If you wait, you lose…

2022 was a bad year on the stock markets: Canadian stocks were down 6% and U.S. stocks were down 18% (not to mention the Nasdaq at -32%!). Interest rates were going up quickly, and I was even caught with two dividend cuts in my portfolio (Sylogist at the end of the year and Algonquin shortly thereafter in 2023).

Many investors thought it was smart to go back into short-term cash and GICs paying generous yields.

“Let’s wait until the storm passes by”.

2023 started the year with more fear as inflation was not tamed yet. However, against all odds, the 2022 market correction was just a breeze, and everything was back to “growth mode” by mid-2023.

Everything? Not really.

If you selected low-yield, high-dividend growth stocks, you smiled through 2023.

It was a tough year if you had a bunch of high-yielding companies with large debt on their balance sheets.

While the market ended in positive territory (Canadian up by 12%, US up by 26%), it was pretty much just their recovery from 2022. Interest rates were still high and hiding with GICs and short-term cash sounded like a plan. After all, consumers’ wallets were closing down, and there was no more room for discretionary spending. Plus, the US election was coming up in 2024.

“Let’s wait until the storm passes by”.

Fast forward to today, both markets are up by more than 20%. In 2024, a monkey would have made money… as long as the monkey was not sitting on the sideline.

Ironically, I would agree that a storm may likely hit the markets soon. After all, consumers don’t have more money to spend, Canada’s economy is slowing down (the U.S. GDP is surprisingly resilient!), and a tariff war is brewing.

“Let’s wait until the storm passes by”.

While waiting is a mistake, knowing what happened will help get a better idea of what’s ahead. In the Top Dividend Stocks for 2025 booklet, you not only get six dividend stock ideas but also learn about their sectors. Get a clear vision for the Communication Services, Consumer Staples, and Industrials so that you do not hesitate when looking at your portfolio.

Are You Serious?

One thing I learned through 21 years of being fully invested in stocks is that no matter what you think or what doesn’t make sense, if you have a portfolio of quality companies, you will always be good.

It’s that simple: you wait, you lose.

I didn’t forecast this, but 2024 was an amazing year on the market. Let’s dive in and see what happened!

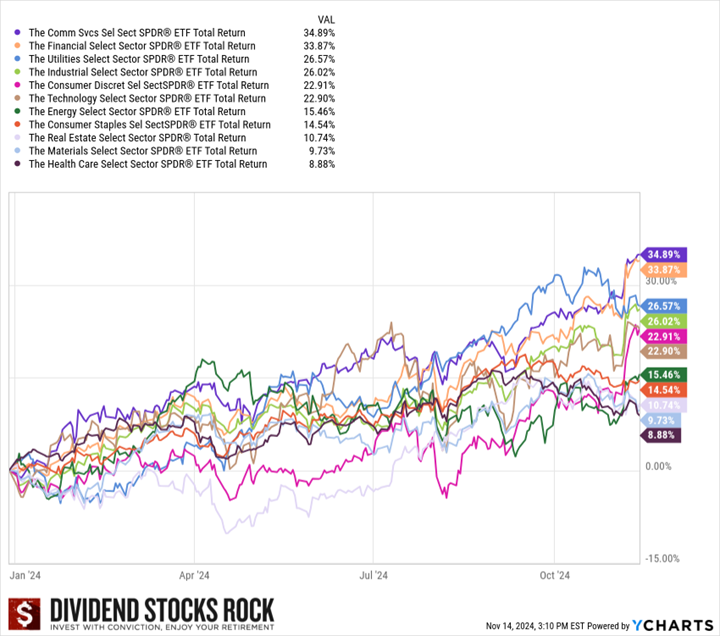

Tech stocks aren’t in the driver’s seat?

I must admit, I’m surprised to see the technology sector in the middle of the mix and not on top of the list for the U.S. market. I expected this sector to take the lead, but Communication Services (including Meta and Alphabet changing the whole picture) and financials are the drivers in the U.S.

The appetite for more power (hello, artificial intelligence!) has driven utilities through the roof.

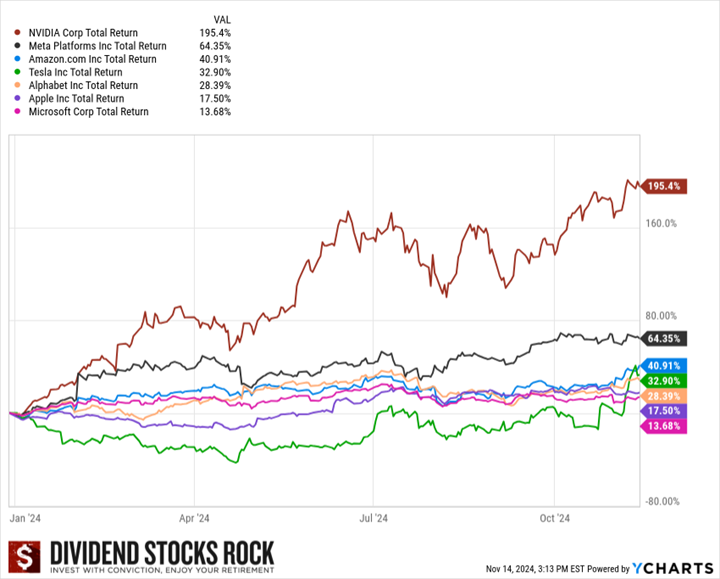

What about the Magnificent 7? Well NVIDIA definitely put on a magical show and Meta made an amazing come back. For the rest, it’s been a solid performance, but we will all be disappointed by Apple and Microsoft, the only two actual dividend growers here, with their “weak” performance of +17.50% and +13.68%. Imagine a world where double-digit performances are disappointing.

There is an overall wind of optimism around the market. That is dangerous. When the tide goes up, no one knows who is swimming naked.

It’s probably time to be cautious and ensure companies in your portfolio show solid financial metrics.

This is my mindset when I pull out the “Best Stocks of the Year”. I always search for companies with growing metrics or a robust dividend triangle. This powerful tool is described below, but first, avoid yourself some trouble and download six of my favorite stocks, including their sectors’ reviews:

Start with the dividend triangle

I first screen stocks using a simple but incredibly effective tool called the “dividend triangle”. I look for leaders in their markets with strong growth vectors, i.e., companies with the ability to increase their sales and also show profit growth. Finally, I look for companies that will increase their dividends year after year. This is why the first three metrics in my filter, representing the dividend triangle, are:

- Revenue growth (5-year trend)

- Earnings per share (EPS) growth (5-year trend)

- Dividend growth (5-year trend)

If you are concerned about market uncertainties, your best bet is to rely on companies with a strong dividend triangle. They won’t disappoint you during the next recession and will likely recover faster upon a market correction. I’m not the only one saying this, even Vanguard established that dividend growers outperform the market with less volatility.

The investment strategy for 2025

In summary, the point is not to transform your investing strategy and start from scratch. This section is more about adjusting your portfolio to ensure you are well-invested and see what is coming. A potential long bear market will impact two types of investors: those invested and those with cash. Here’s a playbook for each of them.

Invested investors (like me!):

- Review your portfolio to ensure you are well-diversified across many sectors

- Identify weaker-rated stocks and make sure you still want to hold them

- Trim overweight positions (Apple and Couche-Tard could be good candidates in my portfolio)

- Optimize your holdings with better-rated stocks using a replacement list

- Build a cash reserve if you are retired and depend on your portfolio to generate income

The cash reserve will supply income in addition to the dividend payments you will receive. I don’t intend to build a cash reserve as I’m still in growth mode.

Cash on the side investors (sitting, waiting, wishing…)

- Build a buy list right now

- Invest 33% of your money now

- Wait for another quarter, review earnings, and invest an additional 33%.

- Rinse & repeat for another quarter to fully invest your money over the next 6 to 9 months.

The key with this strategy is to make sure your portfolio thrives even if you invest right before a market crash or if we are about to ride another 5 years of a bull market. Imagine your worst fear materializes and you invest literally days before a crash starts. Major market crashes are usually violent, and the downtrend doesn’t last very long. Therefore, you’ll be buying the dip 3 months and 6 months down the line. You may not buy at the bottom, but you will surely be averaging down your position with cheaper prices. Conversely, if markets continue to rise, you’ll slowly build a profit cushion with invested money. If you wait, you may wait for years and never get today’s price. I’ll bet you thought 2017 markets were overvalued and that you would likely have many opportunities to buy stocks at better prices, right?

To help you get ready for 2025, we have issued a complete podcast series on How to Invest in 2025.

Many factors will have an influence on the market in 2025. However, the best way to start the year is to have a straightforward strategy. In other words,

“Know what you own and know why you own it.”

– Peter Lynch

Leave a Reply