When you think of the communications services sector, you automatically think of AT&T (T) and Verizon (VZ). Both companies are praised by income seeking investors as they pay high yield and show consistent dividend growth. While their increase rates are modest, both companies can match inflation and protect their payout from being eroded.

There are some exciting changes coming in the upcoming years with the implementation of the 5th generation wireless systems, most often called 5G. 5G technologies will not just speed-up your connection when you binge Netflix during your commute. We are talking about a technology enabling driverless cars, smart-city traffic controls, health-tracking devices and the rise of artificial intelligence (AI). In other words, communication services will enable a world of opportunities in the next decade.

But are there more than simply two companies in this sector? There is a full list!

AT&T & Verizon – the eternal battle

If you are looking for a strong dividend payer that will generate a steady stream of income in your portfolio, chances are you will fall in love with those two companies.

AT&T (T) doesn’t need presentation. It is the largest telecom in the world by revenue. With over $160 billion in revenue, a 5%+ yield, and 33 years with consecutive dividend increases, the big T is a favorite among income seekers. Really, what’s not to love? The problem with this telecom giant is it seems to have too much on its plate for the upcoming years. On top of deploying funds for the 5G technology, AT&T must deal with the Time Warner merger, compete against other aggressive players, transform DirecTV toward digital and pay a generous dividend. It looks like cash flow will be a problem at one point. Nevertheless, T is a well-known dividend aristocrat.

As for Verizon, it looks like a value trap right now. Even if management made several acquisitions to open its business model to potential breakthroughs in the digital media and internet segments (HuffPost, Yahoo Sports, AOL.com, MAKERS, Tumblr, BUILD Studios, Yahoo Finance and Yahoo Mail), VZ remains mainly a wireless company. It serves over 114 million clients and its services cover about 98% of the U.S. population. While its growth potential remains uncertain, the company continues to pay a solid dividend. It is now part of the Dividend Achievers (10+ year with consecutive dividend increases) and should continue to reward shareholders going forward.

On a rare occasion, I think the best options are found on the other side of the Northern border…

Canadian Telecoms is one of the best sector for dividend investors

In my opinion, there are two very interesting sectors for dividend growth investors in Canada: banks and telecoms. Both are evolving in a protected oligopoly, giving them the opportunity to build a solid business model, enjoying pricing power and giving them the ability to distribute large dividend payments.

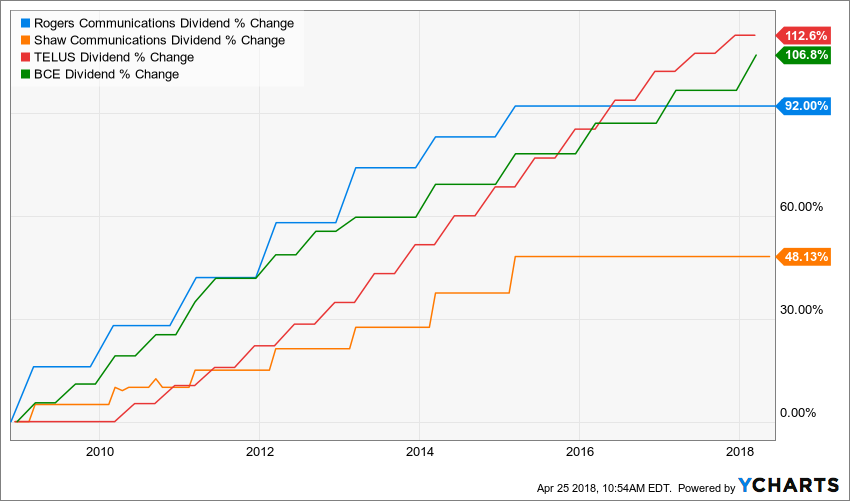

There are currently four players in the wireless industry, with three controlling 90% of the market. BCE (BCE.TO/BCE), Telus (T.TO/TU) and Rogers Communications (RCI.B.TO/RCI) are major players in the Canadian wireless industry while Shaw Communications (SJR.B.TO/SJR) is playing catch-up in this sector. The beauty of all of them is they pay a 4%+ yield, show interesting growth perspectives and are traded on both the Canadian (TSE) and U.S. (NYSE) market. Therefore, it’s important to not mix Telus (T on the TSE) and AT&T (T on the NYSE).

Source Ycharts

The communication services dividend list is updated monthly

I think there are several great opportunities in this sector (especially with Canadian telecoms). The key here is to find companies with a strong competitive advantage. You don’t want to pick junk that has been brought up to the top by the high tide. You want to pick only the finest shrimps for your portfolio. This is what we will offer you in the following list.

While this page cannot be taken as a source for stock recommendations, this is the perfect starting point to build or improve your portfolio. I wanted to create an oasis of stock ideas.

Here are the metrics I’ve used to build each list:

- Dividend yield between 1.5% and 10% (I want stocks that pay dividend)

- 5-year revenue growth positive (I want growing businesses in my portfolio)

- 5-year normalized diluted EPS growth positive (growing earnings leads to more dividend growth)

- 5-year dividend growth positive (I want management committed to make me richer)

- 3-year dividend growth positive (management must not sleep on the job)

- Payout ratio under 100% (I want those dividends to keep coming)

Disclaimer: I hold shares of Telus in my portfolio