In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and drove to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built this portfolio publicly since 2017 to make a real-life case study. I decided to invest 100% of this money in dividend growth stocks.

In August 2017, I received $108,760.02 in a locked retirement account. This means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to tell you to follow my lead. I just want to share how I manage my portfolio monthly with all the good and the bad. I hope you can learn from my experience.

Initiating an Official Position

All right, I told you I would be using dividends sitting in cash in my portfolio to buy more of what I had. I first selected Dollarama as a defensive play in my Smith Manoeuvre portfolio against a potential recession. I guess I can say I was half right! DOL has been quite a performer this year, but we are still not in a recession.

I will share more about this later, but let’s first review my portfolio results.

Performance in Review

Let’s start with the numbers as of July 3rd, 2025 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $299,398.64

- Dividends paid: $5,205.09 (TTM)

- Average yield: 1.74%

- 2024 performance: +26.00%

- VFV.TO= +35.24%, XIU.TO = +20.72%

- Dividend growth: +12.22%

Total return since inception (Sep 2017 – July 2025): 175.28%

Annualized return (since September 2017 – 92 months): 14.12%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 15.71% (total return 206.00%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 11.33% (total return 127.70%)

Initiating an Official Position in Dollarama (DOL.TO)

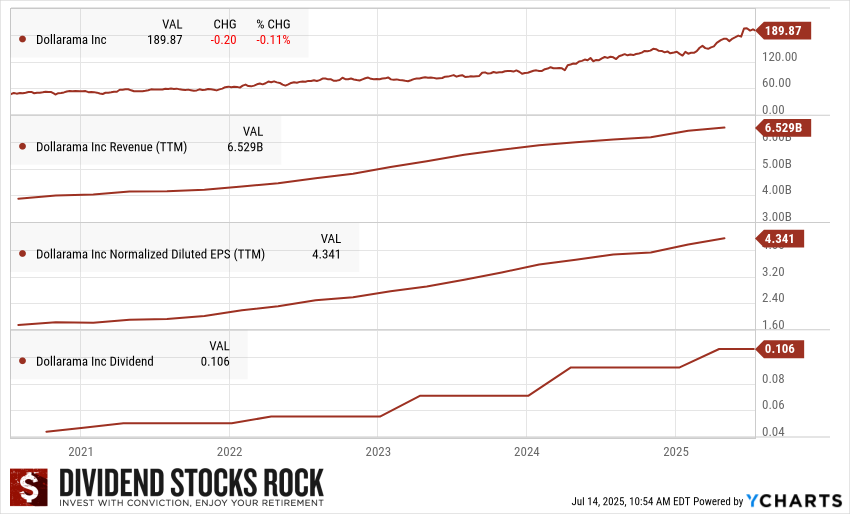

All right, I told you I would be using dividends sitting in cash in my portfolio to buy more of what I had. I first selected Dollarama as a defensive play in my Smith Manoeuvre portfolio against a potential recession. I guess I can say I was half right! DOL has been quite a performer this year, but we are still not in a recession. The recipe behind DOL is simple: consistency.

Considering the perfect dividend triangle and the growth by acquisition opportunity with Dollarcity and the Reject Shop, I decided to make it a full position.

Small positions are insignificant

There is something insidious about monitoring the stock market daily: you get new stock pick ideas all the time! While this is not always a bad thing, it could lead to buying too many different stocks for my own good. In other words, if I don’t stick to a clear strategy, I could easily build a 75+ stock portfolio. Then, it would take me many hours, if not days, to monitor my portfolio each quarter.

I currently hold 37 different companies across all my portfolios. Out of this list, I have five companies that represent less than 1% of the total value of my portfolio. You can guess that those five companies are part of my Smith Manoeuvre portfolio. Those companies currently have a minimal impact on my net worth. For example, Canadian Tire (CTC.A.TO) could go bankrupt and I would only lose $1,300. I doubt I would even notice that loss.

I spend enough time researching a company before adding it to my portfolio and then I add more time quarterly to monitor results that I want those investments to matter. I want each of my positions to have an impact on my total return.

Since my Smith Manoeuvre strategy is based on adding $750 per month to the account, I can’t grow my position in Dollarama quickly. However, since my pension and my SM portfolio have the same long-term goal, I can use money in the pension account to buy more shares.

Therefore, I’ll be using all cash in the account in July to buy shares of Dollarama in the effort of building a full position.

What’s a full position?

Based on the Investment roadmap, I aim for an equally weighted portfolio. Since they all have the same goal (fund my retirement), I treat them as one big portfolio. With that in mind, my definition of a full position would be 100% / 37 positions = 2.70%.

As I allocate more capital toward Dollarama across my different accounts, I will eventually reach a full position. Anything between 2.5% and 3% would be considered a full position (I’m not crazy with numbers).

I also let my big winners run, so it’s normal to see my largest holdings above the 3% mark. I currently have twelve stocks above 3% of my portfolio. Many of them are showing 100%+ return. As I trim the top positions, I typically reallocate this capital across my portfolio.

For the time being, I will build a full position in Dollarama. The next one on my list is likely going to be TMX Group (X.TO).

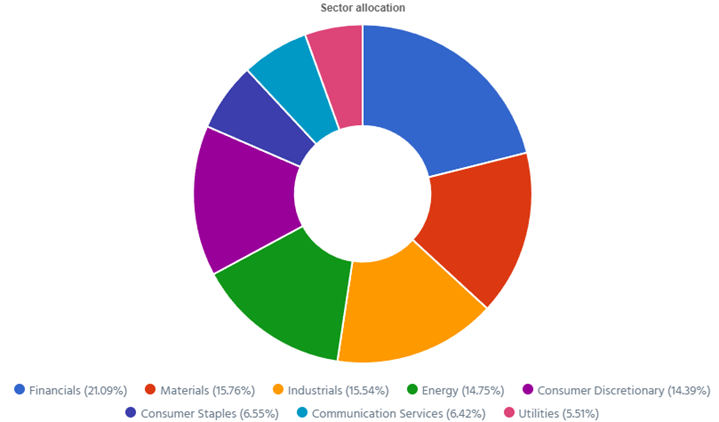

Smith Manoeuvre Update

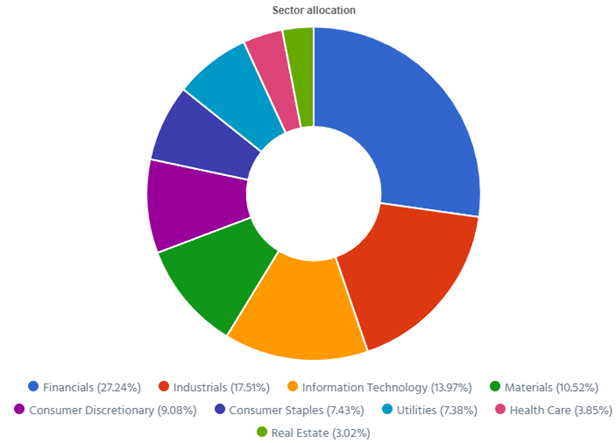

Slowly but surely, the portfolio is taking shape with 13 companies spread across 8 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 3.01% with a 5-year CAGR dividend growth rate of 11.08%.

- The portfolio value is now at $21,810

- The portfolio debt is at $18,250.

- The annual income is $656.70

- To report my Smith Manoeuvre, I export the Excel data from my DSR PRO dashboard.

Smith Manoeuvre Portfolio Summary

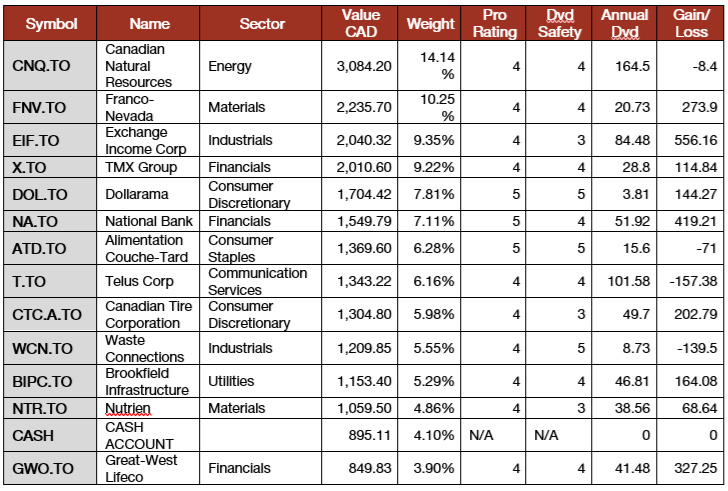

Here’s my SM portfolio summary as of July 3rd, 2025 (before the bell):

Adding more of Telus (T.TO)

Telus is not the success story I had hoped it to be, but it has had a good 2025 so far. What’s the secret? Numbers are getting better. I have told you many times that financial metrics tell a louder (and clearer) story. Telus improved its cash flow from operations, free cash flow and reduced its capital expenditures. In other words, it has generated more cash and has spent less cash than it has over the past few quarters.

It sounds like a good fit to increase my position in Telus and boost a solid dividend payment.

Pension Portfolio Summary

Here’s my pension plan portfolio summary as of July 3rd, 2025 (before the bell):

Total value: $299,398.64 (+$3,804.74 or +1.3% from last month).

Only Alimentation Couche-Tard reported this month!

Alimentation Couche-Tard is stuck in limbo

ATD reported a weak quarter with revenue down 7.5% and EPS down 4.2%. The revenue decline was driven largely by lower fuel prices and softer fuel demand in the U.S. Merchandise and service revenue in the quarter grew modestly was up 2.4% year-over-year with strong contributions from Canada, Europe, and the U.S., where positive merchandise comps helped offset energy segment weakness. The EPS decline was driven by a higher effective tax rate and increased operating expenses from strategic investments, although fuel gross margin improvements partially offset this. There was no additional information around the discussion of acquiring 7 Eleven.

My Entire Portfolio Updated for Q2 2025

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of July 3rd, 2025.

Download my portfolio Q2 2025 report.

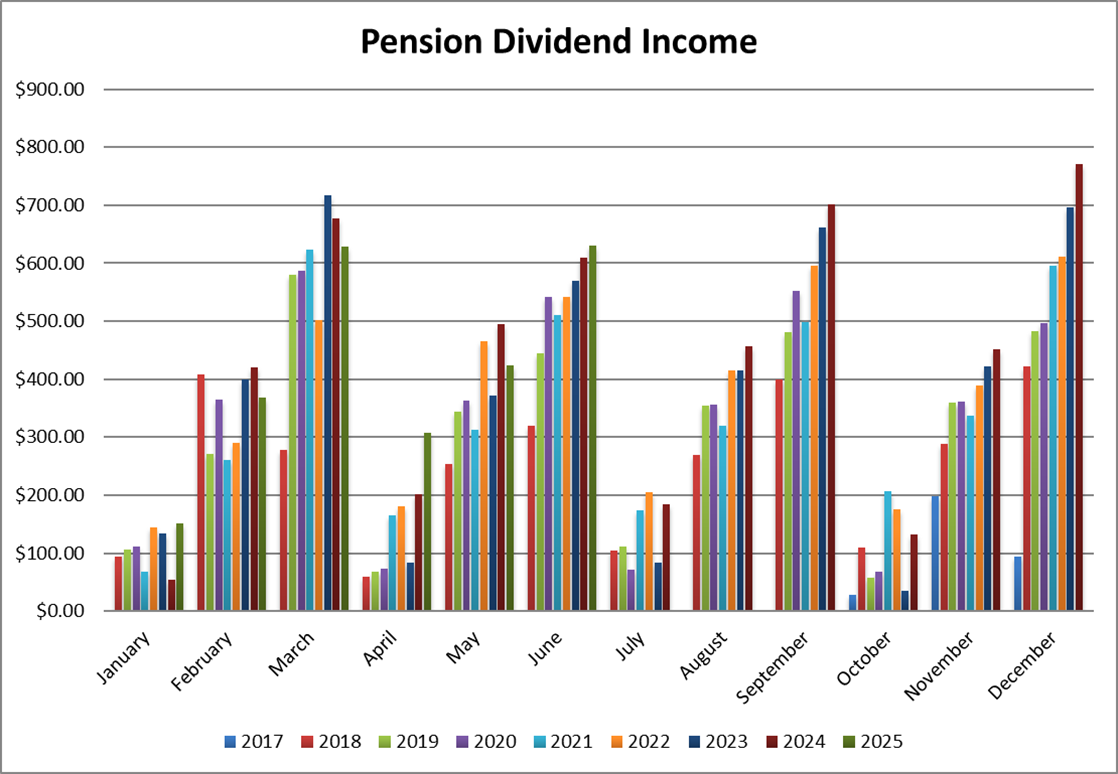

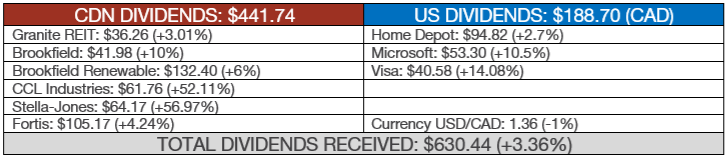

Dividend Income: $630.44 (+3.36% vs June 2024)

There were lots of changes this month vs. last year. First, I sold my shares of BlackRock (that paid almost $100 CAD in dividends) and I reinvested the money into Stella-Jones and CCL Industries. I also publish my US dividend in CAD now, as everything is mixed in my WealthSimple account.

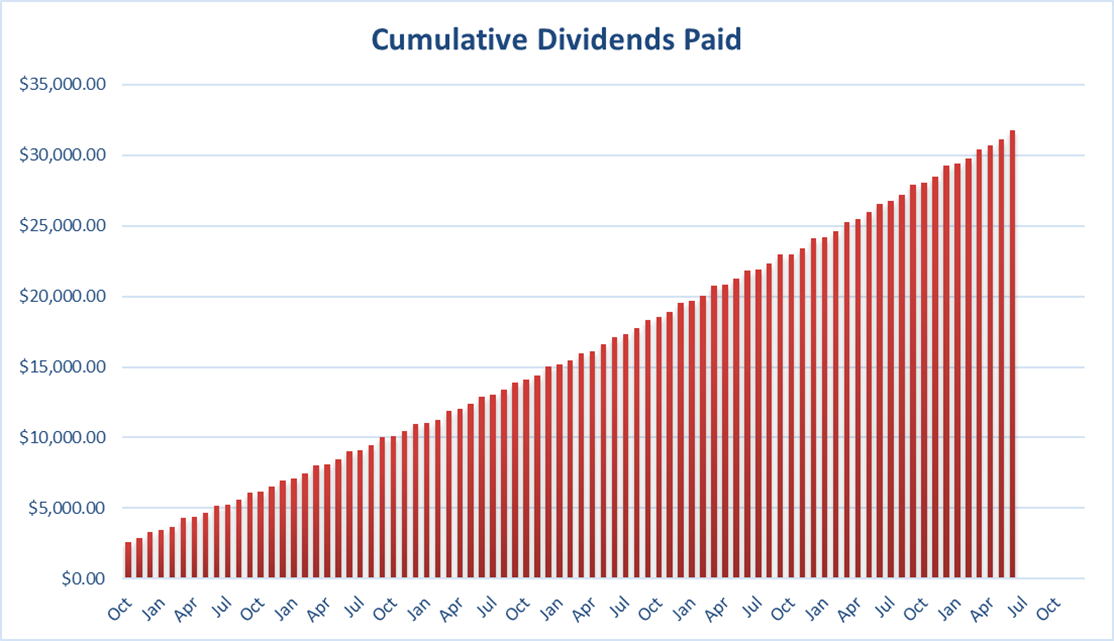

Since I started this portfolio in September 2017, I have received a total of $31,775.83 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

Just a quick note that I’ll report my August portfolio review exceptionally on the third Friday of the month since I will be traveling for a good part of July and the beginning of August.

Cheers,

Mike.

Your chart headline is “Total Dividends Paid”. Shouldn’t it be “Total Dividends Received”?

Your preceding text:

“Since I started this portfolio in September 2017, I have received a total of $31,775.83 CAD in dividends.”

You’re right! Must be my French sneaking in… will edit!