Asset allocation is a tool that investors can use to help reduce the risk in their portfolio. The thinking is that, as not all investment types move in the same direction at the same time, you can “cover your bets” by investing in a few different investment types to take advantage of the various moves each class can take.

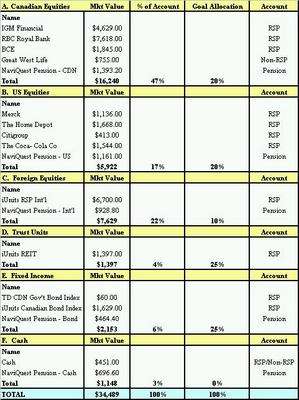

I break my asset allocation into 6 different asset types:

- Canadian Equities

- US Equities

- Foreign Equities

- Trust Units

- Fixed Income

- Cash

If you look at the attached chart, I have a current percentage amount that I hold in each asset class as well as a goal amount. As you can see, I am way off. I will be attempting to balance this out in my future purchases.

How did I come up with this allocation? I started by deciding how much I wanted to have in equities and worked from there. I used the rough calculation of 100 minus my age (100 – 31 = 69%) as a start. I include Trust Units as an equity component as opposed to Fixed Income as it is not fixed income in the same manner as government bonds are – trusts hold much more risk. In addition, I am low on cash which will limit my ability to purchase if the market crashes.

How did I come up with this allocation? I started by deciding how much I wanted to have in equities and worked from there. I used the rough calculation of 100 minus my age (100 – 31 = 69%) as a start. I include Trust Units as an equity component as opposed to Fixed Income as it is not fixed income in the same manner as government bonds are – trusts hold much more risk. In addition, I am low on cash which will limit my ability to purchase if the market crashes.

Anyway, that is how I do it. You may do it differently. Let me know, I would love to hear your thoughts.

How do you capture foreign dividends? As a heavy user of ETFs, I’ve been unable to find something I like that yields dividends (either through bonds or otherwise) from foreign countries and companies. On a related note, are you doing anything to invest in foreign real estate (other than the US and Canada)?

I was checking out the latest ROB portfolio builders site and was wondering what your thoughts were about them? I have at least 10 years in a non taxable account, it seems they are well diversified around the world but still only expect 6-8 % on average per year compounding. Does this seem reasonable or too low in your opinion? I just don’t want to go through the thrashing I took through the 2000-2002 years again! Any insight is appreciated.