Dividend growth investing is one of the most reliable ways to build wealth and create a growing income stream. But here’s the catch: a dividend payment alone doesn’t make a stock “safe.” Some companies pay generous dividends right up until the day they don’t.

That’s why I use a simple framework called the Dividend Triangle. And the name isn’t just marketing.

A triangle is one of the most solid shapes you’ll find. It doesn’t wobble. It holds its form. Think of it like a three-legged stool: if all three legs are strong, you get stability. But if one leg weakens, the whole thing starts to feel shaky.

The Dividend Triangle works the same way. It keeps you focused on three fundamentals that should support a growing dividend over time: revenue growth, earnings growth, and dividend growth. When those three trends move together, the dividend story is usually built on something real—not just a high yield and wishful thinking.

What Is the Dividend Triangle?

The Dividend Triangle tracks three fundamentals that should (ideally) move in the same direction over time:

1) Revenue Growth

Revenue is the fuel. If sales aren’t growing, a company will eventually hit a wall—either on profitability, dividend growth, or both.

A rising revenue trend suggests the business is:

- expanding its customer base,

- increasing prices without losing demand,

- gaining market share,

- or finding new growth vectors.

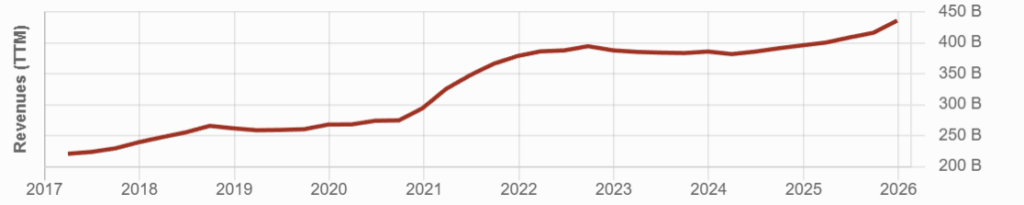

Example: Apple — 10-year revenue growth.

Apple’s revenue trend helps illustrate what you want to see at a high level: a business that keeps finding ways to generate more sales over time.

2) EPS Growth

Revenue is great, but earnings per share (EPS) show whether the business is turning growth into real profitability.

EPS growth shows whether management can:

- protect margins,

- scale operations

- manage costs,

- and allocate capital effectively.

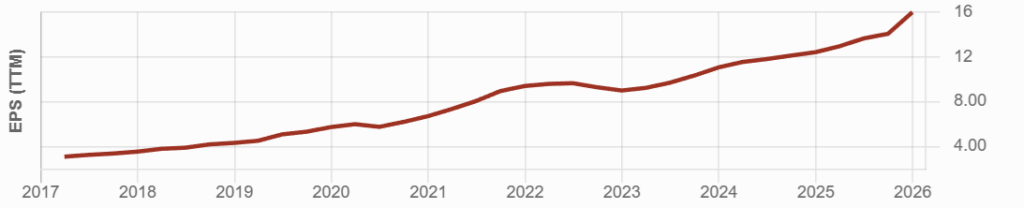

Example: Microsoft — 10-year EPS growth.

Microsoft is a classic case where strong execution (and high-margin business lines) has fueled consistent earnings expansion.

3) Dividend Growth

The dividend is the shareholder’s “paycheck,” but more importantly, it’s a signal.

A company that raises its dividend regularly is usually showing:

- confidence in cash flow durability,

- discipline in capital allocation,

- and a shareholder-friendly mindset.

Dividend growth also protects you against inflation. A stagnant dividend might still pay today, but it loses purchasing power year after year.

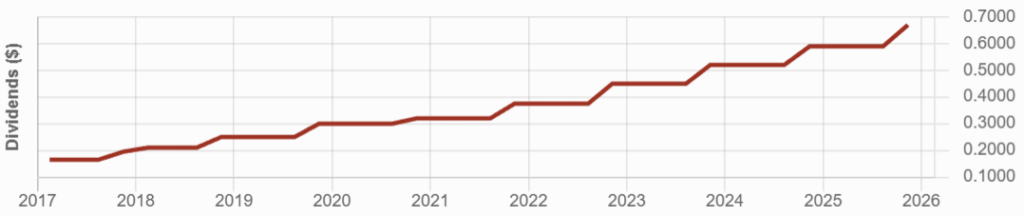

Example: visa — 10-year Dividend growth.

Visa has consistently increased its dividend by double digits, reflecting its strong business model and growth prospects.

Put the three together, and you get something powerful:

A business that grows sales, grows profits, and shares more with shareholders over time.

300 Stock Ideas With a Positive Dividend Triangle—Get the List Now!

I’ve used the Dividend Triangle to build a list of about 300 companies showing positive 5-year trends for revenue, EPS, and dividends.

The Dividend Rock Stars list is updated monthly and is a great starting point if you want to speed up your stock research.

Save yourself a ton of work—enter your name and email below and I’ll send it to you:

Why the Dividend Triangle Matters (More Than Yield)

Most investors learn this lesson the hard way: a high yield can be a trap.

A stock can yield 6%, 7%, even 9%… and still be a bad investment if the business is deteriorating underneath. In many cases, the yield is high because the market is already pricing in trouble.

The Dividend Triangle helps you avoid that by forcing you to look at the full picture.

- Strong revenue + EPS growth but weak dividend growth can suggest a company that may have room to raise dividends later.

- Weak revenue trends paired with a big dividend can be a warning sign that the dividend is living on borrowed time.

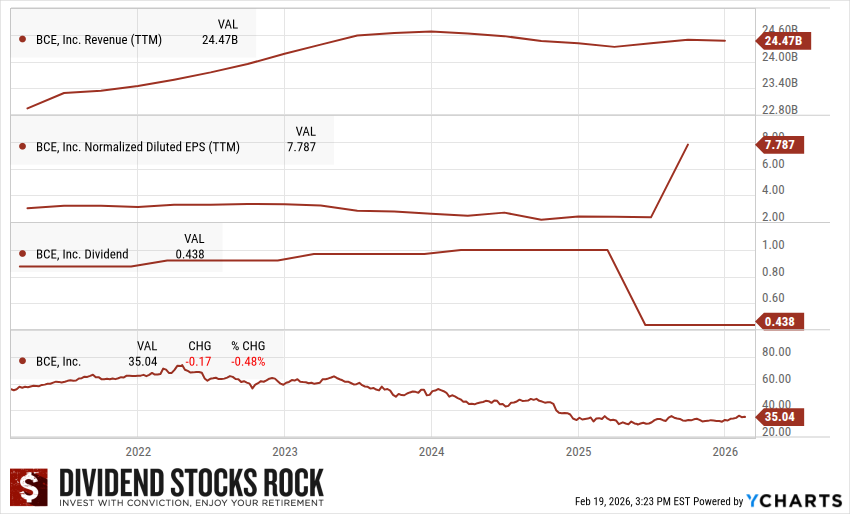

The BCE example (why the triangle can flash warnings)

BCE is a great reminder of why we track trends instead of just yield. In BCE’s updated chart, you can see how the Dividend Triangle has weakened—especially when you look at earnings pressure and dividend sustainability. When one side of the triangle breaks down for long enough, dividend growth becomes harder to justify… and the risk of a reset goes up.

This is exactly why the Dividend Triangle exists: to highlight when the dividend story is getting harder to defend.

How to Evaluate Each Side of the Triangle

You don’t need perfection. You’re looking for direction and consistency.

Revenue Growth: Look for stability

I’m looking for steady growth over the past five years. It doesn’t have to be a straight line, but you want the trend to move in the right direction.

If revenue bounces all over the place, it usually means:

- the business is cyclical,

- exposed to commodity swings,

- or dependent on one unpredictable segment.

EPS Growth: Aim for a healthy floor

As a general guideline, I like to see at least mid-single-digit EPS growth over five years. Strong businesses often do better than that, but consistency matters more than one big year.

Dividend Growth: Keep inflation in the rearview mirror

A good target is 5%+ dividend growth, because that keeps your income compounding ahead of inflation. Some businesses won’t reach that level every year—but over a 5-year stretch, you want to see a clear upward pattern.

A Simple Real-World Comparison

Imagine you’re choosing between two dividend stocks:

- Stock A yields 6%, but revenue is slipping and earnings are flat.

- Stock B yields 2%, but revenue, EPS, and dividends are all trending upward.

Stock A looks like the better income play—until the business can’t support the dividend anymore. Stock B, even with a lower yield, has a much better shot at delivering reliable and rising income for years.

If you want a deeper breakdown of the common misconceptions around low vs. high yield stocks, I’ve explained it in more detail in this article.

The Dividend Triangle Has Limits (Know Them)

The Dividend Triangle is a screening tool—not a crystal ball.

Even great companies can run into:

- industry disruption,

- regulation changes,

- margin compression,

- poor acquisitions,

- or macro shocks.

That’s why you always want to pair the Triangle with a quick check of:

- the business model,

- competitive advantages,

- balance sheet,

- and the key risks.

Special case: REITs

REITs can distort the Triangle because EPS isn’t the best profitability measure for real estate.

If you want a REIT-friendly version, consider:

- Revenue Growth –> Same-Property NOI Growth & Occupancy

- EPS Growth –> AFFO per Share Growth

- Dividend Growth –> AFFO Payout Ratio & Dividend Stability

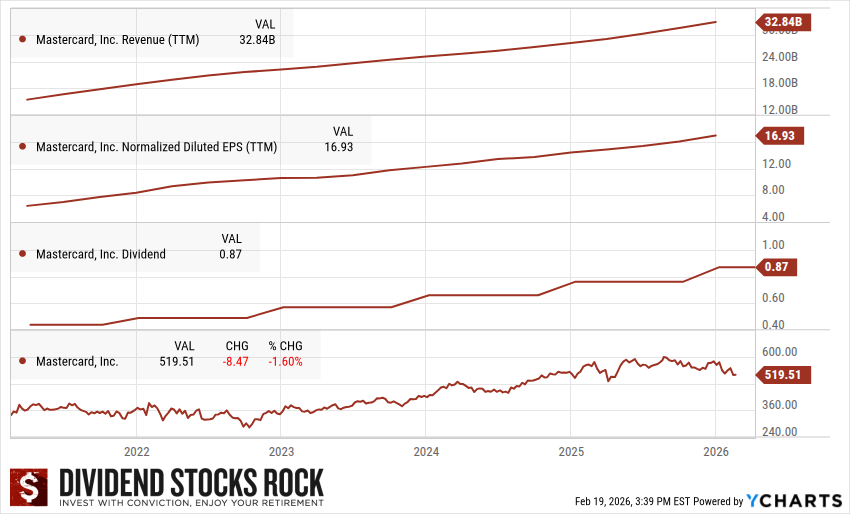

The Dividend Triangle in Action: Mastercard

Let’s apply the Triangle to a business that dividend investors often misjudge at first glance.

Mastercard’s yield is nearly non-existent, which can turn off income seekers. But this is a great example of why yield doesn’t tell the whole story.

Mastercard benefits from powerful secular tailwinds—the ongoing shift from cash to digital payments. Its business model is scalable and capital-light: it acts like a tollbooth on global commerce, earning a fee as transactions flow through its network. That structure has supported strong margins and consistent earnings growth.

Now layer in the dividend story:

- Mastercard has increased its dividend every year since its IPO.

- It has delivered double-digit dividend growth over the past five years.

- Mastercard increased its dividend by 14.5% in 2026.

- With payout ratios under 25%, the company has plenty of room to keep growing the dividend.

That’s what a strong Dividend Triangle looks like in real life: growth in the business, growth in earnings, and a dividend that’s compounding fast—even if the yield starts small.

Final Thoughts: Use the Triangle to Build Better Dividend Habits

The Dividend Triangle is simple on purpose. It keeps you focused on what matters:

Is the business growing? Is profitability improving? Is the dividend rising because it’s supported by fundamentals?

If you make this framework a habit, you’ll naturally drift away from yield traps and toward the kinds of businesses that can pay you more every year—without relying on hope.

If you want a shortcut to finding candidates that already show a positive Dividend Triangle, grab the list.

Leave a Reply