In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and we drove all the way to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built and managed this portfolio publicly since 2017 to create and track a real-life case study.

In August 2017, I received $108,760.02 in a locked retirement account. Locked means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to suggest you follow my lead. My purpose was solely to share with our members how I manage my portfolio with all the good and the bad that inevitably takes place each month. I hope you have learned and will continue to learn from my experiences managing this portfolio.

Bye Bye Apple! (Not really)

This is a big update for this portfolio: I sold all my shares of Apple (AAPL) in my pension plan portfolio.

Before you scream, remember that I have other portfolios and I’m still a proud Apple shareholder.

With the hype around the new iPhone, Apple recovered nicely over the past few weeks and hit the limit of 10% of my portfolio. That justified the sale.

Let’s use this transaction to share more thoughts on selling rules. But first, the results!

Performance in Review

Let’s start with the numbers as of October 2nd, 2025 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $320,936.00

- Dividends paid: $5,227.94 (TTM)

- Average yield: 1.63%

- 2024 performance: +26.00%

- VFV.TO= +35.24%, XIU.TO = +20.72%

- Dividend growth: +12.22%

Total return since inception (Sep 2017- October 2025): +195.09%

Annualized return (95 months): 14.32%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 16.32% (total return 239.50%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 12.25% (total return 154.50%)

Investment rules above all

As you know, I like to keep my investment rules simple. In fact, I only have four rules:

- The company doesn’t appear to respect the investment thesis.

- The company’s metrics don’t back the investment thesis.

- The company cut its dividend.

- The company’s shares I hold exceed 10% of my investments.

The purpose of those rules is to protect my portfolio from myself (against the common tendency of hoping and waiting). With those rules in place, I don’t have room to “think” or “hope”. I must act without question.

While rules #1 and #2 require a waiting period of between 2 and 3 years, rules #3 and #4 are almost immediate. The dividend cut is a point of no return, and I sell upon notice. For the 10% of my portfolio rule, I usually wait until the end of the year to do it.

So why sell Apple now and not wait until the end of the year?

Fair question.

I would have made this trade about 10 weeks ago. Considering the never-ending bull market, I thought that reducing my exposure to risk in my largest holding was a pretty good idea! Sooner or later, we will get a correction, and I will feel a lot better if I have a more balanced portfolio.

Plus, I already knew what I wanted to buy with this money! For 9 years now, I’ve been a fan of Broadcom (AVGO). I never purchased it because I had too much exposure to tech stocks. After the sale of Texas Instruments (TXN) last year, my portfolio was rebalanced, and I had room to make the switch.

I have the same exposure to the tech sector, but I have less exposure to smartphones and other consumer electronics, while increasing my exposure to artificial intelligence and semiconductors in general.

Looking back, I should have made this trade when the fear of Deep Seek appeared at the beginning of the year. But it’s easy to play Monday morning quarterback, isn’t it?

I talked more about loosing money on Apple here:

Broadcom… now?

You may wonder why I chose a stock trading at its all-time high with such a rich valuation. With a forward PE ratio of 37, AVGO is clearly priced for perfection, but I’m okay with that.

Again, I don’t think you should follow my trades and mimic them if you don’t have the same level of conviction.

I’m buying Broadcom now because I believe in its ability to grow over the next 10 years. If I’m down 20% in the next 12 months, I wouldn’t even notice. What’s the point of being concerned about short-term returns when you invest for decades?

There is a clear hype around AI (we’ll see that in the next topic of this newsletter). But when people are in the middle of a gold rush, you want to be the one selling shovels.

Broadcom found its own wave during the high tide of AI by providing chips that optimise energy use and performance. Hype or not, we need more computing power, and it’s even better if it’s efficient and low-energy-consuming computing power. That won’t change in the next 10 years. That’s my thesis.

That’s why I’m okay to purchase AVGO at any price it is trading at today. Again, I’m acting from a very high level of conviction.

Now, enough talking about Apple and Broadcom, and let’s take a peek at which sectors have driven the market so far this year!

The Year So Far

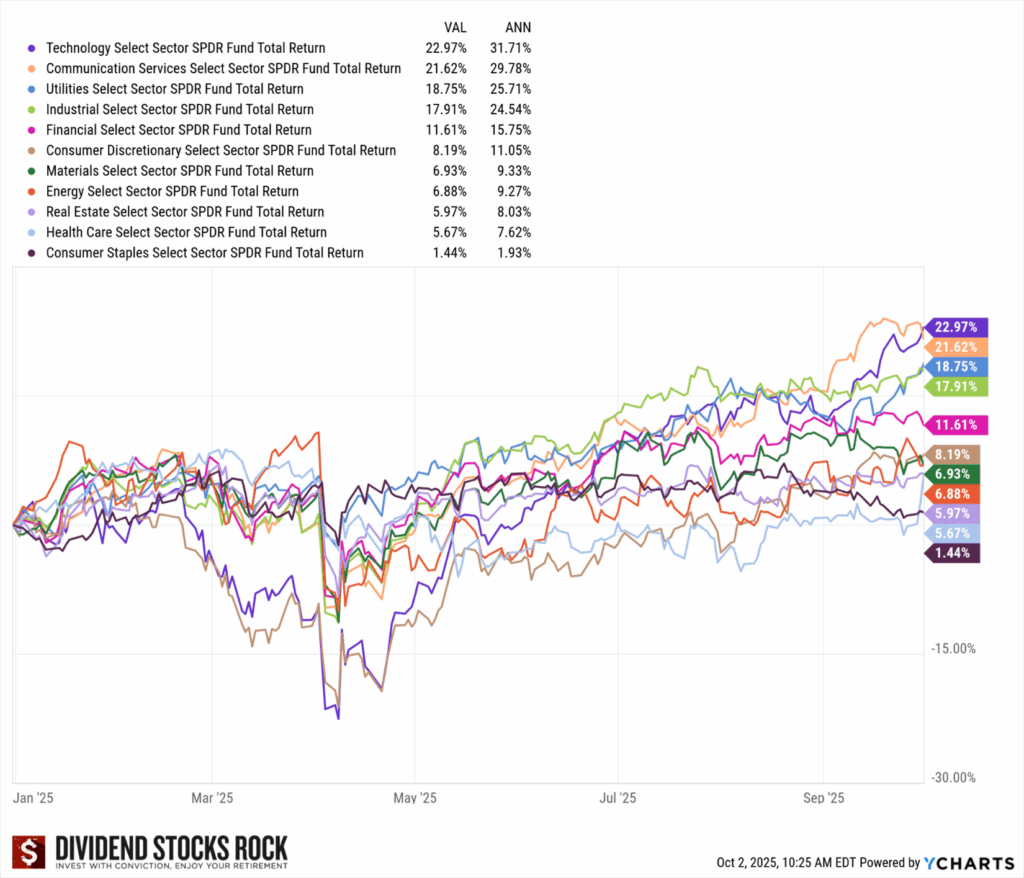

So, for the first nine full months of the year, the U.S. market is up by 15% including dividends. I won’t surprise you with the top sectors being all AI-related:

- Technology +22.97%

- Communication services (mostly Alphabet and Meta) +21.62%

- Utilities (AI consumes a lot of power!) +18.75%

On the other side of the spectrum, we have boring stocks in consumer staples, health care and REITs, and it is not surprising to find them lagging in an overhyped market.

Do you remember the 2025 investment themes?

For those who followed me last year, you know that I always write a special newsletter about the upcoming investment themes for the year. I shared them in a podcast back in January. But on December 27th, I lined up the following:

- Trump & Tariffs

- Lower rates & a Canadian recession

- AI & Energy

- Infrastructure & climate change

So far, I was right about almost everything (we still aren’t in a recession). The search for more power is driving utilities to higher levels. It’s an interesting play if you don’t want to put all your money in technology stocks.

Don’t worry. Next week, I’ll cover all the companies that could benefit from AI’s rise outside the information technology sector.

I can already tell you upfront that caution will be part of my 2026 theme. We are on our way to record a third year in a row with double-digit returns and that is a tad too generous if you ask me.

We are evolving in a chaotic market where lower interest rate announcements boost investors’ morale, tariffs’ impact is lagging, and AI has masked a weaker job market.

What an interesting time to be an investor!

I have covered 3 Canadian Dividend Stock plays on AI in the video below:

Clean up when it’s time

I’ve been telling you this for a while, but if you haven’t done it yet, cleaning your portfolio and focusing on quality is the one thing you should do this fall.

That’s also why I was a bit trigger-happy when I decided to trim my Apple shares to 7% of my investments.

I invite you to revisit the “clean up article” I wrote earlier this year.

What about Canada?

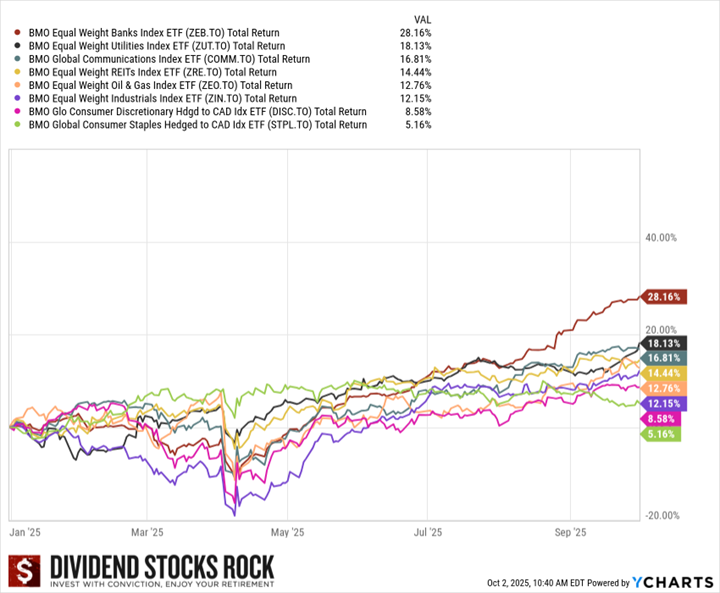

I was surprised to see how well banks did so far this year! For once, National Bank is the worst-performing bank since the beginning of the year (with +17% total return). There is a major comeback from TD (+52%) followed by a strong performance by BMO (+34.73%) and CIBC (+27%).

The oil and gas sector is doing well despite the weak oil prices. However, the expected demand for natural gas is giving the sector hope. Not to mention that if you have invested in gold this year, you are making a killing!

With so much chaos, many investors find it wise to have their own little gold reserve. I’m still not a fan of the yellow metal, but I must admit that if you made a play in a gold-related company, you no doubt did very well. After all, I even started a small position in Franco-Nevada based on that thesis!

Speaking of which, FNV is part of my Smith Manoeuvre portfolio that is looking quite nice!

Smith Manoeuvre Update

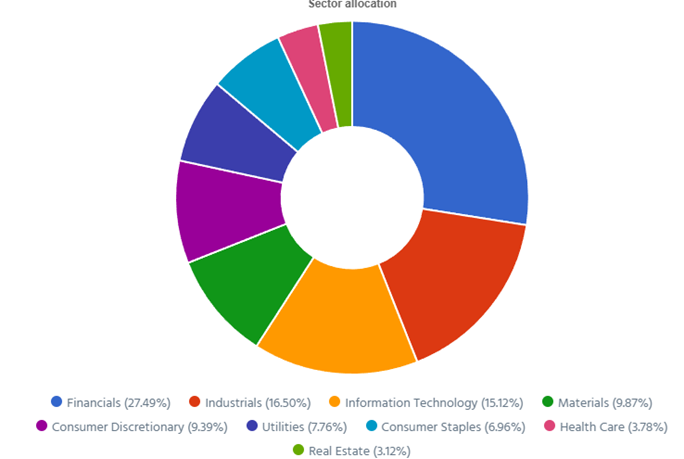

Slowly but surely, the portfolio is taking shape with 14 companies spread across 8 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 3.05% with a 5-year CAGR dividend growth rate of 10.52%.

- The portfolio value is now at $25,497.63

- The portfolio debt is at $20,500.

- The annual income is $778.07, projected income is $859.96

- To report my Smith Manoeuvre, I export the Excel data from my DSR PRO dashboard.

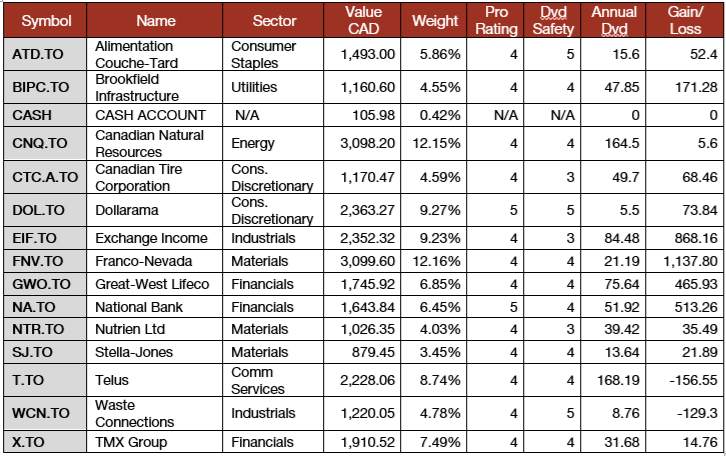

Smith Manoeuvre Portfolio Summary

Here’s my SM portfolio summary as of October 2nd, 2025 (before the bell):

Adding more shares of Dollorama (DOL.TO)

I explained not too long ago that I wanted to bring DOL to a full position, which is about 3% of all my portfolios. Therefore, whenever it makes sense, I add a few shares here and there. Using the DSR PRO global view, I can quickly see that I’m at 1% now. I’ll likely use more dividend payments in my pension account to increase my exposure in the other account as well!

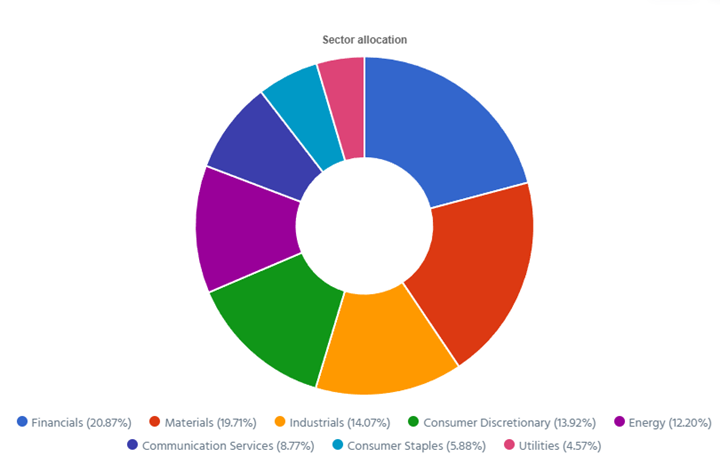

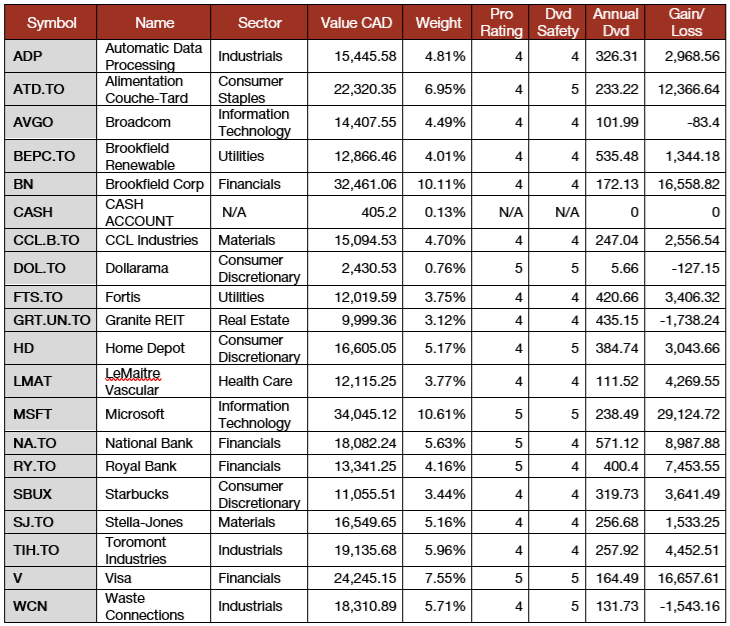

Pension Portfolio Summary

Here’s my pension plan portfolio summary as of October 2nd, 2025 (before the bell):

Total value: $320,936.00 (+$6,241.30 or +1.98% from last month).

We will do a roundup of earnings next month as my portfolio was unusually quiet in September.

My Entire Portfolio Updated for Q3 2025

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now, and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of September 10th, 2025.

Download my portfolio Q3 2025 report.

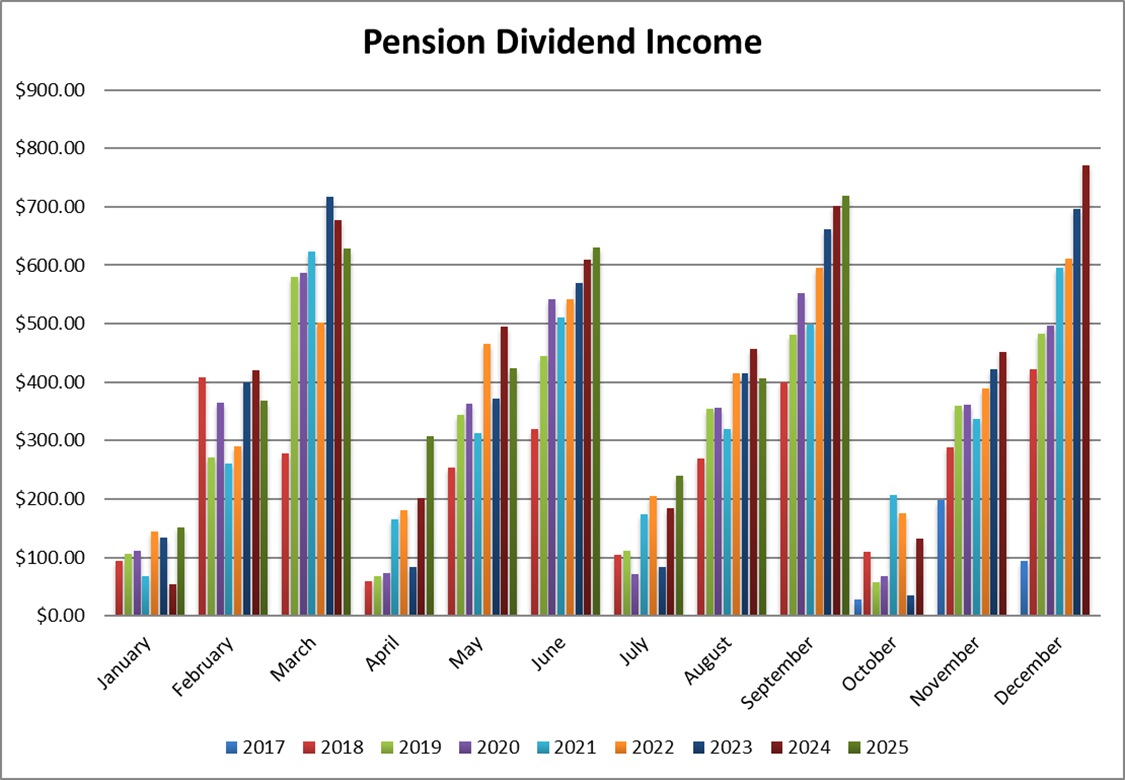

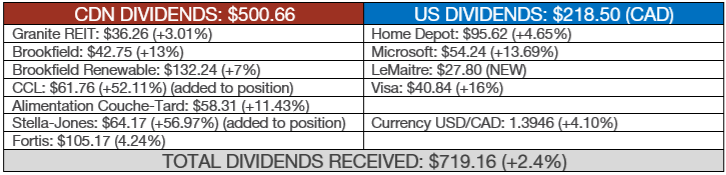

Dividend Income: $719.16 (+2.4% VS. SEPTEMBER 2024)

September was a juicy month with several dividend payments. I also added more shares of CCL and SJ to boost the payouts. The currency factor was also on our side at +4%!

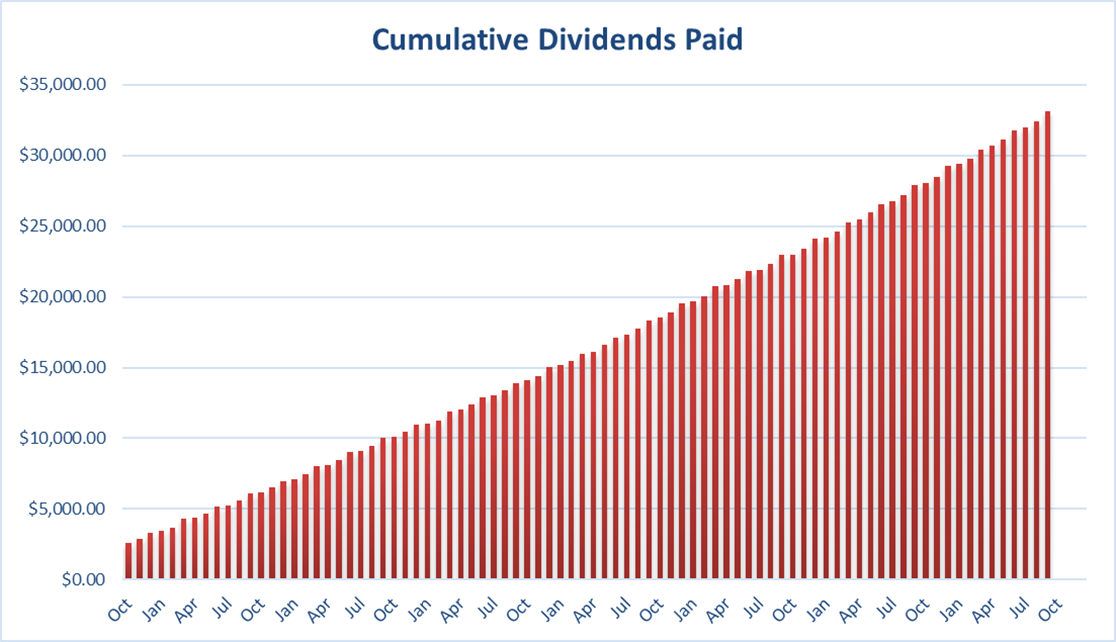

Since I started this portfolio in September 2017, I have received a total of $33,140.87 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

I expected to use my September dividends to buy more Dollarama, but I ended up boosting my new position in Broadcom. I didn’t expect Apple to hit 10% of my portfolio a few weeks ago, either!

Going forward, I have two positions to increase: Dollarama and Broadcom. I will make trades when I reach $1,000 in cash (currently at $405). This will happen around December!

In the meantime, I stay fully invested.

Cheers,

Mike.

Leave a Reply