The payout ratio is a useful tool, but it’s not the only thing that tells you whether a dividend is safe. If you rely on it alone, you can still get blindsided. Over the years at DSR, we’ve developed several reliable techniques to avoid most dividend cuts. They’ve been tested through bull markets, bear markets, and everything in between.

With a few exceptions, these techniques have helped us dodge the worst dividend disasters. If you apply them consistently, you’ll dramatically reduce your risk of holding companies that slash their payouts.

Think of this as your portfolio check-up. Summer is the perfect time to grab a cold drink, sit by the pool, and quietly optimize your holdings before fall volatility returns.

1. Trust the Market: Beware of High Dividend Yield Stocks

One of the first warning signs that something might be wrong is hidden in plain sight: the stock chart. If most investors are heading for the exits, pushing a stock price lower and the yield higher, there’s probably a reason.

There’s no free lunch in finance. A healthy, thriving business doesn’t end up in the penalty box without cause. When you see an unusually high yield, your job is to figure out why.

This doesn’t mean you must sell every high-yield stock you own on the spot. It means you should investigate.

A high yield is a red flag. Alone, it tells you nothing—it could be a temporary market overreaction, or it could be the start of a long decline. If you can’t explain why the yield is so generous, you’re missing a big part of the story and the risk that comes with it.

What’s my definition of a high yield?

I’ve said it many times: I prefer low-yield, high-growth stocks to high-yield, low-growth stocks. My personal rule of thumb is that a “high yield” starts at about 5%.

Yes, in a market crash, many great companies temporarily offer yields above 5%, and those can be fantastic buying opportunities. But in normal market conditions, a yield that high often signals higher risk, poor growth prospects, or both.

When I hold a stock like Telus (T.TO / TU) and see the yield creeping above 5%, my radar goes up. I don’t automatically sell, but I start asking questions.

If you have high-yield stocks in your portfolio, run this checklist:

-

Has the company increased its dividend in the past five years?

-

Is dividend growth steady or slowing down?

-

Are payout ratios above 100% or under control?

-

What’s the trend in those payout ratios?

-

Is there a clear explanation for a high payout ratio? Are you using the right calculation?

-

Is the business growing or struggling?

-

How are EPS and cash flow trending?

If you get mostly negative answers, you’ve probably found trouble before it arrives.

2. Avoid Stocks With No Dividend Growth

Inflation might have been tame between 2010 and 2020, but even a modest 2% rate eats away at your purchasing power over time.

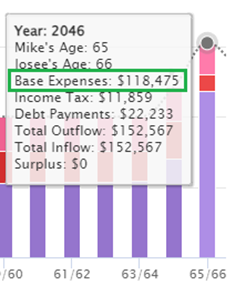

Here’s a quick illustration. In 2046, when I’m 65, I’ll need about $118,500 a year to match the purchasing power of $75,000 today—just from 2.1% annual inflation. By age 80, that jumps to $161,800.

If your dividend income doesn’t grow, your lifestyle will shrink. And no dividend growth is more than an inflation problem—it’s often a red flag for deeper issues.

Companies that keep payouts static in good times are at higher risk of cutting them in bad times. I’ve searched for companies with growing revenues and earnings but no dividend increases in the past five years—they’re rare. More often, no growth means trouble.

A cautionary example: H&R REIT

H&R cut its dividend during COVID, but it also cut it in 2009. That’s two major cuts in just over a decade. Both came after years of apparent stability. In reality, the business model wasn’t resilient enough to support consistent growth.

H&R is a classic “I look good on Prom Night” company—great when the economy is roaring, exposed when the tide goes out. The dividend record shows it.

If you go back to your portfolio now and look for companies that have not consistently increased their payouts over the past 5 years, something is wrong. You might want to find out before it’s too late.

“But Mike, that’s good management not to increase a dividend during rough times”.

My answer to this:

“It’s also poor management to lead a company toward a struggling future. If the company can’t afford to pay a higher dividend today, that’s because it made multiple bad decisions over the past 5 years”.

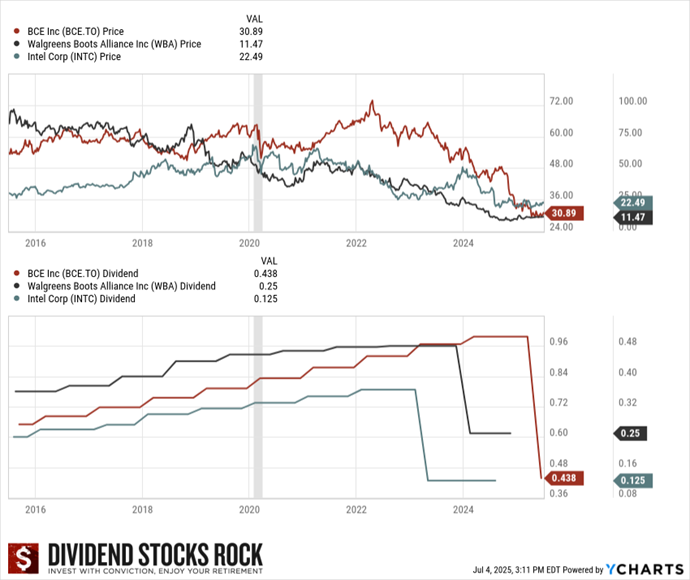

You can double-check this affirmation with the CEOs of Intel (INTC), Walgreens (WBA), or BCE (BCE.TO)…

Hope is not an investment strategy. If a company can’t raise its dividend when the economy is growing, what will happen in a downturn? You probably already know the answer.

In the video below, I not only summarize the three techniques to avoid dividend cuts, but also share how to sell with conviction… before it’s too late.

3. Watch for a Weak Dividend Triangle

You’ve heard me say it before: the Dividend Triangle is one of the most powerful tools we have for evaluating dividend safety. It’s made up of three elements:

-

Dividend triangle representation. Revenue growth – A business isn’t a business without growing sales.

Companies with multiple growth vectors can increase sales year after year, which helps them enter recessions from a position of strength.

-

Earnings growth – You can’t pay dividends without profits. GAAP EPS isn’t perfect, so I also look at adjusted EPS and free cash flow trends over 3, 5, and 10 years. A steady upward slope is ideal.

-

Dividend growth – This is the ultimate sign of management confidence. Raising the dividend signals the company can grow, invest, and still reward shareholders.

If revenue is stagnating, that’s the first red flag. If EPS is flat or shrinking over several years, that’s another. Without growth in both, dividend growth won’t last.

Why the Triangle Works

Companies that lose market share or lack competitive advantages will eventually reveal those weaknesses in the Dividend Triangle. The beauty is that you don’t need to wait for bad news in the headlines—the trends tell the story early.

On the flip side, companies that consistently grow all three sides of the Triangle rarely cut their dividend. Even when the market punishes them in the short term, they have the financial health to ride it out.

Want a shortcut to finding companies with strong Dividend Triangles

The Dividend Rock Star List is built entirely on this principle—ranking over 300 dividend stocks by revenue growth, earnings growth, and dividend growth, plus safety and growth potential scores.

The Dividend Rock Star List is built entirely on this principle—ranking over 300 dividend stocks by revenue growth, earnings growth, and dividend growth, plus safety and growth potential scores.

It’s the perfect starting point for building a portfolio you can count on in good times and bad.

Enter your name and email below to get the instant download in your mailbox.

Putting It All Together

To avoid most dividend cuts:

-

Be wary of unexplained high yields.

-

Demand consistent dividend growth—don’t settle for flat payouts.

-

Use the Dividend Triangle as your cornerstone metric.

When you find trouble in any of these areas, you don’t have to sell immediately, but you should dig deeper. Most cuts don’t come out of nowhere—they’re visible to anyone paying attention to yield spikes, payout history, and underlying business trends.

It’s about stacking the odds in your favor. No approach is perfect, but applying these three techniques can help you sleep a lot better at night.

I’ve recently built up positions in ENB, WPC, and EPD. These positions are ancillary and I’ll limit each of them to 1% or less of the portfolio.

I did suffer a couple of cuts last year (Royal Dutch and Wells Fargo come to mind) and now T as well. Hopefully this doesn’t happen regularly haha. I’ve been in the markets for just under 2 years.

Even if you have a strong investment process in place, it happens from time to time to suffer from a dividend cut. The key is to limit those events and make sure your overall portfolio performs over the long haul!

Cheers,

Mike

I’m a relatively new income investor, and was wondering what percentage of your dividends do you reallocate for continued growth? My strategy is to save 30 percent to create a buffer in case of reductions or for buying opportunities. I’ve made decisions based solely on yields, but am willing to make adjustments as I learn.