A few days ago, I released my Top 3 Canadian Dividend Stocks for 2026, along with a quick market recap showing why the TSX quietly outperformed the S&P 500 in 2025. If you missed that one, you can read it here.

Today, we’re shifting gears. Let’s look south and tackle my Top 3 U.S. Dividend Stocks for 2026—a mix of durability, growth, and structural tailwinds that should keep paying investors for many years to come.

Like the Canadian list, these aren’t flavor-of-the-month names. These are core holdings or educated guesses backed by real numbers, strong dividend triangles, and long-term business relevance.

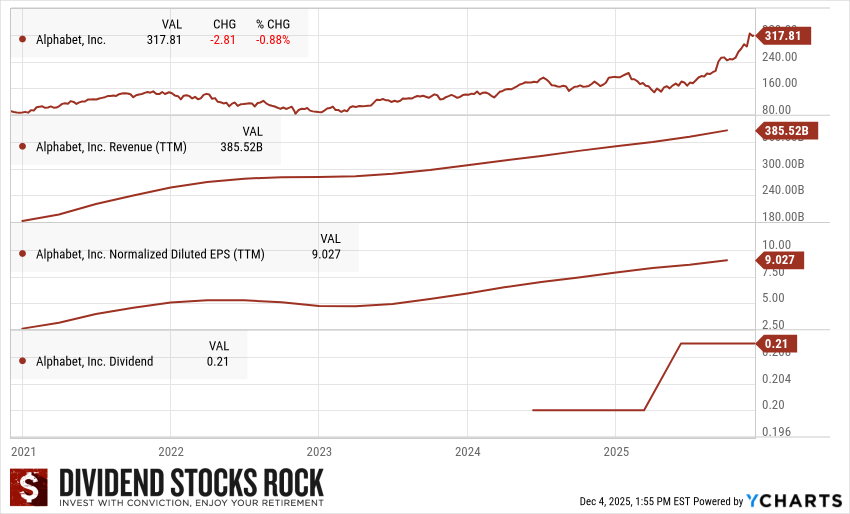

Alphabet (GOOG) — Core Holding

A cash-machine riding two unstoppable tailwinds: digital ads + AI.

Alphabet isn’t a new story—but it is a story that keeps getting better. Google’s search engine continues to dominate, YouTube keeps expanding its reach, and Google Cloud is finally scaling with discipline.

Alphabet’s real moat is simple:

the more people use Google, the more data it gets… which improves its products… which attracts even more users.

That’s the ultimate network effect.

Recent concerns around AI competition haven’t slowed the company down. Alphabet has successfully folded AI into its core products—search, ads, cloud—and continues to integrate generative AI into YouTube and Android. That gives Google the rare combination of stability, scale, and growth.

Why GOOG still works in 2026:

- A fortress balance sheet with huge free cash flow.

- Consistent revenue growth driven by global advertising and cloud services.

- A still-new dividend that should grow aggressively for years.

- AI is not a threat—it’s another catalyst.

This is a business that quietly compounds wealth in the background while the rest of the market argues about who will win the next AI milestone. Alphabet is already in the winner’s circle.

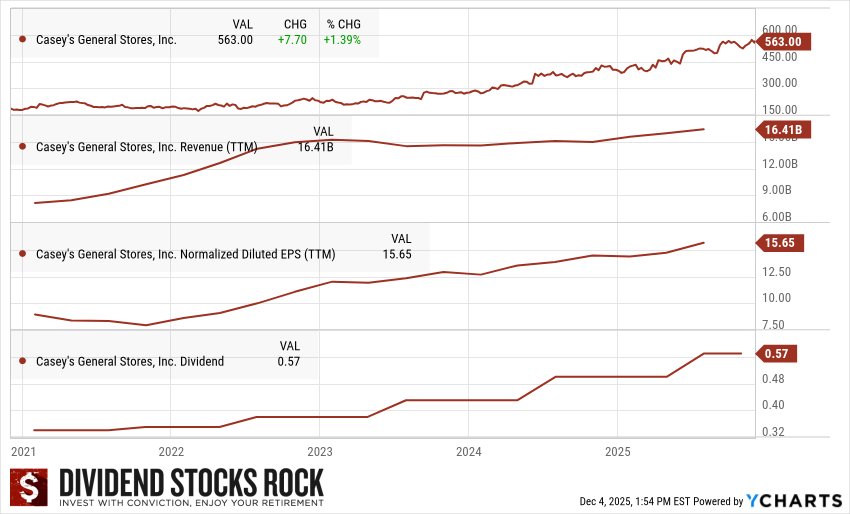

Casey’s General Stores (CASY) — Core Holding

The convenience-store flywheel that keeps accelerating.

If you love Alimentation Couche-Tard (ATD) in Canada, you’ll love Casey’s. ATD actually tried to buy Casey’s back in 2010, and looking at today’s results, we all know who missed out on whom.

Casey’s runs 2,800+ convenience stores, mostly in rural and suburban regions where competition is lighter and loyalty runs deeper. Their model is incredibly powerful because it mixes:

- Fuel

- Convenience retail

- High-margin food (yes, this is a top 5 pizza chain in the U.S.)

That food business is a hidden gem. It drives traffic, boosts margins, and gives Casey’s a strategic edge that many competitors will never match. Couple that with the ability to still open new stores at scale—something Couche-Tard can’t do easily in North America anymore—and you’ve got a long runway for growth.

Here’s why CASY deserves a spot in a 2026 portfolio:

- Management expects to open 270 stores in 2026—~10% growth.

- Revenue, EPS, and dividend growth all check the Dividend Triangle boxes.

- Its customer base is recession-resilient.

- Execution has been flawless for a decade.

Casey’s is the rare company that grows by repeating the same simple formula—store by store, block by block, year after year. That’s the kind of compounding you want in a long-term portfolio.

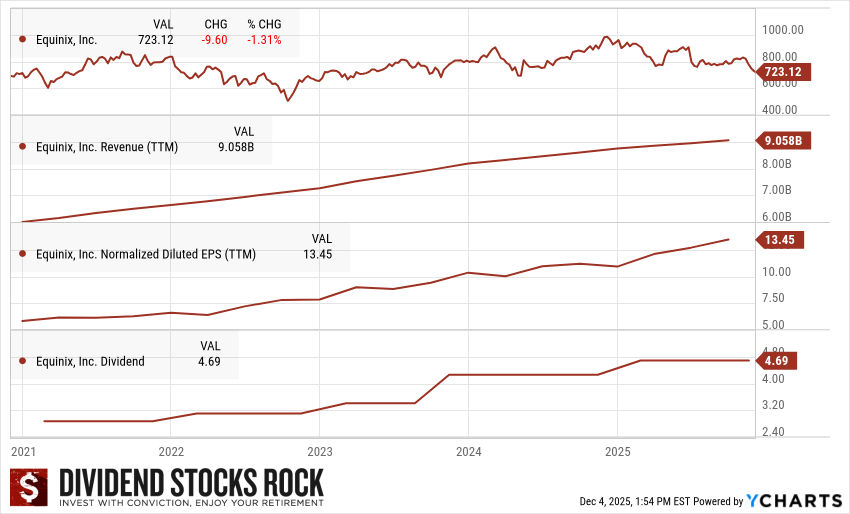

Equinix (EQIX) — Educated Guess

The backbone of global data traffic—and a quiet AI infrastructure winner.

If AI is the engine of the future, data centers are the highways—and Equinix is the toll road operator.

Most investors know AI needs chips (NVIDIA), cloud platforms (Amazon, Microsoft, Google), and power (utilities). What often gets overlooked is interconnection—the ultra-fast links between cloud platforms, enterprises, networks, and servers.

That’s Equinix’s specialty. And they dominate it.

Equinix runs 240+ data centers across five continents, giving it a global footprint that’s almost impossible to replicate. Once inside their ecosystem, clients tend to stay for years because switching is expensive, disruptive, and often unnecessary.

Revenue is sticky. Cash flow is stable. Growth is being fueled by demand from AI training, cloud computing, streaming, and global connectivity. And the dividend? It’s growing exactly the way a REIT investor wants—slow, steady, and sustainable.

Why EQIX has breakout potential in the AI era:

- AI demands more compute ? more servers ? more data centers ? more Equinix.

- Their interconnection business is a high-margin, high-retention niche.

- Expansion projects are already lined up across multiple continents.

- A classic “picks and shovels” play for the digital gold rush.

This isn’t a cheap stock—but great assets rarely are. EQIX is a long-term infrastructure compounder tied directly to the AI megatrend

A Quick Note Before You Build Your 2026 Watchlist

If these three stocks seem very different, that’s on purpose. At this stage in the cycle, you want a mix of:

- A megacap compounding machine (GOOG)

- A retail operator with a repeatable, defensive growth model (CASY)

- An AI infrastructure backbone with global reach (EQIX)

Put together, they create a diversified foundation for long-term dividend growth—even if their yields aren’t huge today.

But the deeper story of 2026 is bigger than any individual stock…

Want My Full 16-Page 2025 Market Review + Top 7 Dividend Stocks?

Download the complete booklet to see:

- The market trends shaping 2026

- Why certain sectors are quietly outperforming

- The 7 stocks I believe are positioned for long-term success

- How to select dividend growers using a simple, metrics-first framework

Download the Top 7 Stocks Booklet – It’s Free

Leave a Reply