In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and drove to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built this portfolio publicly since 2017 to make a real-life case study. I decided to invest 100% of this money in dividend growth stocks.

In August 2017, I received $108,760.02 in a locked retirement account. This means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to tell you to follow my lead. I just want to share how I manage my portfolio monthly with all the good and the bad. I hope you can learn from my experience.

Last month, I covered why BCE is dead to me. This time, let’s also look at our never-ending bull market and what could happen next.

Performance in Review

Let’s start with the numbers as of October 3rd 2024 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $283,139.51

- Dividends paid: $4,952.53 (TTM)

- Average yield: 1.75%

- 2023 performance: +20.69%

- SPY= +26.19%, XIU.TO = +11.87%

- Dividend growth: +1.7%

Total return since inception (Sep 2017 – October 2024): 160.33%

Annualized return (since September 2017 – 84 months): 14.65%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 14.53% (total return 158.50%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 10.42% (total return 100.10%)

Will This Bull Market Ever End?

It seems that each time I review my portfolio, I cross a new all-time high. On one side, I’m glad I’m always 100% invested as I fully benefit from the bull markets. On the other hand, I can’t help but raise an eyebrow when I look at the current state of the market. This will not change my strategy, but I seriously think we are due for a market correction.

Having said that, I would still invest all my money in the stock market if I had received my pension account last summer instead of doing it seven years ago. In the end, it doesn’t matter what I think will happen in the market in the next 12 months, as time in the market is more important than timing the market.

Now, the S&P 500 is up by more than 20% since the beginning of the year, and the TSX is not far behind at +16% (including dividends). When investors ask if it’s time to invest in the stock market because interest rates are finally going down this year, I answer that the market started banking this information 12 months ago. This is what I was telling you in this monthly report back in November 2023.

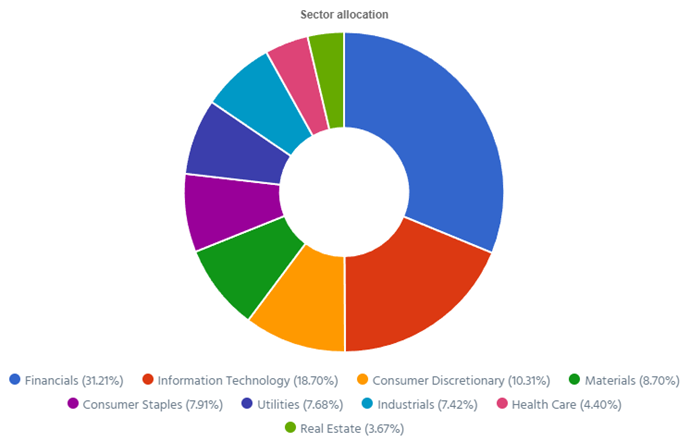

On the U.S. side, I was surprised that the utility sector surged more than all the others (+31.56% so far this year). The communication sector, led by tech giants Alphabet and Meta, is second, while the financial industry closes the top 3 best-performing sectors using SPDR spiders ETFs. Of course, this is not perfect, as ETFs can play around with stock allocation for each sector, but it gives a good idea of what is going on.

You won’t be surprised to find the consumer discretionary sector last, offering a return of about half of the S&P 500 (around 10%). It seems it’s the only sector warning us that a recession could happen as many companies struggle to report sales and profit growth, claiming customers are stuck with tight budgets.

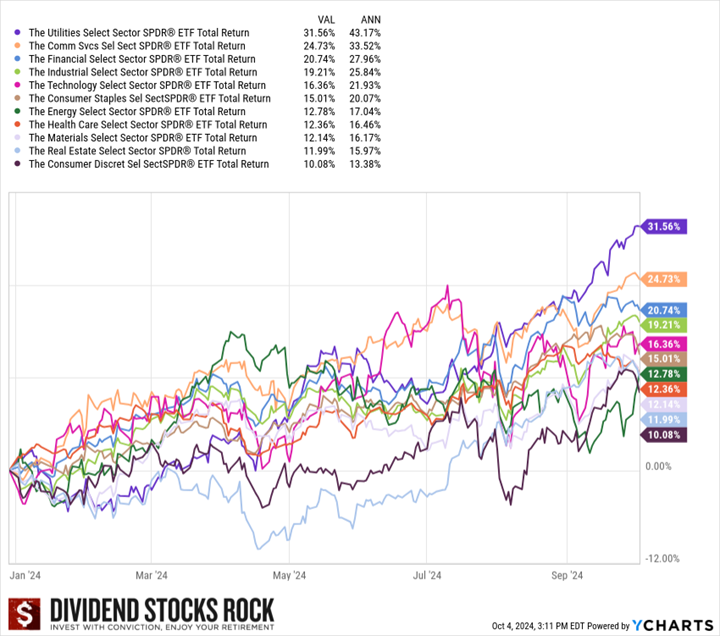

When I look at the BMO ETFs tracking a mix of Canadian and U.S. stocks, I come to a similar conclusion about the consumer discretionary sector. It’s a tough ride if you are exposed to this sector. Still, everything is in positive territory with a strong rebound from the energy sector leading the pack with communications (BMO includes Alphabet and Meta in their ETF too).

Despite concerns about the economy, Canadian Banks are doing quite well! Even ScotiaBank is performing well in 2024!

If you are looking for “undervalued” stocks, the best sectors seem to be consumer discretionary and REITs (potentially utilities in Canada, too). Those sectors have taken a good hit since the rise in interest rates, and the recovery is not complete for many companies.

Investing during all-time highs is always tricky as we fear a market crash. However, focusing on quality (read strong financial fundamentals) will always be a winning strategy. And let’s be honest, it’s a lot easier to select quality companies than predict where the market may be in 6 months!

Should you want to add some stocks to your portfolio, I have shared my Top Underrated Dividend Growers on my YouTube channel. It includes my analysis of LeMaitre Vascular (LMAT), one of my holdings. Watch it below:

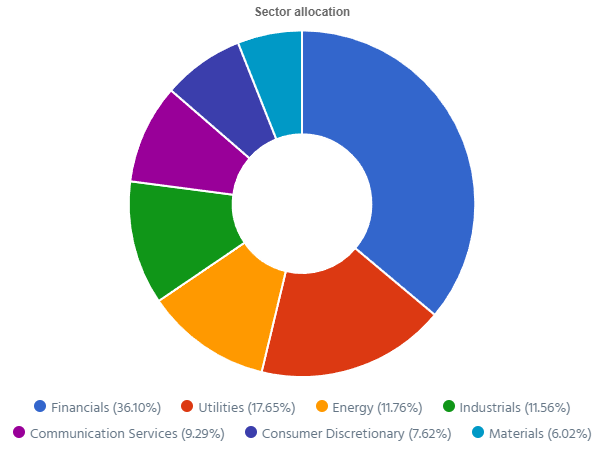

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 11 companies spread across 7 sectors. My goal is to build a portfolio generating 4-5% in yield across 15 positions. I will continue to add new stocks monthly until I reach that goal. My current yield is 4.47%.

Adding $500 to CNQ

I used my $500 contribution to buy more Canadian Natural Resources (CNQ.TO). The stock has dropped about 20% from its peak value due to the weakness in oil prices. That’s a good time to buy more of what always works!

I’ve covered CNQ’s recent drop in this podcast episode:

I will likely sell my shares of CWB in the coming months since the play worked out perfectly, and I can move my money into another stock and it will help reduce my exposure to the financial sector.

Here’s my SM portfolio as of October 3rd 2024 (before the bell):

| Company Name | Ticker | Sector | Market Value |

| Brookfield Infrastructure | BIPC.TO | Utilities | $1,131.40 |

| Canadian National Resources | CNQ.TO | Energy | $1,684.44 |

| Capital Power | CPX.TO | Utilities | $1,450.58 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $1,129.94 |

| Canadian Western Bank | CWB.TO | Financials | $1,903.65 |

| Exchange Income | EIF.TO | Industrials | $1,627.52 |

| Great-West Lifeco | GWO.TO | Financials | $787.95 |

| National Bank | NA.TO | Financials | $1,412.40 |

| Nutrien | NTR.TO | Materials | $874.38 |

| Telus | T.TO | Communications | $1,371.28 |

| TD Bank | TD.TO | Financials | $1,113.22 |

| Cash (Margin) | $2.43 | ||

| Total | $14,489.49 | ||

| Amount borrowed | -$12,500.00 |

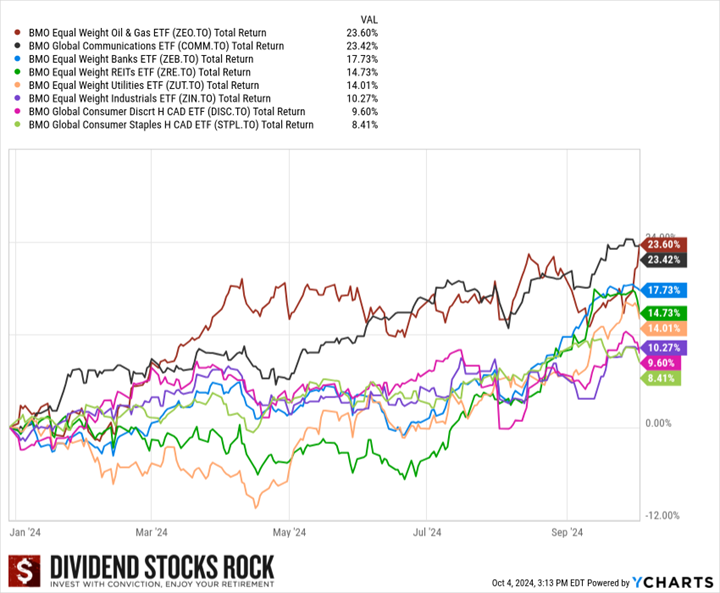

Let’s look at my CDN portfolio. Numbers are as of October 3rd 2024 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.TO | Cons. Staples | $21,871.85 |

| Brookfield Renewable | BEPC.TO | Utilities | $11,212.68 |

| CCL Industries | CCL.B.TO | Materials | $11,187.40 |

| Fortis | FTS.TO | Utilities | $10,566.09 |

| Granite REIT | GRT.UN.TO | Real Estate | $10,307.84 |

| National Bank | NA.TO | Financials | $15,536.40 |

| Royal Bank | RY.TO | Financial | $10,783.50 |

| Stella Jones | SJ.TO | Materials | $13,233.44 |

| Toromont Industries | TIH.TO | Industrials | $6,166.40 |

| Cash | $1,167.76 | ||

| Total | $112,033.36 |

My account shows a variation of +$2,777.13 (+2.54%) since September’s income report. We are at the end of a quarter and I’ll start reviewing U.S. companies’ earnings in my next portfolio update.

Here’s my US portfolio now. Numbers are as of October 3rd 2024 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $9,071.20 |

| Automatic Data Processing | ADP | Industrials | $10,774.90 |

| BlackRock | BLK | Financials | $13,401.50 |

| Brookfield Corp. | BN | Financials | $18,161.85 |

| Home Depot | HD | Cons. Discret. | $12,337.80 |

| LeMaitre Vascular | LMAT | Healthcare | $9,101.00 |

| Microsoft | MSFT | Inf. Technology | $19,605.11 |

| Starbucks | SBUX | Cons. Discret. | $9,071.00 |

| Texas Instruments | TXN | Inf. Technology | $10,171.50 |

| Visa | V | Financials | $13,850 |

| Cash | $862.35 | ||

| Total | $126,408.21 |

My account shows a variation of +$5,894.06 (+4.89%) since September’s income report.

My Entire Portfolio Updated for Q3 2024

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of October 4th, 2024.

Download my portfolio Q3 2024 report.

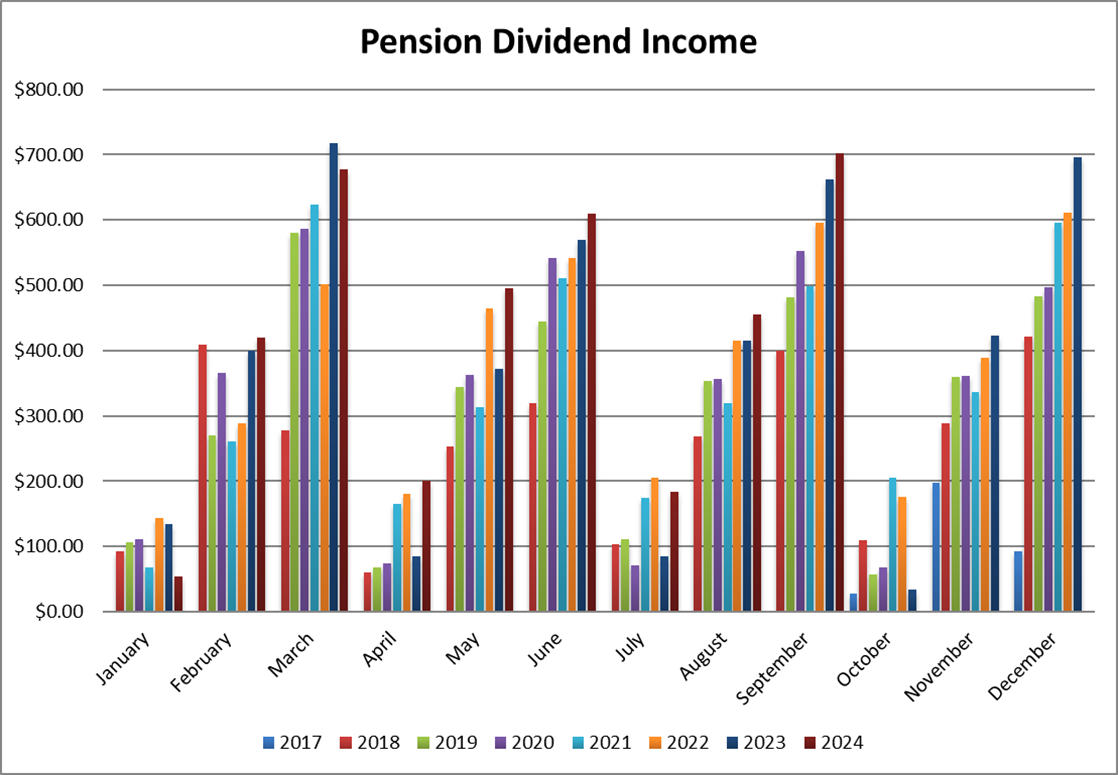

Dividend Income: $702.22 CAD (+6% vs August 2023)

It’s great to see a steady dividend increase over the past few months. I’ve performed a few transactions over the past 18 months such as selling Enbridge and Magna International, and my portfolio still pays more dividends now than ever.

It’s great that most of my holdings have increased their dividends in the mid to high single-digits! It’s a great sign that my portfolio is healthy.

Dividend growth (over the past 12 months):

- Fortis: +4.4%

- Granite REIT: +3.10%

- Stella-Jones: new!

- CCL Industries: +9.4%

- Brookfield Renewable: +19.72% (I bought shares in the past 12 months)

- Alimentation Couche-Tard: +6% (I sold shares in the past 12 months)

- Visa: +15.56%

- Microsoft: -5.75% (I sold shares in the past 12 months)

- Home Depot: +7.66%

- BlackRock: +2%

- Brookfield: +15%

- Currency: -1.91%

Canadian Holding payouts: $393.46 CAD.

- Fortis: $100.89

- Granite REIT: $35.20

- Stella-Jones: $40.88

- CCL Industries: $40.60

- Brookfield Renewable: $123.56

- Alimentation Couche-Tard: $52.33

U.S. Holding payouts: $228.10 USD.

- Visa: $26.00

- Microsoft: $35.25

- Home Depot: $67.50

- BlackRock: $71.40

- Brookfield: $27.95

Total payouts: $702.22 CAD.

*I used a USD/CAD conversion rate of 1.3536

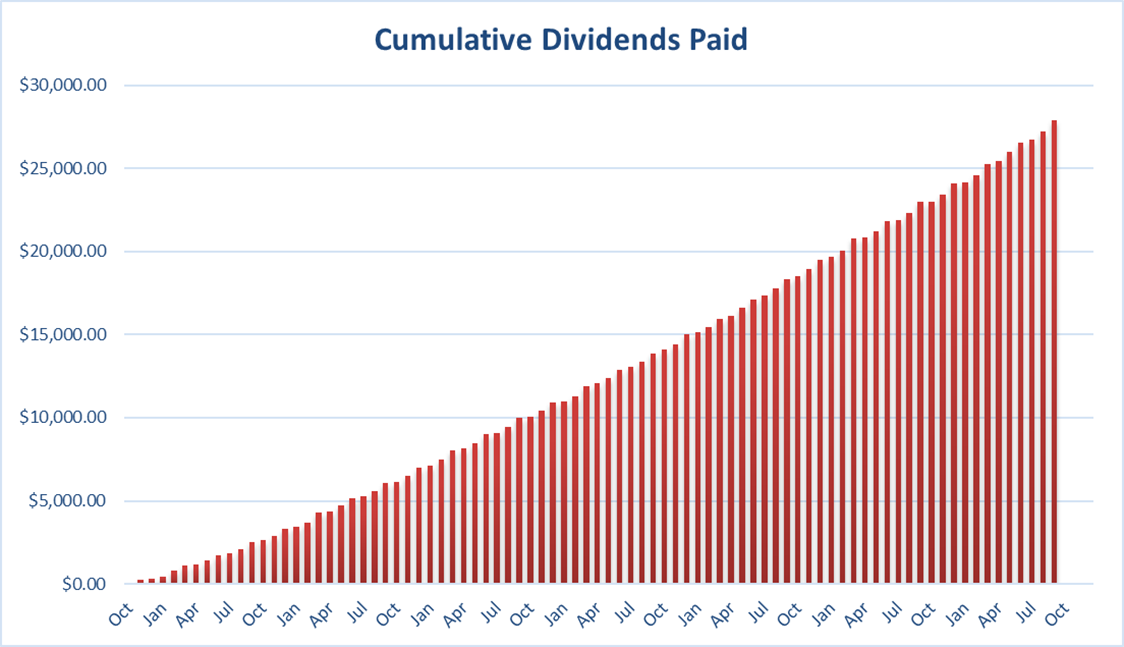

Since I started this portfolio in September 2017, I have received a total of $27,912.93 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio,” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

You may have noticed that I hold over $1,000 in cash across my US and Canadian accounts. This liquidity will soon be used to increase my position in Toromont Industries (TIH.TO) since it’s my smallest holding. I haven’t moved yet because I’ve been busy with other stuff! I don’t expect to make any other trades by the end of the year unless one of my top holdings breaks the 10% barrier of all my portfolios (hello, Apple!).

Cheers,

Mike.

Leave a Reply