In September of 2017, I received slightly over $100K from my former employer, representing the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

This month, I also discuss a play I’ve made that had a deja vu taste.

Performance in Review

Let’s start with the numbers as of July 1st 2024 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $256,905.72

- Dividends paid: $4,772.36 (TTM)

- Average yield: 1.86%

- 2023 performance: +20.69%

- SPY= +26.19%, XIU.TO = +11.87%

- Dividend growth: +1.7%

Total return since inception (Sep 2017 – June 2024): 136.21%

Annualized return (since September 2017 – 82 months): 13.40%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 14.15% (total return 147.00%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 9.05% (total return 80.72%)

A Play on a Deja Vu

In December of 2022, I published a video about an interesting play offering a 25% upside potential. Strangely enough, while many of those titles look like clickbait, this video discussed the purchase of Activision Blizzard (ATVI) in the hope that the offer by Microsoft of $95 per share would actually close and you would have been able to cash a nice 25% profit. Once again, I put my money where my mouth was and rode ATVI in my portfolio until the deal closed. It took a while as the stock price fluctuated, media created lots of noise, and I finally cashed in and collected my profit.

Ironically, I had purchased ATVI as an educated guess / speculative play a couple of months before Microsoft made the offer. I was glad to be on the winning side of that speculative deal no matter what happened.

Last month, I was once again on the “winning side” when National Bank (NA.TO) announced the agreement it made with Canadian Western Bank (CWB.TO) to acquire it for $5B. This time, the winning side is being an NA shareholder with a long-term horizon. NA stock price dropped on the news, but this deal is highly accretive for many reasons:

- NA increases its exposure to Western Canada with limited cannibalization

- NA acquires $30B of commercial loans opening the door to many cross-selling opportunities with its private banking segment. It has solid expertise in developing relationships with entrepreneurs before they sell their business.

- NA can duplicate its business model (operating a super-regional bank) through the acquisition of another “super-regional bank” in CWB.

- Finally, adding the CWB deposits to NA’s balance sheet will enable more flexibility for NA to operate its capital markets segment. NA needed to increase their capital ratio to grow that segment of their business.

The CWB stock price quickly jumped from $25 to $42 but stayed there instead of surging to $52 (the offered price by National Bank). In other words, there is an interesting play to make a 22-23% gain + a 3% dividend if you are patient and wait until the end of 2025 for the deal to close. I jumped on this opportunity to initiate a position in my Smith Manoeuvre using my margin account.

It’s not a big move for me as we are only talking about $1,500, but it’s a fun trade to make. There is a risk that the deal falls through and the stock price may revert back to $25. Therefore, don’t just jump on that “deal” thinking it’s free money. I know I will have to go through the same noise cycle I’ve experienced with ATVI in 2023. The stock price will fluctuate, noise will fuse from all sources, and will test investors’ patience. That’s also the reason why I didn’t invest $15,000 instead of $1,500.

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 10 companies spread across 7 sectors. My goal is to build a portfolio generating 4-5% in yield across 15 positions. I will continue to add new stock monthly until I reach that goal. My current yield is 5.07%.

Buying Canadian Western Bank (CWB.TO) on margin

As explained earlier, I acquired 35 shares of CWB at $42.79 upon the acquisition news. I’ve used my margin to build a quick position and I will then simply use my $500 per month to pay off the margin account in the coming months. As my portfolio shows a heavy concentration in financials, I will likely sell at least one position (either TD or GWO) during the summer to rebalance my portfolio.

Here’s my SM portfolio as of July 1st 2024 (before the bell):

| Company Name | Ticker | Sector | Market Value |

| Brookfield Infrastructure | BIPC.TO | Utilities | $921.00 |

| Canadian National Resources | CNQ.TO | Energy | $1,072.06 |

| Capital Power | CPX.TO | Utilities | $1,130.71 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $950.18 |

| Canadian Western Bank | CWB.TO | Financials | $1,518.30 |

| Exchange Income | EIF.TO | Industrials | $1,447.04 |

| Great-West Lifeco | GWO.TO | Financials | $678.47 |

| National Bank | NA.TO | Financials | $1,193.61 |

| Nutrien | NTR.TO | Materials | $905.45 |

| Telus | T.TO | Communications | $1,263.31 |

| TD Bank | TD.TO | Financials | $1,052.80 |

| Cash (Margin) | -$971.06 | ||

| Total | $11,161.87 | ||

| Amount borrowed | -$11,000.00 |

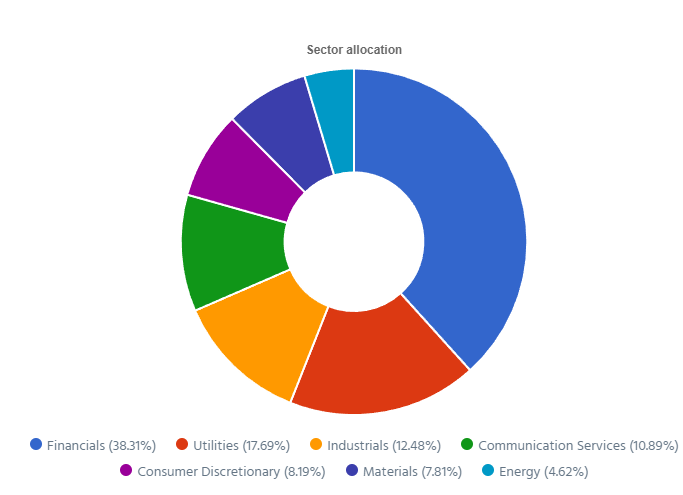

Let’s look at my CDN portfolio. Numbers are as of July 1st 2024 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.TO | Cons. Staples | $22,954.23 |

| Brookfield Renewable | BEPC.TO | Utilities | $10,000.08 |

| CCL Industries | CCL.B.TO | Materials | $10,071.60 |

| Fortis | FTS.TO | Utilities | $9,092.07 |

| Granite REIT | GRT.UN.TO | Real Estate | $8,677.12 |

| National Bank | NA.TO | Financials | $13,129.71 |

| Royal Bank | RY.TO | Financial | $9,467.25 |

| Stella Jones | SJ.TO | Materials | $13,033.42 |

| Toromont Industries | TIH.TO | Industrials | $5,693.11 |

| Cash | $381.05 | ||

| Total | $102,499.64 |

My account shows a variation of -$1,528.16 (-1.47%) since the last income report on June 4th.

Alimentation Couche-Tard fails to grow profit

ATD reported a mixed quarter as revenue increased by 8%, but adjusted EPS was down by 32%. Poor EPS was driven by lower road transportation fuel gross margins in the US, the impact of one less week this quarter compared to last year, and the impact of the Corporation’s investments and business acquisitions on depreciation and financial expenses. Merchandise and service revenues were down 1.7% and same-store sales were down 0.5% in the US, 2% in Europe and 3.4% in Canada. Revenue growth came solely from acquisitions, the wholesale fuel business, and new stores opening.

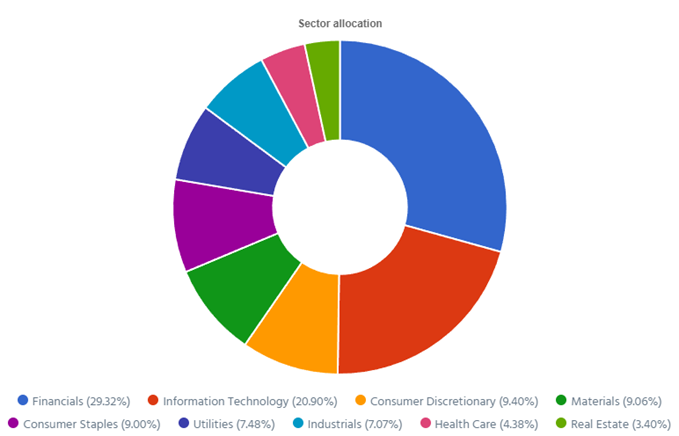

Here’s my US portfolio now. Numbers are as of July 1st 2024 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $8,424.80 |

| Automatic Data Processing | ADP | Industrials | $9,070.22 |

| BlackRock | BLK | Financials | $11,022.48 |

| Brookfield Corp. | BN | Financials | $14,248.22 |

| Home Depot | HD | Cons. Discret. | $10,327.20 |

| LeMaitre Vascular | LMAT | Healthcare | $8,228.00 |

| Microsoft | MSFT | Inf. Technology | $21,006.65 |

| Starbucks | SBUX | Cons. Discret. | $7,317.90 |

| Texas Instruments | TXN | Inf. Technology | $9,726.50 |

| Visa | V | Financials | $13,123.50 |

| Cash | $383.27 | ||

| Total | $111,135.29 |

My account shows a variation of +$1,742.90 (+1.57%) since the last income report on June 4th

It was a quiet month for my portfolio as all my companies reported their earnings in April or May. I’m now ready to enjoy summer as I don’t plan to make any trades in this account in the short term.

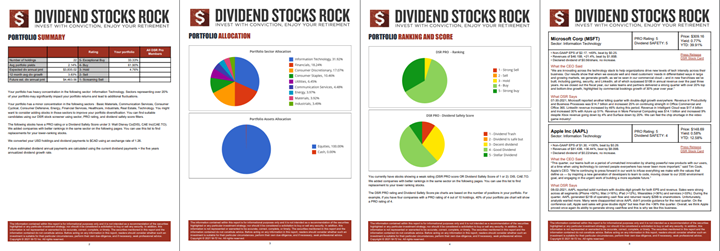

I will take some time to review the latest quarter using my DSR PRO report. My team does a review of all dividend-paying stocks’ quarterly earnings and highlights what’s important. This report saves time and enables me to focus on what matters. You can download my updated report in the next section.

My Entire Portfolio Updated for Q2 2024

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of June 30th, 2024.

Download my portfolio Q1 2024 report.

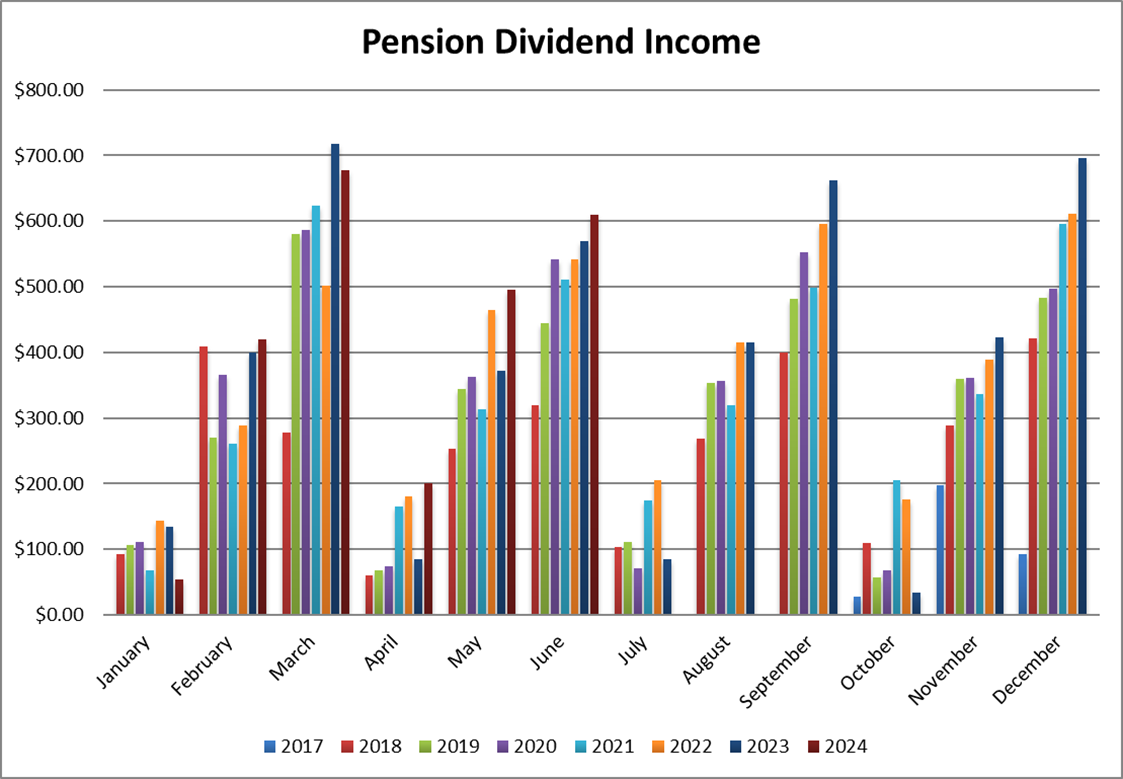

Dividend Income: $609.92 CAD (+7.12% vs June 2023)

I had a good month of dividend income with many companies showing more generous payments than last year. Additionally, we have two new dividend payers in Stella-Jones and the Brookfield Corp. The currency exchange rate also helped to boost income a bit from the US dividends.

Bad times for Some Brookfields – Is It Time to Sell? [Podcast]

Dividend growth (over the past 12 months):

- Fortis: +4.4%

- Stella-Jones: new

- CCL: +8.56%

- Brookfield Renewable: +20.37% (more shares)

- Granite: +3.14%

- Visa: +15.56%

- Microsoft: -5.75% (I sold some shares)

- Home Depot: +7.66%

- BlackRock: +2%

- Brookfield: new

- Currency: +4.54%

Canadian Holding payouts: $297.97 CAD.

- Fortis: $100.89

- Stella-Jones: $40.88

- CCL: $40.60

- Brookfield Renewable: $124.90

- Granite: $35.20

U.S. Holding payouts: $228.05 USD.

- Visa: $26.00

- Microsoft: $35.25

- Home Depot: $67.50

- BlackRock: $71.40

- Brookfield: $27.90

Total payouts: $609.92 CAD.

*I used a USD/CAD conversion rate of 1.3679

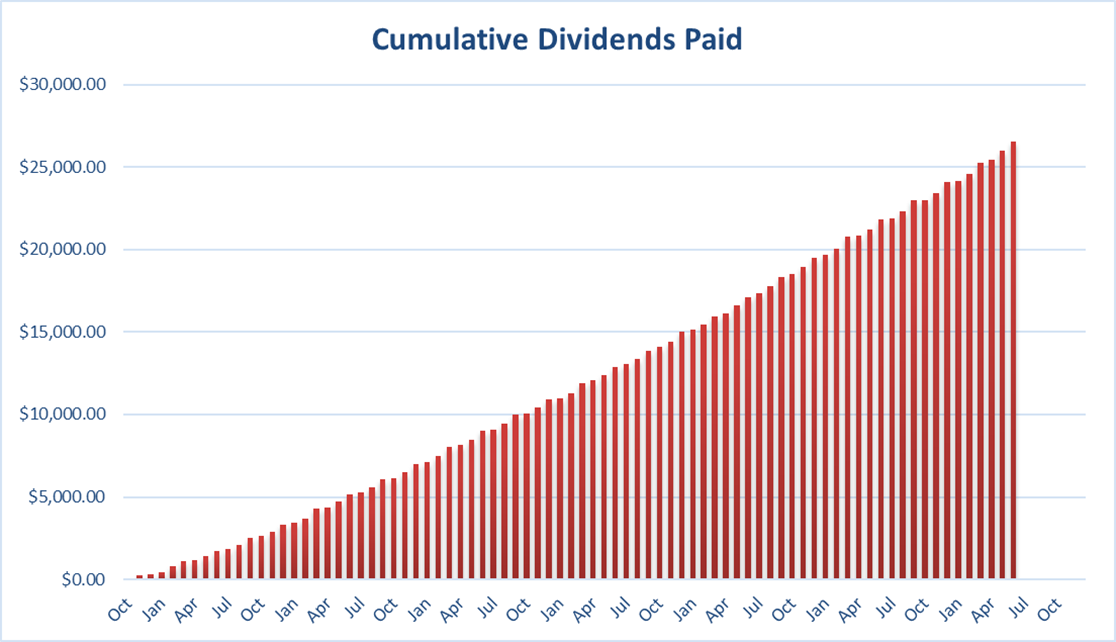

Since I started this portfolio in September 2017, I have received a total of $26,570.74 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

I’m excited to see my Smith Manoeuvre portfolio growing past $10,000 and on its way to getting close to $15,000 by the end of this year. While my SM portfolio isn’t generating huge returns right now, it does force me to add more capital each month. It’s a good way for me to “pay myself first” as I continue my entrepreneurial journey.

Cheers,

Mike.

Leave a Reply