First, I must tell you; I miss my one-year trip badly these days! It is usually spring in Quebec at this time of the year, but we just got more snow last weekend! It seems to me that not too long ago, I was surfing in El Salvador with Amy & William my 2 oldest children.

This is exactly what is happening with consumer cyclical stocks; they are surfing on easy waves and enjoying the sun. Consumers feel like they are on vacation and they don’t hesitate to spend more on cervezas & vinos a la playa. However, as you may know, the ocean can rapidly shift moods, and the next wave could eat you up. This may happen faster than we expect as interest rates are rising faster than the tide.

I still believe there is money to be made with consumer cyclical stocks. In fact, there are several companies that are being wrongly punished right now. It looks like investors are so desperately waiting for a crash that they ignore cyclical stocks based on the “hope” a recession is coming. It gives us a great opportunity as dividend growth investors to pick those fishes. For the time being, there are lots of reasons to be bullish about the economy.

source: Ycharts

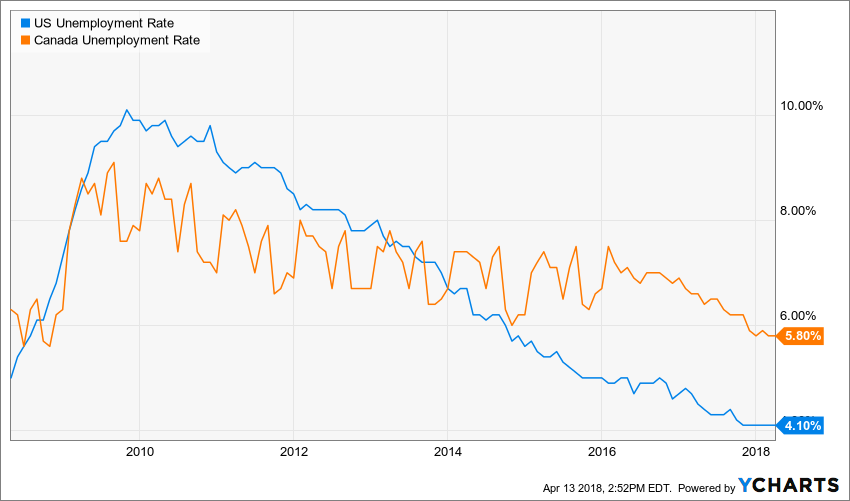

The Job Market is Healthy

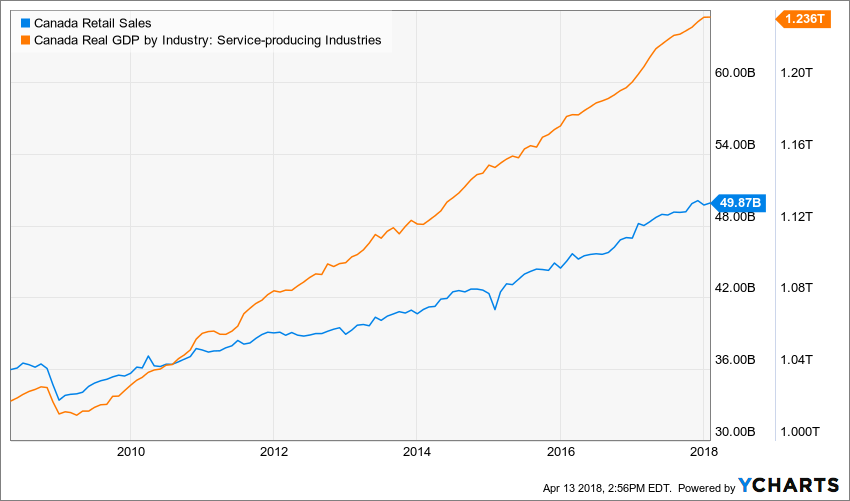

As you can see in the graph presented on the previous page, the unemployment rate in both the U.S. and Canada is on a steady decline. Since the last financial crisis, I’m still surprised to see how the Canadian job market was able to compensate for job losses in the oil & resources industries. What’s their secret? The retail and service industries! Canadians kept spending over the past 4 years which led to interrupted growth in both sectors.

source: Ycharts

Unfortunately (or fortunately depending on which side you look at this matter), minimum wages massive raise to $15/hr in both Ontario and Alberta may slowdown margins in the retail business. It’s not enough to have the Amazon threat over their head, but they also must cope with rising expenses. Some businesses like Restaurant Brands International (QSR.TO) reacted by chopping employees’ benefits (Tim Hortons did that). While both measures should bring a zero sum, it seems the population didn’t see it that way. In fact, Canadians dropped Tim Hortons in surveys for the most admired companies. Tim Hortons tanked from the 4th position to the 50th and last position of the survey. Such bad press can’t be good for business. On their side, Cineplex (CGX.TO) announced jobs cut under a “small restructuring” action. The Canadian largest movie theater operator is spending lots of money in diversification right now as movie attendance is on a slump. I believe the company will continue to improve its situation with its promising REC rooms, virtual golf investments and loyalty program.

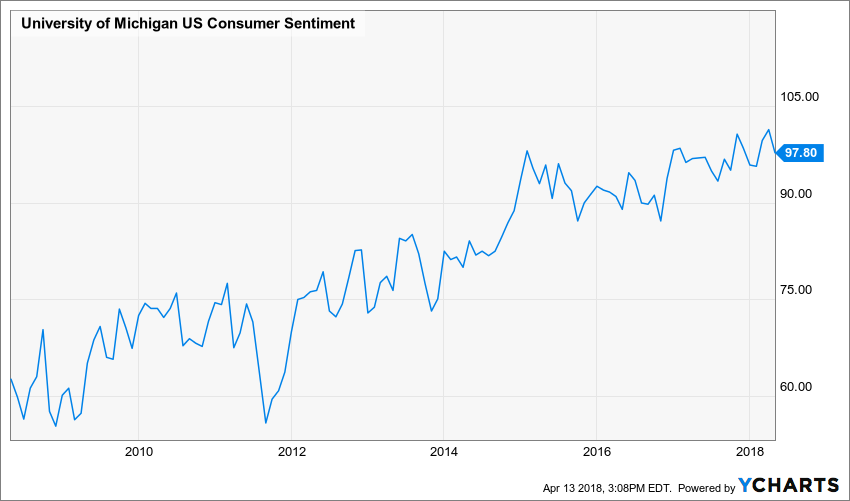

Americans Are Confident

South of the border, the American economy is fueled by happy Americans. Jobs are easy to find and well-paid, interest rates are still low, and all families plan to change their pickups and go to Disneyland for vacations! The Consumer sentiment index has never been better:

source: Ycharts

This tells me companies like Disney (DIS) will continue to report strong results from their theme & parks segments. Disney’s stock has been struggling for several months, and even the acquisition of FOX (which has still to close) didn’t excite investors. They keep focusing on ESPN customer losses quarter after quarter. I’d say it’s their loss, as Disney will come back stronger, supported by their park & themes and movies division.

The consumer cyclical dividend list is updated monthly

I think there are several great opportunities in this sector. The key here is to find companies with a strong competitive advantage. You don’t want to pick junk that has been brought up to the top by the high tide. You want to pick only the finest shrimps for your portfolio. This is what we will offer you in the following list.

While this page cannot be taken as a source for stock recommendations, this is the perfect starting point to build or improve your portfolio. I wanted to create an oasis of stock ideas.

Here are the metrics I’ve used to build each list:

- Dividend yield between 1.5% and 10% (I want stocks that pay dividend)

- 5-year revenue growth positive (I want growing businesses in my portfolio)

- 5-year normalized diluted EPS growth positive (growing earnings leads to more dividend growth)

- 5-year dividend growth positive (I want management committed to make me richer)

- 3-year dividend growth positive (management must not sleep on the job)

- Payout ratio under 100% (I want those dividends to keep coming)