In September of 2017, I received slightly over $100K from my former employer, representing the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

This month, I also took a deeper look at telecoms. Don’t miss it!

Performance in Review

Let’s start with the numbers as of November 2nd, 2023 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $221,331.59

- Dividends paid: $4,613.03 (TTM)

- Average yield: 2.20%

- 2022 performance: -12.08%

- SPY= -18.17%, XIU.TO = -6.36%

- Dividend growth: +10.83%

Total return since inception (Sep 2017-Nov 2023): 103.5%

Annualized return (since September 2017 – 74 months): 12.21%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 11.46% (total return 95.24%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 8.08% (total return 61.49%)

What’s Going on with Telcos?

I have been asked this question often over the past few months. Most specifically around BCE and Telus, but I thought of doing a broader review including Rogers, Verizon and AT&T. They all have a few things in common:

- Most of their revenue and growth originate from wireless services.

- They have all invested massively to expand their networks and develop the 5G technology.

- Their balance sheets are heavy in debt, not to mention the interest charges’ effects on earnings.

- Most importantly they all struggle to attain significant growth.

However, the situation isn’t as bad as investors make it seem when they sound concerned and ask questions. Here’s Telcos’ total returns (including dividends) over the past 12 months.

It’s definitely not great but being down 5% – 10% may be just normal. However, the biggest problem is the price anchoring bias. When investors ask me about telcos, they don’t see Rogers at +1.83% and Verizon at +3.88%. They see it at -16.96% and -15.32%, respectively. How do they get those numbers?

- They look at the all-time-high price (May 1st for Rogers and January 6th for Verizon)

- They ignore dividends paid during the timeframe (and just consider stock price movements)

Along the same train of thought, while BCE (-5.85%), AT&T (-7.48%) and Telus (-10.69%) haven’t done great in the past 12 months, many investors see them at -17.10%, -22.92% and -17.24%, respectively. While their returns have been negatively amplified by price anchoring, I’m not going to tell you that everything is pinky.

Did telcos perform well in the past 12 months? – NO

Why do they lag the market? – Poor growth and higher interest charges

But the problem is deeper – they haven’t done well in a long time:

Ironically, BCE and Telus are the only ones with decent returns over the past 5 years. Even then, they lag the TSX by a wide margin. For the record, the iShares XIU.TO tracking the TSX 60 is up 53.73% (total return) in the past 5 years and the SPDR S&P 500 SPY is up 72.67%.

There is definitely something wrong with telcos.

Now let’s do a quick overview to understand what’s is going on and which metrics we must follow going forward.

Verizon is slowly dying?

Verizon is part of our US retirement portfolio and it’s probably the position I dislike the most. What’s the problem? The company is seriously lacking growth vectors. Revenue has grown by less than 2% annually over the past 5 years. While the EPS growth is better (7.65% CAGR), most of it happened 4-5 years ago. Therefore, the 5-year growth will slow down going forward if the company doesn’t change its course. The company is stuck between a rock and a hard place: on one side, it must continue to invest in its network, on the other side, paying down debt would be a smart idea. Paying down debt would strengthen Verizon’s balance sheet, but limit growth vectors. The company has an urgent need to find growth.

Verdict: the situation isn’t catastrophic as VZ counts on predictable cash flow coming from its customers. I believe Verizon will continue its course and I don’t expect much capital appreciation, but a solid dividend. It’s important to monitor VZ quarterly.

AT&T is like Verizon, but worse

AT&T is in the exact same situation as Verizon, but it must carry the burden of several bad management decisions. Its adventure in the media business (hello Direct TV!) destroyed a lot of value. Here we are about a year and a half after AT&T tried to repair its mistake after spinning off Warner Bros Discovery (WBD) and going back to what management knows best: wireless and wireline services. The most optimistic would say T is generating more cash flow and started to pay off its debt. Similar to Verizon, AT&T generates tons of cash flow quarterly. Again, AT&T must get that debt down while continuing to invest in its network. T has the advantage of having a stronger wireline business than Verizon to “attach” its customers.

Verdict: Dividend cutters have no place at DSR. AT&T failed investors once and has offered poor results ever since. I’ll reconsider my position if and when the company shows a strong dividend triangle again. Until I see revenue, EPS and dividend growth, AT&T will remain dead to me.

Rogers going big or going bust?

It’s no secret I have had little interest in Rogers for many years. In my view, Rogers is like BCE without the dividend growth. The company has produced one dividend increase over the past 5 years and won’t likely reward shareholders with additional increases in the future considering its recent acquisition of Shaw.

The acquisition gives more size and scale to expand Rogers’ empire and improve margins. The early days of Shaw’s integration already show some solid synergy. Rogers faces steep competition coming from BCE and Telus and it won’t end anytime soon. With a larger exposure to media than its competitors, I can’t see how Rogers will grow faster. The media business is struggling and there is not clear direction toward strong profits.

Verdict: Rogers isn’t really on my radar due to its lack of dividend growth. If the integration of Shaw doesn’t go as well as management expects, this story will quickly turn sour.

BCE is a slow elephant

I often describe BCE as a “deluxe bond”: a stock with limited capital appreciation, but with a good dividend yield and decent dividend growth. It’s still true today, but the market is eager to see a better cash flow picture. The story is the same for all telcos at the moment: strong cash flow from operations + high capital expenditure = smaller free cash flows and less room for dividend growth. The recent quarters show a small improvement in that regard (e.g., smaller CAPEX leads to stronger free cash flow), but we will need a clear trend going forward before we celebrate. While BCE generates some revenue from media, we are talking about 13-15% of its total revenues. The bulk of its cash flow comes from wireline and wireless services.

Verdict: BCE remains a deluxe bond. If I was looking for income, I wouldn’t have a problem holding BCE right now. As long as the company shows improvement with its cash flow metrics, I would sleep well at night.

Telus’ growth vectors are hurting the business!?!

On top of dealing with higher interest charges along with weak growth like other telcos, Telus is facing an additional problem: its growth vectors are actually shrinking! Telus Healthcare, Agriculture and International aren’t contributing to Telus’ success right now, and in fact quite the opposite is true. As many companies expect a recession, they are building their war chest instead of spending on technology. Therefore, Telus International had to review its guidance and report weaker earnings during the entire year of 2023. They are not losing market share, but they are in a down investment cycle which has had a great impact on their results and reflects on Telus. The company reported a good quarter where free cash flow was up 7%, mostly driven by a reduction of CAPEX. The company also announced its second dividend increase of the year, bringing its yearly dividend increase to 7% in 2023.

Verdict: Telus keeps me smiling as management keeps showing confidence in its business with a second dividend increase this year. Since their cash flow metrics are improving a little each quarter, we may see the company doing a lot better in the second half of 2024.

What to look for going forward

As you can see, the entire sector faces the same challenges. The dividend triangles are similar as well (e.g., they show EPS growth weakness and some dividend trends aren’t as strong as they used to be). In this situation, I prefer to go with the one with the strongest dividend growth trend (Telus), but that’s just me. However, going forward, they must all show strong metrics. To help you monitor them, I’ve made a quick list:

Cash from operations: They all made the same promise: “we’ll get as much cheap debt as possible to invest in our network and we will later generate tons of cash flow”. Well, we are now “later” and it’s time to show that growth.

Capital expenditure (CAPEX): Again, the promise was to invest massively and then slow down to generate higher cash flow. While telcos will continue to be capital-intensive businesses (e.g., for network maintenance), they should slow down their expenses as their 5G networks are now well-developed.

Free cash flow: If we see cash from operations going up and CAPEX going down, free cash flow should increase. In an ideal world, telcos should show enough free cash flow to cover the dividend. In other words, they should be able to generate enough cash from operations to cover their expansion and maintenance (CAPEX) along with their dividend payments.

Dividend growth: If all goes well, a company should not see any problem in increasing its dividend. Any slowdown or absence of dividend growth is definitely a red flag here. If cash flow metrics improve and the dividend growth remains, I’m not going to worry much about the stock price fluctuation.

Bonuses: If one telco goes with a share-buyback program or a debt payoff announcement, it would make it my favorite play by far. However, in order to do that, each telco must generate stronger cash flow and spend less… That’s a tall order!

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 9 companies spread across 7 sectors. My goal is to build a portfolio generating 4-5% in yield across 15 positions. I will continue to add new stock monthly until I reach that goal. My current yield is 4.85%.

Added 5 Shares of Canadian Natural Resources (CNQ.TO)

Canadian Natural Resources just announced another 11% dividend increase. The company is rapidly paying back its debt and buying back shares on top of increasing its dividend. It’s a rare “income play” that shows interesting growth right now.

Here’s my SM portfolio as of November 6th, 2023 (before noon):

| Company Name | Ticker | Sector | Market Value |

| Brookfield Infrastructure | BIPC.TO | Utilities | $845.60 |

| Canadian National Resources | CNQ.TO | Energy | $1,013.54 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $433.98 |

| Exchange Income | EIF.TO | Industrials | $501.93 |

| Great-West Lifeco | GWO.TO | Financials | $676.43 |

| National Bank | NA.TO | Financials | $530.76 |

| Nutrien | NTR.TO | Materials | $965.77 |

| Telus | T.TO | Communications | $921.12 |

| TD Bank | TD.TO | Financials | $1,135.33 |

| Cash (Margin) | $20.21 | ||

| Total | $7,044.67 | ||

| Amount borrowed | -$7,000.00 |

Let’s look at my CDN portfolio. Numbers are as of November 2ND, 2023 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | Cons. Staples | $28,002.00 |

| Brookfield Renewable | BEPC.TO | Utilities | $8,833.92 |

| CAE | CAE.TO | Industrials | $5,856.00 |

| CCL Industries | CCL.B.TO | Materials | $7,722.40 |

| Fortis | FTS.TO | Utilities | $9,788.04 |

| Granite REIT | GRT.UN.TO | Real Estate | $8,454.40 |

| Magna International | MG.TO | Cons. Discre. | $4,715.90 |

| National Bank | NA.TO | Financials | $10,707.29 |

| Royal Bank | RY.TO | Financial | $7,461.35 |

| Cash | $353.33 | ||

| Total | $91,894.63 |

My account shows a variation of +$4,338.85 (+4.96%) since the last income report on October 3rd.

Here’s a quick review of companies that declared their earnings (the rest will be in my December update).

Brookfield Renewable is ready

Brookfield reported an acceptable quarter as funds from operations grew by 7%, but the FFO per share remained flat. The results reflect strong operating activities as BEP benefitted from its highly diversified operating platform, inflation-indexed contracts and development in-line with plan. I appreciated that management addressed the poor stock performance on the market. BEP reaffirmed its conviction in generating a strong return on its capital invested. It is also confident in making additional acquisitions as the renewables industry is struggling. Speaking of which, BEP ended the quarter with more than $4B in available liquidity.

Magna International surprises the market

Magna International pleased investors with this quarter: revenue up 15% and EPS up 36%! Revenues were driven by higher sales of light vehicles and positive currency rates. Revenues were up 10% in constant dollars. After a difficult start in 2023, Magna focused on optimization and cost reductions to expand its margin quickly. Their ongoing focus on operational excellence and cost initiatives helped drive strong earnings on higher sales. Management also revised its guidance for 2023 showing stronger revenue expectations and better margins. The stock now trades at a forward PE of 10.

Fortis is a King!

Fortis had good news to announce to its shareholders as it reported an EPS jump of 18%! The increase reflects the new cost of capital parameters approved for the FortisBC utilities in September 2023 retroactive to January 1, 2023. Earnings growth was also supported by a strong performance in Arizona, due to warmer weather and new customer rates. Finally, a higher USD boosted results translated into CAD. The company is on track with its $4.3B CAPEX plan for 2023 with $3B invested through September. Finally, Fortis announced a dividend increase of 4.4% in September of 2023 making it its 50th consecutive dividend increase. Congrats!

Here’s my US portfolio now. Numbers are as of November 2nd, 2023 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $13,317.75 |

| BlackRock | BLK | Financials | $9,022.86 |

| Brookfield Corp. | BN | Financials | $11,017.16 |

| Disney | DIS | Communications | $3,748.05 |

| Home Depot | HD | Cons. Discret. | $8,835.90 |

| Microsoft | MSFT | Inf. Technology | $19,157.60 |

| Starbucks | SBUX | Cons. Discret. | $8,500.85 |

| Texas Instruments | TXN | Inf. Technology | $7,365.50 |

| Visa | V | Inf. Technology | $12,162.50 |

| Cash | $351.36 | ||

| Total | $94,479.53 |

My account shows a variation of +$4,492.07 (+5%) since the last income report on October 3rd.

Most of my holdings reported their earnings, let’s have a look!

Apple warns investors of what’s coming ahead

Apple reported a mixed quarter as EPS jumped by 13%, but revenue was down by 1%. Net sales by category: iPhone revenue: $43.8B (2.7 Y/Y %); Mac revenue: $7.61B (-33.9 Y/Y %); iPad revenue: $6.44B (-10.2 Y/Y %); Wearables, home and accessories: $9.32B (-3.4 Y/Y %); Service revenue: $22.31B (16.3 Y/Y %). We continue to see weakness coming from China. Revenue in China totaled $15.084B compared to the average analyst estimate of $17B and versus $15.42B a year earlier. International revenue was also affected by a strong USD. Going forward, we should see stagnant revenue in this uncertain economy.

BlackRock remains a solid investment

BlackRock reported a solid quarter with EPS up 14% and revenue up 5%. EPS growth reflected a lower effective tax rate, partially offset by lower non-operating income in the current quarter. The 5% increase in revenue was primarily driven by organic growth and the impact of market movements over the past twelve months on average AUM and higher technology services revenue. However, long-term quarterly net inflows were only $3B, slowing from the $80B of inflows in Q2 and reflecting $49B of net outflows from lower-fee institutional index equity strategies. Clients are happier in cash right now and they prefer to wait.

Microsoft is the beast!

Microsoft reported another killer quarter with EPS up 27% and revenue up 13%, soundly beating analysts’ expectations. In September, MSFT also announced a 10% dividend increase (that makes a perfect dividend triangle for the quarter!). Revenue in Productivity and Business Processes increased by 13%, driven by Office commercial products (+15%) and Dynamics (+22%). Intelligent Cloud jumped by 19%, driven by Azure (+29%). Revenue in More Personal Computing was up 3% driven by Xbox (+13%) and Windows (+5%), but partially offset by Devices (-22%). MSFT is set for another year of growth!

Starbucks is opening more stores!

Starbucks reported a strong quarter with revenue up 11% and EPS up 31%, beating analysts’ expectations. Comparable store sales rose 8% as the average ticket was up 4% and transactions were up 3% during the quarter. Surprisingly, inflation didn’t slow down Americans and Canadians from buying their latte at Starbucks as comparable sales were up 8% in North America! International comparable sales rose 5%. China comparable store sales increased by 5%. Active membership in Starbucks Rewards in the U.S. rose 14% to 32.6M. There is more growth to come as SBUX opened 816 stores this quarter! SBUX also announced a 7.5% dividend increase in September!

Texas Instruments disappoints

This wasn’t the quarter we wanted from Texas Instruments. The company saw its revenue decline by 14% and EPS was down by 38%. The company’s results were affected by weaker demand from the automotive and industrial segments. We can feel a recession is brewing. Looking ahead, Texas Instruments expects fourth-quarter sales to be between $3.93B and $4.27B, below the $4.49B that analysts were anticipating. The company said that during the third-quarter, weakness in the industrial space “broadened.” At least, TXN offered a 5% dividend increase, but I’ll put this one on my radar as the dividend triangle is weakening.

Copy/paste for Visa

11-03-2023, I could literally copy/paste our comment about Visa quarterly earnings from one quarter to another! Another impressive quarter with revenue up 11% and EPS up 21%! The icing on the cake was a 16% dividend increase. Payments’ volume increased 9% Y/Y in constant dollars with cross-border volume up 16% and processed transactions increasing 10%. That compares with Q3 payments volume growth of 9%, cross-border volume growth of 17%, and process transactions growth of 10%. The growth isn’t over as management expects good numbers for 2024: EPS growth in the low teens and revenue growth in the high single-digits to low double-digits.

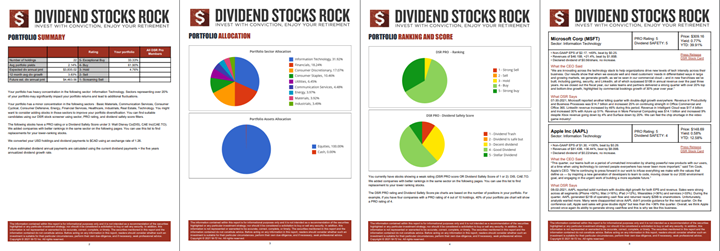

My Entire Portfolio Updated for Q3 2023

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of October 3rd, 2023.

Download my portfolio Q3 2023 report.

Dividend Income: $34.14 CAD (-81% vs October 2022)

What happened to October????

I’m down 81% on that month! If we go back in time, we will remember that Algonquin and Gentex were part of my portfolio last year. While AQN reminds me of my mistake, I still smile when I think of GNTX.

I sold the first one after a painful dividend cut and I sold the latter since it forgot its dividend growth policy. On one side, I lost about 50% and on the other, I made about 50% profit. But both stocks weren’t in line with my investment strategy (e.g., dividend growth investing). Focusing on the process is more important than focusing on a single stock’s returns.

Here are the details of my dividend payments.

Dividend growth (over the past 12 months):

- Granite: +3.2%

- Currency: +1.22%

Canadian Holding payouts: $364.55 CAD.

- Granite: $34.14

U.S. Holding payouts: $0 USD.

Total payouts: $662.29 CAD.

*I used a USD/CAD conversion rate of 1.3744

Since I started this portfolio in September 2017, I have received a total of $22,994.54 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

After looking at what is going on over the past two months on the market, one thing I can tell you is that we are far from being done with volatility. The only thing you can do now is to make sure you are comfortable with your portfolio and to focus on the long term.

Get rid of that price anchoring bias and get back to looking at metrics such as the dividend triangle. Numbers are stronger than stories.

Cheers,

Mike.

Leave a Reply