When investors think of dividend-paying stocks, they usually picture large, stable blue-chip companies. But small-cap dividend stocks—particularly in Canada and the U.S.—offer a powerful (and often overlooked) opportunity for income and long-term growth.

Let’s explore why these under-the-radar stocks deserve a spot in your portfolio, how to evaluate them, and what to watch out for.

Why Should You Care About Small-Cap Dividend Stocks?

Small-cap companies—typically those with market capitalizations under $2–3 billion—don’t attract the same attention as their larger counterparts. But that’s exactly what makes them interesting.

Because they’re not widely followed by analysts or institutional investors, small caps can be mispriced, offering a rare edge for retail investors. And when a small-cap stock does break out, the upside can be significant.

Fun Fact: It’s much easier to double the value of a $500 million company than a $500 billion one.

Small caps that pay dividends tend to be more financially stable, often with strong cash flow, manageable debt, and niche market dominance. These companies offer a blend of reliability and upside potential if chosen carefully.

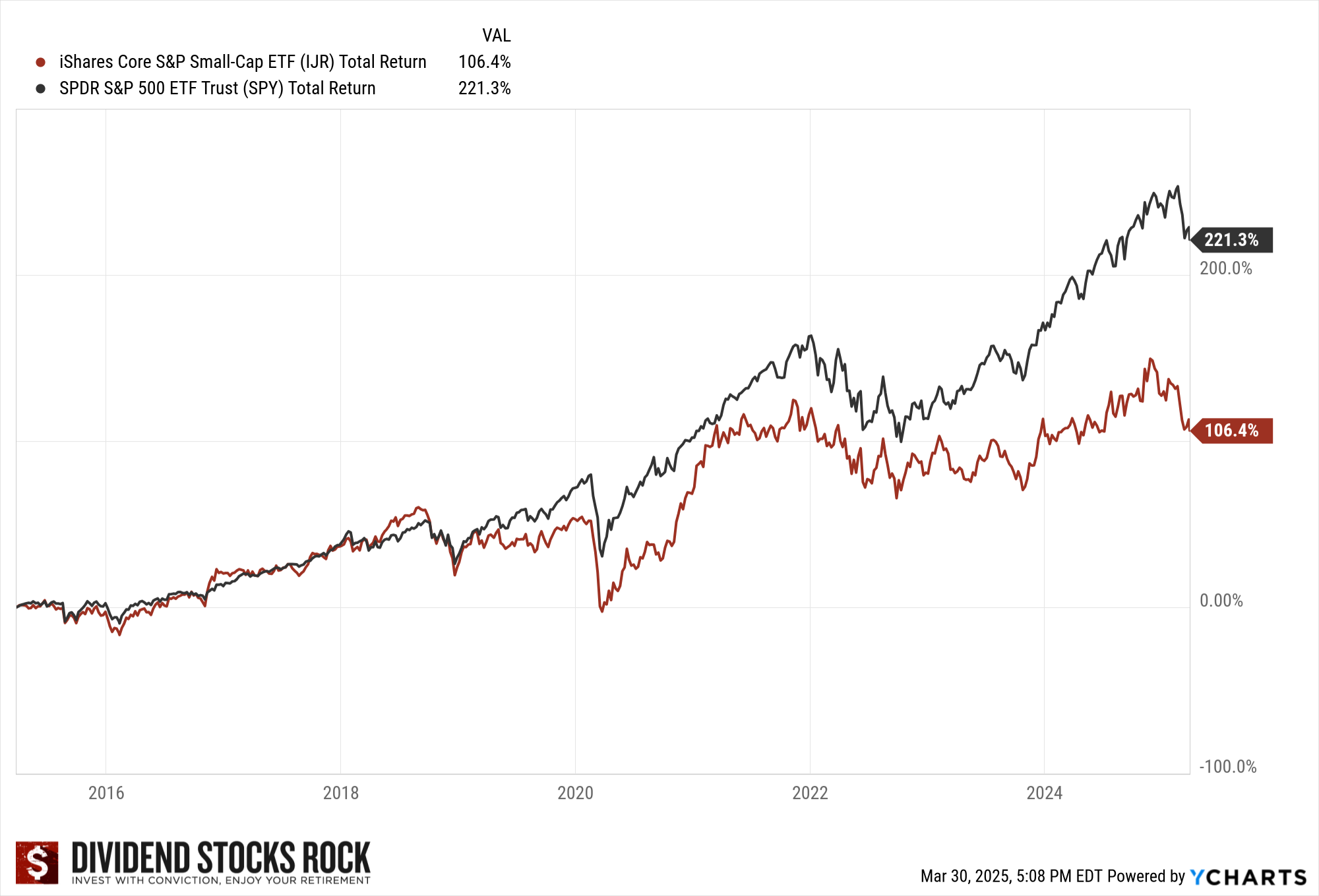

However, you will notice that small caps failed to match the Magnificent Seven in the past few years. In general, small caps will do better during a bull market than the rest of the market. This time, we are writing a new page in the stock market’s history.

The Risk-Reward Trade-Off: What You Need to Know

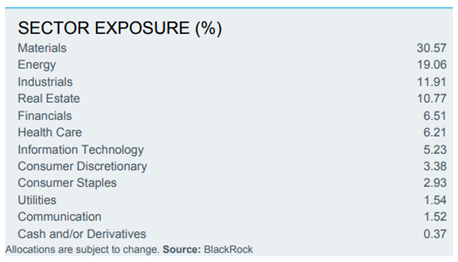

Small caps are often more volatile than large caps—and Canadian investors know this well. Over the past decade, the iShares S&P/TSX SmallCap Index ETF (XCS.TO) has underperformed broader markets due to its heavy exposure to resource-heavy sectors like energy and materials.

By contrast, U.S.-based small caps (e.g., those in the iShares Core S&P Small-Cap ETF, IJR) have delivered performance closer to the S&P 500, though still with choppy price action.

—> Key takeaway: Passive investing doesn’t work well in this segment. Active, thoughtful stock selection is critical.

What Makes a Great Small-Cap Dividend Stock?

At Dividend Stocks Rock (DSR), a simple but powerful framework called the Dividend Triangle is used to identify strong candidates:

-

Revenue Growth

-

Earnings per Share (EPS) Growth

-

Dividend Growth

When all three metrics trend positively over five years, the company has likely found a sustainable business model and has room to grow both its business and its dividend.

Let’s take a look at some of the standouts.

300 Stock Ideas With a Positive Dividend Triangle—Get the List Now!

I have used the dividend triangle to create a list of about 300 companies showing growing 5-year trends for revenues, EPS, and dividends.

The Dividend Rock Stars list is updated monthly and is a great place to start your dividend stock hunting.

Save yourself some hard work, and enter your name and email below to get the list in your mailbox.

Top US Small-Cap Dividend Stocks

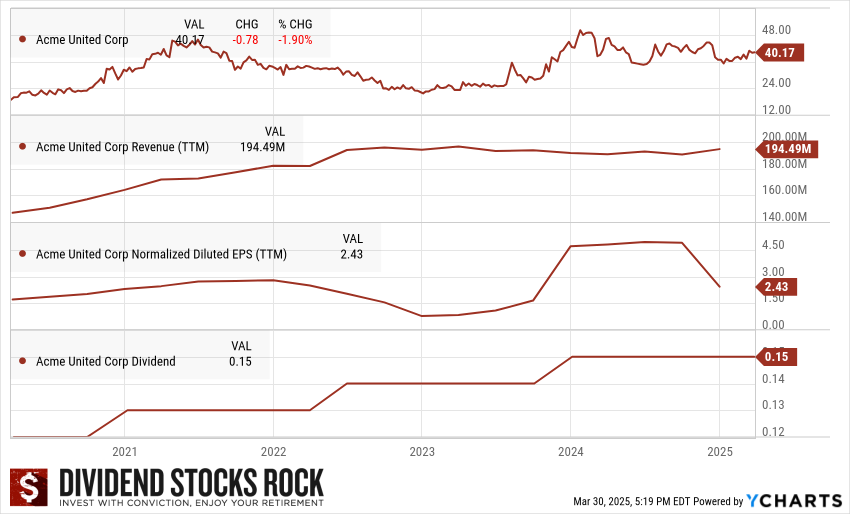

Acme United (ACU)

Market cap: $156M

Acme is a niche player that produces first-aid kits, medical supplies, and cutting tools, serving both the consumer and industrial markets. Known for its acquisition-driven growth strategy, ACU integrates smaller brands to expand product lines and cross-sell across channels.

Its dividend track record spans over 15 years with a modest but steady payout. Debt levels remain low, and management is highly focused on operational efficiency.

+ Strengths: Acquisitions boost growth, recurring product demand

– Risks: Faces intense competition from giants like 3M and Honeywell

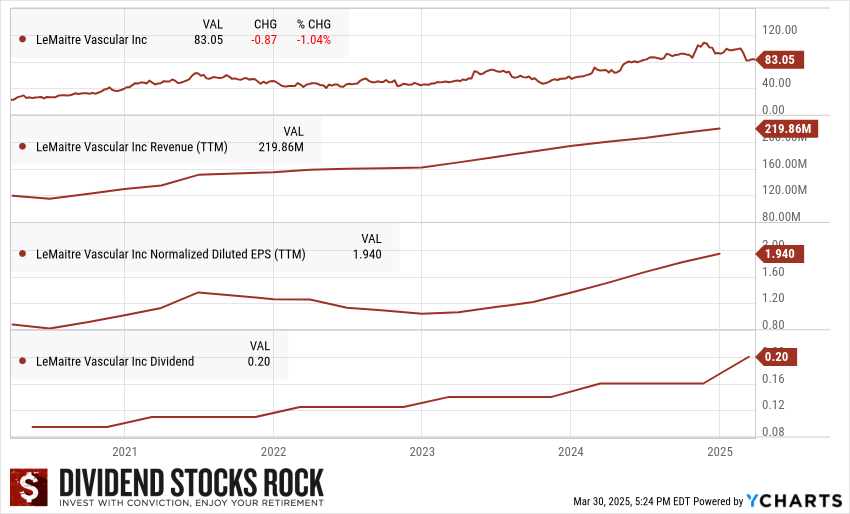

LeMaitre Vascular (LMAT)

Market cap: $2.29B

A medical device company specializing in vascular surgery, LeMaitre Vascular operates in a niche market with a razor-sharp focus. With over 85% of its revenue derived from recurring or consumable product sales, LMAT offers a level of stability not often found in small caps.

It has increased its dividend for over a decade, maintains a clean balance sheet, and consistently posts double-digit revenue and EPS growth. The company actively acquires complementary products, integrating them efficiently to expand its portfolio.

The catch? Its premium valuation. LMAT often trades at a high P/E due to its strong growth metrics and reliable income stream, so investors need to weigh future growth against the current price tag.

+ Strengths: Strong product moat, global expansion, recurring revenue

– Risks: Valuation is rich, healthcare regulatory shifts could bite margins

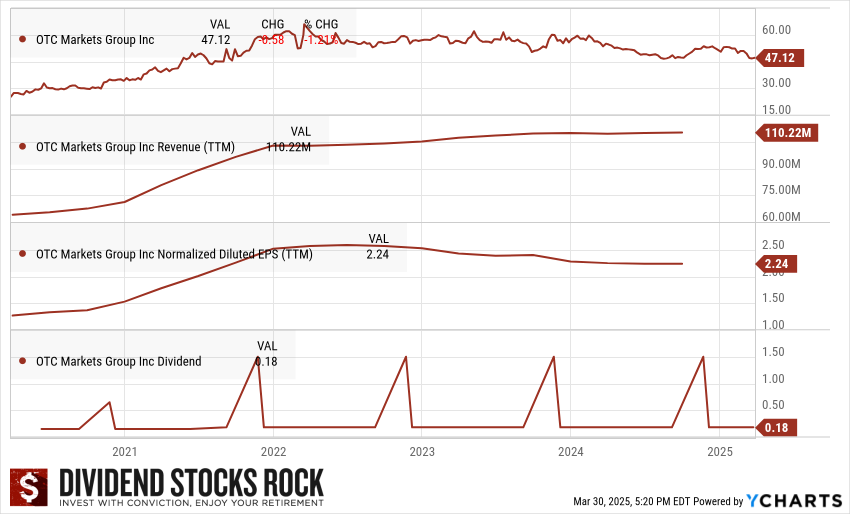

OTC Markets Group (OTCM)

Market cap: $646M

The backbone of over-the-counter trading in the U.S., OTCM runs platforms like OTCQX and OTCQB, facilitating trading for thousands of securities not listed on major exchanges.

It enjoys a monopoly-like niche, strong profit margins, high insider ownership, and consistent dividend growth. As a B2B model, it benefits from scale and recurring issuer fees.

+ Strengths: High-margin niche business, steady dividend growth

– Risks: Regulatory risks, trading volume can fluctuate with market cycles

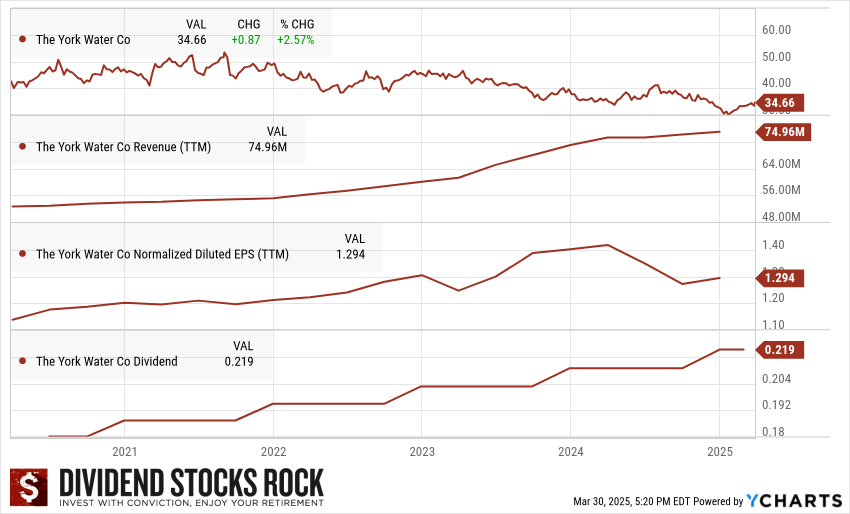

York Water Company (YORW)

Market cap: $548M

Founded in 1816, York Water is the oldest investor-owned utility in the U.S. It delivers water and wastewater services to Pennsylvania customers and boasts a rock-solid dividend record—28+ consecutive years of increases.

With regulated pricing, recurring revenue, and defensive characteristics, it’s a favorite for income-seekers looking for small-cap stability. Growth is modest but reliable.

+ Strengths: Extremely stable business, dependable dividend history

– Risks: Limited growth runway, regulatory oversight caps upside

Top Canadian Small-Cap Dividend Stocks

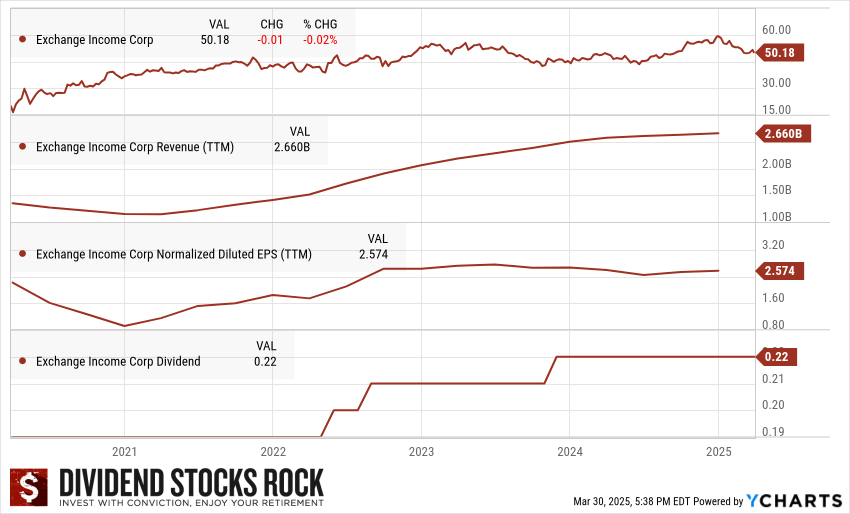

Exchange Income Fund (EIF.TO)

Market cap: $3B

EIF operates in specialized aviation (think medevac and Arctic logistics) and manufacturing across North America. It’s a diversified cash flow machine, using acquisitions to fuel growth.

Management has a disciplined acquisition framework, and its dividend is generous and stable. However, its debt has risen, and exposure to economic cycles is a factor to watch.

+ Strengths: Diversification, reliable cash flow, consistent dividend

– Risks: Higher debt from acquisitions, cyclical exposure

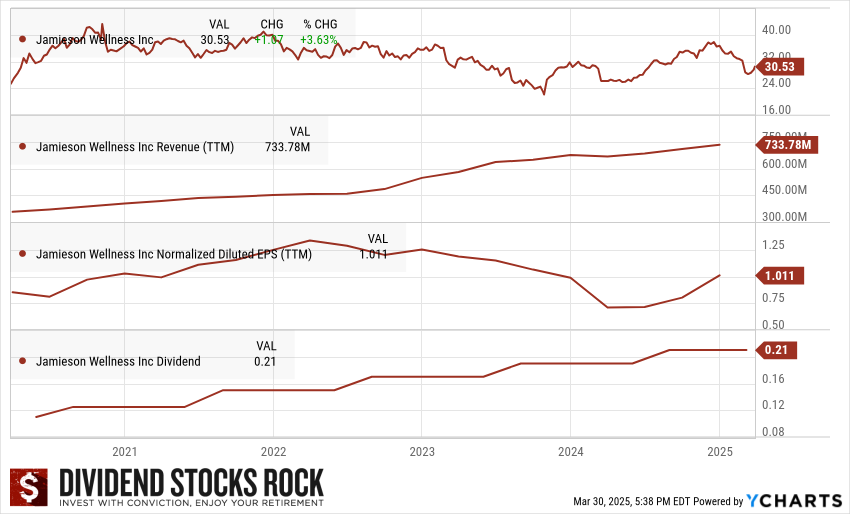

Jamieson Wellness (JWEL.TO)

Market cap: $1B

A household name in Canada for vitamins and natural health products, Jamieson benefits from strong branding and increasing global health awareness. International growth, especially in China, is a core strategy.

While it maintains a steady dividend and cash flow, rising marketing costs have constrained EPS growth. The company’s success hinges on brand strength and execution in new markets.

+ Strengths: Strong brand equity, growing health supplement market

– Risks: Margins pressured by marketing spend, slower dividend growth

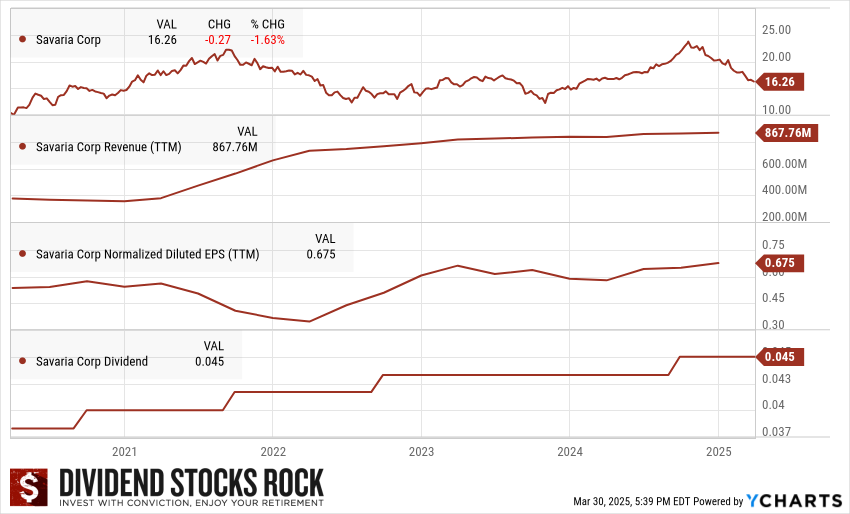

Savaria Corporation (SIS.TO)

Market cap: $2B

Savaria builds accessibility equipment—home elevators, wheelchair lifts, and mobility vehicles—capitalizing on aging population trends. It’s growing both organically and through M&A, with operations expanding globally.

The company targets $1B in revenue by 2025, showing ambition. Dividend growth is modest, but consistent. Operational leverage is improving, though integration costs and rising debt need watching.

+ Strengths: Demographic tailwinds, global reach, growing demand

– Risks: M&A execution risk, debt buildup, lower margins in inflationary periods

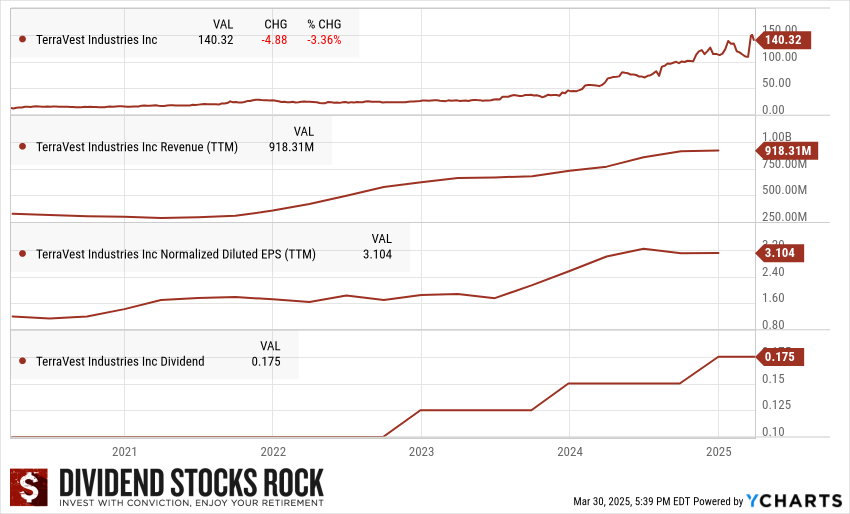

TerraVest Industries (TVK.TO)

Market cap: $2B

TerraVest is a quiet outperformer in energy equipment manufacturing. It serves niche industrial markets with products like propane tanks, natural gas processing units, and other fabricated metal goods.

Boasting 20%+ revenue and EPS CAGR over five years, TVK is a model of disciplined growth. Its balance sheet is healthy, and the dividend is safe with room to grow.

+ Strengths: Strong growth track record, low debt, robust backlog

– Risks: Smaller customer base, exposure to energy industry cycles

How to Use Small Caps in Your Dividend Strategy

Spice, Not Core

Small-cap dividend stocks shouldn’t be the core of your portfolio. Instead, treat them like spice: a little adds flavor, too much can overwhelm.

Keep your small-cap positions below 3% each. That way, even a big loser won’t hurt your portfolio too much.

Be Selective, Not Speculative

Avoid sectors like energy, materials, or healthcare unless you have deep knowledge. These sectors are often boom-or-bust, and small caps are more exposed to swings.

Blend with Blue Chips

Use small caps to complement a core portfolio of established dividend growers. They can boost total return without sacrificing long-term stability.

Final Thought: Are Small-Cap Dividend Stocks Right for You?

Small-cap dividend stocks offer a rare combination of growth potential and income—but only if you’re willing to put in the work.

They’re not “set-it-and-forget-it” investments, but they can become core holdings over time if you identify winners early.

What to remember

-

Small caps can outperform—but they’re volatile.

-

Active selection is key; ETFs won’t cut it.

-

Use the Dividend Triangle to find stable growers.

-

Limit your exposure to manage risk.

-

Think of small caps as a complement, not a core.

Small-cap dividend investing could add serious horsepower to your portfolio if you’re ready to dig deeper and uncover hidden gems.

The Dividend Rock Stars List: Built on the Power of the Dividend Triangle

At Dividend Stocks Rock (DSR), we believe simplicity leads to clarity—and results. That’s why we created the Dividend Rock Stars List, the only curated list of small-, mid-, and large-cap dividend stocks built entirely on the Dividend Triangle: consistent growth in revenue, earnings, and dividends.

At Dividend Stocks Rock (DSR), we believe simplicity leads to clarity—and results. That’s why we created the Dividend Rock Stars List, the only curated list of small-, mid-, and large-cap dividend stocks built entirely on the Dividend Triangle: consistent growth in revenue, earnings, and dividends.

While many investors use these metrics independently, DSR is the first to build a stock list that uses them as foundational filters—cutting through the noise of dozens of overlapping metrics and pointing you directly to quality.

Forget about overly complex strategies. This list is a great place to start if you’re looking for small-cap dividend payers with strong fundamentals.

Download the list with filters applied and start narrowing your picks by sector or risk profile.

Leave a Reply