In September of 2017, I received slightly over $100K from my former employer, representing the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

Performance in Review

Let’s start with the numbers as of March 1st 2024 (during the day):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $249,809.27

- Dividends paid: $4,530.76 (TTM)

- Average yield: 1.81%

- 2023 performance: +20.69%

- SPY= +26.19%, XIU.TO = +11.87%

- Dividend growth: +1.7%

Total return since inception (Sep 2017 – March 2024): 129.69%

Annualized return (since September 2017 – 78 months): 13.65%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 13.60% (total return 129.100%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 9.15% (total return 76.63%)

Markets Performance Review

From time to time, I use my portfolio update to do a quick market review of both the U.S. and Canadian stock market’s performance.

I discussed the inflation and interest rate themes at length in 2023. While it’s impossible to know how this story will end (smooth landing or recession?), I’ve often stated that once investors believe we are finished with inflation and done with interest rate hikes, we will see the markets resume their upward movement.

We got the first hints towards the end of October 2023. Since then, the market has been pushing higher and higher while we haven’t yet seen the first interest rate cut. Ironically, it seems that Wall Street and Bay Street expect a lot more from the FED and the Bank of Canada than what’s on the central banks’ play book for 2024.

My guess? The market and its followers will be disappointed as the months go by this year.

Are Markets Overvalued?

This brings us to the eternal question: “are markets overvalued?”. After all, we don’t expect a major earnings surge in 2024 as many companies will deal with an economic slowdown. Many retailers and transportation companies have raised red flags toward the end of 2023 and are not that optimistic for 2024.

When we look at the S&P 500 Shiller CAPE ratio, we are “in line” with what we have seen since 2017. However, please keep in mind that in 2017 the market was trading at an all-time high and many thought the market was overvalued back then.

The Shiller CAPE ratio is calculated by dividing the current market price of the S&P 500 index by the average of the last 10 years of earnings, adjusted for inflation. This adjustment for inflation allows for a more accurate comparison of earnings over time ensuring that the ratio reflects real changes in valuation, and not just changes in the price levels.

31 times earnings seem expensive. Correction; it is expensive!

Does it mean you should sell everything and wait for a market crash? Ah! Imagine if you had done that in 2017…

I prefer to focus on quality companies that will continue to increase their dividends over time. It’s easier to apply and it generates better returns. In the meantime, what I read is high expectations from investors.

- Investors expect interest rate cuts and hope it will drive economic growth.

- They also expect a lot from artificial intelligence (more growth, more profit, and also ways to help “older” companies to cut down their operation costs).

As you know, the stock market is a voting machine. Right now, all votes are for growth. If it doesn’t happen, then you can expect a correction in the best-case scenario (market down around 10%) or a bear market (down by more than 20%) if we don’t get enough rate cuts.

Again, the focus on dividend growers appears to be one of the best approaches to achieving my financial goals.

U.S. Market Review

I’ve discussed with many DSR members the relevance of selecting specific holdings while you can simply invest in the S&P 500 and get amazing results. Let’s be honest: it’s incredibly difficult to beat the S&P 500. As of late, it has gotten even harder to beat it. Why?

Because most of the S&P 500 return is driven by the Magnificent Seven. This is a small group of tech stocks driving the entire index to whole new levels. They are able to affect significantly the performance of the entire market as they move higher quickly and represent 29% of the index (as of February 23rd 2024):

- Apple (AAPL): 6.30%

- Microsoft (MSFT): 7.15%

- NVIDIA (NVDA): 4.53%

- Amazon (AMZN): 3.71%

- Alphabet (GOOGL, GOOG): 1.99% + 1.69% = 3.68%

- Meta (META): 2.52%

- Tesla (TSLA): 1.28%

On one hand, those companies drove exceptional results. Not having them in your portfolio makes it very difficult to beat the S&P 500 performance.

On the other hand, concentration in technology-related companies is a high risk. If they fail to perform, your retirement could be at risk.

What’s the solution? The efficiency and magic of diversification!

You are wrong if you think that matching or beating the market should be your objective. You should focus on how much return you need constantly to achieve your financial goals.

Chasing returns will force you to jump from one strategy to another. To always chase the strategy that generated the best return… last year, over the last 3 years or the last 5 years. How can you know that this is the strategy that will do well going forward?

As a quick example, you can see how the Energy sector isn’t the solution for growth anymore (but it was for two consecutive years!).

The U.S. market has been driven by tech stocks and most companies in the communication services pushing this sector ETF through the roof are companies like Alphabet and Meta. Another sector doing well is the financial sector. It makes sense as asset managers did benefit from a strong market in 2023 (if the market goes up, assets under management follow and so do the fees paid to asset managers). Banks should do better as interest rate revenues will continue to be stable and we have better chances of avoiding a recession if we start cutting rates pre-emptively.

What’s New in Maply Syrup Country?

Utilities continue to suffer as the interest rates are not their friend and renewable energy utilities can’t seem to get any love from the market. Consumer staples are sobering up and maybe investors have realized that while grocery stores are great foundation stocks for a sleep-well-at-night portfolio, their growth potential is limited due to heavy competition.

Inflation seems to be under control as it slowly but surely gets closer to the magical target of 2%. This means banks should have a break and could hope for better days in 2025. In the meantime, it’s obvious that the economy is slowing down. We have seen many companies (notably Canadian Tire, Canadian Pacific and Canadian National Railway) explaining that their results have been affected negatively by weaker consumer spending.

While the U.S. market seems overpriced, the Canadian market hasn’t surged as high. There might be more opportunities up north for the time being. However, this doesn’t mean buying all high yielding stocks thinking they will recover magically. Keep in mind there is a reason why Scotiabank offers about 2.5% more yield than National Bank.

While I’m building my Smith Manoeuvre portfolio, I find it difficult to select companies offering a yield above 4% coming from various industries. I’m even starting to think that I’ll lower my overall yield by adding a few more low-yield, high-growth positions in 2024. The goal will be to improve total return, benefit from the leverage impact and also to select companies that are in a better position to face a potential recession.

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 10 companies spread across 7 sectors. My goal is to build a portfolio generating 4-5% in yield across 15 positions. I will continue to add new stock monthly until I reach that goal. My current yield is 5.05%.

Adding more of Exchange Income (EIF.TO)

Exchange Income reported a solid quarter with revenue up 21% and EPS up 12%. Revenue in the Aerospace & Aviation segment increased by $45 million or 13% while revenue in the Manufacturing segment increased by $68 million or 34%. This growth was partially attributed to strategic acquisitions and continued investment in operating subsidiaries, demonstrating the success of EIC’s strategy to nurture and invest in acquired companies with excellent management teams. IN 2023, EIF made substantial growth capital investments, particularly in the Aerospace and Aviation segment which should drive growth in 2024 and beyond.

Here’s my SM portfolio as of March 1st, 2024 (during the day):

| Company Name | Ticker | Sector | Market Value |

| Brookfield Infrastructure | BIPC.TO | Utilities | $907.40 |

| Canadian National Resources | CNQ.TO | Energy | $1,080.42 |

| Capital Power | CPX.TO | Utilities | $578.85 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $966.70 |

| Exchange Income | EIF.TO | Industrials | $1,555.20 |

| Great-West Lifeco | GWO.TO | Financials | $714.85 |

| National Bank | NA.TO | Financials | $641.76 |

| Nutrien | NTR.TO | Materials | $935.35 |

| Telus | T.TO | Communications | $903.64 |

| TD Bank | TD.TO | Financials | $1,139.60 |

| Cash (Margin) | -$32.48 | ||

| Total | $9,358.81 | ||

| Amount borrowed | -$9,000.00 |

Let’s look at my CDN portfolio. Numbers are as of March 1st, 2024 (during the day):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | Cons. Staples | $25,172.81 |

| Brookfield Renewable | BEPC.TO | Utilities | $8,446.92 |

| CCL Industries | CCL.B.TO | Materials | $9,830.80 |

| Fortis | FTS.TO | Utilities | $8,922.78 |

| Granite REIT | GRT.UN.TO | Real Estate | $9,433.60 |

| Magna International | MG.TO | Cons. Discre. | $5,146.40 |

| National Bank | NA.TO | Financials | $12,934.90 |

| Royal Bank | RY.TO | Financial | $8,615.75 |

| Stella Jones | SJ.TO | Materials | 10,698.88 |

| Cash | $561.62 | ||

| Total | $99,764.46 |

My account shows a variation of +$1,172.26 (+1.19%) since the last income report on February 5th.

Many companies reported their earnings in February, let’s have a look!

Brookfield Renewable keeps growing

Brookfield Renewable reported a solid quarter with FFO per unit growth of 9% for the quarter and +7% for the year. Management also announced a 5% dividend increase! The results reflect the benefit of BEP’s diverse asset base, high-quality inflation-linked and contracted cash flows, organic growth, and contributions from acquisitions. In 2023, BEP secured contracts for new developments for almost 50 terawatt hours, 90% is with corporate customers. BEP keeps growing as it deployed (or agreed to deploy) $9B in capital last year into new projects.

CCL Industries surged!

CCL Industries reported a solid quarter with revenue up 5%, EPS up 17% and a dividend increase of 9%. The stock surged by more than 15% on earnings day! Revenue growth was supported by a mix of organic growth and acquisitions. CCL Segment sales were up 8.9%, Avery +1%, Checkpoint +9.7%, but at Innovia (which is under a restructuring) sales were down 18.6%. The Company finished the year with a strong balance sheet and excellent liquidity despite investing $345.8 million on eight acquisitions, buying back shares and paying a nice dividend.

Fortis is boring but that’s okay

Fortis reported an okay quarter with revenue down 9% and flat adjusted EPS. Adjusted Net Earnings was unfavorably impacted by the timing of adjustments associated with the disposition of Aitken Creek ($0.05). Excluding this adjustment, the increase in Adjusted Net Earnings for the fourth quarter was due mainly to rate base growth from higher retail revenue in Arizona. The Corporation’s 2024-2028 capital plan totals $25 billion, $2.7 billion higher than the previous five-year plan. The increase is driven by organic growth, reflecting regional transmission projects for several business segments.

Granite REIT shows a safe distribution

Granite REIT reported another solid quarter as revenue increased by 3% and AFFO per unit increased by 10%. The payout ratio for the quarter was 70% and 71% for the full year of 2023. Granite’s growth was driven by the completion of developments and expansions beginning in the fourth quarter of 2022, contractual rent adjustments and consumer price index-based increases and renewal leasing activity. For 2024, management expects AFFO per unit to grow by 3% to 7%. With a payout ratio at 71%, this leaves plenty of room for another distribution increase while still allocating capital for additional projects.

Magna International shows improvements

Magna International reported a solid quarter with revenue up 9% and EPS up 46%. The company’s revenue growth was ahead of the 7% growth for global light vehicle production. In addition to higher global vehicle production, sales benefitted from the launch of new programs and acquisitions net of divestitures. Earnings were fueled by an ongoing focus on cost controls initiated last year. The company also announced a 3.2% dividend increase. It’s not much, but it reflects prudent capital allocation. Looking ahead, the company sees 2024 sales of $43.8B to $45.4B vs. $44.9B consensus and adjusted net income of $1.6B to $1.8B.

National Bank remains the best of the big 6

National reported a good quarter all things considered. Revenue was up 5% and EPS was up 2%. Results were driven by higher interest income but partially offset by higher PCLs (from $1.17B to $1.26B, or +8%). By segment: P&C: net income +4%, slowed down by higher PCL (from $511M to $539M or +5%). Wealth Management -1%; revenue was up from higher fees on assets and strong market performance. However, the segment income was hurt by higher expenses. Financial markets +3%, driven by higher revenue from global markets and corporate and investment banking services. US & Intl: +2%, mostly driven by ABA bank performance. PCLs rose $1M for this quarter.

Royal Bank didn’t impress, but didn’t disappoint

Royal Bank reported declining adjusted EPS of -6%. Results were affected by a higher tax rate (we mentioned it was temporary last year), higher PCLs (from $532M to $813M or +53%). By segment: P&C -3%, driven by higher volume of deposits (+9%) and loans (+5%), more than offset by higher PCLs. Wealth Management: -27%, affected by the cost of the FDIC special assessment in the U.S. (including City National) and higher expenses. Insurance went from $67M to $220M driven by higher insurance investment and different actuarial assumptions. Capital Markets -7%, was driven by lower revenue and higher PCLs.

I did a complete of Q1-2024 for the Canadian Banks in this video below.

Stella Jones boosts its dividend!

Stella-Jones reported a good quarter as revenue increased by 3.5%, but EPS jumped by 61%. Management also announced a dividend increase of 22%! Pressure-treated wood sales rose $22 million, or 4%, driven by the 8% organic sales growth of the Company’s infrastructure businesses, namely utility poles, railway ties and industrial products. Higher pricing for utility poles (sales +13%) and railway ties (+2%) was partially offset by lower volumes and a decrease in residential lumber sales (sales were down 18%). Industrial products (only 4% of SJ’s sales) were also down 15.6% due to the timing of projects related to railway bridges and crossings.

Here’s my US portfolio now. Numbers are as of January 9th, 2024:

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $7,111.40 |

| Automatic Data Processing | ADP | Industrials | $9,476.82 |

| BlackRock | BLK | Financials | $11,314.80 |

| Brookfield Corp. | BN | Financials | $14,224.21 |

| Home Depot | HD | Cons. Discret. | $11,510.65 |

| LeMaitre Vascular | LMAT | Healthcare | $6,730.00 |

| Microsoft | MSFT | Inf. Technology | $19,394.89 |

| Starbucks | SBUX | Cons. Discret. | $7,944.10 |

| Texas Instruments | TXN | Inf. Technology | $8,491.50 |

| Visa | V | Financials | $14,132.50 |

| Cash | $370.63 | ||

| Total | $110,701.50 |

My account shows a variation of +$3,460.44 (+3.23%) since the last income report on February 5th.

There were lots of companies reporting earnings over the past 30 days. Let’s review what they did!

Brookfield Corp is buying shares

Brookfield reported a solid quarter with adjusted distributable EPS up 17%. You must look at the adjusted results as it includes the special distribution of 25% of its asset management business (Brookfield Assets Management into BAM) in December 2022. The company also announced a 14% dividend increase! Brookfield’s private fund strategies continue to attract strong interest from its clients leading to $93B of capital raised which, combined with the approximately $50B anticipated upon the closing of American Equity Life (“AEL”), brings the total to $143B. Management also expects to buy back $1B in shares in 2024.

Home Depot feels the economic slowdown

It was a disappointing quarter for Home Depot as revenue declined by 3% and EPS fell by 15%. Comparable sales decreased 3.5% during the quarter vs. -3.6% consensus. Customer transactions were down 1.7% during the quarter to $372.0M. The average ticket of customers was 1.3% lower to $88.87 for the quarter. Management also expects comparable sales to decline by 1% in 2024. The home improvement retailer expects to open approximately 12 new stores this year. At least, HD increased its dividend by 7.7% as management is optimistic for the long-term perspective of home renovation and construction. This is just going to be a bad year for HD.

LeMaitre Vascular surged on a good quarter

LeMaitre Vascular reported a solid quarter with revenue up 19%, EPS up 52% and management announced a dividend increase of 14%! Growth was driven by geographical expansion and product sales, with significant growth in EMEA, the Americas, and APAC. LMAT plans to increase its sales force and has made regulatory strides, including Artegraft CE filings and expansions in Asia. The guidance for 2024 anticipates continued growth, leveraging operational efficiencies and an improved gross margin. They are projecting a 10% sales growth and a gross margin of 68%.

Here’s the complete stock analysis of LMAT.

Microsoft integrated Activision Blizzard with success

Microsoft reported a solid quarter with revenue up 18% and EPS up 26%. Revenue in Productivity and Business Processes was up 13%, driven by Office Commercial products and Dynamics. Intelligent Cloud was up 20%, driven by Azure (+30%). Please note that Azure’s growth has been slowing down for a few quarters in a row now. More Personal Computing was up 19%, driven by the acquisition of Activision Blizzard and, surprisingly, by Windows revenue (+9%). Going forward, Microsoft has the intention of integrating AI functions at scale across its products. This should open the doors for more growth.

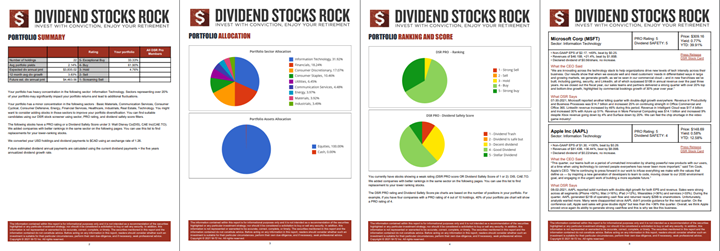

My Entire Portfolio Updated for Q4 2023

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of January 10th, 2024.

Download my portfolio Q4 2023 report.

Dividend Income: $419.95 CAD (+5% vs February 2023)

This was a good month for dividends, my best one for the month of February. The dividend growth was driven by Canadian banks (National bank and Royal) and all companies show a higher dividend payment than last year. I sold some shares of Apple at the end of 2023 which partially offset my dividend income for this month.

Dividend growth (over the past 12 months):

- Granite: +3.13%

- Royal Bank: +13.26%

- National Bank: +9.28%

- Starbucks: +7.55%

- Apple: -44.35% (I sold shares of AAPL)

- Texas Instruments: +4.84%

- Currency: -0.006%

Canadian Holding payouts: $253.17 CAD.

- Granite: $35.21

- Royal Bank: $89.70

- National Bank: $128.26

U.S. Holding payouts: $123.05 USD.

- Starbucks: $48.45

- Apple: $9.60

- Texas Instruments: $65.00

Total payouts: $419.95 CAD.

*I used a USD/CAD conversion rate of 1.3554

Since I started this portfolio in September 2017, I have received a total of $24,586.88 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

Going forward, being cautiously optimistic should be the new buzzword. I must admit: seeing the overall market valuation at such levels makes me think twice about my next move. However, I follow a strict process where I sell my winners when they become too big. This process enables me to take profits when they are juicy and reallocate the proceeds toward better diversification.

I will never sell to go cash, but I’m thinking about trimming more aggressively some positions as the year advances. I have entertained this possibility, but I’m not ready to pull the trigger yet. As you are aware of my process, I like to take mental note and reflect on them for a few months or often until the end of the year. I don’t make rash decisions with my portfolio and it has served me well so far.

Cheers,

Mike.

Leave a Reply