In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and we drove all the way to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built and managed this portfolio publicly since 2017 to create and track a real-life case study.

In August 2017, I received $108,760.02 in a locked retirement account. Locked means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to suggest you follow my lead. My purpose was solely to share with our members how I manage my portfolio with all the good and the bad that inevitably takes place each month. I hope you have learned and will continue to learn from my experiences managing this portfolio.

Lots of trades

2025 was an exciting year for me regarding my investments. This is the year I started having more capital to allocate to my portfolios. Over the past few years, I’ve reinvested most of my money into my best investment ever: Dividend Stocks Rock. While it paid off tremendously, it’s time to think about increasing my liquid assets (since I have no intention of selling the business!).

By adding more capital (increasing my Smith Manoeuvre from $500 to $750/month and starting a new account that is not reported here), I also added a few more names to my holdings. I hit my limit of 40 not too long ago, and that rang a bell: it’s time to do a full review.

I explained my process last month in this very newsletter, so I’ll spare you the details and focus on the results.

Performance in Review

Let’s start with the numbers as of December 9th, 2025 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $323,127.52

- Dividends paid: $5,227.85 (TTM)

- Average yield: 1.62%

- 2024 performance: +26.00%

- VFV.TO= +35.24%, XIU.TO = +20.72%

- Dividend growth: +12.22%

Total return since inception (Sep 2017- November 2025): +197.10%

Annualized return (97 months): 14.42%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 16.55% (total return 244.90%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 12.73% (total return 163.50%)

Small is beautiful

After my cleanup, I’m now down to 34 positions across all my portfolios. I always want to keep between 30 and 40 stocks for two simple reasons:

- I want each position to be meaningful and have an impact on my total returns.

- I always want to have my two hands on the wheel and be in full control. I can’t do that if I have 50+ stocks.

Again, this is my rule and it’s not the only way to manage a portfolio. My goal with this report is to share my views and my strategies. I suggest you take what you like and discard what doesn’t apply to your situation. There are thousands of ways to manage your investments successfully. Build your own rules and you’ll be happier with your results.

Smith Manoeuvre clean up

This is where I have the most trades! I first started the Smith Manoeuvre with the intention of generating a decent yield (around 4%). But I quickly realized that I was more comfortable focusing on my main strategy of picking strong dividend growers.

Sell Canadian Tire (CTC.A.TO)

Sell Nutrien (NTR.TO)

I would have never considered having Canadian Tire and Nutrien in my pension plan account.

While they are both great companies and I made a profit on both trades, they are just not a 100% fit with my core strategy. For that reason, I decided to get rid of both and align my holdings with the rest of my investments.

Buy Waste Connections (WCN.TO)

With the extra capital, I decided to bolster one of my existing positions: Waste Connections. This is an excellent defensive stock, and I have the chance to buy it on the current price weakness. You will notice that the WCN price sometimes goes nowhere for a while. That’s why I’m not worried about the underperformance in 2025.

Here is a recent video about WCN earnings report

Buy Intact Financial (IFC.TO)

The rest of my capital went to a new position that was highlighted in my buy list not too long ago: Intact Financial. IFC is a leader in property and casualty insurance in Canada with expansion opportunities in the UK and the US.

Increasing to $1,000/month starting in January

I’m doubling down on my Smith Manoeuvre strategy and will increase the monthly capital from $750 to $1,000. This was one of my goals in 2025, but I had to act diligently and make sure I could afford it. When you play with leverage, you play with fire.

Leverage amplifies everything: your good returns and your worst nightmares.

While I have a very high-risk tolerance, I’m not a gambler. I’ve reviewed my financial plan for the next 6 years to ensure it fits within my global strategy.

Why six years? That’s an odd number is it not?

In 6 years, I’ll be 50 and two of my three children will not live with us anymore (#3 will be 20). This will be the end of a season in my life and the beginning of a new one. I still don’t know for sure what this season will look like, but there will be several opportunities. Right now, I’m in a season of “financial consolidation” where many of my past moves are paying off and it’s time to secure my financial future and invest as much as possible.

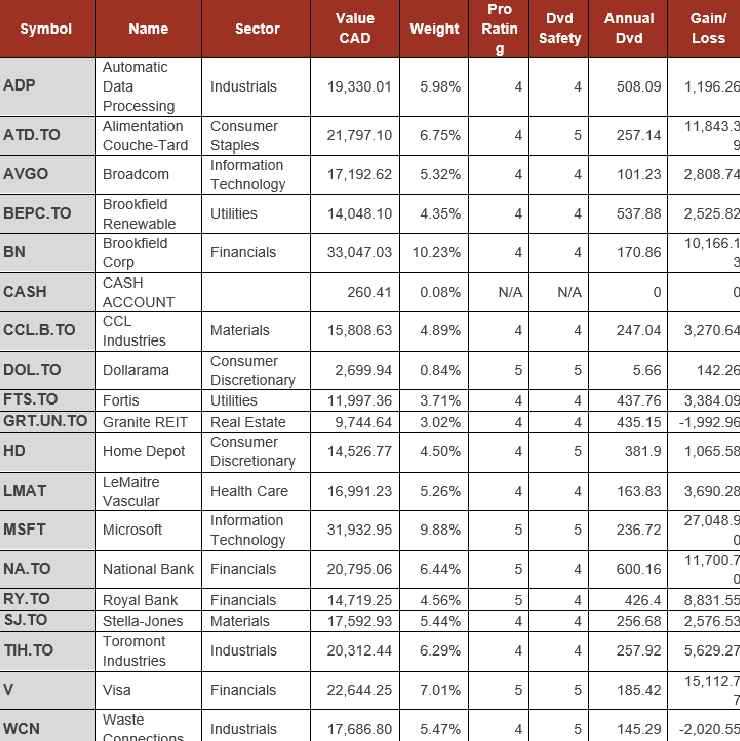

Pension portfolio optimization

As you know, I don’t like to make many trades. I prefer to buy and hold for a long time. But that doesn’t mean I’m blind to my portfolio performance. Hence, I have made three trades of late.

Sell Starbucks (SBUX)

This one should not come as a surprise. Starbucks had 3 years to change my mind. The dividend triangle has weakened since 2022, especially EPS. Management has a plan, but the team is more optimistic than the numbers indicate. Part of my investment thesis about SBUX was its impressive growth in China. This narrative isn’t true anymore (SBUX even sold 60% of its stake in the Chinese business). Finally, the latest dividend increase announcement (+1.64% vs. a high single digit growth rate in the past 5 years) was the final nail in the coffin.

Thank you, SBUX, for an 80% total return, but it’s now time to move on.

Buy Automatic Data Processing (ADP)

Part of the proceeds from Starbucks went to my position in ADP. This company runs a tight ship with a sticky business model generating constant cash flow. The proof is in the pudding with a nearly perfect dividend triangle for the past 10 years. I’m adding to my position as ADP was a smaller portion of my investment. It was time to bring it back to my target weight (between 3% and 3.5%).

Buy LeMaitre Vascular (LMAT)

The rest of the Starbucks’ proceeds went to another great business that I already hold: LMAT! I love when I can buy a stock with a great dividend triangle with a stock price that goes nowhere. LMAT is down almost 10% year to date while revenue is up 10% and EPS is up 20% so far this year.

Telus will be sold in our portfolio model

Finally, I can already tell you upfront that our first portfolio model review will happen after one quarter (we started them on October 1st) and Telus will be gone from the Canadian income portfolio. The full review of the four portfolios will be part of a newsletter published in January.

I just wanted to give you a hint of what I plan to have happen with Telus since so many members have it in their portfolio.

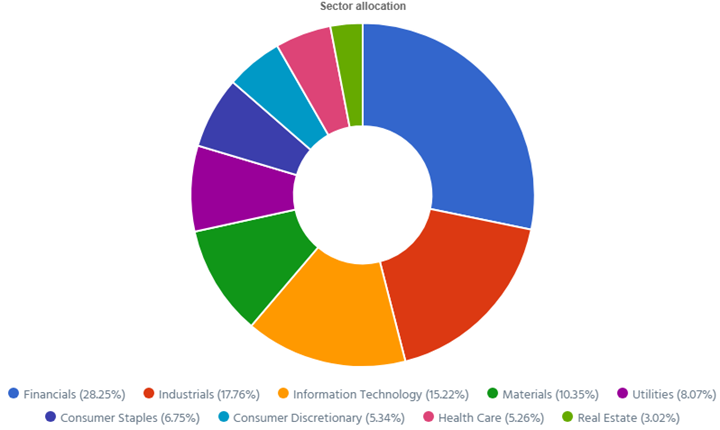

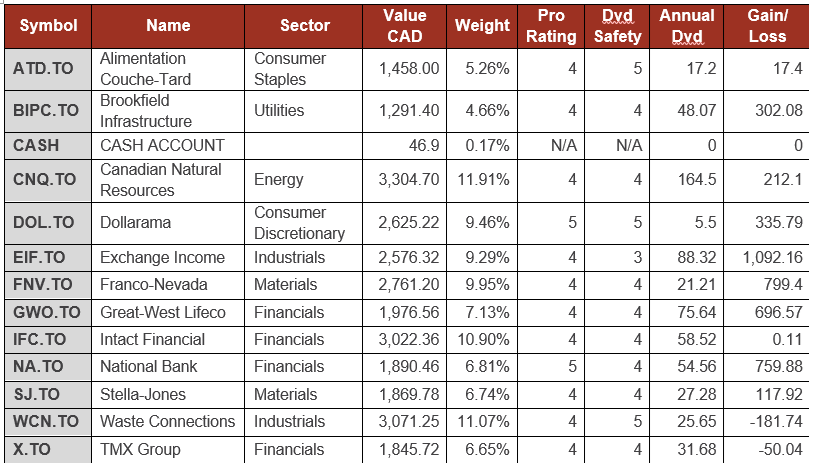

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 12 companies spread across 7 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 2.23% with a 5-year CAGR dividend growth rate of 11.75%.

- The portfolio value is now at $27,739.87

- The portfolio debt is at $22,000.

- Monthly contribution is set at $750. ($1,000/month starting in January)

- The annual income is $618.13, and the projected income is $690.74

- To report my Smith Manoeuvre, I export the Excel data from my DSR PRO dashboard.

Smith Manoeuvre Portfolio Summary

Here’s my SM portfolio summary as of December 9th, 2025 (before the bell):

$1,000 per month starting in January

I will start 2026 by adding $1,000 to some of my smallest positions (companies like GreatWest, Brookfield Infrastructure, etc.).

The point will be to balance the portfolio and then move forward. I also have a few stocks in mind to add next year!

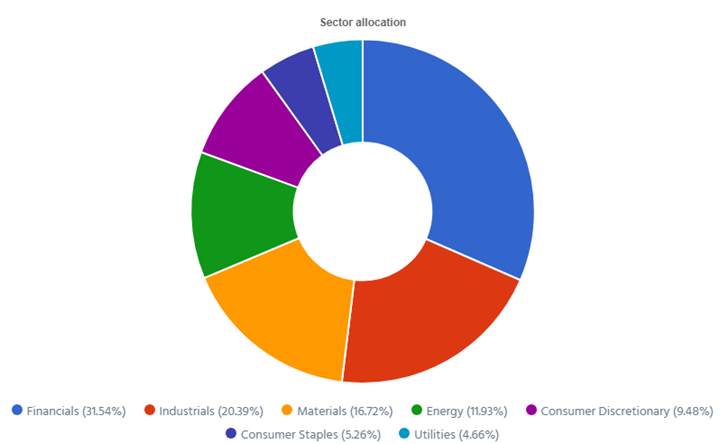

Pension Portfolio Summary

Here’s my pension plan portfolio summary as of December 9th, 2025 (before the bell):

Total value: $323,127.52 (+$301.83 from last month).

My Entire Portfolio Updated for Q3 2025

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of September 10th, 2025. Q4 will be ready for the new year!

Download my portfolio Q3 2025 report.

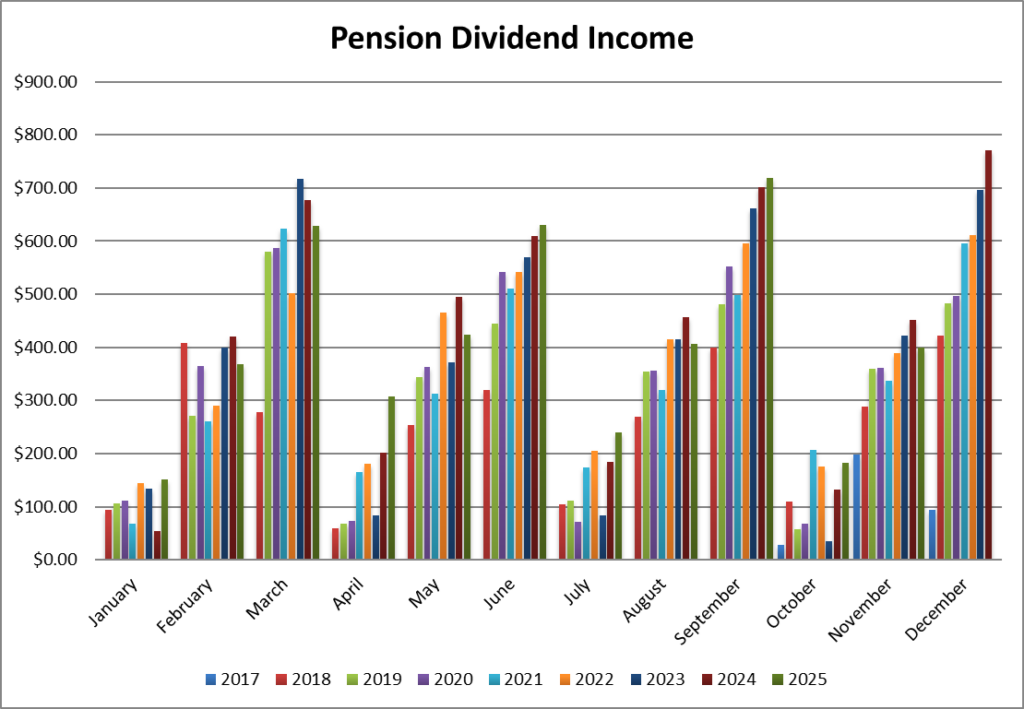

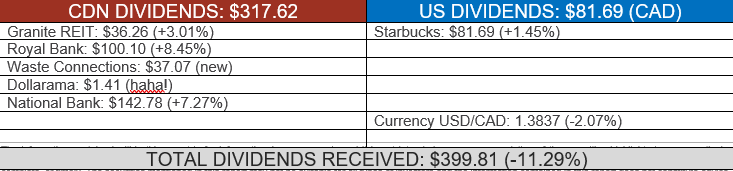

Dividend Income: $399.81 (-11.29% VS. November 2024)

I’m down a little this month as I don’t have Texas Instruments and Apple in my portfolio ($78USD paid last year). The other companies all increased their dividends since last year.

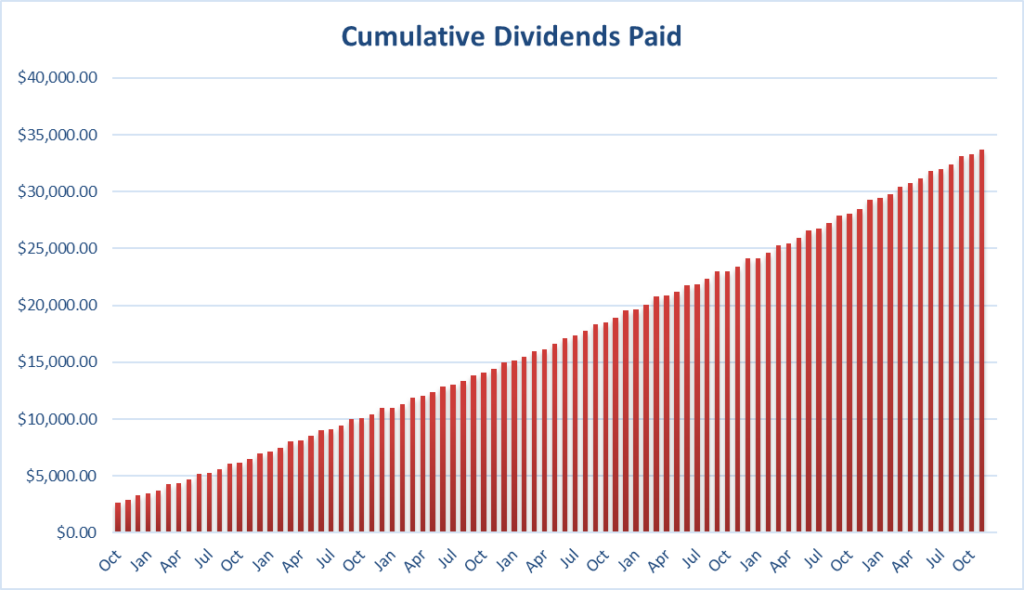

Since I started this portfolio in September 2017, I have received a total of $33,723.42 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

I like the moves I made this month for my portfolio. I know my investments are ready to thrive through 2026 with a smile.

I wish you a wonderful Christmas with your friends and family. Don’t worry, I’ll have the investment themes for 2026 ready for next Friday!

Cheers,

Mike.

Leave a Reply