When it comes to building a retirement portfolio, the dream is simple: an income stream that lasts as long as you do. Yet, achieving this requires a careful balance between risk, growth, and sustainability. At Dividend Stocks Rock (DSR), we advocate for an often-overlooked but powerful strategy: investing in low-yield, high-dividend-growth stocks. These companies may not offer the immediate gratification of a high dividend yield, but their potential for long-term growth makes them a cornerstone of a resilient and prosperous retirement portfolio.

The Mirage of High-Yield Stocks

At first glance, high-yield stocks appear to answer every retiree’s needs. A 6% or 7% yield feels like a golden ticket to financial freedom, offering a seemingly predictable income without the need to sell shares. However, this simplicity often masks significant risks. High-yield stocks frequently represent mature businesses with limited growth potential. As these companies face headwinds, their ability to sustain—or even increase—their dividend payments diminishes.

The Harsh Reality of High-Yield

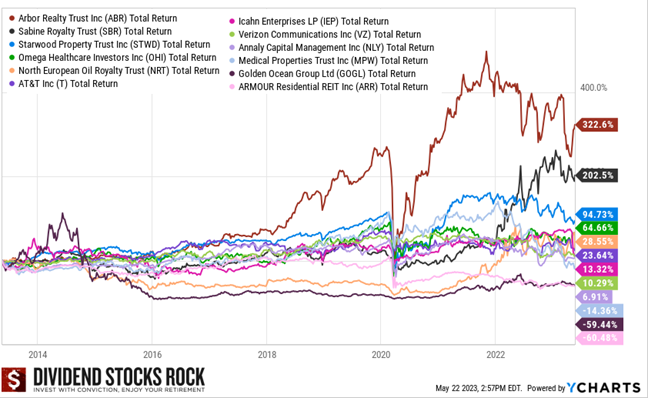

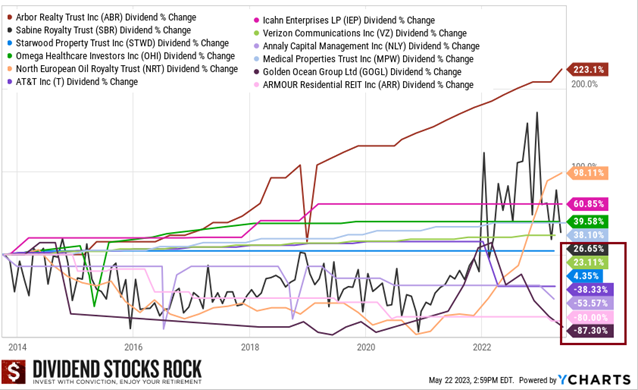

Our research spanning the last decade uncovered some sobering truths. While low-yield, high-growth stocks showed remarkable resilience and growth, 25% of high-yield stocks delivered negative total returns. That’s right—investors not only failed to gain value but saw their capital erode. Worse, over one-third of these companies cut their dividends during the same period. Such instability can derail even the best-laid retirement plans, forcing retirees to compromise their quality of life.

High Yields often Signal Trouble

The reason for this underperformance is simple: high-yield stocks often signal trouble. When a company offers an unusually high dividend yield, it’s frequently because its stock price has dropped due to market concerns. While some of these concerns may be temporary, others reflect deeper structural issues. The higher yield then becomes a red flag rather than a reward.

The Best Guide to Create a Sustainable Dividend Income at Retirement

This guide is for any investor who wants to create a sustainable income from his/her portfolio. It will be useful during your accumulation phase as you will avoid major mistakes and build a solid portfolio for your retirement. It will be even more useful if you are retired and count on your portfolio to pay the bills.

We all invest with the same goal in mind: having our money working for us.

Download the Dividend Income for Life Guide Now!

Or read on to get a sneak peek of what’s inside.

Why Low-Yield, High-Growth Stocks Shine

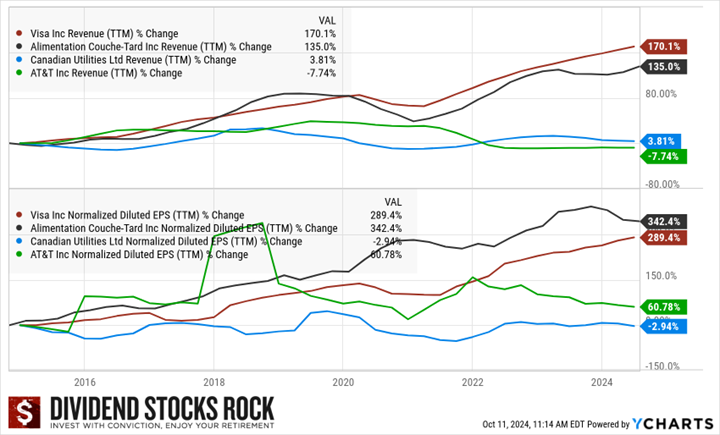

By contrast, low-yield, high-growth companies tend to be industry leaders, boasting robust business models and ample growth opportunities. Companies like Visa and Alimentation Couche-Tard are prime examples of businesses that prioritize reinvesting profits to fuel expansion, innovation, and long-term shareholder value. While modest in yield, their dividends grow steadily over time, supported by rising revenues and profits.

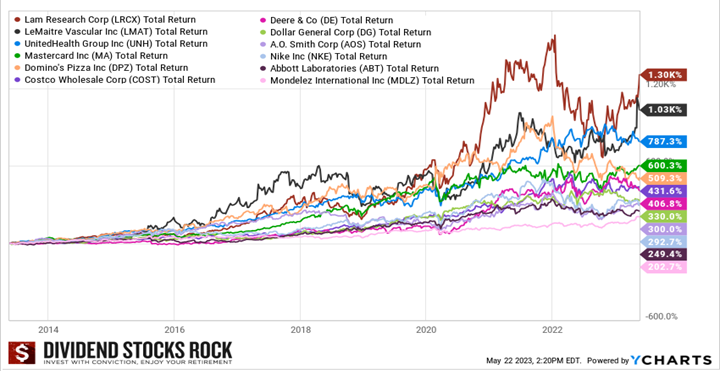

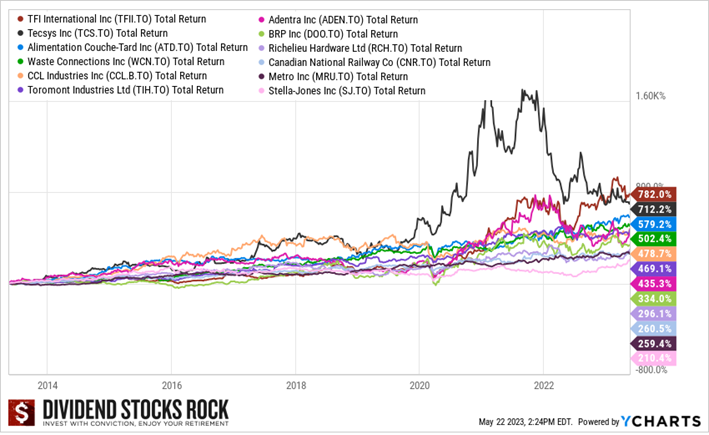

The Power of Long-Term Growth

Between 2013 and 2023, U.S. stocks in this category delivered total returns ranging from 203% to an astounding 1,300%. Their Canadian counterparts weren’t far behind, achieving total returns between 210% and 782%. These results aren’t anomalies but reflect the fundamental strength of businesses focused on growth.

What Makes These Companies Unique?

First, they operate in sectors with significant growth potential. Second, they maintain conservative payout ratios, ensuring that dividends are well-supported by cash flow. Finally, their management teams prioritize long-term success over short-term appeasement of shareholders. This combination makes them ideal candidates for a retirement portfolio that aims to grow income year after year.

The Misconception of Low Yield

Many retirees shy away from low-yield stocks because they don’t immediately “pay the bills.” This concern, while understandable, overlooks the bigger picture. Over time, a portfolio of low-yield, high-growth stocks can far outpace one built on high-yield alternatives.

A 10-Year Case Study

Consider this example: between 2013 and 2023, $10,000 invested in low-yield stocks like Visa (V) and Alimentation Couche-Tard (ATD.TO) grew to over $123,000, while a similar investment in high-yield stocks like AT&T (T) and Canadian Utilities (CU.TO) amounted to just $27,000.

Yes, the high-yield stocks provided higher immediate income, but the low-yield stocks delivered a total return nearly five times greater. By carefully managing withdrawals—selling a small portion of shares each year to supplement dividends—investors in low-yield stocks could enjoy a similar income stream while preserving far more capital for future growth.

Building Stability with a Cash Reserve

One of the most persistent fears about low-yield stocks is the need to sell shares during market downturns. What happens if the market drops just as you begin retirement? Selling shares at a loss can create a downward spiral that’s difficult to recover. The solution lies in creating a cash reserve to act as a buffer during volatile periods.

Use Secure Investments: GICs and Bonds

A three-year cash reserve, built with liquid and secure investments like GICs or bonds, can provide the flexibility needed to weather bear markets. For example, if your portfolio generates $20,000 in dividends but you need $50,000 annually, the $30,000 gap can be drawn from your cash reserve during tough years. Once the market recovers, you can replenish the reserve by selling higher-priced shares. This approach ensures you never have to liquidate assets at the worst possible time.

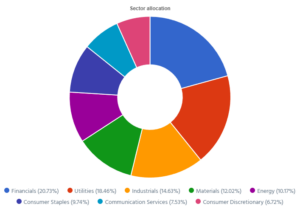

A Balanced Sector Approach

A well-constructed portfolio combines income stability with growth potential, and the key to achieving this is diversification. By spreading investments across multiple sectors, you reduce the impact of downturns in any industry.

Where to Find Low-Yield, High-Growth Stocks

Low-yield, high-growth companies can be found in sectors like technology, industrials, and consumer staples, while more stable income can come from utilities and real estate investment trusts (REITs). The right mix depends on your financial goals and risk tolerance, but the principle remains the same: balance stability with opportunity.

Why This Strategy Works

The magic of this strategy lies in its dual focus on preservation and growth. While high-yield stocks may provide immediate gratification, their long-term viability is often questionable. On the other hand, low-yield, high-growth stocks represent thriving businesses that can adapt, innovate, and deliver consistent results. Over time, this approach protects your portfolio and allows it to grow, ensuring you never outlive your wealth.

How to Secure Your Future

By incorporating a cash reserve, maintaining a balanced sector allocation, and focusing on dividend growth, you can create a dividend income for life. This isn’t just about generating income—it’s about building a retirement plan that thrives in any market condition. Whether you’re years away from retirement or already enjoying its rewards, this strategy can help you achieve financial security and peace of mind.

Make Sure You Don’t Forget — Download the Guide!

I know what it’s like. We all have busy lives and move from one resource to another quickly. I have created the Dividend Income for Life Guide so you don’t forget what you’ve just learned and more!

In this guide

- Deep dive into high versus low yields.

- Advantages of low-yield, high-growth dividend stocks.

- How to identify dividend growers.

- Sectors allocation and categories.

- Portfolio Case Study.

- Withdrawal Mechanics and Cash Reserve.

- Special Offer.