In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and drove to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built this portfolio publicly since 2017 to make a real-life case study. I decided to invest 100% of this money in dividend growth stocks.

In August 2017, I received $108,760.02 in a locked retirement account. This means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to tell you to follow my lead. I just want to share how I manage my portfolio monthly with all the good and the bad. I hope you can learn from my experience.

Should you take action on double-digit earnings movements?

The short answer is no.

The long answer is: it depends.

I have given more thought to that question in this issue.

Performance in Review

Let’s start with the numbers as of March 4th, 2025 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $298,398.10

- Dividends paid: $5,197.46 (TTM)

- Average yield: 1.74%

- 2024 performance: +26.00%

- VFV.TO= +35.24%, XIU.TO = +20.72%

- Dividend growth: +12.22%

Total return since inception (Sep 2017 – February 2025): 174.36%

Annualized return (since September 2017 – 88 months): 14.75%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 16.48% (total return 206.10%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 10.85% (total return 112.90%)

What to Do With Stocks Falling on Earnings?

Last month, I received a dozen emails about TFI International (TFII.TO). The stock dropped like a rock (-30% over a few days) after a disastrous quarter. Ironically, I also must add that I received ZERO emails about Stantec (STN) going up about 18% after its earnings.

Should you take action on double-digit earnings movements?

The short answer is no.

The long answer is: it depends.

One should not take action immediately when the earnings are announced. Whether the stock goes up or down by 10%+, it’s a matter of valuation reassessment. It doesn’t mean it should automatically affect your view.

Share prices are driven by general expectations and then validated by financial results

Some investors think share prices are driven by voodoo or even possibly manipulated. It’s the perception of “you are not responsible” and “there is nothing you can do about it”. In other words, you buy shares, you hold, you hope.

I already told you that hoping is not an acceptable investing strategy, right?

In reality, share prices are driven by expectations. When a majority of investors (retail, financial analysts, investment firms) think a company will thrive, they will buy more shares. That will drive the stock price up. The opposite is also true when the market thinks a company will struggle for a while, many investors sell, driving prices lower.

Those expectations are based on known information. What creates volatility is that new information becomes available almost every single day. Most importantly, we get a boatload of new information for a specific company during its quarterly earnings report. This new information will impact how the market views a stock and drive new expectations.

TFI reported EPS down 30%, and management said it will continue to hurt in the following quarters.

This information was not available prior to the earnings call. Over the past quarters, investors expected a slowdown (reflected in a stock price that doesn’t take a direction up or down). Now, short-term views (e.g., coming quarters) are likely to look like the last one. Therefore, the market now expects lower EPS.

Previous expectations weren’t confirmed, but the opposite was true! Therefore, a new price is set accordingly.

The stock goes down by 30% while the EPS goes down by 30%. Do you see a connection here?

The challenge is to review your investment thesis and set a time frame

Here comes the tough part: what to do next.

Let’s be straightforward: I don’t have a crystal ball, nor do you. Nobody does. Therefore, instead of craving for more material to consume (YouTube, podcast, newsletter, etc.) on a problematic stock, you should focus on having a clear process for this type of situation.

The process doesn’t guarantee you will be right 100% of the time.

But you will be confident as you take action 100% of the time.

Since there is a shortage of good crystal balls, I’ll stick with a clear process:

- What’s my investment thesis, and how does the latest quarter affect it?

- Am I looking at a temporary problem or something permanent?

- Will I talk about this problem in 10 years?

- If unsure, how long am I ready to wait?

- During that waiting period, which metrics or other facts (management’s plan) will I monitor?

- Once the time is up, I review my investment thesis again and double-check the financial metrics.

Here’s an example of how I applied this simple process with Alimentation Couche-Tard:

- What’s my investment thesis, and how does the latest quarter affect it?

ATD has several growth vectors in place with a clear 5-year plan including organic growth and growth by acquisition. However, the last 4 quarters have shown weaknesses in revenue and earnings putting my investment thesis to the test.

- Am I looking at a temporary problem or something permanent?

According to management, ATD’s recent results are due to a challenging economic environment. It has been proven harder to grow organically in 2024. When I look at the past 10 years, it’s not the first time ATD has shown a slowdown in revenue and EPS. These “plateaus” happen from time to time.

- Will I talk about this problem in 10 years?

Based on past plateaus, there is a good chance I won’t even remember 2024.

- If unsure, how long am I ready to wait?

I will still monitor the company’s quarterly earnings as the problem has been ongoing for an entire year already. Considering my investment thesis and ATD’s strong management team, I’m willing to wait for another 2 years (3 years total). Therefore, my deadline will be after the first quarter of 2027.

- Which metrics or other facts (management’s plan) will I monitor during that waiting period?

I expect management to discuss their plan to grow organically in 2025. I will monitor revenue, EPS, and margin for each quarter. I wish to see improvements toward the end of 2025.

- Once the time is up, I review my investment thesis again and double-check the financial metrics.

I should see improvements in 2025-2026. If the company continues to struggle, I will sell and move on.

To get more of my thoughts about Couche-Tard’s most recent quarter, listen to this Moose on The Loose episode.

If you follow a similar process, you won’t have to ask yourself dozens of questions each quarter. I sleep well at night and won’t give much thought to the stock price fluctuations.

After all, Broadcom (AVOG) jumped by 54% between November 29th and December 16th, 2024, only to see its stock price go down by 25% between January 24th and March 4th for a net result of +8% between November and March.

It was probably better not to look at the AVGO stock price over the past 6 months ?.

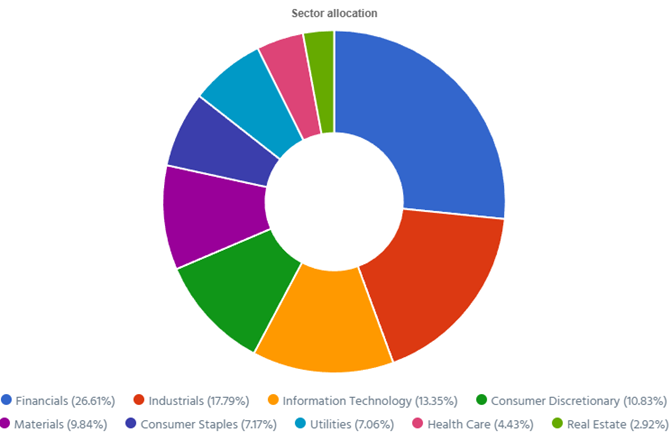

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 13 companies spread across 8 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 4.08% with a 5-year CAGR dividend growth rate of 8.67%.

Increasing the Smith Manoeuvre amount

Starting in March, I will increase my Smith Manoeuvre contribution from $500 to $750 monthly. My 2025 goal is to reach $1,000 per month toward my SM portfolio. I’ve cleared my car loans, and I will use some of the free cash flow to fuel this strategy.

Here’s my SM portfolio as of March 4th 2025, 2025 (before the bell):

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.TO | Consumer Staple | $1,416.20 |

| Brookfield Infrastructure | BIPC.TO | Utilities | $1,139.00 |

| Canadian National Resources | CNQ.TO | Energy | $1,395.00 |

| Capital Power | CPX.TO | Utilities | $1,460.44 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $989.31 |

| Exchange Income | EIF.TO | Industrials | $1,617.60 |

| Franco-Nevada | FNV.TO | Materials | 1,228.56 |

| Great-West Lifeco | GWO.TO | Financials | $904.74 |

| National Bank | NA.TO | Financials | $1,304.93 |

| Nutrien | NTR.TO | Materials | $936.70 |

| Telus | T.TO | Communications | $1,371.28 |

| TD Bank | TD.TO | Financials | $1,209.74 |

| Waste Connections | WCN.TO | Industrials | $1,391.60 |

| Cash (Margin) | $875.67 | ||

| Total | $17.240.77 | ||

| Amount borrowed | -$15,250.00 |

All-in on Franco-Nevada!

I reported a cash balance of $875 this month as I’m still waiting for my broker to show my $750 transfer. Starting this month, I will increase my monthly contribution to $750 as I finally paid off my two car loans. I will use the entire $875 to add more shares of Franco-Nevada as I believe it will be a strong play once tariffs hit the market!

I did a complete video on this interesting company.

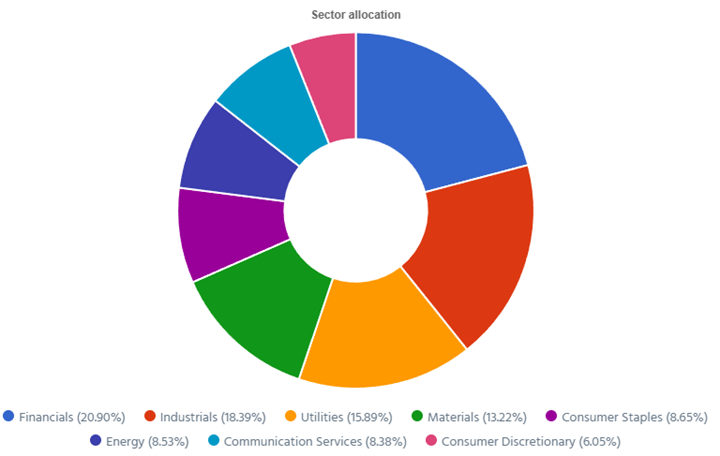

Let’s look at my CDN portfolio. Numbers are as of March 4th, 2025 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | Cons. Staples | $21,172.19 |

| Brookfield Renewable | BEPC.TO | Utilities | $9,917.52 |

| CCL Industries | CCL.B.TO | Materials | $14,193.22 |

| Fortis | FTS.TO | Utilities | $10,944.00 |

| Granite REIT | GRT.UN.TO | Real Estate | $8,641.28 |

| National Bank | NA.TO | Financials | $14,354.23 |

| Royal Bank | RY.TO | Financial | $11,021.40 |

| Stella Jones | SJ.TO | Materials | $14,883.30 |

| Toromont Industries | TIH.TO | Industrials | $14,939.52 |

| Cash | $105.17 | ||

| Total | $120,171.83 |

My account shows a variation of $157.60 (flat) since February’s income report.

CCL Industries rewards its shareholders

CCL Industries reported another good quarter with revenue up 9% and EPS up 5%. This growth was driven by 6.8% organic expansion, 1.4% from acquisitions, and a 0.8% positive impact from currency translation. The company’s various segments delivered mixed performances with CCL, Checkpoint, and Innovia posting organic sales growth of 5.4%, 13.3%, and 20.2%, respectively. Avery experienced a 2.0% organic decline due to weaker international demand. The company’s operating margin stood at 14.8% reflecting a 50 basis-point decline due to higher input costs and operational restructuring charges. Management also increased the dividend by 10%!

Fortis focuses on its CAPEX plan

Fortis reported a good quarter with EPS up 15%. This increase was primarily driven by rate base growth across its utilities, new customer rates at Tucson Electric Power effective September 1, 2023, and at Central Hudson effective July 1, 2024. Fortis invested $5.2 billion in capital expenditures in 2024 which contributed to a 6% annual rate base growth. The company is focused on its $26 billion five-year capital plan which targets a 6.5% annual rate base growth through 2029. Fortis reaffirmed its guidance for 4-6% annual dividend growth through 2029 which will be supported by its robust capital plan and consistent rate base growth.

Granite REIT: good numbers, still no love!

Granite REIT reported another good quarter with revenue up 14% and AFFO per unit up by 9%. The AFFO payout ratio for the full year of 2024 was 68%. The primary drivers were the commencement of leases from two expansion projects in Canada and the Netherlands completed in Q3, as well as two development projects in Canada and the U.S. that came online earlier in 2024. Same-property NOI on a cash basis rose 6.3%, reflecting strong lease renewals, contractual rent increases, and consumer index adjustments. Granite provided 2025 FFO/unit guidance of $5.70 to $5.85 (+5% to +8%). AFFO/unit between $4.80 and $4.95 (flat to +2%), due to higher capital expenditures.

National Bank’s PCLs more than double!

National Bank reported a good quarter with revenue up 17.5% and EPS up 13%. However, Personal & Commercial net income was down 14% due to a significant increase in provisions for credit losses. PCLs across the bank more than doubled going from $120M to $254M this quarter. The market certainly didn’t like that. On the other side, wealth management was up 23% on higher fees while Capital markets was up 35% on strong revenue growth (+40%). U.S. & International did well at +22%, supported by growth at Credigy and ABA bank. NA completed its acquisition of Canadian Western Bank aiming to accelerate domestic growth and expand its presence in Western Canada.

Royal Bank remains solid

Royal Bank reported an impressive quarter with revenue up 24% and EPS up 27%. Personal Banking net income was up 24%, driven by the HSBC acquisition. Excluding HSBC, net income would have been up 17%, driven by higher interest rates, strong deposit growth (+8%) and loans (+4%). Commercial Banking was up 20% (+8% excluding HSBC). Wealth management was up 48% on higher fee-based assets and market appreciation. Insurance operations were up 24% driven by the impact of reinsurance contract recaptures and improved claims experience. Capital Markets results increased by 24% driven by strong revenue from Corporate & Investment Banking and Global Markets. PCLs increased by $237M (29%).

Get my complete Canadian Banks ranking for 2025.

Stella Jones rewards its shareholders despite a mixed quarter

Stella-Jones reported a mixed quarter as revenue increased by 6%, but EPS declined by 5%. Revenue growth was driven by railway ties where revenue surged 15% thanks to higher Class 1 shipment volumes. Residential lumber sales also grew strongly rising by 12%, and no doubt benefiting from favorable lumber prices. However, utility pole sales remained flat as lower non-contract volumes offset price increases. The industrial products segment was up 11% led by higher sales of railway bridges and crossings. Margins took a slight hit due to an unfavorable sales mix which brought the EBITDA margin down to 15.8% from the 17.4% they enjoyed last year. SJ raised its dividend by 11% which was a strong showing of confidence.

Toromont Industries also increases its dividend!

Toromont reported a good quarter with revenue up 7% and EPS up 2%. Management also announced an 8% dividend increase. Revenue growth was driven by the Equipment Group which was up 5% and CIMCO was up 23%. Higher revenue in the Equipment Group resulted from solid new equipment deliveries against the order backlog. Product support revenue was healthy and rental revenue increased in the quarter. CIMCO’s growth reflects good package revenue and higher product support activity levels in Canada. EPS was up on revenue but partially offset by higher interest charges. Bookings for the fourth quarter increased 3%, with higher bookings at CIMCO offset by lower bookings in the Equipment Group.

Here’s my US portfolio now. Numbers are as of March 4th, 2025 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $9,511.60 |

| Automatic Data Processing | ADP | Industrials | $12,165.32 |

| Brookfield Corp. | BN | Financials | $19,453.91 |

| Home Depot | HD | Cons. Discret. | $11,678.70 |

| LeMaitre Vascular | LMAT | Healthcare | $9,216.00 |

| Microsoft | MSFT | Inf. Technology | $18,029.80 |

| Starbucks | SBUX | Cons. Discret. | $10,774.28 |

| Visa | V | Financials | $17,990.00 |

| Waste Connections | WCN | Industrials | $14,439.68 |

| Cash | $29.50 | ||

| Total | $123,288.79 |

My account shows a variation of -$1,527.89 (-1.22%) since February’s income report.

Brookfield Corp’s investment keeps growing

Brookfield reported another solid quarter with distributable EPS up 22% while management announced a 12.5% dividend increase. The growth was driven by strong contributions from asset management, wealth solutions, and operating businesses, including renewable power, infrastructure, and the private equity sectors. Wealth solutions earnings nearly doubled with the acquisition of American Equity Life (“AEL”). FFO in renewable power, transition and infrastructure businesses increased by 10% over the prior year. BN ended the year with a record $160 billion of deployable capital, including $68 billion in cash, financial assets, and undrawn credit lines.

Home Depot shows signs of weakness

Home Depot reported a good quarter with revenue up 14% and EPS up 7%. However, comparable sales rose by only 0.8% globally and 1.3% in the U.S. indicating small levels of growth from existing stores. The fourth quarter of fiscal 2024 consisted of 14 weeks compared with 13 weeks for the prior year. The 14th week added approximately $2.5B in sales for the quarter and the year. The operating margin shrunk to 11.3% from 11.9% in the previous year primarily due to supply chain investments and higher costs associated with strategic initiatives. The company offered a surprisingly low dividend increase of 2%. I am bracing myself for change with this security.

LeMaitre Vascular disappoints with double-digit growth!

LeMaitre Vascular reported a solid quarter with revenue up 14%, EPS up 29% and a dividend increase of 25%. Unfortunately, the market expected more and the stock price went down on earnings day. Grafts (+23%), carotid shunts (+14%) and catheters (+12%) drove Q4 sales growth. APAC sales increased 21%, EMEA was up 18% and the Americas were up 12%. XenoSure patches received Chinese cardiac approval in December. The gross margin improved to 69.3% (vs. 68.1% in Q4 2023), due to higher average sales prices and manufacturing efficiencies. The company issued $172.5M of senior notes to support LMAT’s ongoing growth. For 2025, LMAT expects revenue growth of 9-10% and EPS growth of 16% at the midpoint.

Waste Connections’ quarter is driven by acquisitions and stronger pricing

Waste Connections reported another good quarter as revenue increased by 11% and EPS was up by 4.5%. This growth was primarily driven by acquisitions and strong core pricing reflecting the company’s strategic expansion efforts and effective pricing strategies. During 2024, Waste Connections completed acquisitions totaling approximately $750 million in annualized revenue which significantly enhanced its market presence. For 2025, Waste Connections anticipates revenue between $9.450 billion and $9.600 billion with net income estimated between $1.186 billion and $1.224 billion.

Watch my complete stock analysis for WCN in the video below.

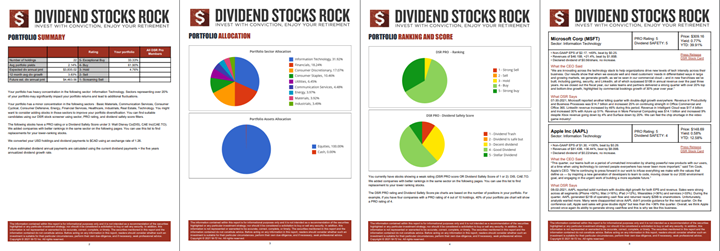

My Entire Portfolio Updated for Q4 2024

Each quarter, we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our special additional service, DSR PRO.

The PRO report includes a summary of each company’s earnings report for the period. I wanted to share my own DSR PRO report for this portfolio.

You can download the full PDF showing all the information about all my holdings. Results have been updated as of January 2nd, 2025.

Download my portfolio Q4 2024 report.

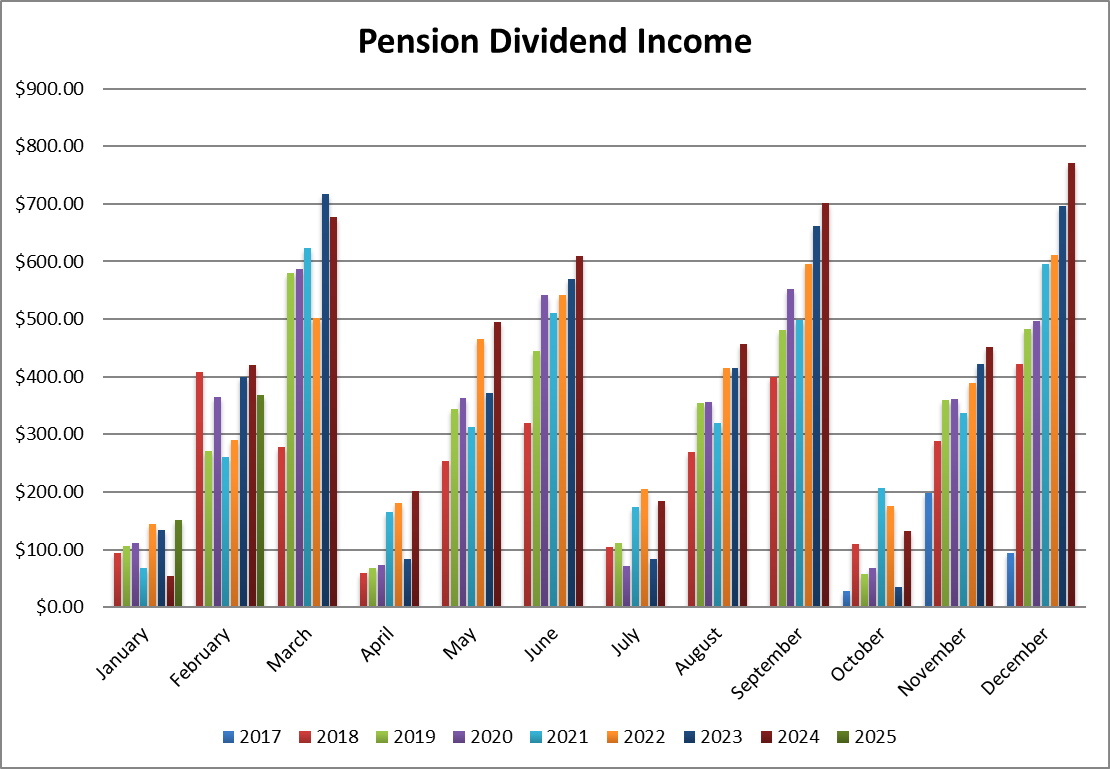

Dividend Income: $367.75 CAD (-12.43% vs February 2024)

While all my holdings increased their dividend vs. last year, my dividends are smaller (12%) vs. last year as I sold my shares of Texas Instruments last fall. On another note, I must highlight the huge USD/CAD jump (thx tariffs!) for this month (+9% vs last year!).

| CDN DIVIDENDS: $270.40 | US DIVIDENDS: $67.34 |

| Granite REIT: $36.26 (+3.01%) | Apple: $10 (+4.2%) |

| National Bank: $137.94 (+7.55%) | Starbucks: $57.34 (+18.35%) |

| Royal Bank: $96.20 (+7.25%) | Currency USD/CAD: 1.4456 (+9.02%) |

| TOTAL DIVIDENDS RECEIVED: $367.75(-12.43%) | |

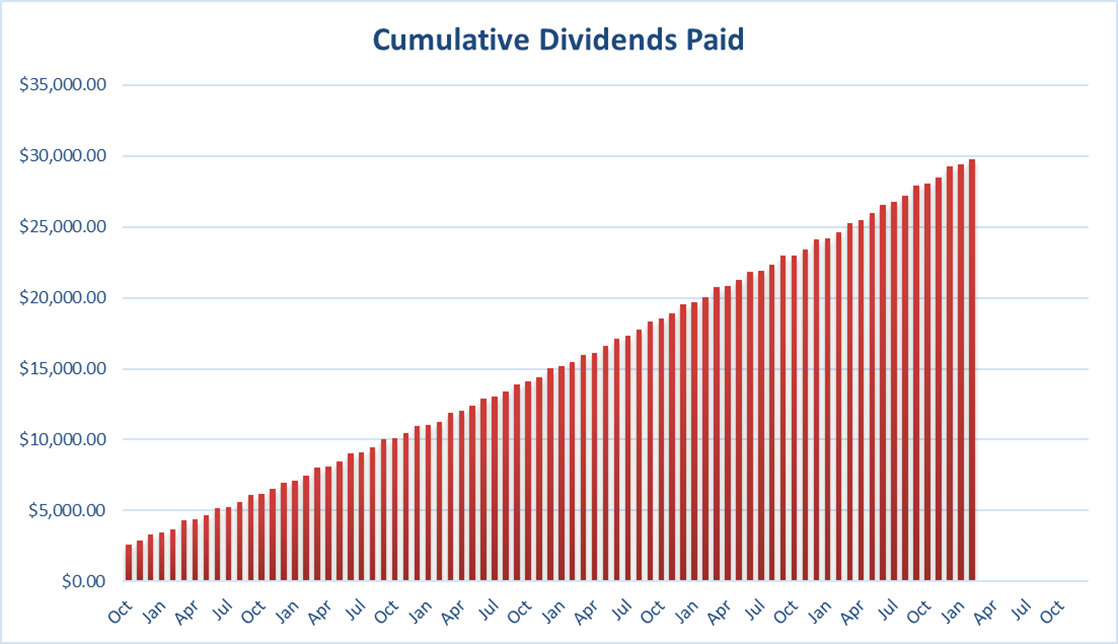

Since I started this portfolio in September 2017, I have received a total of $29,784.34 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth comes from the stocks and not from any additional capital added to the account.

Final Thoughts

As I finish writing this it would appear that tariffs are “finally” in place (well… wrong!). On March 4th, the market didn’t appreciate the news, and most stocks were in the red.

How should I invest during Trump & Tariffs? I would refer you back to the beginning of this newsletter with this question:

Am I looking at a temporary problem or something permanent?

There you go!

Nothing has changed in my strategy. I’ll stick to it while this storm passes. I anticipate that I won’t remember much about this tariff episode 10 years from now.

Cheers,

Mike.

Leave a Reply