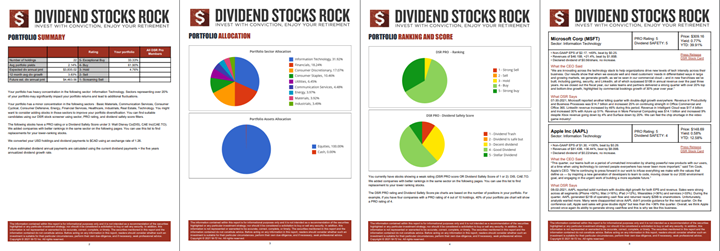

Dynamic sector allocation calculated by DSR PRO as of July 5th, 2023.

Dynamic sector allocation calculated by DSR PRO as of July 5th, 2023.

What to Do in This Complicated Environment?

On January 2nd, 2023, investors’ sentiments were quite negative for the year. Many were still digesting their losses from 2022 accentuated by some painful investments in Sylogist, Algonquin, or others. I know because I suffered as well. However, I’m an eternal optimist when it comes to discussing my portfolio and the stock market in general.

I believe the market will always go up. It’s just a matter of time.

Therefore, I started 2023 with the same smile on my face. Fast forward 6 months later, my portfolio is up 12.40% (from $197,155.42 on January 2nd, 2023, to $221,602.34 on July 5th before the bell). Not bad for a supposedly bear market, right?

Here’s an interesting observation: if you read the news, the negative sentiment is overwhelming.

Meanwhile, the S&P 500 is up more than 16%, the NASDAQ is crushing it with +32% and the Canadian market is up almost 6%. Again, not bad for a supposedly bear market. But why do many experts keep warning us about the next collapse? The easy answer is that it brings traffic and clicks (and that’s what pays them). But there’s more.

We still have negative sentiment because we have evolved in a highly complex environment.

Inflation and higher interest rates are difficult to handle as their impact is long-lasting and takes time to manifest themselves. It’s like a chronic disease. You’ll see signs, but you won’t be sure until there is a crisis. Once the crisis happens, it’s a bit late to make changes.

Lessons Learned from Inflation and High-Interest Rates [Podcast]

Which changes should you make to your portfolio?

If you have been loyal to your investment strategy since day 1, you can skip this part and go to my portfolio update. Because that is the trick:

Rule #1: stay invested and stay loyal to your strategy.

A complete investment strategy will guide you in your decision when the market is up, and when the market is down. Earlier this year, I did a spring cleaning of my portfolio:

- Sold Algonquin (AQN.TO)

- Sold Enbridge (ENB.TO)

- Sold VF Corporation (VFC)

I didn’t completely transform my portfolio, but I moved 7% of it (the total of those three holdings) into more solid dividend growers.

I sold AQN and VFC because they cut their dividend. That’s a pillar of my investment rules:

- The company must show a strong dividend triangle.

- The company must increase its dividend every year.

- The company must show a strong investment thesis.

AQN and VFC were negative on all three rules with a weak dividend triangle, a dividend cut, and I was wrong with my investment thesis.

I sold Enbridge because of a weaker dividend triangle and a shift in my investment thesis. I considered the rising cost of pipeline construction and maintenance plus higher interest rates would weigh on their balance sheet. I’m not convinced ENB can continue to maintain its dividend growth policy over the next 5 years.

I’m telling you this not because I think you should sell AQN, VFC or ENB if you have them in your portfolio, but rather to show you my decision process.

Your investment strategy should include a straightforward and fast decision process.

I’ve told you several times: waiting is losing. Too many times I have sat on a loser in the hope it will recover. While it was going nowhere, other opportunities were thriving. The opportunity cost is real. The mental cost of seeing this red line in my brokerage account is also real. You must get rid of both costs and build a stronger portfolio.

Quick guide for a stronger portfolio

Here are the steps I regularly follow to ensure I maintain a robust portfolio that can do well in a complicated environment.

- Define my investment goal: mine is dividend growth, yours could be income, total return, or other goals.

- Define my asset allocation: 100% equities, roughly 50% CAD and 50% USD

- Define my sector allocation: Well diversified, < 20% per sector, sectors focused on growth.

- Side note: I’ll have to cut my allocation on tech again due to appreciation!

- Define my stock allocation: <10% for each position, no small positions, making sure all stocks contribute to my investment goal.

- Side note #2: I’ll have to cut on Apple and potentially Alimentation Couche-Tard

- Review each stock according to my 3 investing rules:

If a stock fails the dividend triangle, dividend growth or the investment thesis rules, it must be sold.

It’s a simple process, but it helps me to stay focused on my long-term goal and not on the short-term market fluctuations. For sector and stock weight, I usually wait until December to proceed with my trades. Therefore, don’t expect me to sell shares in tech this fall.

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 9 companies spread across 7 sectors. My goal is to build a portfolio generating 4-5% in yield across 15 positions. I will continue to add new stocks monthly until I reach that goal. My current yield is 4.60%.

Adding Nutrien (NTR.TO)

While I was tempted to add more Telus, I saw Nutrien appearing on my radar. As you know, I’m not a big fan of material stocks. They are highly dependent on commodity prices and generally make bad dividend growers. Nutrien is no exception in this regard. Before the merger of Agrium and Potash, Potash cut its dividend due to weak commodity prices.

Since the beginning of the year, NTR is on a downtrend mostly related to the same narrative: commodity prices have declined. Management added another layer of uncertainty by lowering their guidance for 2023.

Since the NTR stock price will fluctuate according to commodity prices, it’s always a good idea to look at this type of business during a downtrend. NTR will not likely be part of my portfolio forever, but it makes sense at this price. It’s a classic “buy low, sell higher” type of play.

Here’s my SM portfolio as of July 5th, 2023 (before the bell):

| Company Name | Ticker | Sector | Market Value |

| Brookfield Infrastructure | BIPC.TO | Utilities | $545.13 |

| Canadian National Resources | CNQ.TO | Energy | $446.88 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $548.91 |

| Exchange Income | EIF.TO | Industrials | $571.78 |

| Great-West Lifeco | GWO.TO | Financials | $660.11 |

| National Bank | NA.TO | Financials | $593.64 |

| Telus | T.TO | Communications | $972.04 |

| Nutrien | NTR.TO | Materials | 554.61 |

| TD Bank | TD.TO | Financials | $984.20 |

| Cash (Margin) | -$645.33 | ||

| Total | $5,426.69 | ||

| Amount borrowed | -$5,000.00 |

Let’s look at my CDN portfolio. Numbers are as of July 5th, 2023 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | Cons. Staples | $24,297.12 |

| Brookfield Renewable | BEPC.TO | Utilities | $9,537.20 |

| CAE | CAE.TO | Industrials | $5,908.00 |

| CCL Industries | CCL.B.TO | Materials | $9,051.00 |

| Fortis | FTS.TO | Utilities | $9,729.90 |

| Granite REIT | GRT.UN.TO | Real Estate | $10,184.96 |

| Magna International | MG.TO | Cons. Discre. | $5,269.60 |

| National Bank | NA.TO | Financials | $11,971.74 |

| Royal Bank | RY.TO | Financial | $8,236.80 |

| Cash | $552.72 | ||

| Total | $94,739.04 |

My account shows a variation of +$1,784.19 (+1.88%) since the last income report on June 2nd.

Alimentation Couche-Tard is a GOAT! ATD reported a mixed quarter as revenue declined by 1%, but EPS jumped by 29%. The company reported total merchandise and service revenues of $4.2B, which was up 11%. Same-store merchandise revenues increased by 3.3% in the United States, by 3.0% in Europe and other regions, and by 5.9% in Canada. Unfortunately, the revenue decline was driven by fuel revenue (-4.2%) which more than offset convenience store sales. EPS was up 29% despite higher expenses (+8.8%) as margins expanded for both convenience stores and road transportation fuel segments. ATD is set for another great year!

Here’s my US portfolio now. Numbers are as of July 5th, 2023 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Activision Blizzard | ATVI | Communications | $9,667.44 |

| Apple | AAPL | Inf. Technology | $14,434.50 |

| BlackRock | BLK | Financials | $9,710.12 |

| Disney | DIS | Communications | $4,072.50 |

| Home Depot | HD | Cons. Discret. | $9,300.60 |

| Microsoft | MSFT | Inf. Technology | $18,589.45 |

| Starbucks | SBUX | Cons. Discret. | $8,427.75 |

| Texas Instruments | TXN | Inf. Technology | $8,988.00 |

| Visa | V | Inf. Technology | $11,898.50 |

| Cash | $839.09 | ||

| Total | $95,927.95 |

The US total value account shows a variation of +$3,772.90 (+4.09%) since the last income report on June 2nd.

Quick note: you already know I sold my shares of ATVI on July 11th, but that will be part of my next portfolio update!

All my holdings have reported their earnings over the past few months. It’s now time to relax and enjoy summer until they start reporting again in a few weeks!

My Entire Portfolio Updated for Q2 2023

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of July 5th, 2023.

Download my portfolio Q2 2023 report.

Dividend Income: $569.35 CAD (+5% vs June 2022)

There were many transactions that affected this month’s results. Last year, I owned shares of Enbridge, Sylogist, and VF Corp paying a dividend. They are all now history for my portfolio. On the other hand, I now have more shares of Fortis, CCL, Brookfield Renewable and Home Depot.

I’d say I feel a lot better with those new additions! As I’ve mentioned in previous updates, I’ve reduced my dividend yield this year (notably through the sale of Enbridge to buy CCL), but I’m building a strong dividend growth portfolio for the future.

Here are the details of my dividend payments.

Dividend growth (over the past 12 months):

- Fortis: +82.40% (I added shares)

- Magna Intl: N/A (paid in May last time)

- Granite REIT: +3.4%

- CCL: new

- BEPC: new

- Visa: +20%

- Microsoft: +9.7%

- Home Depot: new

- BlackRock: +2.5%

- Currency: +3.31%

Canadian Holding payouts: $314.64 CAD.

- Fortis: $96.62

- Magna Intl: $42.73

- Granite REIT: $34.13

- CCL: $37.40

- BEPC: $103.76

U.S. Holding payouts: $192.60 USD.

- Visa: $22.50

- Microsoft: $37.40

- Home Depot: $62.70

- BlackRock: $70.00

Total payouts: $569.35 CAD.

*I used a USD/CAD conversion rate of 1.3225

Since I started this portfolio in September 2017, I have received a total of $21,798.38 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

If there is one thing, I love about having a dividend portfolio it is to see that cash being deposited monthly. Once again, I have over $1,000 in cash from dividends in my investment account. I’ll likely take another month before I deploy this money since I’m leaving for Portugal soon. I’ll wait until August to use my dividends to add to an existing position. At this point, I don’t feel the need to add a different company to my portfolio. Sometimes, buying more of what you already have is the best plan!

Cheers,

Mike.

Leave a Reply