2025 Set the Stage—Now Let’s Talk About 2026

On paper, 2025 shouldn’t look as good as it does. High interest rates, endless tariff announcements, geopolitical tensions, a U.S. government shutdown… pick your headline. Yet unless markets collapse for five straight weeks, we’ll close the year with a third consecutive year of double-digit gains. That kind of streak hasn’t happened since the late 1990s.

But here’s the important part for Canadian dividend investors:

Canada is outperforming the U.S.—and not because of AI.

South of the border, the rally is being carried by the usual suspects: semiconductors, hyperscalers, data-center-dependent utilities, and communication giants riding the AI wave.

In Canada, the story is completely different. Three big forces shaped the TSX this year:

- Gold stocks doubled, carrying basic materials to the top of the index.

- Banks and insurers rebounded sharply, fueled by strong earnings and cleaner balance sheets.

- Industrials and utilities benefited indirectly from the global AI buildout, as data-center construction and power demand surge.

Meanwhile, sectors like consumer staples, REITs, and some cyclical names barely moved—creating opportunities for patient dividend investors heading into 2026.

For the full charts, sector deep dives, and Mike’s tactical takeaways, you can download the complete 2025 Market Commentary inside the Top 7 Stocks Booklet and get stock ideas for your buy list at the same time!

This exclusive 16-page guide includes:

- A deeper 2025 stock market review so you understand the environment—not just the stock picks.

- A simple, repeatable framework based on the Dividend Triangle (revenue, earnings, dividend growth).

- Seven high-conviction stocks selected using real fundamental metrics.

Make 2026 your best investing year—download the free PDF inside the article.

This blend of sector divergence and macro contradictions is the real backdrop for choosing 2026’s top Canadian dividend stocks. With that context in mind, here are three core holdings that align perfectly with the trends shaping the Canadian market.

Top 3 Canadian Dividend Stocks for 2026

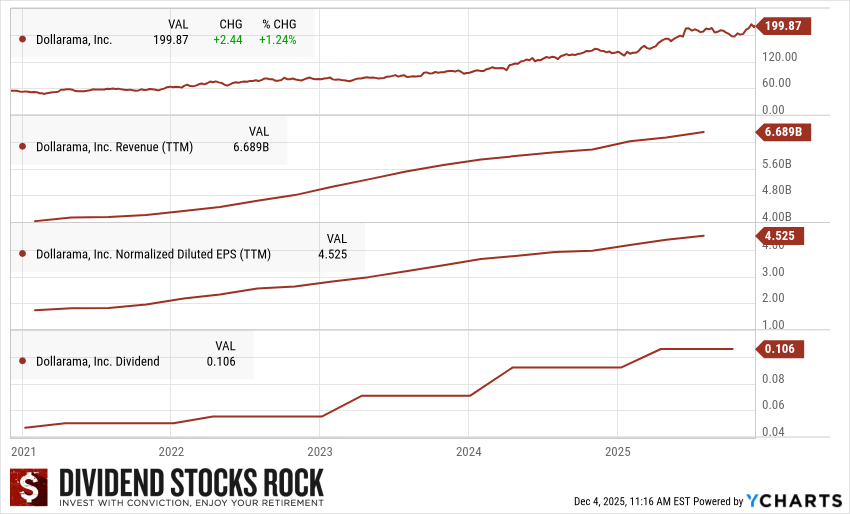

Dollarama (DOL.TO) — A Core Compounder

Dollarama is one of those rare Canadian stocks where the long-term story writes itself. In an environment where consumer budgets are tight and retailers face pressure from e-commerce, DOL has become a refuge for value-oriented shoppers. And it’s not slowing down.

What I like most is the consistency:

- Same-store sales keep rising.

- New stores open every year.

- Higher private-label penetration expands margins.

- The new $5 price point gives Dollarama even more pricing power.

And now comes the next chapter: Dollar City’s rapid expansion in Mexico and the acquisition of Australia’s Reject Shop. These moves extend DOL’s growth runway far beyond Canada’s borders—something most Canadian retailers can only dream of.

Dollarama remains a textbook example of a defensive, efficient, high-growth machine that still isn’t fully appreciated by the market.

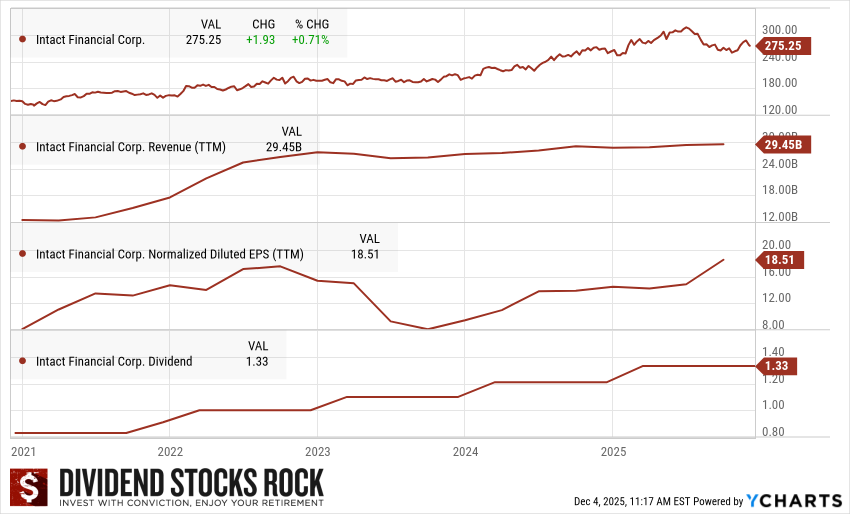

Intact Financial (IFC.TO) — Quality on Sale

Finding a high-quality financial stock that still trades on weakness in this market is rare—but Intact fits the bill.

As Canada’s largest property and casualty insurer, IFC has scale, data, and pricing power that competitors can’t easily replicate. Its underwriting discipline is second to none, and expansions into the U.S. and U.K. are starting to pay off.

Why it stands out in 2025–2026:

- IFC is barely up this year, creating an attractive entry point while the rest of financials run hot.

- It uses data analytics and AI to sharpen underwriting and improve profitability.

- Its geographic and product diversification insulates it from regional risks.

- It continues to generate industry-leading combined ratios and stable dividend growth.

This is the kind of stock you buy, hold, and rarely question.

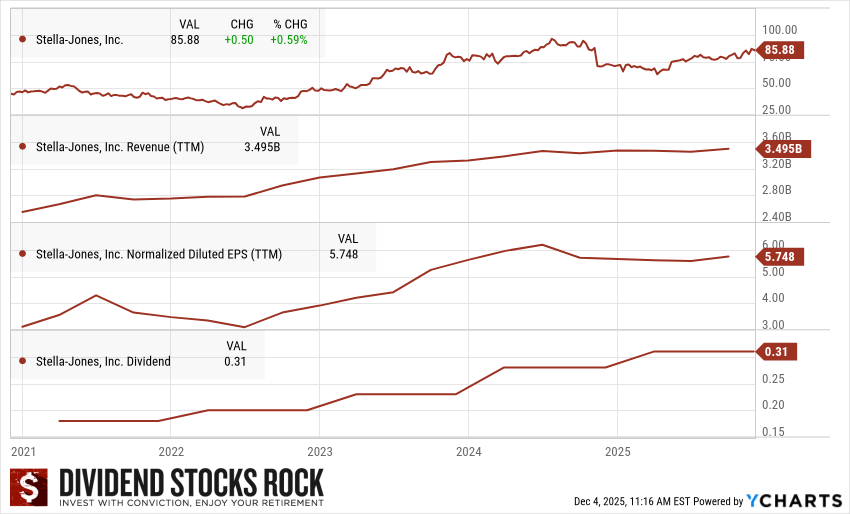

- Stella-Jones (SJ.TO) — A Steady Performer Hiding in Plain Sight

Stella-Jones is not flashy, trendy, or hyped—and that’s exactly why I like it. It supplies essential materials for critical infrastructure: utility poles, railway ties, and industrial lumber. These aren’t “nice-to-have” items; they’re required for modernization, maintenance, and safety across North America.

Despite consistent earnings, revenue growth, and strong demand from utilities and railroads, the market keeps overlooking SJ. Yet the fundamentals speak for themselves:

- Q3 revenue up 5%

- EPS up 12%

- Higher volumes in utility poles

- Solid pricing gains in railway and industrial product lines

Infrastructure spending isn’t slowing down. Stella-Jones continues to deliver, quarter after quarter, entirely under the radar.

Get the Free Booklet: Top 7 Dividend Stocks for 2026

This exclusive 16-page guide includes:

- A deeper 2025 stock market review so you understand the environment—not just the stock picks.

- A simple, repeatable framework based on the Dividend Triangle (revenue, earnings, dividend growth).

- Seven high-conviction stocks selected using real fundamental metrics.

Make 2026 your best investing year—download the free PDF inside the article.

DGB –

I am going to dive into Fortis a bit more, love the Utility business model and do hold Dominion, as well. Great picks and as you said – you can hardly go wrong with a Canadian bank!

-Lanny

FTS is the ultimate money printing machine in Canada, you can’t go wrong 🙂

Cheers,