When prices run, our brain screams: “It’s too expensive!” Then we watch those “expensive” stocks keep climbing and wonder if we should jump in… or bail out.

My take is simple: valuation without context is just fortune-telling. A high P/E isn’t automatically a bubble, and a low P/E isn’t automatically a bargain. What matters is whether the price you pay is backed by fundamentals and durability—or by hype and hope.

Below is a quick playbook to handle high-P/E names, followed by three case studies from your list—Waste Connections (WCN), Dollarama (DOL.TO) and Microsoft (MSFT)—with their 5-year P/E charts attached.

How to judge a “high” P/E (My rules in plain English)

1) Is the P/E rising faster than earnings?

That’s P/E expansion. It can be fine if earnings are also compounding quickly and predictably. It’s dangerous when the multiple is doing all the work.

2) Compare today’s P/E to its own 5-year range/average.

Great companies trade at “house multiples.” If a stock usually lives around 30–40× and it’s at 34× today with the same thesis intact, that’s not “crazy”—that’s normal.

3) Look through the right lens for the business model.

Capital-light compounders (software, networks, roll-ups) deserve higher P/Es. Capital-intensive models often appear more attractive on a cash-flow or EV/EBITDA basis. Don’t judge pipelines by EPS, don’t judge REITs by plain P/E.

4) Validate the Dividend Triangle.

If revenue, earnings, and dividends are rising together, it’s easier to justify a premium. If any leg is wobbling, that premium is fragile.

5) Separate moat from momentum.

Recurring revenue, switching costs, network effects, and pricing power all earn a higher multiple. Viral hype does not.

6) Manage position size, not headlines.

Even amazing businesses can get “priced for perfection.” Caps, trims, and rebalancing exist to protect you against narrative whiplash.

With that lens, let’s look at your three high-P/E names.

Want to Avoid Price Confusion?

Ever look at a stock chart and wonder: “Why is it up today? Why is it down this week?”

If you’ve ever felt unsure about whether to sell, hold, or buy, you’re not alone. That’s why we’re hosting a free webinar:

Don’t know why a stock is up or down? Avoid price confusion!

You’ll walk away with a simple framework to make better decisions, even when the market feels irrational.

Seats are limited—save your spot today.

Case Study 1: Waste Connections (WCN / WCN.TO)

What the 5-year P/E chart shows:

The line sits way up in the stratosphere (recent reading ~71×). You’ll notice step-changes and long stretches where the multiple stays elevated. Translation: the market habitually pays up for this business.

Business quality & growth drivers:

Waste is a beautiful, “boringly wonderful” industry. Route density, local permits, and long contracts create local monopolies. WCN layers on disciplined M&A, pricing above CPI, and steady free-cash-flow growth. This combo is exactly the profile that commands a premium—durable demand, recurring cash, and incremental consolidation opportunities.

Is the P/E out of control?

High? Absolutely. Out of control? Not necessarily—if cash flow keeps compounding at a healthy clip. GAAP EPS can be noisy for roll-ups (acquisition accounting, amortization), which is why many pros focus on free cash flow per share and EV/EBITDA for WCN. On those lenses, it’s still expensive relative to peers (WM, RSG), but not absurd given its growth runway and best-in-class execution.

My Conclusion:

-

Verdict: Paying for quality, but priced for perfection.

-

Action: Nibble on pullbacks, keep a firm position-size cap, and watch pricing/margin commentary every quarter. If organic pricing slows or acquisition returns compress, a premium like ~70× EPS has nowhere to hide.

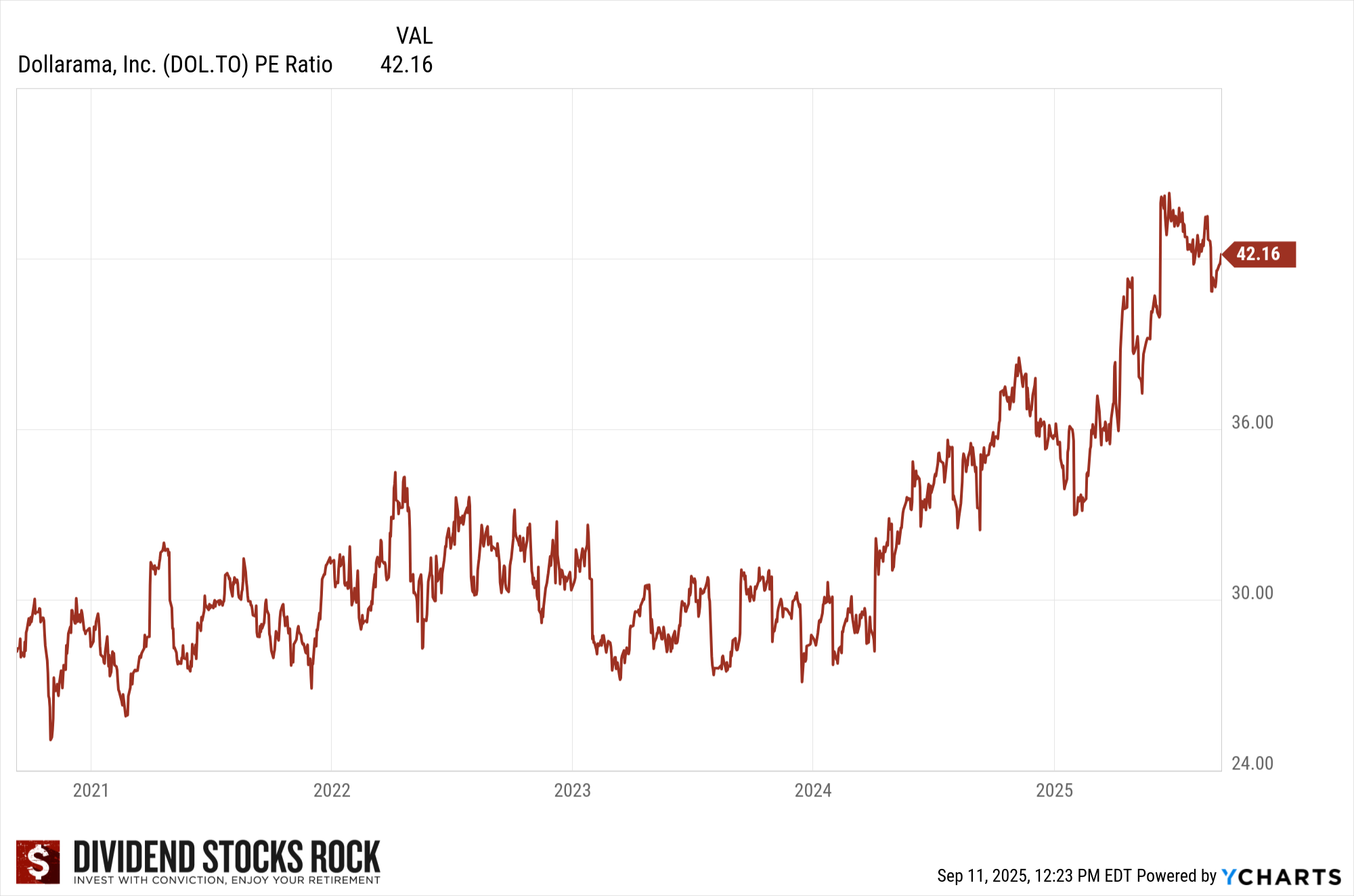

Case Study 2: Dollarama (DOL.TO)

What the 5-year P/E chart shows:

A clear, persistent re-rating—from the high-20s/low-30s into the 40s (recent ~42×). The market is willing to pay more today than it did a few years ago.

Business quality & growth drivers:

DOL is a ruthless operator: tight SKU discipline, private-label mix, small-ticket essentials, rapid payback on new stores, and a model that travels (Dollarcity/LatAm). You get same-store sales growth + store expansion + margin discipline. That’s the Dividend Triangle on rails.

Is the P/E out of control?

It’s elevated versus its own past, but the thesis improved while the multiple expanded—international optionality, inflation-era traffic, and consistent execution. A 40-ish P/E requires continued mid-teens EPS compounding. If comps cool or expansion stumbles, you can see a swift multiple snap-back. But as long as DOL keeps hitting that triangle, the premium is defendable.

My Conclusion:

-

Verdict: Paying for quality. Just don’t expect multiple expansion to drive returns from here; earnings growth must do the heavy lifting.

-

Action: Accumulate on weakness or during flat periods; avoid chasing vertical spikes. Keep an eye on: traffic vs. basket mix, gross margin (shrink, freight), and international execution.

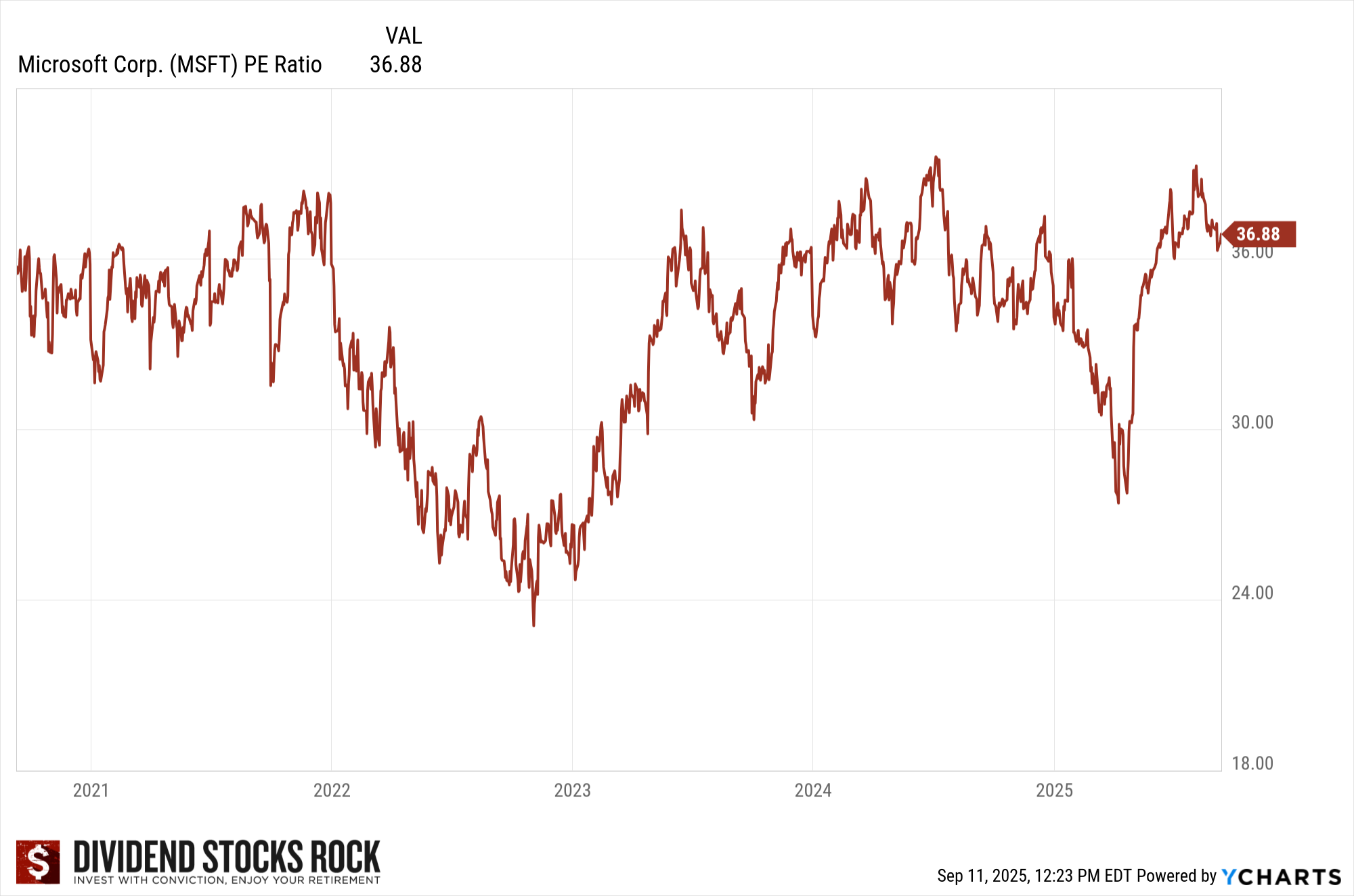

Case Study 3: Microsoft (MSFT)

What the 5-year P/E chart shows:

A premium—but not nosebleed—multiple in the mid-30s (recent ~37×). The chart also shows that MSFT’s P/E compresses quickly when sentiment wobbles and snaps back when results arrive.

Business quality & growth drivers:

This is the modern textbook for high-return, recurring, mission-critical software + cloud. Azure growth, Office 365 subscription lock-in, GitHub/Developer ecosystem, security bundle, and now AI copilots threaded across the stack. Switching costs, network effects, and cross-sell are formidable.

Is the P/E out of control?

Not by Microsoft standards. In fact, compared to many AI-adjacent names, MSFT’s premium looks reasonable given its breadth, cash generation, and visibility. The 1999–2009 “lost decade” is the cautionary tale when P/E was ~70× on hype with weak earnings momentum; today is the opposite—earnings drive the story and the multiple rides shotgun.

My Conclusion:

-

Verdict: Paying for quality, not a bubble.

-

Action: Comfortable to hold and add on dips. Risks to watch: Azure growth deceleration, AI monetization lag vs. expectations, or margin pressure from heavy AI capex.

So… is there room left for profit?

Yes—if profits (and cash flow) keep compounding. Here’s the reality:

-

WCN can keep winning with price + tuck-ins, but the multiple leaves little room for disappointment. Treat it like a luxury good: great to own, buy on sale, size prudently.

-

DOL.TO deserves a premium as long as comps, expansion, and margins hum. Expect total returns to track earnings growth more than multiple expansion from here.

-

MSFT remains a high-quality compounding machine at a justifiable premium; weakness tends to be opportunity as long as the AI/cloud flywheel spins.

Quick checklist before you buy any high-P/E stock

-

Is today’s P/E inside (or only modestly above) its own 5-year range?

-

Are revenue, EPS, and dividends all trending up (the Dividend Triangle)?

-

Do moat + model (recurring revenue, switching costs, network effects) truly justify a premium?

-

Are you using the right metric (cash flow/EV-EBITDA for roll-ups, not just EPS)?

-

Do you have a position-size cap so “priced for perfection” doesn’t become “portfolio risk”?

Bottom line: The right price is the one you pay with conviction—because you understand the business, the metrics back the story, and your risk controls are in place. High-P/E isn’t the enemy. Paying a high P/E for the wrong story is.

Still Wondering If It’s Time to Sell, Hold, or Buy?

High P/E ratios can look scary, but context is everything. The same applies to daily stock price fluctuations.

If you’re tired of second-guessing your decisions, join our free webinar:

Don’t know why a stock is up or down? Avoid price confusion!

You’ll walk away with:

- A framework for telling you when to ignore noise and when to listen

- A clear business model check that reveals real risk

- The Dividend Triangle signals that separate bargains from traps

Over 30,000 investors have seen my webinars since 2017.

- The webinar is on Thursday, September 18th at 1pm ET.

- If you can’t attend, register and you will receive the replay for free

- It is 100% free, no strings attached.

- The presentation is about 50 minutes.

- I will stay for one hour after the presentation to answer all your questions.

- I will also provide handouts and other resources to all live attendees.

- Live places are limited to the first 500.

Leave a Reply