When it comes to building a retirement portfolio, the dream is simple: an income stream that lasts as long as you do.

But here’s the part most investors don’t like hearing: you don’t get there by shopping for the highest yield. You get there by building a portfolio that can keep producing cash flow and preserve (or grow) your capital across complete market cycles.

This is precisely why I created the Dividend Income for Life Guide—a practical roadmap to help you build a retirement income strategy that doesn’t fall apart the first time markets get ugly.

Download the Dividend Income for Life Guide for free here.

Or keep reading for a sneak peek of what’s inside.

The Mirage of High Yield: When “Income” Becomes a Trap

A 6% or 7% yield looks like a retirement shortcut. It feels like a clean solution:

- Buy the stock

- Collect the dividend

- Pay the bills

That’s the “napkin math” retirement plan.

The problem is that high yield often comes with a hidden message from the market: “We don’t believe this business can grow.” When growth disappears, dividend safety eventually gets tested. And if that dividend breaks, you don’t just lose income—you often lose capital at the same time.

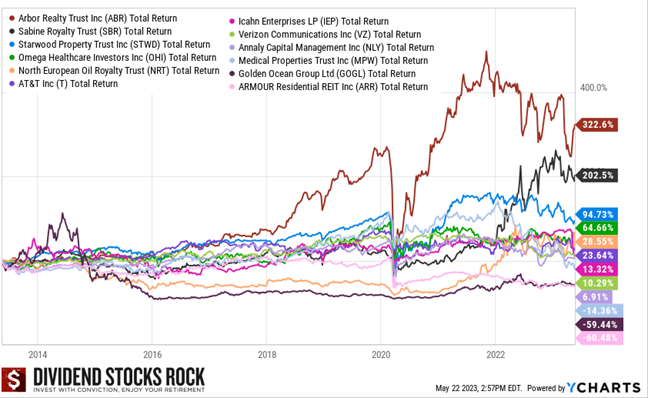

In my research comparing high-yielders over a decade, the results were uncomfortable:

- A meaningful chunk delivered negative total returns even after collecting dividends.

- Dividend cuts were common.

- Many more companies didn’t raise dividends fast enough to keep up with inflation.

That’s not “income for life.” That’s a portfolio quietly aging out… until it forces you to make decisions you don’t want to make in retirement.

But don’t take my word for it. Look at the graphs instead.

To celebrate our 10th anniversary in 2023, I ran the Dividend Stocks Rock stock screener to find a list of stocks that have paid a high yield (4-5%) over the past 10 years. Remember, between 2013 and 2023, we had low interest rates, strong consumer confidence and a growing economy for the most part. In other words, it was the perfect time to run a business.

You will recognize many popular U.S. companies.

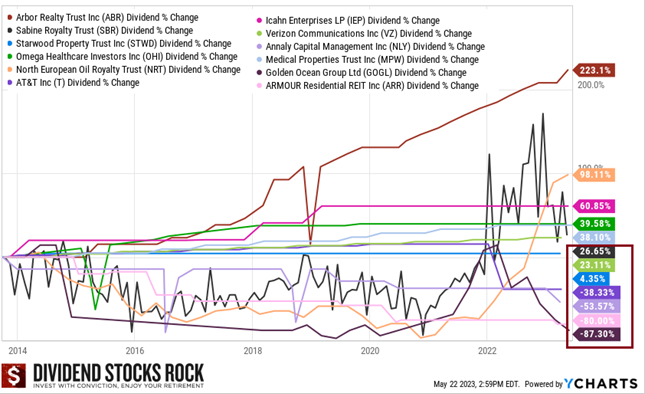

You may think this is actually not bad at all. But here’s what their dividend growth looks like.

*Details of my selection and research can be found in the complete Dividend Income for Life Guide. Download it here.

Dividend Income Isn’t Magic—But Dividend Growth Can Feel Like It

Let’s get one thing straight: dividends aren’t free money. A dividend is a transfer of cash from the company to you because management couldn’t find a better use for that dollar internally.

That’s why mature, slower-growing businesses often pay higher yields.

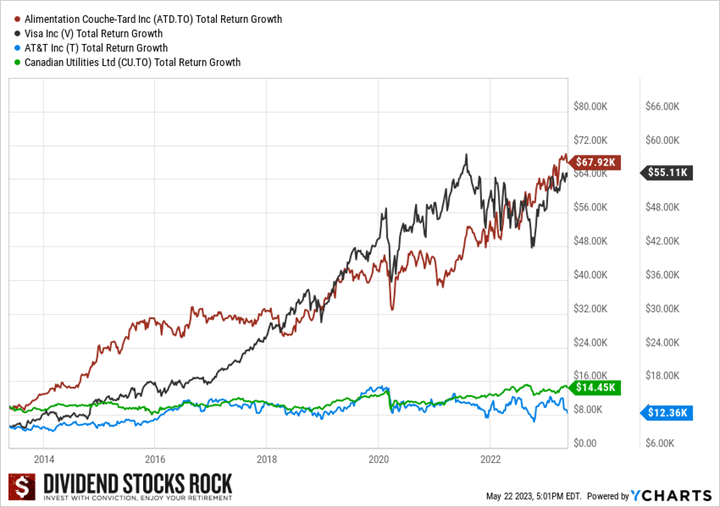

But the “magic” happens when you own companies that can grow sales, grow earnings, and grow dividends year after year.

That’s the entire foundation of dividend growth investing—and it’s also why I put so much emphasis on what I call the Dividend Triangle:

- Revenue growth

- EPS growth

- Dividend growth

When those three trends are healthy, your retirement income has a fighting chance of keeping up with inflation for decades.

“Low Yield Doesn’t Pay the Bills”… Until You Learn This One Shift

The #1 objection I hear from retirees (or future retirees) is simple:

“I don’t want to sell shares.”

I get it. Nobody wants to feel like they’re dismantling their portfolio to fund retirement.

But here’s the twist: if you own the right companies, selling shares isn’t a weakness—it’s a tool.

A low-yield, high-growth dividend stock can grow into a much larger capital base over time. That larger base gives you flexibility:

- You still collect dividends

- You can sell a small amount of shares when needed

- You can manage income without betting your retirement on fragile payout policies

This is what I call creating your own dividend (or a homemade dividend). You’re not “hoping” the yield works out—you’re controlling your cash flow.

The Real Retirement Risk: Selling Shares in a Down Market

Now, retirees are right to worry about one thing: sequence of returns risk.

If markets drop early in retirement and you’re forced to sell shares at depressed prices to fund income, that can punch a hole in your plan.

So the solution isn’t “avoid low-yield stocks.”

The solution is simple:

Build a cash reserve

A 3-year cash reserve—using secure, liquid instruments like a GIC ladder (or bonds, depending on your situation)—can act like a shock absorber for your retirement income.

When markets are down:

- You fund the “income gap” from the reserve

- You leave your equity portfolio intact

- You avoid selling shares at the worst possible time

When markets recover:

- You sell shares at better prices

- You refill the reserve

- You keep the system going

This is one of the core mechanics in the guide, because it turns a theoretical strategy into a livable retirement plan.

A More Timely (and More Realistic) Take: You Can Use a Balanced Yield Approach Too

I’m not here to tell you everyone should build a portfolio yielding under 2%.

My approach is yield-agnostic. The goal is not “low yield” or “high yield.” The goal is to invest in quality dividend growers backed by strong fundamentals.

That’s why I also like a “balanced” lane: medium yielders (roughly 2%–5%)—as long as the business checks the right boxes.

Here’s the exact process I used to generate a research list of these medium yielders:

- Minimum quality rating threshold

- Minimum dividend safety threshold

- Yield range filter (2%–5%)

- Dividend growth filter (5-year minimum)

This kind of screen doesn’t hand you “buy recommendations.” It gives you a shortlist of candidates—and then your job is to validate the business model, the risks, and whether it fits your portfolio.

That balanced approach matters because most retirees want:

- a base of reliable income

- plus enough growth to protect purchasing power

You can absolutely do that—as long as you stop selecting stocks based on yield alone.

What You’ll Learn in the Dividend Income for Life Guide

This guide is built for:

- DIY investors building toward retirement

- Retirees who want income without walking on a dividend-cut tightrope

- Anyone who wants a repeatable framework (not a stock tip)

Inside, you’ll learn:

- The real trade-off between high yield vs. dividend growth

- Why many high-yield stocks fail the retirement test

- How to spot dividend growers using the Dividend Triangle

- How to create a homemade dividend (dividends + share sales, done right)

- How to use a cash reserve so you don’t sell in a downturn

- A practical portfolio logic: position sizes, sector balance, and what to sell first

Download the Guide (Free)

If you want the full roadmap—plus the retirement mechanics that make it workable in real life—download the guide here:

Because the goal isn’t a high yield.

The goal is an income plan you can actually live on—through bull markets, bear markets, and everything in between.

Leave a Reply