In Part 1 of this two-part series, we explored how dividend growth ETFs compared to the broader market over the long term and during the so-called Lost Decade (2000–2010). Spoiler: dividend growth investors fared much better when things got rough.

Now, let’s explore how dividend growth strategies held up during two of the most defining periods of recent market history: the 2008 financial crisis and the post-COVID rollercoaster. Then we’ll wrap things up with some powerful takeaways to help you choose a strategy that fits you.

The 2008 Financial Crisis

The global meltdown of 2008 exposed flaws in the banking system and reminded investors how painful bear markets can be.

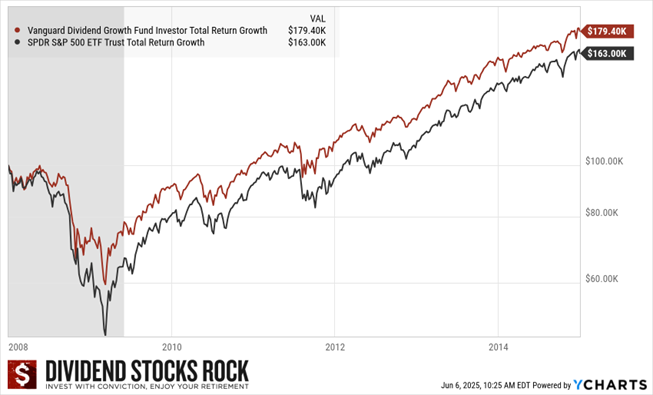

Let’s look at how our benchmark ETFs performed from January 2008 to 2015.

U.S. Market vs. Dividend Growth (2008–2015)

- S&P 500 (SPY): $100,000 grew to $163,000

- Dividend Growth (VDIGX): $100,000 grew to $179,000

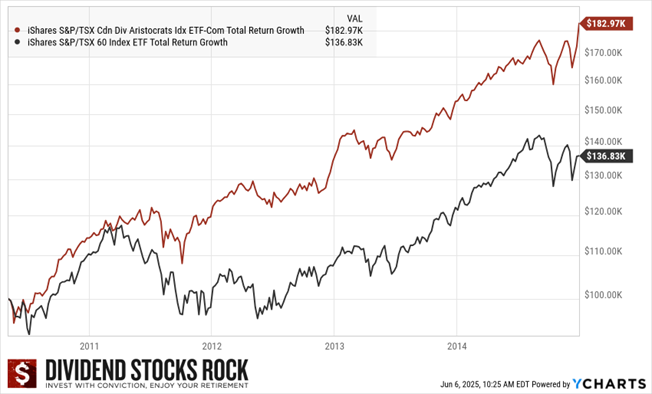

Canadian Market vs. Dividend Growth (2010–2015)*

- TSX (XIU.TO): $100,000 grew to $137,000

- Dividend Growth (CDZ.TO): $100,000 grew to $183,000

*Note: CDZ’s data begins in 2010, so the comparison starts post-crisis.

Despite the turmoil (U.S. government shutdowns, European debt crises, and endless market panic), dividend growth investors ended up with stronger results and lower drawdowns. That consistency is a major advantage for retirees or anyone drawing income from their portfolio.

And just like we saw during the Lost Decade, dividend payers didn’t just recover—they led the way back.

Since January 2020: COVID and the Recovery

Here’s where things get even more interesting.

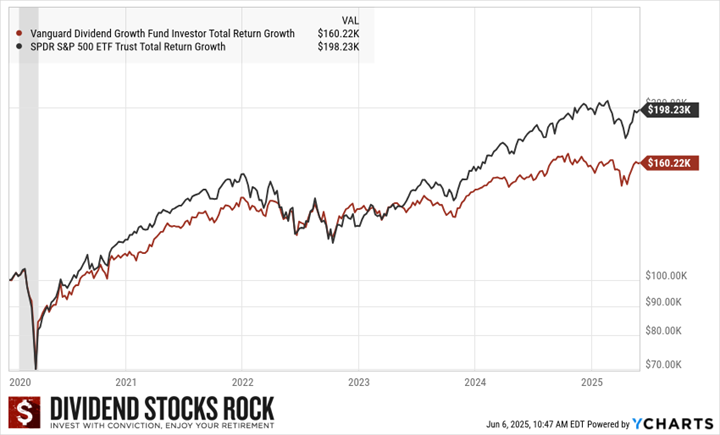

From a historical standpoint, 2020 to 2025 might be one of the wildest five-year periods in market history. We went from global lockdowns and market freefall to one of the fastest recoveries ever—followed by high inflation, aggressive rate hikes, and a tech resurgence.

So how did the ETFs perform?

U.S. Market vs. Dividend Growth (2020–2025)

- S&P 500 (SPY): $100,000 grew to $198,000

- Dividend Growth (VDIGX): $100,000 grew to $160,000

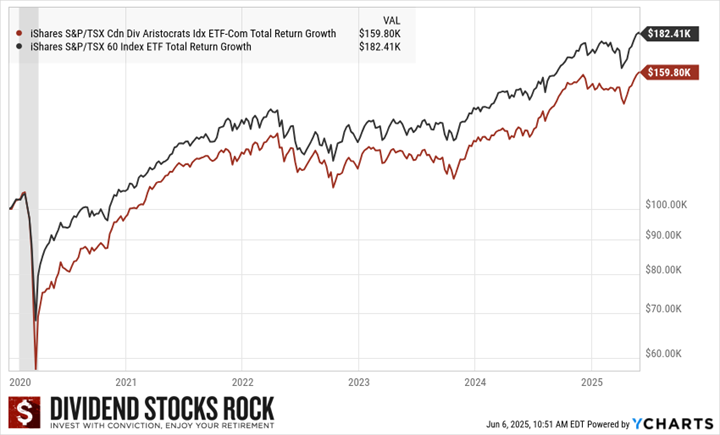

Canadian Market vs. Dividend Growth (2020–2025)

- TSX (XIU.TO): $100,000 grew to $182,000

- Dividend Growth (CDZ.TO): $100,000 grew to $160,000

This time, the index outperformed. Especially in the U.S., where mega-cap tech names like Apple, Microsoft, and NVIDIA (a.k.a. the Magnificent Seven) pulled the market to new highs.

Interestingly, the Canadian dividend ETF underperformed even the TSX. This is unusual, and may be explained by its exposure to sectors like REITs—which suffered during the COVID crash and were slow to recover amid higher interest rates.

Still, the dividend-focused portfolios delivered solid double-digit gains—and with less volatility. If your goal is to sleep well at night while still growing your wealth, that’s a win.

Not Sure How to Start?

I have built a free mini-course about buying stocks. Subscribe to our free newsletter to start it and purchase new holdings confidently within a week!

So, Who Wins?

Let’s break down the lessons from this two-part series:

Dividend Growth Wins When…

- The market is falling (e.g., 2000–2010, 2008 crisis)

- You prioritize consistency, lower volatility, and income

- You value owning businesses you understand and believe in

The Market Index Wins When…

- We’re in a raging bull market (e.g., post-2009 tech run, 2023+ recovery)

- You’re focused solely on maximizing total return

- You’re comfortable with higher drawdowns and more volatility

In other words, dividend growth doesn’t always outperform. But it does shine in the moments that matter most—when fear is highest and investors are second-guessing everything.

If you want your portfolio to be something you can stick with through thick and thin, dividend growth has a powerful edge.

My Real-Life Results

If you’re wondering how to put dividend growth theory into practice, here’s a real example. Better yet, I’ve outlined my approach step-by-step in the Investment Roadmap—the very process I’ve followed to manage my portfolio since 2017.

In my own pension portfolio (started in 2017), I’ve followed a strict dividend growth strategy. It’s outperformed a 50/50 blend of XIU.TO and VFV.TO (used to reflect currency-adjusted index performance). And I did that with less volatility—even with a few losing picks along the way (looking at you, Algonquin and Sylogist).

What carried me through wasn’t picking all the winners—it was staying true to the process. And that’s what dividend growth investing is all about.

You can follow it through my monthly updates:

The Final Word: Stay Invested

Here’s the most important insight of all:

No one who stayed invested was a loser.

Whether you went with dividend stocks, the S&P 500, or a mix of both—if you stuck with it, you won.

If you’re still debating which strategy is right for you, ask yourself this: Which one will I stay loyal to when the market drops 20%?

Because the market will drop again. And if you’ve built your plan around predictable income, high-quality businesses, and a clear strategy… you’ll sleep a lot better when it does.

Leave a Reply