Last Tuesday, I published my top 5 US dividend growth stocks. Today, I’m coming back with my Canadian picks. Believe it or not, there is more than banks and telecoms on the market for income seeking investors! As a long term dividend blogger, I’m often asked what are my favorite dividend growth stocks. It’s hard to make a short list as there are so many great companies out there. Based on my 7 investing principles, I’ve selected 5 I really like right now.

ANDREW PELLER (ADW.A.TO)

Business Model

Business Model

Andrew Peller owns wineries in British Columbia, Ontario and Nova Scotia. It doesn’t only produce its own wine, but also markets it along with other products. ADW owns several brands like Peller Estates, Trius, Hillebrand, Thirty Bench, Sandhill, Copper Moon, Calona Vineyards Artist Series VQA wines and Red Rooster. Currently it has an estimated 14% share of its total wine market and a 37% share of domestic wines.

Investment Thesis

Andrew Peller is known to grow its revenues through acquisitions. Since 1995, management invested over $114M to purchase 14 vineyards. The company built a solid relationship with provincial liquor stores, but also maintained company-owned retail stores in Ontario. Andrew Peller shows a strong and steady growth of its sales mainly due to the creation of multiple products, a strong marketing program and several acquisitions. The Canadian wine business is doing well and ADW continues to ride this bullish trend. Its recent alliance with Wayne Gretzky vineyard will not only be good for wine sales but will also open the door to whisky production.

Potential Risks

The wine industry and the domestic and international market in which ADW operates are consolidating. While this could be a great opportunity, it also brings stronger competitors to the table. ADW must continue investing in its brand awareness to keep its market share. Since wine is a luxury product, any economic downturns would affect ADW sales. I don’t think it’s an issue as the Canadian economy is more resilient than anticipated.

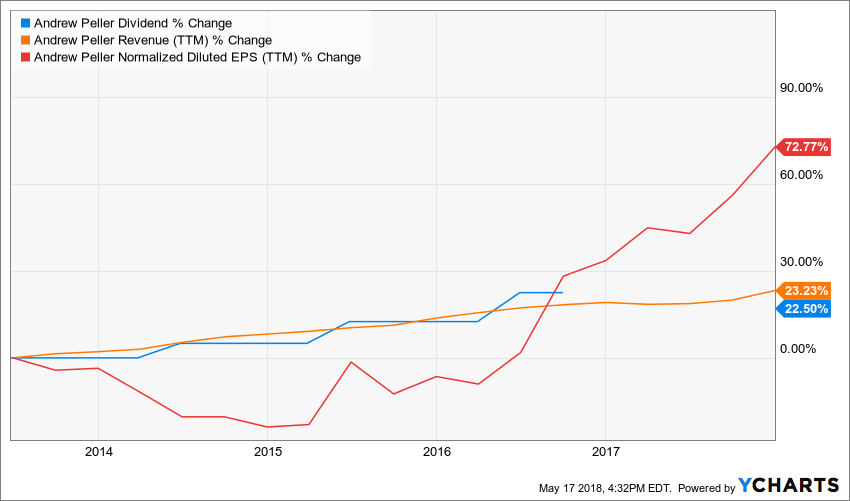

Dividend Growth Perspective

While the yield went down from 3.75% to 1.46%, the stock price surged 260% over the past years. The dividend payment also increased by 36% or 6.34% annualized growth rate during the same period. It is rare that we see such low payout ratio with such high cash payout ratio. Looking at its financial statement, we can see that the company had to invest massively recently, boosting capital expenditure to a record level. CAPEX should go back down to a more reasonable level in 2018. Therefore, dividend sustainability is not at risk.

ALIMENTATION COUCHE-TARD (ATD.B.TO)

Business Model

Alimentation Couche-Tard is the largest convenience store operator in Canada and 2nd largest in North America. While constantly expanding its presence in the US and Europe, it successfully built a convenience store including daily use products. Many stores are also combined with fuel service stations. ATD operates 12,081 stores (7,863 in North America, 2,708 in Europe and 1,510 internationally). Instead of simply selling chips and beers, ATD focuses on a superior offer including fresh food, private labels and strong product concept offerings.

Investment Thesis

An investment in ATD is definitely not for an income producing stock. However, if you are looking at the long-term horizon, your dividend payouts will grow in the double digit for a while and you will enjoy a strong stock price growth. ATD potential is directly linked to its capacity to swallow and integrate more convenience stores. ATD shows a perfect combination of the dividend triangle: revenue, EPS and dividend strong growth.

Potential Risks

Growers by acquisitions are all vulnerable to making a bad purchase. While ATD methodology to acquire and integrate more convenience stores has been proven, it is important to not grow too fast or become too greedy and overpay in the name of growth. Still, it doesn’t seem like an issue with the current management team. As interest rate rises, cost of future acquisitions will increase accordingly.

Dividend Growth Perspective

The mediocre 0.60% dividend yield is so low ATD shouldn’t even be considered as a dividend grower. However, the dividend paid nearly tripled since 2011 (from $0.03 to $0.09/share) and the stock price surged 500%. The only reason why the dividend yield is so low is because ATD is on a fast track for growth. ATD will continue increasing steadily its payout while providing stock value appreciation to shareholders.

BROOKFIELD INFRASTRUCTURE (BIP.UN.TO)

Business Model

Brookfield Infrastructure Partners L.P. is one of the largest owners and operators of critical and diverse global infrastructure networks which facilitate the movement and storage of energy, water, freight, passengers, and data. BIP is active across the world and specializes in developing infrastructure in fast growing places, such as Latin America and India.

Investment Thesis

Strong from 115 years of history, BIP is a stellar company. It focuses on growing markets like Latin America and India, which are in deep need for strong infrastructure. The company has a strong growth by acquisition expertise. Each year, it invests billions in new projects. In 2017, BIP invested $1.6 billion in a partnership acquisition of a Brazilian gas transmission business, Nova Transportadora do Sudeste. It also invested $40 million in energy systems in North America and $100 million in toll roads in India. Furthermore, BIP can grow organically with a multitude of projects with endless growth possibilities.

Potential Risks

BIP needed billions to finance its projects. Most of its debt is secured by 2022 but is based on fixed term rate. Therefore, the rise of interest rates will eventually hurt. Also, between Jan 2008 and Dec 2008, the stock lost 42% of its value and 52% at the beginning of 2009. As BIP’s performs much better during a bull market, it will be interesting to see how it does in tougher times.

Dividend Growth Perspective

Brookfield has 8 consecutive years with a dividend increase and shows a CAGR of 10.40% over the past 5 years. Management is confident to keep a 5%-9% distribution increase policy in the years to come. As the company is a LP, the payout ratio is not relevant. However, the FFO payout is at 68%, inline with management guidelines (between 60% and 70%).

CANADIAN TIRE CORP (CTC.A.TO)

Business Model

Canadian Tire is a well-known and loved Canadian retail stores. It offers variety of products throughout several categories (automotive, living, fixing, playing/sporting goods, apparel and financial services). Besides the various Canadian Tire brand declination, the company also owns Sports Experts, Sportchek and Atmosphere brand under the FGL sports division (21.5% of CTC revenues).

Investment Thesis

CTC trades at a 15 PE ratio and is poised for additional growth in the upcoming year. If the Canadian economy slows down, it would serve as a solid shield against any stock market drops. Canadian Tire will continue to benefit from its leadership position in Canada and shows a strong combination of dividend growth and stock appreciation perspectives.

Potential Risks

One of the biggest risks for Canadian Tire is online shopping. Having exclusive products is helping, but there is little that CTC could offer in store or online that another Amazon of this world can’t compete with. CTC continues to be heavy in the old school & classic marketing methods (flyers, catalogs, etc.). While it seems to work now, it could catch up to the company as baby boomers are aging.

Dividend Growth Perspective

CTC is another Canadian low yield company with impressive results (up +111% over past 5 years and 91% div growth during same period). With its low payout ratio, CTC has enough room to stick to a generous course with shareholders. Due to its presence in the Canadian economy, CTC enjoys a steady cash flow growing quarterly.

EMERA (EMA)

Business Model

Emera is an energy and service company. Emera’s main market is Nova Scotia as it owns Nova Scotia Power, the province’s main electricity provider. Emera owns power plants and distributes natural gas in Canada, the USA and the Caribbean.

Investment Thesis

Emera is a very interesting utility now that it has completed the purchase of the Florida-based TECO energy. EMA now shows $28 billion in assets and will generate revenues of about $6.3 billion. It is well established in Nova Scotia, Florida and four Caribbean countries. This utility counts on several “green projects” with hydroelectricity and solar plants. This decreases the risk of future regulations affecting its business as the world is slowly moving toward greener energy.

Potential Risks

The biggest risk that could face Emera is a rapid rise in interest rate. As it has pursued a growth-by-acquisitions strategy and it has used more debts to finance the Maritime Link, higher interest rate would slow down Emera’s appetite for growth projects in the future.

Dividend Growth Perspective

Emera has been increasing its dividend payment each year for over a decade now. With the purchase of TECO energy, management intends to continue its tradition. The company forecast an 8% dividend growth rate throughout 2020 while targeting a payout ratio of 70-75% (Emera Investors Presentation). At 4%+ dividend yield, this is a keeper for several years.

I HAVE 5 MORE FOR YOU…

I couldn’t stop at only 5 picks. This is why I kept on working on that list and end-ed up with 10 US dividend growth stocks. If you want get the full report, you can download it for free right below:

disclaimer: I’m long all the above in my Dividend Stocks Rock portfolios

Leave a Reply