In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and drove to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built this portfolio publicly since 2017 to make a real-life case study. I decided to invest 100% of this money in dividend growth stocks.

In August 2017, I received $108,760.02 in a locked retirement account. This means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to tell you to follow my lead. I just want to share how I manage my portfolio monthly with all the good and the bad. I hope you can learn from my experience.

In December, I reviewed my yearly performance, and it highlighted the most underrated mistake investors make when they plan their retirement, which I will share in this article. But first, let’s see how my portfolio performed in 2024.

Performance in Review

Let’s start with the numbers as of January 2nd, 2025 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $301,964.28

- Dividends paid: $5,152.47 (TTM)

- Average yield: 1.71%

- 2024 performance: +26.00%

- VFV.TO= +35.24%, XIU.TO = +20.72%

- Dividend growth: +12.22%

Total return since inception (Sep 2017 – January 2025): 177.64%

Annualized return (since September 2017 – 87 months): 15.13%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 16.61% (total return 204.60%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 10.64% (total return 108.20%)

Yearly Performance in Review

As you know, I’m not a fan of looking at short-term performance. If you hold a majority of the S&P 500 (or simply made a significant investment in the Magnificent 7), you are killing it… now. There is nothing wrong with that. In fact, it’s great that you are making money. However, it’s important to put everything in context.

Today, it’s easy to say that the S&P 500 was the place to invest 5 years ago. But if you want to look for a return with hindsight, you would have made much more money skipping the US market and investing it all in Bitcoin in January of 2020 instead ?.

Looking at this specific portfolio, I’m starting to have a good history of whether the strategy works after investing for over seven years. Ideally, I would include a real recession to create a perfect timeframe for a case study. In the meantime, I must deal with a small bear market in 2018, a quick crash in 2020, and another small bear market in 2022.

Note on benchmark

Since its inception, my portfolio has been up 177%, with a 15% annualized growth rate. I started my portfolio with 50% CAD and 50% USD. Therefore, the correct benchmark should be 50% Canadian and 50% US.

50% iShares S&P/TSX 60 ETF (XIU.TO) return (108.20 *0.50) = 54.10%

50% of Vanguard S&P 500 Index ETF (VFV.TO) return (204.60*0.50) = 102.30%

Benchmark return: 156.40% vs my return (177.64%) for an added value of 21.24%.

I used to benchmark with SPY, a USD S&P 500 ETF, but I will use VFV.TO in the future, a non-hedged CAD ETF tracking the S&P 500. At first, the currency fluctuation wasn’t significant enough, so SPY was doing a good job. Now, there is a clear advantage to investing in the U.S. for Canadians, and I must use a fair benchmark.

So, while my portfolio underperformed the index in 2024 (26% vs 27.98% for my benchmark), my 7-year track record shows excellent results.

In fact, I see the outperformance as a bonus because this is not why I select individual stocks in the first place. I like to be in control of my portfolio and I like to know what is happening for each of my holdings.

Jane, a long-time DSR PRO member, said on our podcast that she likes to be friends with her holdings. You know them, how they will react, and why they do it. This is great for conviction.

As Jane said, it’s hard to be friends with an ETF.

To be clear, ETF investing works perfectly and would have generated a similar return to mine over the past 7 years. The significant difference is the control you must give away and that you won’t know what is happening with your ETF when it drops in value.

I guess I just don’t like being passive but to each their own ?.

The Most Underrated Mistake Destroying Your Retirement

Don’t get blinded by return

I bet you didn’t see it coming, right? You might know that I launched a new service called Retirement Loop in December. Within a few weeks, I had incredible discussions with members. Meanwhile, I was preparing this dividend income report.

It struck me. Many investors make this mistake, which can greatly harm them in retirement: They overestimate returns in their retirement projections.

While I don’t believe we live in a world where the stock market will only generate 3% per year for the next 20 years, I don’t think I can maintain such a high annualized return over the long term. When I plan my retirement, I still use a 6.5% and 7% portfolio growth rate.

I remember when I started my career as a financial planner in 2007. Five-year returns for all portfolios showed high single-digit to double-digit returns (even for the conservative ones!). I was young and impressed by such generous returns.

Then 2008 happened.

In 2009, our portfolio 5-year returns were wiped out, and there wasn’t anything left to brag about anymore.

The reality has hit us again to remind all investors that markets work in cycles.

The reality has hit us again to remind all investors that markets work in cycles.

If you look at your portfolio returns when you are at the top, you may think you are a genius. A few years later, the bottom of a cycle looks like you will retire on Kraft Dinners and peanut butter sandwiches.

The key to planning your retirement is like driving in a curve: don’t look at where your bumper ends but rather to the horizon. Keep the same low and conservative expected return and you will be fine.

If you’d like to get more hindsight on how to build a portfolio that will generate a sustainable income at retirement, you can download the Dividend Income for Life Guide below. This is not a guide to high-yielding stocks (quite the opposite). This is a guide to creating a lifetime dividend income.

It will be useful during your accumulation phase as you will avoid major mistakes and build a solid portfolio for your retirement. It will be even more helpful if you are retired and count on your portfolio to pay the bills.

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 12 companies spread across 8 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 4.05% with a 5-year CAGR dividend growth rate of 9.00%.

Here’s my SM portfolio as of January 2nd, 2025 (before the bell):

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.TO | Consumer Staple | $1,594.40 |

| Brookfield Infrastructure | BIPC.TO | Utilities | $1,153.60 |

| Canadian National Resources | CNQ.TO | Energy | $1,597.68 |

| Capital Power | CPX.TO | Utilities | $1,847.88 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $1,058.54 |

| Exchange Income | EIF.TO | Industrials | $1,883.20 |

| Franco-Nevada | FNV.TO | Materials | 1,013.20 |

| Great-West Lifeco | GWO.TO | Financials | $810.39 |

| National Bank | NA.TO | Financials | $1,441.44 |

| Nutrien | NTR.TO | Materials | $836.16 |

| Telus | T.TO | Communications | $1,188.89 |

| TD Bank | TD.TO | Financials | $1,071.42 |

| Waste Connections | WCN.TO | Industrials | $493.20 |

| Cash (Margin) | $314.99 | ||

| Total | $16,305.31 | ||

| Amount borrowed | -$14,000.00 |

$500 standing still

I took time off everything during the holidays! Therefore, at the time of writing, I haven’t made a purchase yet. The $500 was transferred to my account. I will invest the money in January. At this time, I’m thinking of adding a little bit more of Telus to this portfolio. The stock has been significantly penalized, while Telus’ situation isn’t that catastrophic (free cash flow and cash from operations improved throughout 2024).

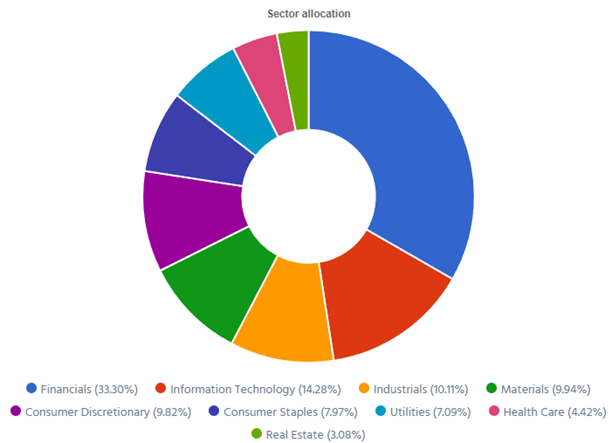

Let’s look at my CDN portfolio. Numbers are as of January 2nd, 2025 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | Cons. Staples | $23,836.28 |

| Brookfield Renewable | BEPC.TO | Utilities | $10,263.24 |

| CCL Industries | CCL.B.TO | Materials | $14,272.35 |

| Fortis | FTS.TO | Utilities | $10,213.83 |

| Granite REIT | GRT.UN.TO | Real Estate | $8,929.28 |

| National Bank | NA.TO | Financials | $15,855.84 |

| Royal Bank | RY.TO | Financial | $11,265.80 |

| Stella Jones | SJ.TO | Materials | $14,736.33 |

| Toromont Industries | TIH.TO | Industrials | $14,091.36 |

| Cash | $159.81 | ||

| Total | $123,624.12 |

My account shows a variation of $9,385.88 (+8.22%) since December’s income report. While stocks were down, I transferred the proceeds of Texas Instruments into my Canadian account to maintain my CAD / USD balance.

I made this move for two reasons:

#1 I want to maintain a 50-50 balance between my CAD and USD across all my portfolios. After this trade, my global view shows 50.26% CAD and 49.74% USD. I can’t be much closer to my objective!

#2 I had smaller positions in my Canadian portfolio that needed a little boost.

Adding 61 shares of Stella-Jones (SJ.TO)

I see both SJ and TIH as long-term holdings and plays on infrastructure. The market was once again quick to run on weak guidance for 2025 and Trump’s threat to impose tariffs on everything. I don’t expect SJ to do incredibly well in 2025, but the price drop and the fact that SJ was a bit small in my portfolio encouraged me to add more shares.

Adding 60 shares of Toromont Industries (TIH.TO)

TIH has over 50 years of history built a solid sales network with roughly 140 locations across Canada and the U.S. Combining this large distribution network with a well-known brand (Caterpillar) has secured success that will last for decades. I started my position in 2024. This trade puts TIH at a “full position” stage.

Adding 53 shares of CCL Industries (CCL.B.TO)

Finding an international leader with a well-diversified business based in Canada is rare Through the major acquisition of business units from Avery (world’s largest supplier of labels) in 2013, the company has set the tone for several years of growth. Bolstered by its previous successes, CCL also bought Checkpoint, a leading developer of RF and RFID, and Innovia over the past few years and announced more acquisitions in the past few years. The company is still able to generate organic growth (roughly 4-5%) on top of its growth through acquisitions.

In more depth, I have discussed CCL Industries and two other Canadian dividend stocks, part of my favorites for 2025, in the video below.

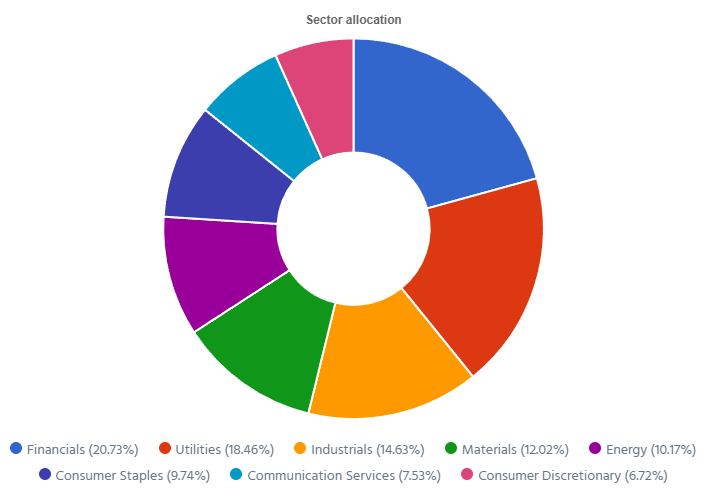

Here’s my US portfolio now. Numbers are as of January 2nd, 2025 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $10,299.42 |

| Automatic Data Processing | ADP | Industrials | $11,123.74 |

| BlackRock | BLK | Financials | $14,351.54 |

| Brookfield Corp. | BN | Financials | $19,705.35 |

| Home Depot | HD | Cons. Discret. | $11,669.70 |

| LeMaitre Vascular | LMAT | Healthcare | $9,214.00 |

| Microsoft | MSFT | Inf. Technology | $19,810.50 |

| Starbucks | SBUX | Cons. Discret. | $8,577.50 |

| Visa | V | Financials | $15,802.00 |

| Cash | $28.29 | ||

| Total | $120,299.42 |

My account shows a variation of -$15,434.11 (-11.37%) since December’s income report. The fluctuation was mostly driven by the market and the transfer of the sell of my TXN shares into my CAD account.

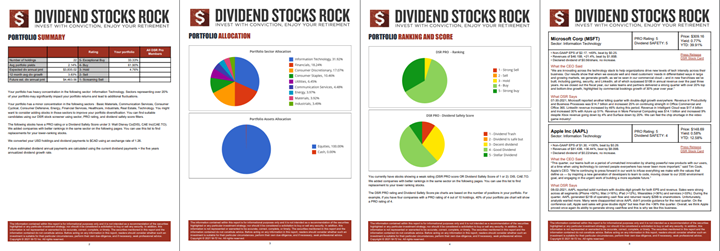

My Entire Portfolio Updated for Q4 2024

Each quarter, we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our special additional service, DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of January 2nd, 2025.

Download my portfolio Q4 2024 report.

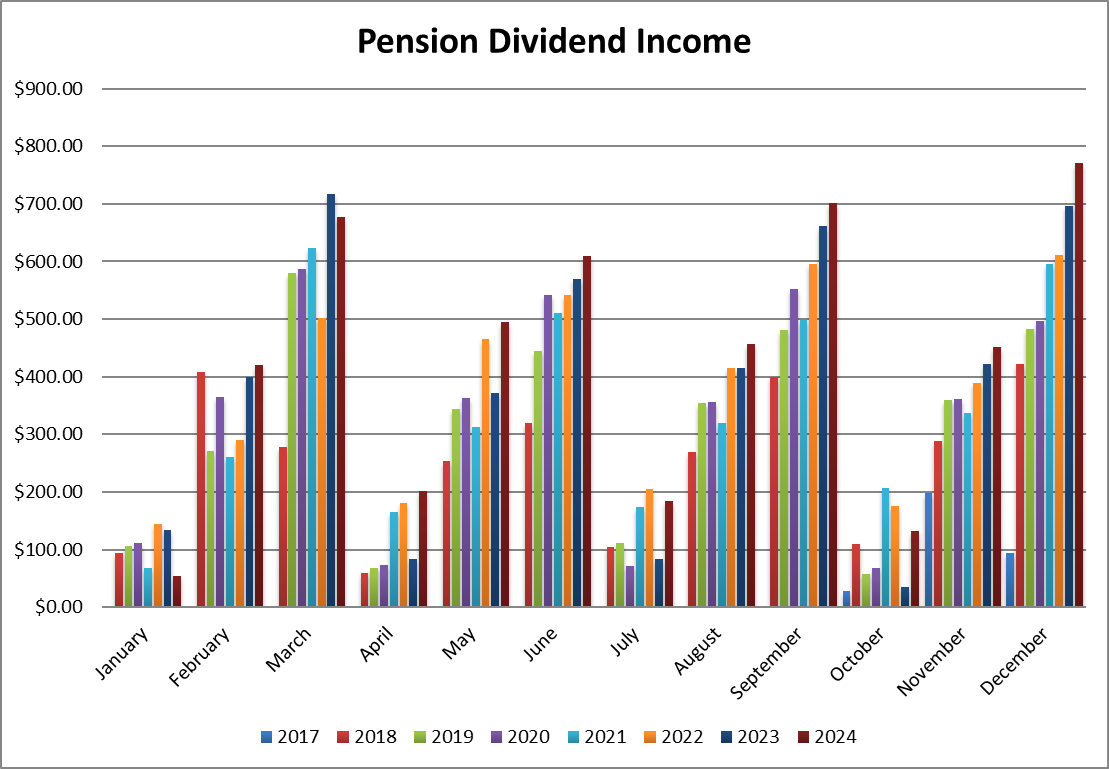

Dividend Income: $770.40 CAD (+10.65% vs December 2023)

I’m ending the year on a strong note. My total dividends received grew by 12% in 2024. December was also a record month with close to $800 in dividends! Even my small portfolio with a small yield is starting to pay some serious money!

Dividend growth over the past 12 months:

- Granite REIT: +3.10%

- Fortis: +4.24%

- Couche-Tard: -7.2% (I sold some shares)

- Stella-Jones: new

- CCL: +18.92%

- Brookfield Renewable: +8.5%

- Visa: +13.46%

- LeMaitre: new

- Microsoft: -5.4% (I sold some shares)

- Home Depot +7.66%

- BlackRock: +2.00%

- Brookfield: +11.58

- Currency: +10.63%

Canadian Holding payouts: $408.48 CAD.

- Granite REIT: $35.20

- Fortis: $105.17

- Couche-Tard: $58.31

- Stella-Jones: $40.88

- CCL: $40.60

- Brookfield Renewable: $128.32

U.S. Holding payouts: $250.88 USD.

- Visa: $29.50

- LeMaitre: $16.00

- Microsoft: $39.01

- Home Depot $67.50

- BlackRock: $71.40

- Brookfield: $27.47

Total payouts: $770.40 CAD.

*I used a USD/CAD conversion rate of 1.4426

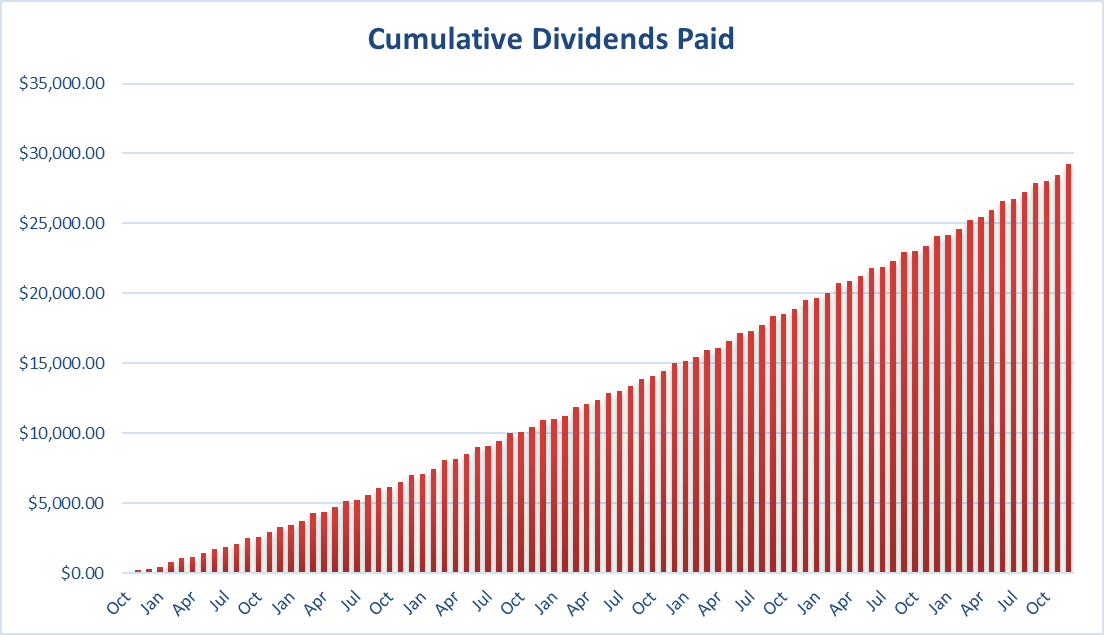

Since I started this portfolio in September 2017, I have received a total of $29,265.97 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio,” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

After selling Texas Instruments (TXN.TO), the only stock I could see myself selling in 2025 would be Blackrock (BLK). While the stock is doing well in terms of total return performance, I’m disappointed by the weak dividend growth in 2023 and 2024. I’ll wait to see what the dividend increase will be for 2025. Then, I’ll do a deep dive to determine if BLK still meets my investment thesis because, good performance or not, I must stay true to my strategy.

Cheers,

Mike.

Leave a Reply