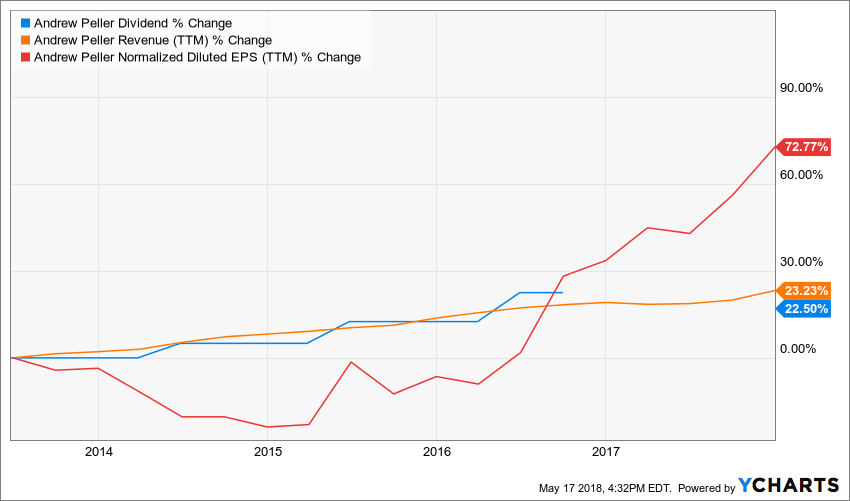

Last Tuesday, I published my top 5 US dividend growth stocks. Today, I'm coming back with my Canadian picks. Believe it or not, there is more than banks and telecoms on the market for income seeking investors! As a long term dividend blogger, I'm often asked what are my favorite dividend growth stocks. It's hard to make a short list as there are so many great companies out there. Based on my 7 investing principles, I've selected 5 I really like right now. ANDREW PELLER (ADW.A.TO) Business …

Continue Reading about My 5 Canadian Favorite Dividend Growth Stocks