In a world full of high-yield traps and low-yield growth names, it can feel like you’re always sacrificing one part of your portfolio to strengthen another. Should you take the 5.5% yield that might not grow? Or stick with a 1.2% yielder that hikes 10% annually?

Fortunately, there’s a middle ground: balanced dividend growers.

These are companies with yields ranging between 2% and 5%—enough to satisfy income needs, while also offering sustainable dividend growth backed by earnings and revenue.

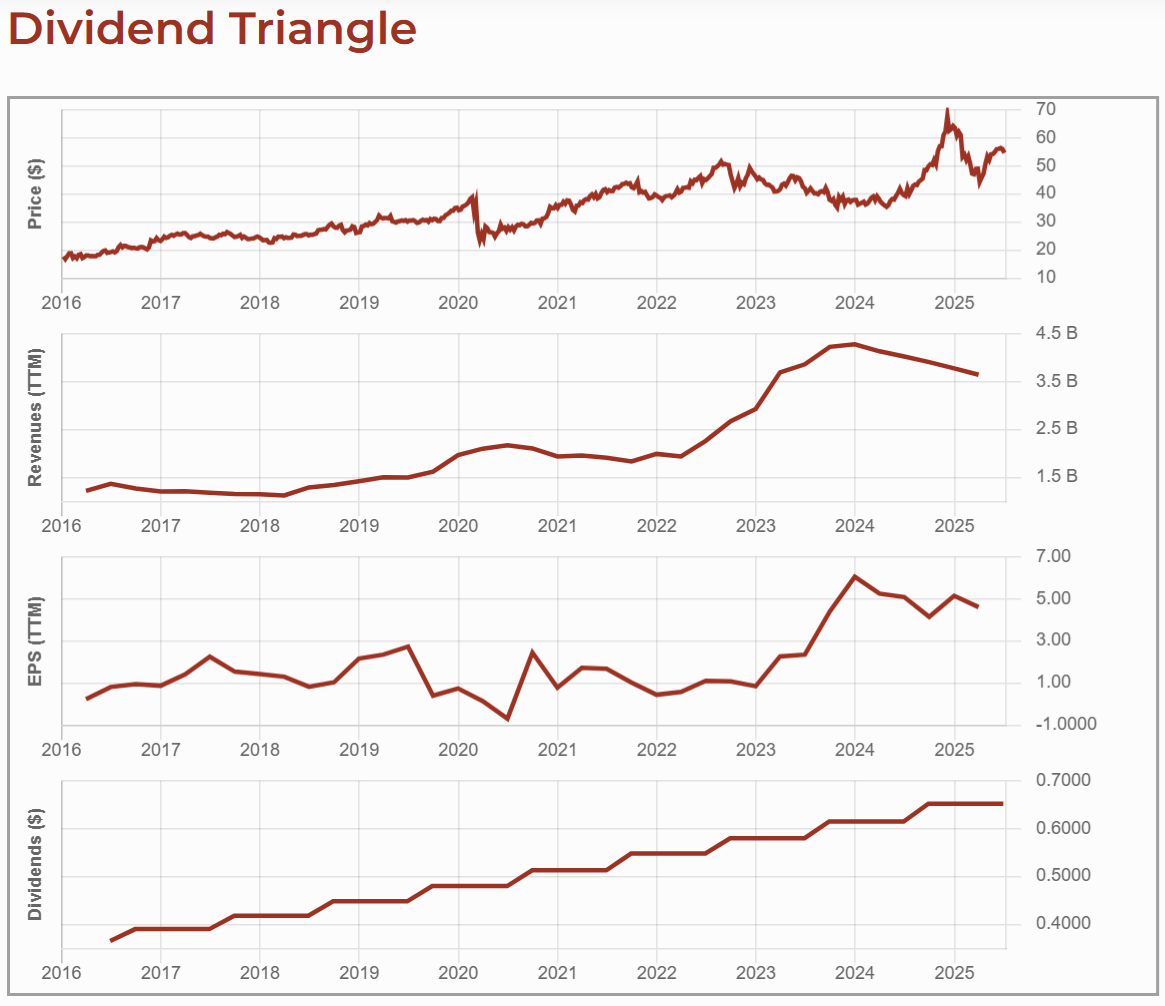

At Dividend Stocks Rock (DSR), we don’t chase yield—we focus on the Dividend Triangle:

- Revenue Growth

- Earnings Per Share Growth

- Dividend Growth

To qualify for this list, companies had to meet four criteria using the DSR stock screener:

- Dividend Yield between 2% and 5%

- 5-Year Dividend Growth of at least 5%

- DSR Pro Rating of 3 or higher

- Dividend Safety Score of 3 or higher

This isn’t a buy list. It’s a shortlist to help you speed up your research. We’ve included both U.S. and Canadian names, organized by country. Each company comes with a business summary, plus a bull and bear case to help you assess the fit.

Best U.S. Balanced Dividend Growers

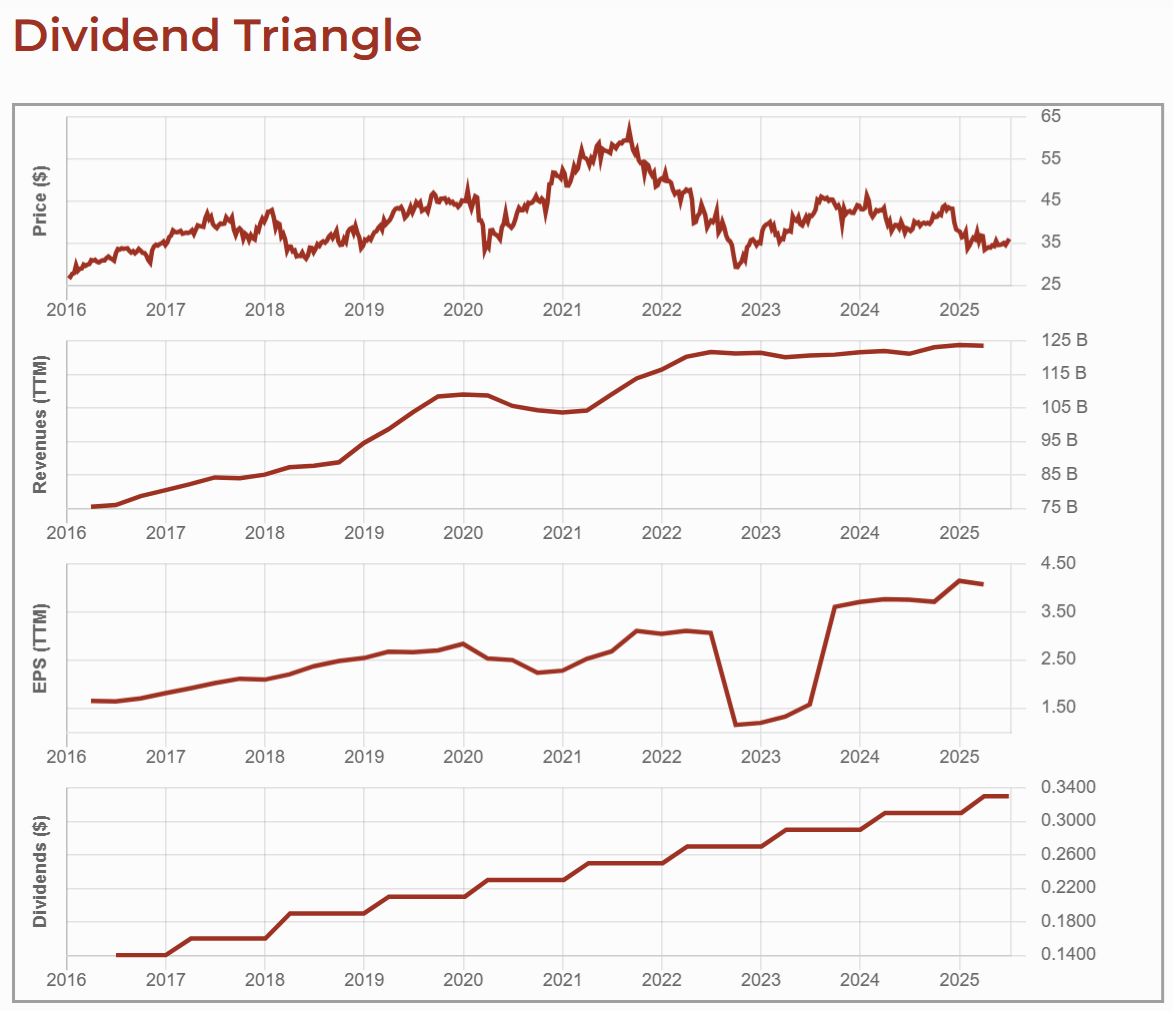

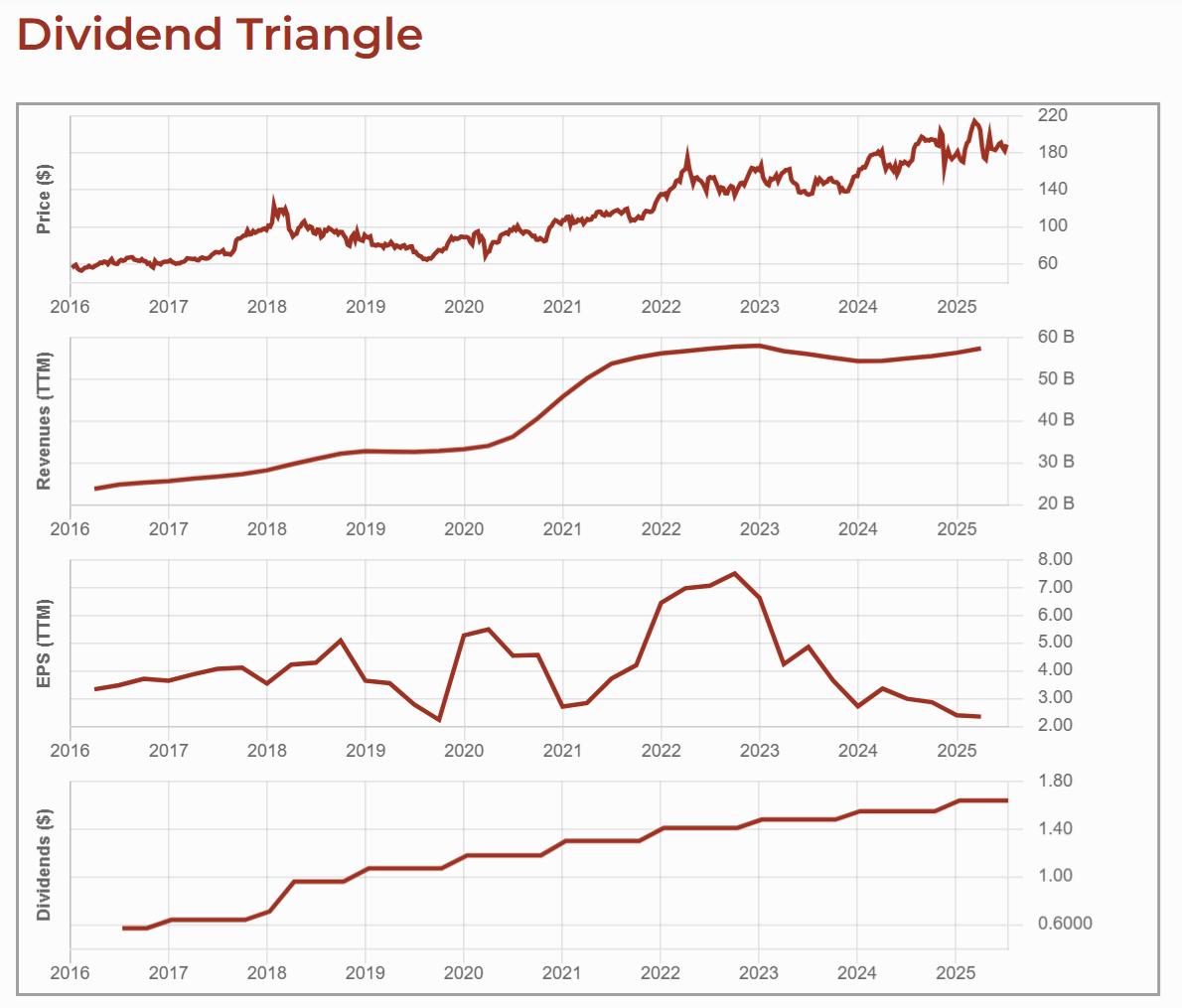

Comcast (CMCSA)

Yield: 3.71%

What it does: Comcast is a telecom and media giant with operations in broadband, cable TV, NBCUniversal, and Sky (Europe). It also owns streaming platform Peacock.

Bull Case: Comcast benefits from diversified cash flow through broadband, content creation, and international operations. Its streaming platform and infrastructure investments (like fiber upgrades) aim to drive long-term growth. Despite stagnating revenue, earnings continue to rise—a sign of operational efficiency.

Bear Case: The traditional cable TV segment continues to shrink due to cord-cutting. Streaming growth may not fully replace lost cable revenues. Capex needs are high, and while EPS is climbing, flat revenue could eventually slow the party.

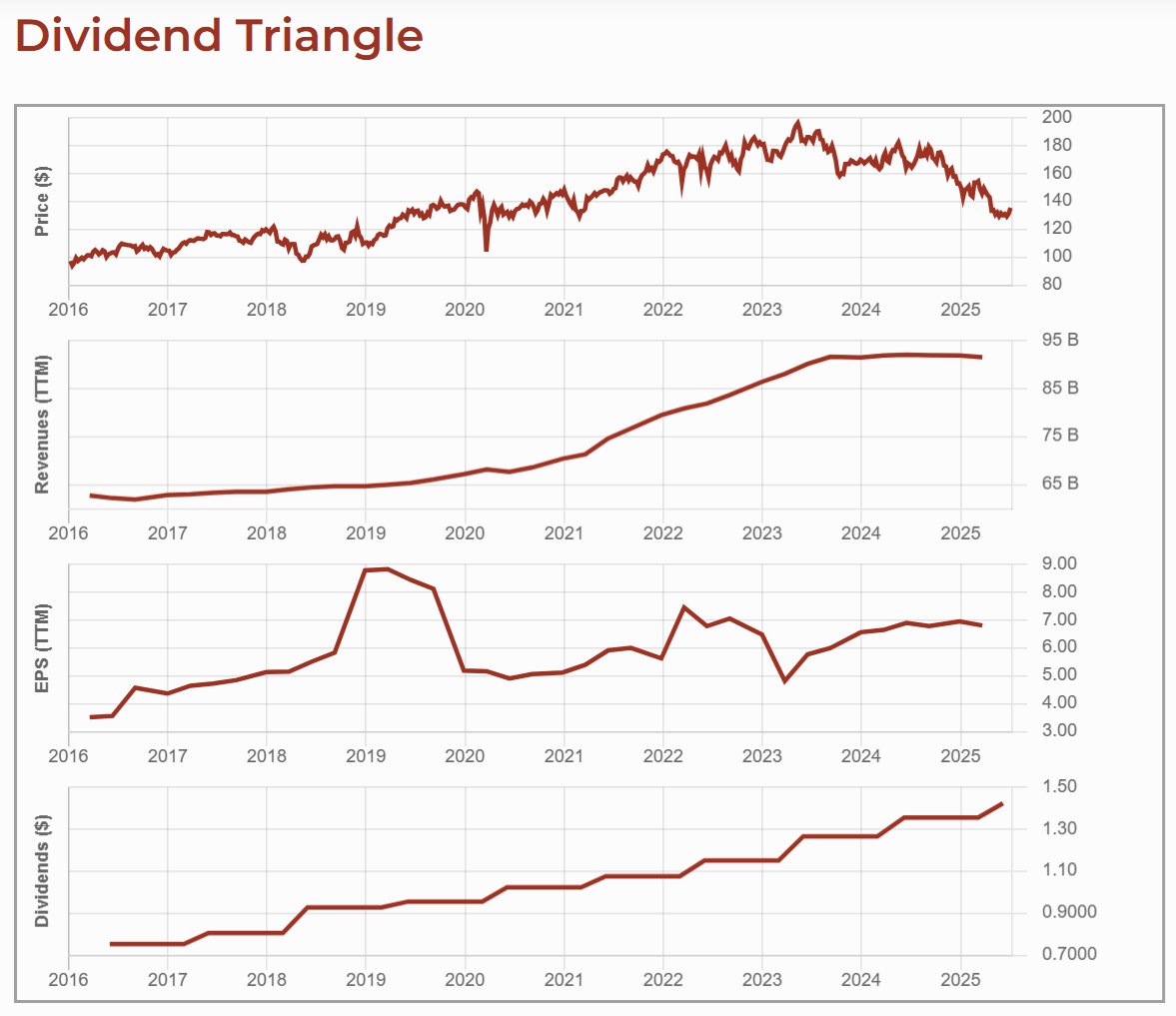

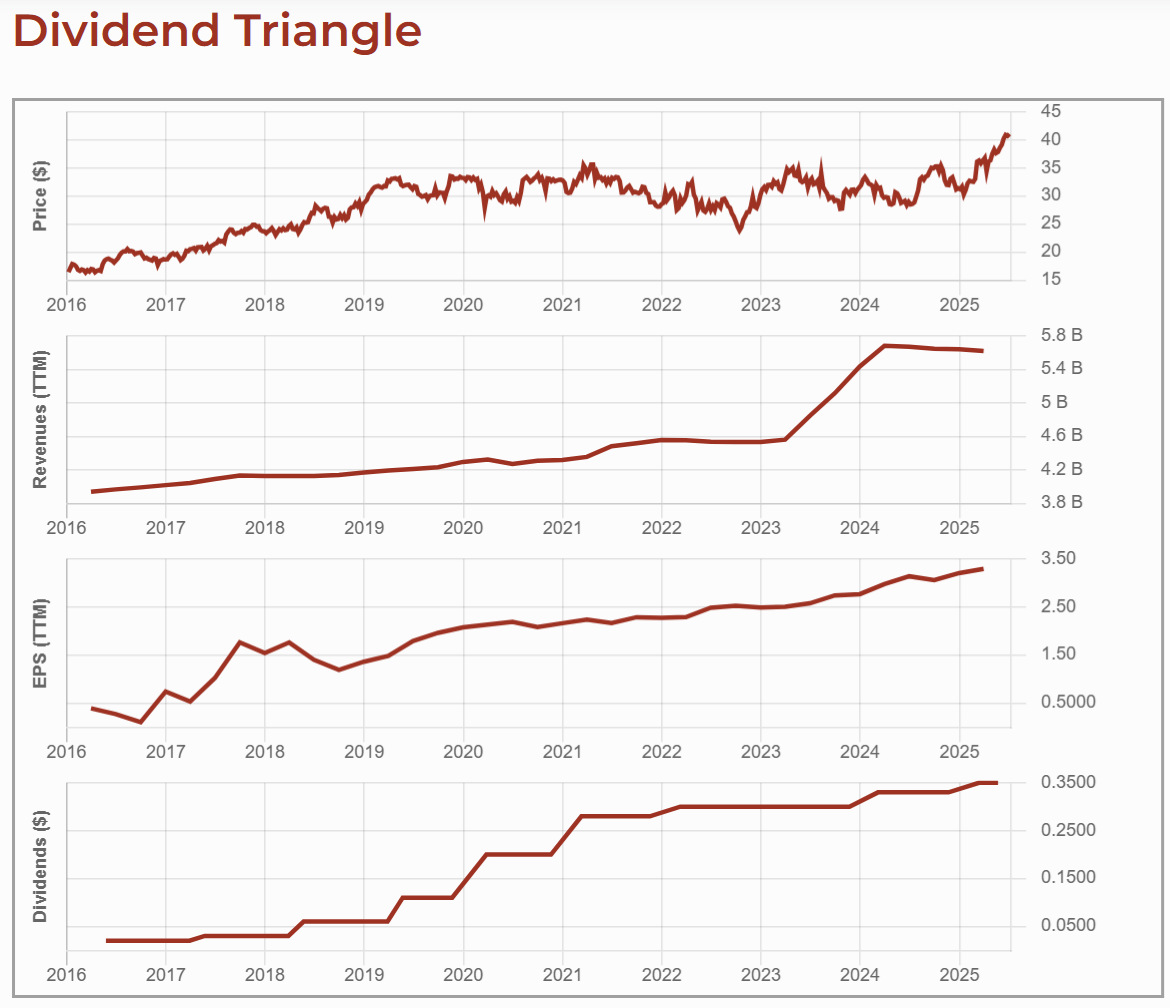

Genuine Parts (GPC)

Yield: 3.22%

What it does: GPC owns NAPA Auto Parts and Motion Industries, distributing replacement parts for vehicles and machinery.

Bull Case: It’s a boring business that thrives in any cycle. With over 10,000 locations, it serves as a backbone for repair shops and manufacturers. As vehicles age, demand for parts increases. The company keeps buying small players to grow its footprint and digitizing to streamline orders and inventory.

Bear Case: The business remains cyclical—recessions hit industrial demand, and European expansion poses integration risks. Longer term, advances in EVs could reduce part replacements. It’s stable, but not without growth hurdles.

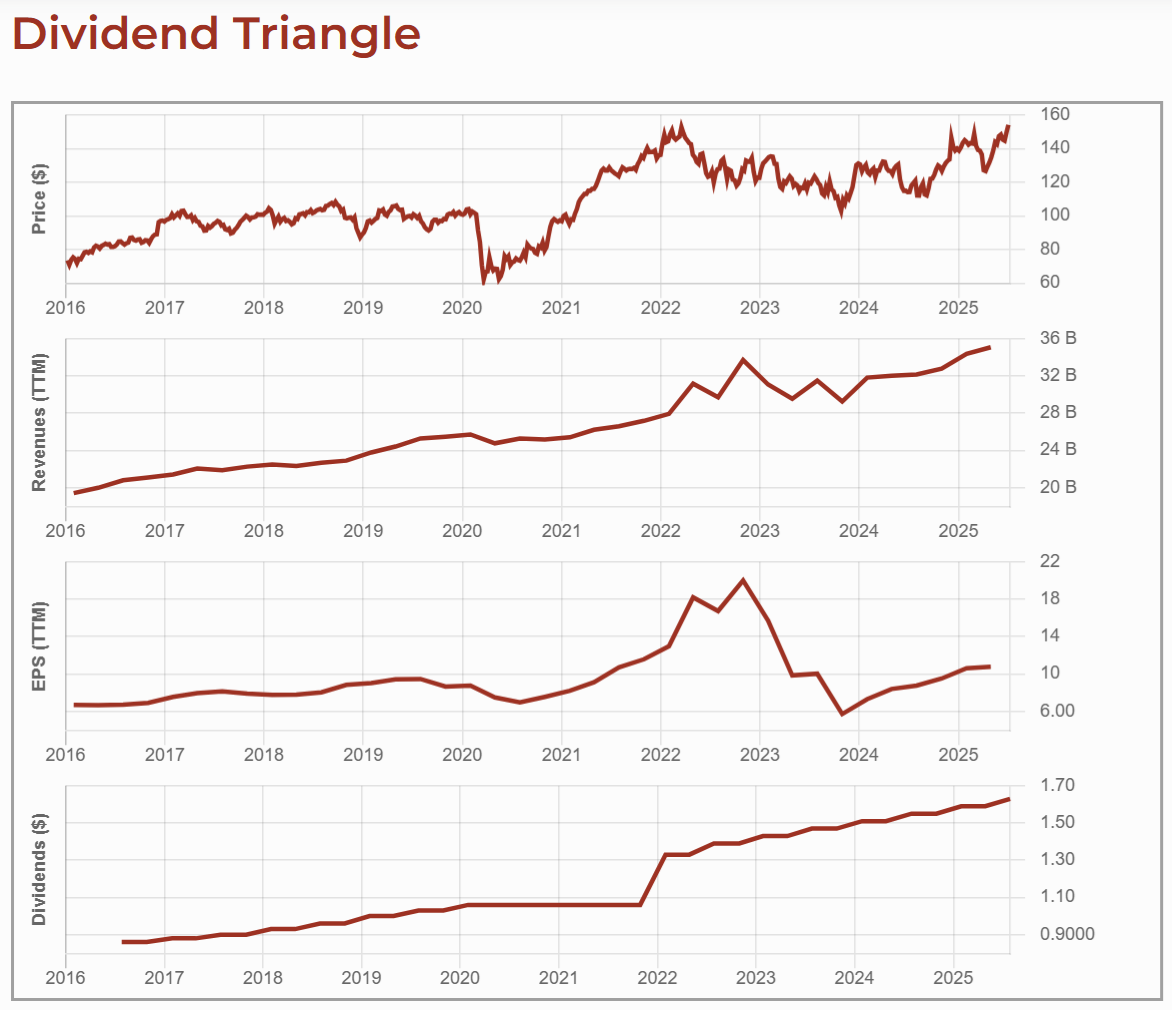

PepsiCo (PEP)

Yield: 4.32%

What it does: A global leader in beverages and snacks, PepsiCo owns brands like Gatorade, Frito-Lay, and Quaker.

Bull Case: Brand power and wide distribution provide resilience. PepsiCo is expanding its healthier product lines and boosting e-commerce. The company’s vast shelf space in retail outlets gives it pricing power.

Bear Case: The shift toward healthier foods poses a threat to legacy products. Input costs and supply chain issues have hurt margins. Sales and earnings have been flat lately, leaving investors wondering where growth will come from.

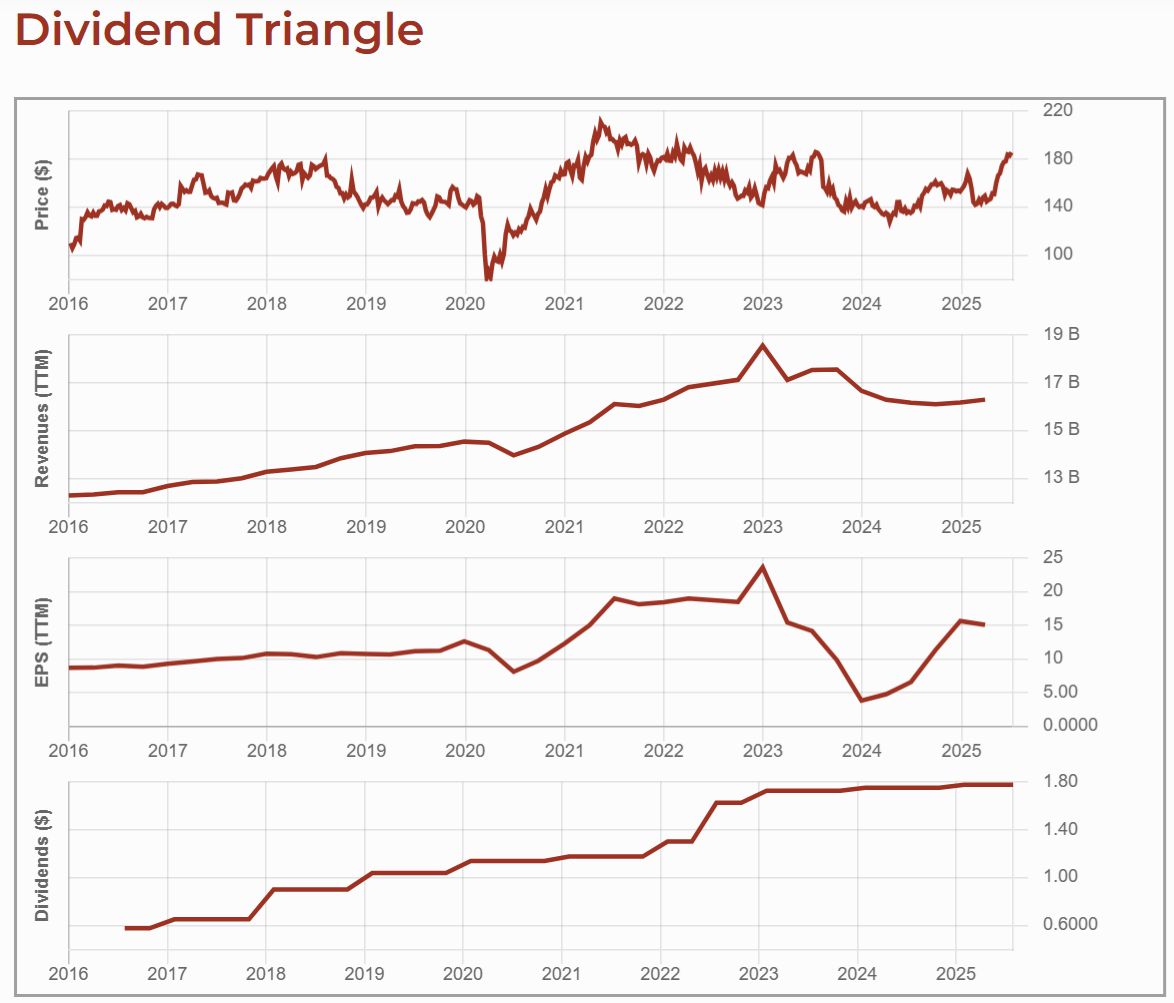

AbbVie (ABBV)

Yield: 3.55%

What it does: A global biopharma company known for Humira, Skyrizi, Rinvoq, and Botox (via its Allergan acquisition).

Bull Case: With Humira losing exclusivity, AbbVie has already positioned replacements (Skyrizi and Rinvoq) to take over. Its aesthetics, neuroscience, and immunology portfolio is strong, and international growth adds fuel.

Bear Case: Losing Humira exclusivity was a big blow. The firm’s reliance on a few blockbuster drugs creates risk if clinical trials or approvals are not successful. It must keep pumping billions into R&D just to tread water.

Want More Rock-Solid Dividend Ideas?

Download our Dividend Rock Star List—featuring over 300 stocks ranked by yield, growth, and safety.

Perfect for building your watchlist or strengthening your portfolio core. Filters enable you to strike a balance between yield and growth.

Get the Dividend Rock Star List now

Best Canadian Balanced Dividend Growers

Quebecor (QBR.B.TO)

Yield: 3.71%

What it does: Quebec-based telecom and media company, owner of Videotron and TVA. Recently acquired Freedom Mobile.

Bull Case: It dominates Quebec’s market with bundled services and has begun expanding nationally through Freedom Mobile. The vertical integration across telecom and media offers good synergies.

Bear Case: Over 80% of revenue comes from Quebec, so economic or regulatory changes there would have a significant impact. The media division is a low-growth sector, and the push outside Quebec will likely be met with fierce competition.

Canadian Tire (CTC.A.TO)

Yield: 4.22%

What it does: National retailer operating Canadian Tire, SportChek, Mark’s, and financial services through CT REIT.

Bull Case: Strong private label brands (like Mastercraft) and a real estate footprint give it pricing power and customer loyalty. The company also owns a financial arm that adds recurring income.

Bear Case: Heavily tied to the Canadian consumer and brick-and-mortar retail. E-commerce competition is real. While the business is diversified, growth remains modest and execution must be flawless to stay ahead.

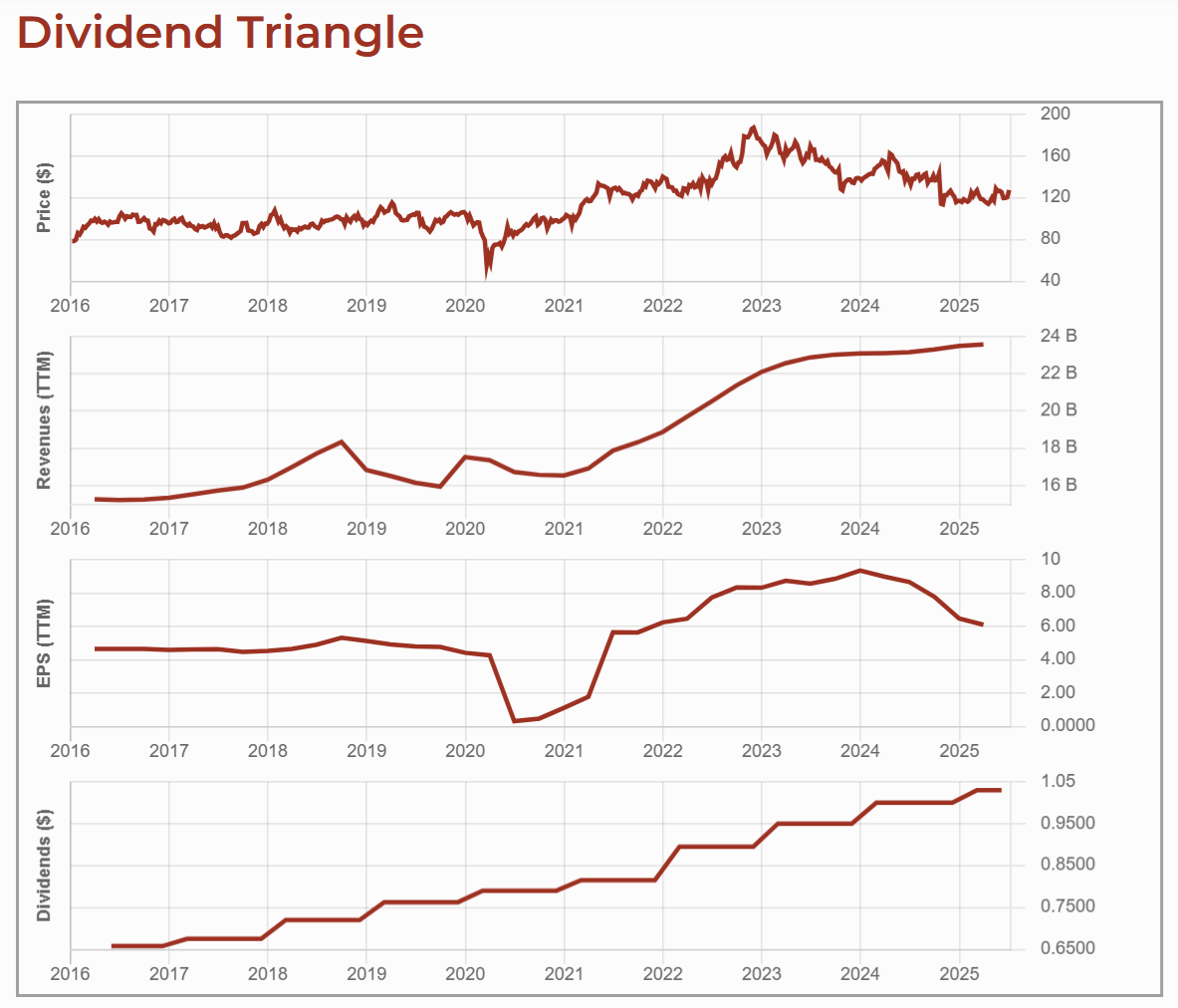

BMO (BMO.TO)

Yield: 4.41%

What it does: One of Canada’s Big 6 banks with major exposure to the U.S. via its Bank of the West acquisition.

Bull Case: BMO is now a binational bank with strong growth prospects in wealth management and ETFs. It’s well capitalized, has growing U.S. earnings, and focuses on cost control.

Bear Case: Provisions for credit losses (PCLs) spiked after the Bank of the West deal. While the U.S. presence is a long-term win, short-term earnings are under pressure. If the economy worsens, PCLs could rise even more.

Watch my complete review of the Canadian Banks’ Q2 2025 below.

Capital Power (CPX.TO)

Yield: 4.79%

What it does: A power producer shifting from Alberta-heavy fossil generation toward renewables and U.S. growth.

Bull Case: CPX is one of the few Canadian utilities with a credible transition plan. Its U.S. acquisitions and renewables pipeline position it for 8% AFFO/share growth. Less Alberta exposure means lower regulatory risk.

Bear Case: Like Algonquin, growth by acquisition carries integration risk. High debt levels and rising interest rates could erode margin expansion. It’s a promising plan—but execution is key.

Still Want High-Yield Choices?

When chosen carefully, a few high-yielders can complement your portfolio. They won’t outperform the market, but they can give you dependable cash flow—especially if you’re in retirement or shifting from accumulation to income.

So yes—there are high-yield stocks I’d consider. But they have to pass the sniff test.

I have detailed how to detect them in the article below:

Final Thoughts: Yield + Growth = Balance

When you aim for balanced dividend growers, you’re not picking sides—you’re building a resilient portfolio. A 3–4% yield coupled with 5–7% dividend growth creates a powerful compounding engine.

Some of these companies are slow and steady. Others still have runway. But all offer that rare blend of income today and income growth tomorrow.

Ready to Rock Your Portfolio?

Download the Dividend Rock Star List—our free guide with 300+ dividend stocks ranked by yield, growth, and safety.

Whether you’re looking for 2%, 4%, or even 6% yield, we’ve got the research to back it up.

Hi Mike,

I have been following your progress and emails ever since your trip to Central America. 2010-2012? I was also on a road trip at that time, but around the US. I am now back in the UK. I always thought I had missed the boat with your recommendations, as I am now 81, and well retired.

I have a good pension, which supports me financially. Besides that I have an investment account with TD, and have been buying and selling NNRG on the rise and fall, over the last couple of years, now worth about $92,000 but in cash at the moment. I can’t make up my mind whether to dive in with some of your recommendations above, for a more solid future to pass on, like CPX, QBR, & CMCSA as they are cheap stocks to buy, or is the actual price irreverent. I also like GPC, & PEP, which I know you have recommended in the past for a more solid future or whether to continue playing NNRG over their rise and falls, for just plain growth.

Great overview of balanced dividend growers. Quick question though: with industries like telecom and auto parts facing challenges, how reliable are these dividend growth projections over the next 5 years?