How can Enbridge sustain its dividend payment? Is it safe? This is a question I’ve received many times in the last months from webinar attendees. How were they able to increase their dividend AND offer a high yield? Is there something wrong? Should we fear a dividend cut?

What’s the Story?

When I first purchased ENB (back in 2018), I invested in a company with massive (and profitable) toll roads with an investment plan of $20B+. By completing those projects, supported by strong economic tailwinds ENB should increase its cash flow for years to come. My investment thesis was on the right track until, well you know…2020! Unfortunately, 2020 happened and now, Enbridge will not have such tailwinds to enjoy. The company still operates its amazing pipeline network, but the demand for oil & gas transportation may not be as strong as expected over the next 10-20 years.

On top of that, the yield is super high (7-9%), both payout and cash payout ratios are hectic; going from negative value to over 100%. The company has also increased its dividend for 25 consecutive years so far and it faces large debt. There are many things in these metrics that scream for a dividend cut.

Is it really the case?

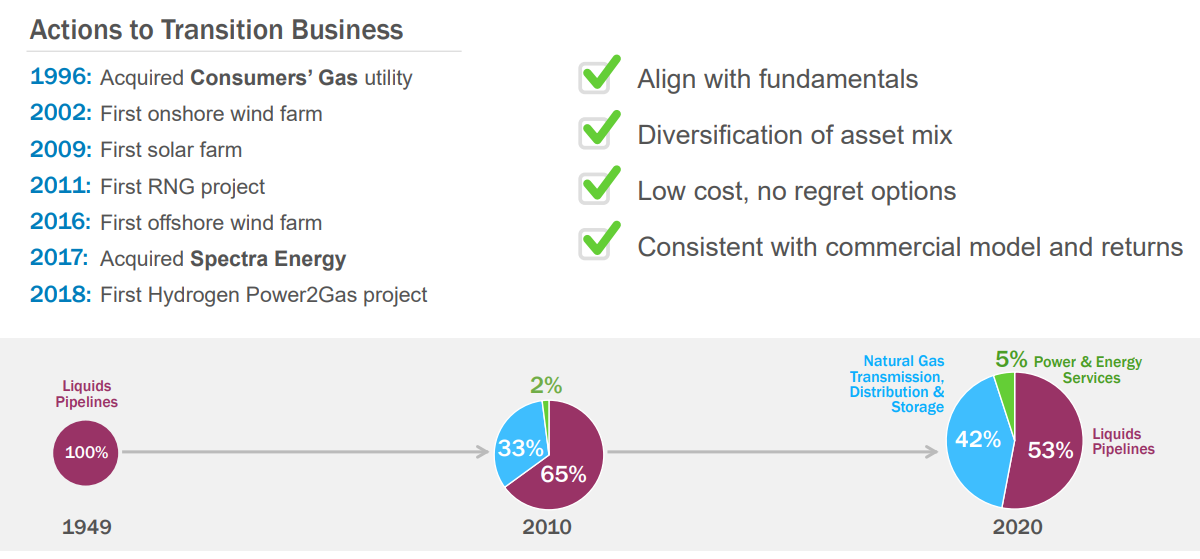

On the positive side of things, management announced in early November that they intend to invest in lower carbon infrastructure like wind and solar power generation, hydrogen and renewable natural gas. Their goal is to reach net zero greenhouse gas emissions by 2050.

source: ENB Q3 presentation.

Let’s put aside metrics and fear for a moment.

The best way to identify if the dividend is safe is to understand the company’s business model.

Business Model

Enbridge is an energy generation, distribution, and transportation company in the U.S. and Canada. Its pipeline network consists of the Canadian Mainline system, regional oil sands pipelines, and natural gas pipelines. The company also owns and operates a regulated natural gas utility and Canada’s largest natural gas distribution company. Additionally, Enbridge generates renewable and alternative energy with 2,000 megawatts of capacity.

So basically, Enbridge is roughly half liquid pipeline and half natural gas (storage and transmission). They also have a tiny bit of renewable energy. ENB’s business model is therefore well-diversified.

Investment Thesis

ENB’s clients enter 20-25-year transportation contracts. It is already well positioned to benefit from the Canadian Oil Sands (as its Mainline covers 70% of Canada’s pipeline network). As production grows, the need for ENB’s pipelines remains strong. After the merger with Spectra, about a third of its business model will come from natural gas transportation. Enbridge has a handful of projects on the table or in development. It must deal with regulators notably for their Line 3 and Line 5 projects (slowly but surely!). Both projects are slowly but surely developing. In the meantime, management has fulfilled its promise to its shareholders, and we can see more momentum around the stock price. The stock offers a yield over 7% which makes it a strong candidate for a retirement portfolio. The dividend is safe when you consider ENB distributable cash flow.

Potential Risks

Companies do not pay a high yield for nothing. ENB raised its debts and number of shares with the merger of Spectra. the integrations of all partners. The total long-term debt stands around $67B since 2017. It is time we see some debt repayment. As pipelines require lots of capital to build and maintain, Enbridge may find itself in a position where cash is missing. After all, management has plenty of projects to fund, a double-digit dividend growth promises to keep and larger debts to repay. This could seriously jeopardize the company’s growth plans. Many pipeline projects have been revised or paused by regulators in the past few years. This incurs additional costs and delays.

Dividend Growth Perspective

The company has been paying dividends for the past 65 years and has 25 consecutive years (2020) with an increase. Further dividend growth shouldn’t be as generous as compared with the past 3 years (10%/year). Management aims at distributing 65% of its distributable cash flow leaving enough room for CAPEX. Look for their latest quarterly presentation for their payout ratio calculation. Management may consider buybacks once the Line 3 replacement is completed. Since the pipeline business model is built around long-term contracts and predictable cash flows, I have no doubt this will happen.

I dove deeply into Enbridge’s dividend sustainability in the video below. Should you pursue your analysis, this video will bring you more insights.

Final Thought

After reviewing financial statements, recent news and stories as well as Enbridge’s business model and my investment thesis, I will keep my shares and expect a dividend increase in 2021. I don’t forecast any dividend cut at this point.

The company has proven it can pay its dividend and increase it. It has also proven it can adapt through difficult times. I also like the fact that they’re moving into more natural gas and renewable energy which I think can be great growth vectors for the future.

If you want to protect your portfolio from dividend cuts, I suggest you watch my free webinar replay on the very same topic (no strings attached).

Great company. I also own shares of the company and collected good dividends. I hope this will hold on in the future. Thank you for this great article.

Great post, many people just look at the GAAP earnings payout ratio and dismiss Enbridge because of that.

ENB is currently my favourite high-yield dividend stock.