Let’s face it—most dividend investors don’t wake up excited to dig into earnings reports. It’s not exactly sipping-coffee-on-the-deck kind of fun. But reviewing your holdings quarterly? That’s not busywork—it’s your best defense against dividend surprises, sleepless nights, and “why didn’t I sell this earlier?” regrets.

At Dividend Stocks Rock (DSR), we don’t believe in watching the market daily. That’s a surefire path to analysis paralysis (and probably some unnecessary trades). But checking in four times a year? That’s the sweet spot. You stay informed, catch red flags early, and—most importantly—reinforce your confidence when things are going well.

In this post, we will walk you through:

-

Why quarterly reviews matter (even for long-term buy-and-hold investors),

-

What to look for in earnings reports,

-

And how to decide if your stock deserves a spot in your portfolio for another quarter—or not.

It’s all about making your dividend strategy stronger, not more complicated.

Let’s start with a simple truth: reviewing your portfolio isn’t about second-guessing your decisions—it’s about validating your convictions.

Why You Need to Review Your Stocks Quarterly (and How to Start Without Overwhelm)

Confidence Is the Real Dividend

For dividend growth investors, seeing a consistent income stream is great—but knowing your holdings are solid? That’s where real peace of mind comes from. A quarterly review isn’t about micromanaging your portfolio—it’s about reaffirming your decisions (or catching red flags early).

“Reviewing quarterly results isn’t thrilling—but it’s way more fun than watching a dividend cut unfold.”

Why It Matters

-

Spot issues before the dividend is in danger.

-

Reassure yourself that your investment thesis still holds.

-

Stay in control instead of reacting to market noise.

Where to Find the Right Info

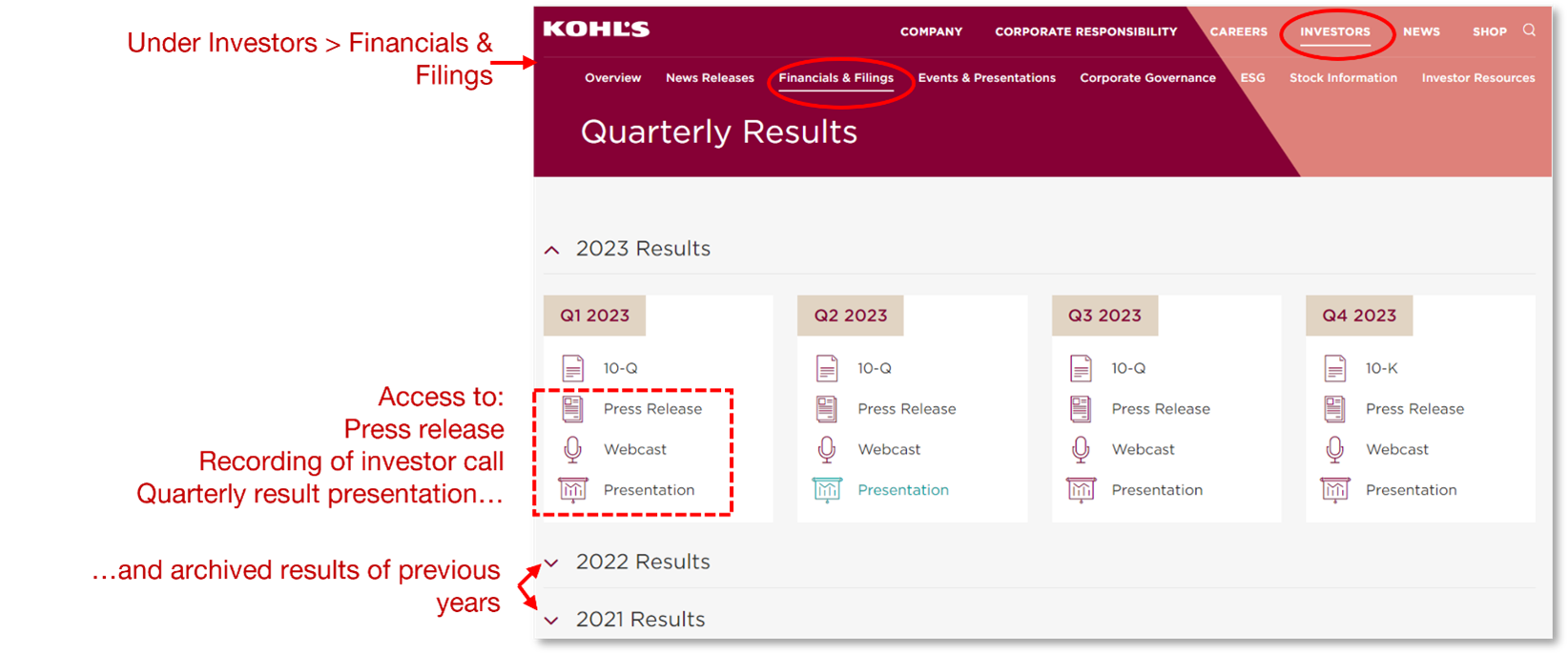

Make the company’s Investor Relations (IR) section your best friend. Start with:

-

The press release of the quarterly results.

-

The quarterly presentation (usually includes graphs and visuals).

-

Conference call transcripts or replays.

-

The Management Discussion & Analysis (MD&A) provides more profound insights.

Not Sure if a Stock is the Right Fit?

Before you hit that any button, grab our Stock Buy Checklist. It’s a quick, practical tool to help you ask the right questions and double-check the essentials—like dividend safety, growth potential, and where that stock fits in your portfolio.

No fluff, just clarity.

Use it to reduce the market noise and make investment decisions more confidently.

Download the Stock Checklist Now!

3 Simple Questions That Tell You Everything You Need to Know About a Stock’s Quarterly Results

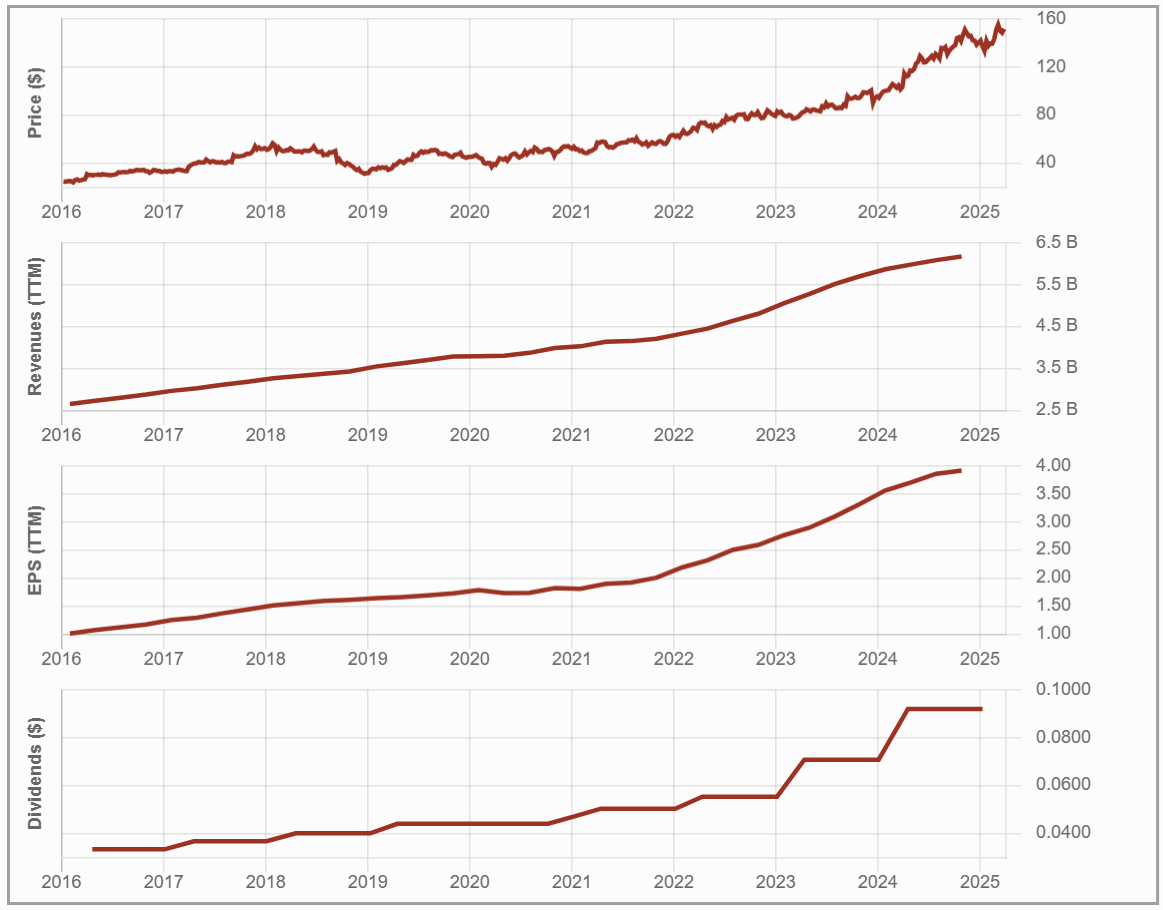

1. Is the Company Growing Revenue, Profits, and Dividends?

This is the heartbeat of your stock. Growth across the board = healthy.

-

Compare YoY results: Q1’25 vs Q1’24.

-

Seasonal effects? Be mindful (e.g., winter coats won’t sell in June).

-

Sequential analysis: Sometimes Q1 ? Q2 is more revealing than Q1 ? Q1.

-

Check if the dividend grew vs last quarter or last year. Has it at least kept pace with inflation?

2. Is the Dividend Still Safe?

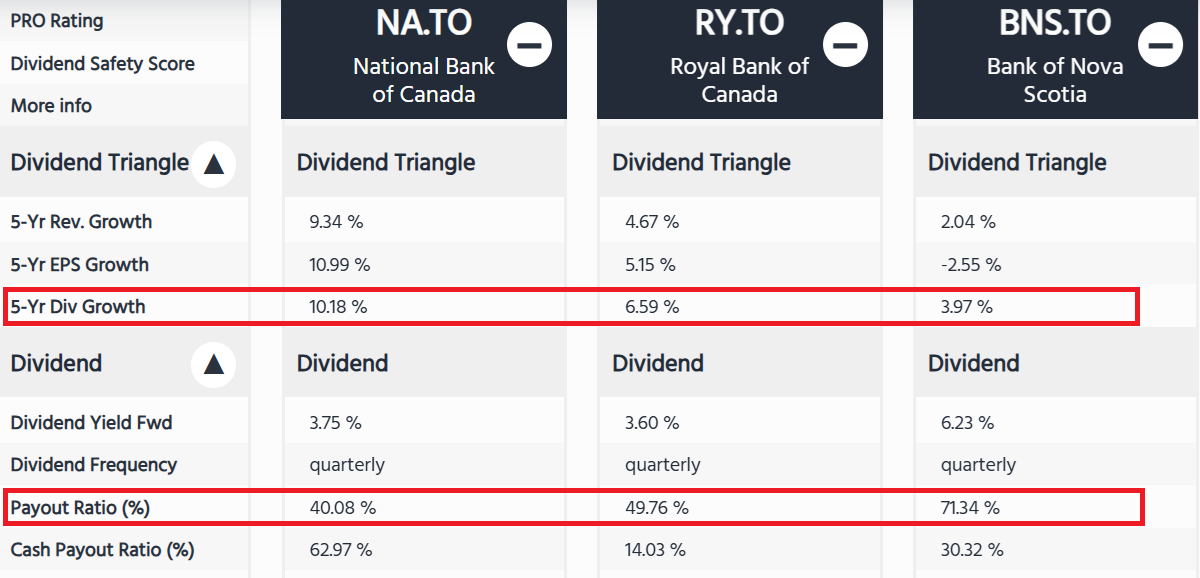

To ensure my dividends are safe, I start with the dividend triangle.

Normally, 5-year or 10-year growing trends are a good sign that a business is healthy.

A slowing dividend growth rate could be a warning sign—don’t ignore it.

Look at the payout ratio (dividend ÷ EPS). Is it rising uncomfortably over time?

In the DSR Stock Comparison tool below, you can clearly see how ScotiaBank (BNS.TO) is in a weaker state than its peers.

While the dividend remains safe for now, its payout ratio is higher, and its dividend growth is lower. These are two signs that your money may not be invested in the industry’s leader.

Pro Tip: Compare the company’s payout ratio against its sector norms using your DSR tools.

3. What’s the Future Outlook?

Even the best quarterly performance can be overshadowed by weak guidance.

What to watch:

- Mergers and acquisitions: buying or merging with other companies brings challenges but also growth opportunities.

- Divestitures: companies getting rid of non-productive assets can improve their future results.

- Is the company launching new products or product categories?

- Is the company expanding geographically or into related businesses?

- CAPEX amounts: is the company investing a lot in its infrastructure? Will it likely bring revenue growth?

- How much new debt is the company assuming? Is it repaying some of its debt?

- Is the company buying back shares or renewing their share repurchase authorization?

- When companies buy back shares, they reduce the number of outstanding shares in the hands of shareholders, which can increase earnings per share. Conversely, companies issuing more shares to raise capital are diluting the EPS with more outstanding shares.

- What is the company’s outlook for the full year, or the new year? Is it anticipating growth? Has it revised its earlier outlook for better or worse?

- A company increasing its outlook for revenue or profit is confident about the near future, whereas one revising its outlook downwards might be facing challenges.

- Is it implementing cost-cutting or efficiency programs to improve profitability?

Bullish signals: Management raises guidance or invests heavily in future growth.

Caution flags: Lowered guidance, mounting debt, or unexplained earnings drops.

Bonus: The Quarterly Review Checklist: DSR Style

-

Revenue ? year-over-year?

-

EPS ? year-over-year?

-

Dividend ? or held steady (and above inflation)?

-

Payout ratio under control?

-

Future guidance shows growth or stability?

-

No red flags in debt or business model?

“Your stocks don’t have to be perfect. They just have to keep getting better.”

Wondering which Stocks to Keep? Make Smarter Decisions

Stop second-guessing your decisions and start investing with clarity.

Our Stock Buy Checklist helps you cut through the noise, ask the right questions, and focus on what really matters—dividend safety, growth potential, and your portfolio’s goals.

Whether you’re vetting your next pick or doing a final gut-check, this tool brings structure to your process and conviction to your buys.

Download the checklist now and take the guesswork out of building a stronger dividend portfolio.

Leave a Reply