In September of 2017, I received slightly over $100K from my former employer, representing the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

This month, I also took a deeper look at what’s going on with Renewables Stocks. Don’t miss it!

Performance in Review

Let’s start with the numbers as of October 3rd, 2023 (in the morning):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $209,908.87

- Dividends paid: $4,613.03 (TTM)

- Average yield: 2.20%

- 2022 performance: -12.08%

- SPY= -18.17%, XIU.TO = -6.36%

- Dividend growth: +10.83%

Total return since inception (Sep 2017-September 2023): 93%

Annualized return (since September 2017 – 73 months): 11.41%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 11.32% (total return 91.92%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 7.56% (total return 55.83%)

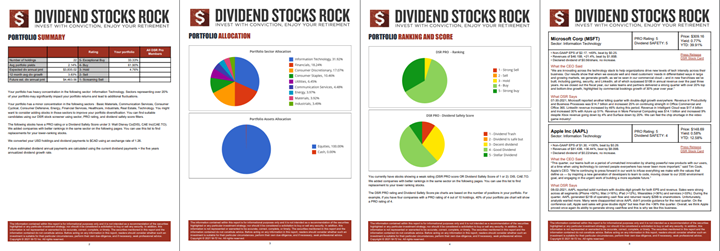

Dynamic sector allocation calculated by DSR PRO as of October 3rd 2023.

The Death of Renewables?

If you hold a renewable energy stock in your portfolio, you have probably been in shock since September. Many of those stocks dropped by more than 15% over the past two weeks.

What created that chaos? Nope, we are not talking about a dividend cut here or even an absence of dividend growth. On September 27th, NextEra Partners (NEP) announced a revision of its distribution per unit growth from 12%-15% per year down to 5%-8% with a target growth rate of 6% per year. For the record, NEP’s distribution has almost doubled over the past 5 years (+89.78%) with an annualized growth rate of 13.67%. The CEO explained why in a press release:

“NextEra Energy Partners is revising its long-term growth rate expectations for limited partner distributions to increase its flexibility as it continues to execute on its growth opportunities,” said John Ketchum, chairman and chief executive officer. “Tighter monetary policy and higher interest rates obviously affect the financing needed to grow distributions at 12%, and the burden of financing this growth has had an impact on NextEra Energy Partners’ unit price and yield. In the current market environment, the partnership believes revising its growth expectations for now is the appropriate decision for unitholders and better positions it to continue to deliver long-term value.”

The company already announced a strategic shift in May when NEP confirmed its intention to sell its natural gas pipelines.

The idea behind the asset sales and the reduction of the dividend growth policy is to give the company more financial flexibility and to maintain its ability to invest in new projects to pursue growth. It’s also to pay off debts that are coming up.

NEP has roughly $1.5B of convertible equity financing debt to pay off through 2025. The CEFP (Convertible Equity Financing Portfolio) is a way to get financing where you intend to either pay the debt in cash or in units when it comes to maturity.

As you know, companies can use debt or issue more stocks/units to finance their projects. NEP uses a mix of equity financing (issuing units) and regular debt. They can then use CEFP to get money “today” and bet that their NEP unit price will go up before the CEFP comes to maturity and then get a good deal by issuing units at a higher price to pay the debt. As the stock has dropped by nearly 60% recently, you can count on them not using the issuance of additional units as their source for near term financing.

This specific situation has highlighted how most renewable energy utility companies are now highly sensitive to the higher interest rates. NEP is now stuck between a rock and a hard place. Future debt will carry interest rates of 7%-8% while issuing more units when your stock price is so depreciated could only drive the price lower as it dilutes shareholders’ investment.

What’s next for NEP?

Let’s be clear here: NEP is walking on the edge of a cliff, but it doesn’t mean it will fall. Numbers seem to work between now and 2025 (assuming no further major interest rate hikes). However, the company is not out of the woods yet. There is a pessimistic scenario where NEP faces higher interest rates, and the unit price doesn’t bounce back. In that scenario, NEP will eventually face the possibility of a dividend cut or NextEra Energy (NEE) will buy all NEP units and bring that kid back home. NEE is a leader in renewable energy and has a market cap of $97B and owns 51% of NEP which has a market cap of $2B. If this happens, NEP shareholders won’t be happy as they won’t receive much for their units.

There is also an optimistic scenario where NEP walks on the edge of the cliff for a few years and then sees interest rates going lower before 2026 when more debt (including CEFP) comes to maturity.

If this happens, then the NEP unit price will slowly but surely go back up, the dividend will be paid, and growth will be back on the table. At this point, however, NEP has become a high-risk, high-reward investment.

What about other renewable utilities?

You heard me several times telling you that “now is not the time to take wild guesses”. That “now is the time to make sure you have a solid portfolio”. That implies you must do more digging and make sure the companies you hold in your portfolio show strong financial metrics. Unfortunately, utilities aren’t easy to analyze since they use a combination of GAAP (Generally accepted accounting principles) and non-GAAP (like homemade calculations). Funds from operations (FFO) and FFO per unit are common metrics used in their press releases and quarterly earnings reports.

Therefore, digging into DSR’s numbers isn’t enough. You must go on the company’s website and look for investors’ presentations along with quarterly earnings reviews.

If you do that, you will notice that a company like Brookfield Renewable (BEPC/BEPC.TO) hosted its investors day earlier in September. You will also notice that as opposed to NEP, BEPC reaffirmed their growth expectations along with their distribution growth targets. In other words, it’s business as usual for BEPC.

Different companies, different business models, different debt structures. The good news is that when something like this happens, great companies get punished on the market because they are put in the same basket as the one with the problem.

In this case, it appears clear that all utilities (along with other capital-intensive companies) will suffer for a while. Higher interest charges hurt their balance sheet and cash flow while many retirees are now moving away from utilities (a sector considered relatively safe and paying a relatively good yield) to go back to bonds and GICs. After all, when 10-year government bonds offer a yield above 4.5%, an income-seeking investor would be a fool to go after a stock paying the same yield.

How to look at renewable utilities

First, ignore the noise. If you look for other’s thoughts on NEP or the like, you’ll get lost in a myriad of conflicting information. On your left, you can see the last 3 articles on the Seeking Alpha page as of October 6th (Strong Buy, Sell, and Hold ratings).

I read all three and they all make some solid points. Therefore, I’m left with no opinion if I trust others. Therefore, you are better off developing your own opinion. How can you do that? By following the same investment process as usual: making sure your investment thesis (the narrative) is backed by the numbers.

First and foremost, I start with the dividend triangle. It’s harder to make sense as the EPS won’t be much of use in this category. Therefore, I look at the revenue and dividend growth trend first and then I look for FFO per unit (the common replacement for EPS in that case) on the company’s website.

No or weak dividend growth would raise a huge pirate-size red flag. I’ve discussed that many times in the past while comparing BEPC to Northland Power (NPI) for example. If you have the choice between two stocks and one shows no or weak dividend growth, it should be eliminated from your decision process.

Then, I’ll look at the company’s debt structure and maturity (you can find that in the company’s investor presentation). There is a big difference between a company that shows fixed-rate debt over a long period of time vs. a company with floating rates or short-term maturities that will push interest rate charges higher.

Finally, the past performance and track record of the company and management is key here. Knowing how a company reacts during difficult times is very important. You may have to go back and study the 2008 crisis, but it’s worth spending time if you are uncomfortable with your stocks.

Renewables aren’t dead, they are just facing significant headwinds

Renewable utilities are facing more voluminous headwinds than classic utilities due to their business model. Many classic utilities like Fortis, Canadian Utilities, Xcel, and WEC Energy operate regulated assets. The term “regulated” means that the utility is given a monopoly over an area to ensure the quality and stability of the service (we don’t want to live in a world where we don’t know when the power will be cut off). In exchange for that monopoly, the utility can’t raise rates whenever it wants. It must present a case to the regulator (that will ensure the rate increase makes sense for both the utility and its customers). If interest rate costs increase, regulated utilities have more pricing power as they can more easily defend their rate increase request.

Renewable utilities don’t enjoy a monopoly as their energy source is often a complement (as it’s less stable). They benefit from the free market advantages (e.g., being able to raise prices as they want), but they also face more competitors. In the current economic environment, I am sure they wish they could negotiate rate increases with a regulator!

As is the case with other capital-intensive businesses (Telcos, REITs, pipelines, some industrial, etc.) it will be a rough ride until we have confirmation that the rate increases are over (and we are heading toward some rate cuts eventually). Unfortunately, we are not there yet, and investors must decide if they want to endure this “walk in the desert”. Again, focusing on dividend growers should help.

Here’s a thought-provoking investment strategy that relies on low-yield, high dividend growth stocks for retirement shared on my YouTube channel.

I will deep-dive into the topic during my Next Free Webinar on November 2nd at 1pm EST. There will be a one-hour Q&A session if questions remain.

Save Your Spot Now! Live Seats are Limited!

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 9 companies spread across 7 sectors. My goal is to build a portfolio generating 4-5% in yield across 15 positions. I will continue to add new stock monthly until I reach that goal. My current yield is at 4.86%.

Added 11 Shares of Brookfield Infrastructure (BIPC.TO)

As utilities are getting hammered, I’m using my $500 to do some DCA (dollar-cost-averaging). I added 11 shares of BIPC and brought back my adjusted cost to $49.47. It’s a great time to add a stock paying a 4.30% yield!

Here’s my SM portfolio as of October 3RD, 2023 (in the morning):

| Company Name | Ticker | Sector | Market Value |

| Brookfield Infrastructure | BIPC.TO | Utilities | $904.80 |

| Canadian National Resources | CNQ.TO | Energy | $514.68 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $425.16 |

| Exchange Income | EIF.TO | Industrials | $477.95 |

| Great-West Lifeco | GWO.TO | Financials | $640.90 |

| National Bank | NA.TO | Financials | $527.64 |

| Nutrien | NTR.TO | Materials | $1,044.81 |

| Telus | T.TO | Communications | $813.20 |

| TD Bank | TD.TO | Financials | $1,115.38 |

| Cash (Margin) | -$67.95 | ||

| Total | $6,464.52 | ||

| Amount borrowed | -$6,500.00 |

Let’s look at my CDN portfolio. Numbers are as of October 3RD, 2023 (in the morning):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | Cons. Staples | $25,007.94 |

| Brookfield Renewable | BEPC.TO | Utilities | $7,840.62 |

| CAE | CAE.TO | Industrials | $6,219.00 |

| CCL Industries | CCL.B.TO | Materials | $7,929.60 |

| Fortis | FTS.TO | Utilities | $8,532.90 |

| Granite REIT | GRT.UN.TO | Real Estate | $9,059.84 |

| Magna International | MG.TO | Cons. Discre. | $4,963.70 |

| National Bank | NA.TO | Financials | $10,625.01 |

| Royal Bank | RY.TO | Financial | $7,381.40 |

| Cash | $195.77 | ||

| Total | $87,755.78 |

My account shows a variation of -$6,816.18 (-7.2%) since the last income report on September 5th.

During the quarter, I used my liquidity to buy a little more of BEPC. I bought 32 shares at $32.85. I know… I should have waited for NextEra Partners (NEP) to drop its bomb on utilities to make my purchase!

Here’s my US portfolio now. Numbers are as of October 3RD, 2023 (in the morning):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $12,854.25 |

| BlackRock | BLK | Financials | $8,791.02 |

| Brookfield Corp. | BN | Financials | $10,255.70 |

| Disney | DIS | Communications | $3,610.58 |

| Home Depot | HD | Cons. Discret. | $8,756.10 |

| Microsoft | MSFT | Inf. Technology | $17,316.20 |

| Starbucks | SBUX | Cons. Discret. | $7,645.75 |

| Texas Instruments | TXN | Inf. Technology | $7,914.00 |

| Visa | V | Inf. Technology | $11,492.50 |

| Cash | $351.36 | ||

| Total | $88,987.46 |

My account shows a variation of -$8,130.40 (-8.37%) since the last income report on September 5th.

We’ll do earnings reviews next month!

In the meantime, here’s a podcast episode on the ideal portfolio allocation. I shared my well-tested methodology to build a rock solid portfolio.

My Entire Portfolio Updated for Q3 2023

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of October 3rd, 2023.

Download my portfolio Q3 2023 report.

Dividend Income: $662.29 CAD (+11.27% vs September 2022)

Dividends paid in September were up 11% vs. last year. There were many changes, though. In 2022, I received dividends from Sylogist ($52.13), Enbridge ($138.46) and VF Corp ($40.50). I sold those positions since last year and I now receive more dividends from Fortis and Brookfield Renewable because I bought more shares, some decent increases from Alimentation Couche-Tard, Visa and Microsoft plus new dividend payers such as CCL, Home Depot and Brookfield Corporation.

On top of that, Magna International paid in September this year, but in August last year. In the end, what really matters is that I’m on my way to receiving more dividends in 2023 than in 2022 ?.

Here are the details of my dividend payments.

Dividend growth (over the past 12 months):

- Magna Intl: +6.8% (small increase + currency fluctuations)

- Fortis: +82% (I sold AQN to buy more FTS earlier this year)

- Granite: +3.2%

- CCL: new

- Brookfield Renewable: +74.5% (I added more BEPC this year)

- Alimentation Couche-Tard: +27.27%

- Visa: +20%

- Microsoft: +9.7%

- Home Depot: new

- BlackRock: +2.5%

- Brookfield: new

- Currency: +1.22%

Canadian Holding payouts: $364.55 CAD.

- Magna Intl: $43.22

- Fortis: $96.62

- Granite: $34.14

- CCL: $37.10

- Brookfield Renewable: $103.21

- Alimentation Couche-Tard: $50.26

U.S. Holding payouts: $216.90 USD.

- Visa: $22.50

- Microsoft: $37.40

- Home Depot: $62.70

- BlackRock: $70.00

- Brookfield: $24.30

Total payouts: $662.29 CAD.

*I used a USD/CAD conversion rate of 1.3727

Since I started this portfolio in September 2017, I have received a total of $22,960.40 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

It’s crazy how fast the market evolves. Last month, I reported great results and one of my highest (if not my highest) portfolio value ever. 30 days later, I’m humbled again by the wrath of Mr. Market.

Does it really matter?

Not really. In the end, I don’t invest to know my portfolio value in September or in October of 2023. I invest thinking I’ll need part of that money somewhere around 2043. Never forget about your end game here.

Cheers,

Mike.

Hi Mike.

I listened to your podcast today for the first time and was really impressed by your honest, open attitude.

I’m just checking out your website now and I’m thinking I will become a PRO member. I really like how you offer information without a lot of pressure to buy your memberships on your site too.

I’m looking forward to exploring your website, and podcasts further.

Kind Regards

Shelley