In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and we drove all the way to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built and managed this portfolio publicly since 2017 to create and track a real-life case study.

In August 2017, I received $108,760.02 in a locked retirement account. Locked means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to suggest you follow my lead. My purpose has been solely to share with our members how I manage my portfolio with all the good and the bad that inevitably takes place each month. I hope you have learned and will continue to learn from my experiences managing this portfolio.

Volatility To Start The Year

The year started strongly and as we get earnings reports, investors have started to worry again. Is it the fact that the market almost doubled over the past 3 years? Or, that many stocks look overvalued? Or investors are now concerned that the AI bubble will burst not only among tech stocks, but also around infrastructure, industrial, construction, power and energy?

There are many questions in early 2026. The more questions we have, the more volatile the market becomes.

It’s probably time to stash money in a good store of value, right? Gold? Silver? Bitcoin?

Sorry, my friend, but volatility is everywhere.

A few stocks and topics caught my attention at the beginning of the year. It seems that not much is making sense right now. This is why it’s a good time to go back to the basics and look closely at the narratives and then at the numbers!

But first, the results!

Performance in Review

Let’s start with the numbers as of February 3rd, 2026 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $321,685.53

- Dividends paid: $5,306.00 (TTM)

- Average yield: 1.61%

- 2025 performance: +7.34%

- VFV.TO= +12.18%, XIU.TO = +28.88%

- Dividend growth: +1.5%

Total return since inception (Sep 2017- January 2026): +195.78%

Annualized return (99 months): 14.05%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 16.15% (total return 243.80%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 12.84% (total return 167.80%)

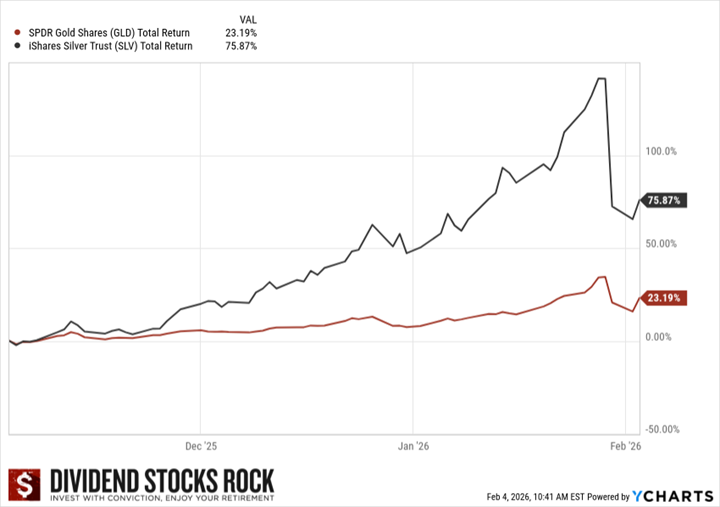

Golden age of Gold & Silver… then falling from grace

At the beginning of the year, I joked on a podcast and made a few predictions for fun. One of them was that Gold could hit $5,000 and probably even $6,000 in 2026.

It made the $5,000 mark faster than I expected and almost reached $6,000 in January!

Then the yellow metal pricing dropped like a rock. If you think silver was better, it dropped by 30% in a single day!

To keep everything in perspective, silver was up by more than 60% in a single month right before the drop. Therefore, it’s still in positive territory for 2026 (and the bright metal has started to recover as well).

What’s next for metals? I honestly don’t know. What I do know is that one should not invest out of Fear of Missing Out (FOMO) but rather decide if you want metals as an asset class for the next 25 years not just 25 months.

United Health (UNH) gets slapped… again

Ironically, UNH reported good numbers in January. The problem is that another big news story stole the attention. The Centers for Medicare & Medicaid Services (CMS) released the rate increases for Medicare Advantage (MA) for 2027. Medicare Advantage provides care to over 35 million seniors in the U.S. The news is not good: 0.09% increase (read ZERO). In perspective, the MA reimbursement rate increased by 5% for 2026.

The problem is that UNH is relying on these increases to raise its profit. The company receives money from the government to provide care. The profit is made with the spread between what UNH receives and the cost of providing that care. For a decade, UNH made a fortune managing this spread. But now that healthcare costs are rising and the rate is not, you can see how UNH’s margin will get thinner.

UNH reacted by saying it will focus on margin recovery, not membership growth this year (you understand why!). Therefore, the MA membership is expected to reduce as the company will focus on reducing costs and get its margin back on track for the future.

What to think of it?

I have mixed feelings. On one side, UNH is the healthcare company with the largest scale and network to face this challenge. In other words, if there is a winner on the other side of this story, UNH has a big chance to be the one.

On the other hand, UNH has been taking beating after beating over the past 2 years. So much bad news is hitting the same business in so little time. It is confusing to say the least. Even analysts don’t know where to put their target price. It ranges from $280 (close to the current stock price) to $457, suggesting a significant opportunity. The proportion of “sell” and “hold” ratings has increased significantly since May 2025.

Personally, I like the “gamble”, but I don’t have a position in the stock. I can see UNH going back up, but it will need a series of good quarters and a better outlook (keep in mind 2026 numbers will get the 5% rate increase as the new rate announcement is for 2027).

Microsoft beats expectations and gets beaten up

While I didn’t get affected by the UNH drop, another major company got smacked on earnings day: Microsoft dropped by more than 10% on earnings day. The reason? A revenue growth of 17%, including cloud computing being up 29% and EPS increase of 24% is not enough.

Crazy, I know.

So, while Microsoft keeps on reporting strong numbers quarter after quarter, investors are requiring more than what was delivered for a stock that is now trading at a forward PE of 24. On a side note, Walmart (WMT) is skyrocketing and now trades at a forward PE of 43.

Different industry, different standards, right?

The big issue Microsoft faces is not related to its current growth, but to the immense capex it is spending on AI. Investors want to see a return on this spending. In other words, many are concerned that we have hit the bubble level.

I disagree, especially when it comes down to a company like Microsoft with several growth vectors.

I remember that MSFT reported great numbers in 2022 and yet, the stock price fell like a rock as interest rates were on the rise.

I’m more concerned about negative-cash-flow companies like OpenAI (the company behind ChatGPT) than I am about cash-flow-positive companies like Microsoft and Alphabet. They have the financial structure to support massive AI investments while growing their business elsewhere.

It is true that AI may not be as profitable as expected. It may not be the game-changer we all expected. However, the AI infrastructure will continue to be used for decades to come either way. Companies like Microsoft will benefit from this long-term tailwind.

Here is a quick video about MSFT without AI

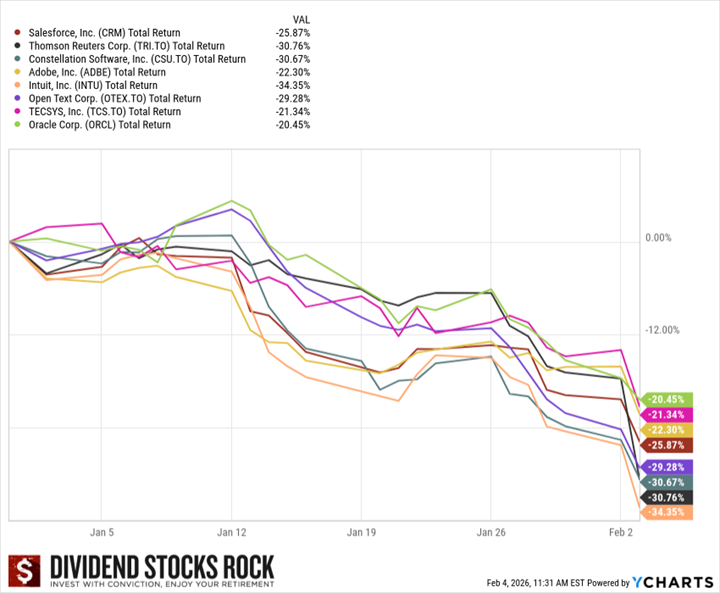

The Saas era is over – AI will make them all obsolete

The market is full of contradictions. While companies like Microsoft are getting punished for their AI capex as investors have a hard time seeing the return on that investment, SaaS (Software as a Service) companies are getting eaten alive as investors also think AI will replace all of them.

The bloodshed is real: many companies offering software as a service are down by 20, 25, 30, even 35% in a single month! I’m not talking about small businesses here (see the graph below).

While they all serve different industries, those companies have one thing in common: too many people think their services will be replaced by a cheap AI agent.

Again, this is a case of a strong negative sentiment that is not backed by the numbers yet.

Ironically, I see a potential tailwind for many of these companies. The key for them is how they will implement AI in their services. Without guidance and expertise, there is no “intelligence” in AI; it remains just “artificial flavors”.

However, if you can combine knowledge and AI to create an upgraded version of your software, possibilities are infinite. From the list below, I own shares of Constellation Software. This company is in freefall since last year. It’s almost like CSU will go bankrupt in 5 years from now. That’s an interesting take for a company that saw its operating cash flow almost doubled over the past 3 years.

The pain will continue for a while as it takes a lot of good numbers to reverse a negative sentiment. However, if you are a patient investor like me, I suggest you study those companies carefully as you may find great winners in a few years from now.

On my side, I’ll stick to my position in CSU. I even added a share earlier this year.

Here are 4 Tech Stocks Immune to the AI Bubble

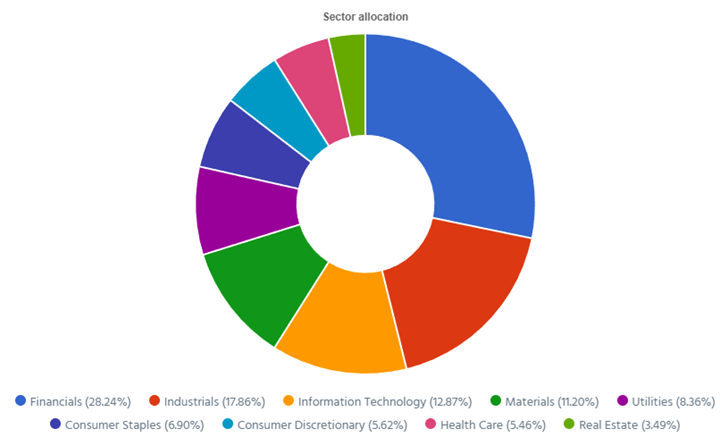

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 13 companies spread across 8 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 2.16% with a 5-year CAGR dividend growth rate of 11.57%.

- The portfolio value is now at $30,752.19

- The portfolio debt is at $24,000.

- Monthly contribution is set at $1,000/month.

- The annual income is $665.47, and the projected income is $742.44

- To report my Smith Manoeuvre, I export the Excel data from my DSR PRO dashboard.

Smith Manoeuvre Portfolio Summary

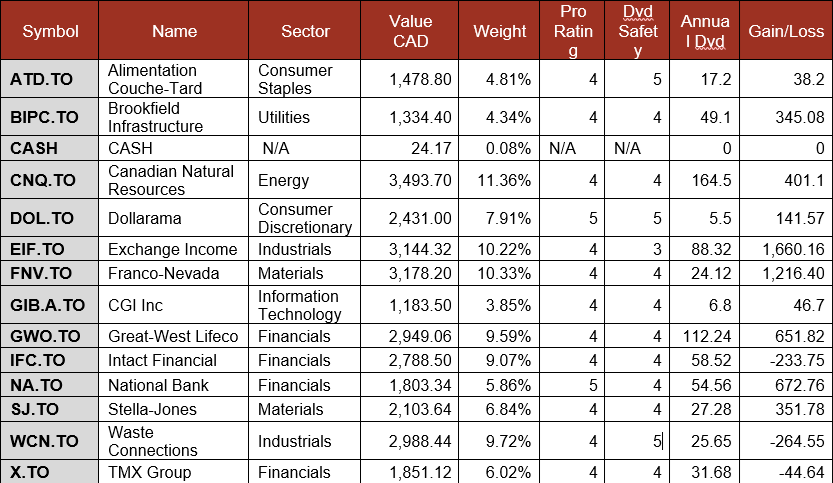

Here’s my SM portfolio summary as of February 3rd, 2026 (before the bell):

$1,000 invested in CGI

Slowly but surely, I’m building a new position in CGI (GIB.A.TO). The stock is going down while numbers are going up. This is the type of play I like! Across all my portfolios, CGI is a small 0.50%. However, I’m adding more each time I have a few dollars on the side. The goal is to build a position of at least 2.5% in this portfolio.

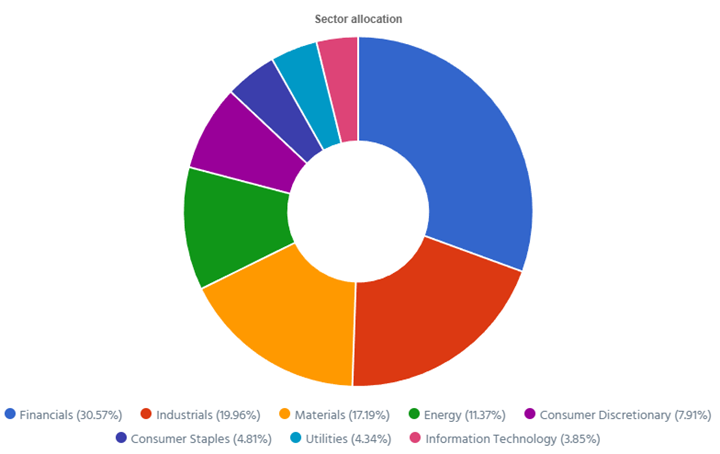

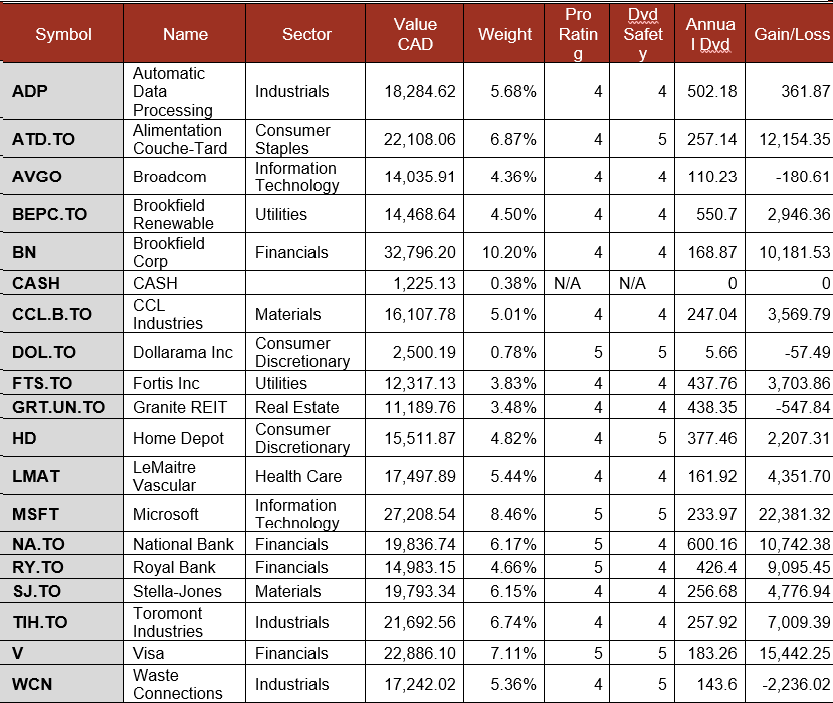

Pension Portfolio Summary

Here’s my pension plan portfolio summary as of February 3rd, 2026 (before the bell):

Total value: $321,685.53 (+$2,615.07, -0.81% from last month).

A few companies reported their earnings. Let’s look at them!

Automatic Data Processing keeps beating expectations, but keeps getting beaten up

Automatic Data Processing reported another strong quarter with revenue up 6% and EPS up 11% while beating the analysts’ expectations. While ADP continues to report high single-digit to double-digit growth, the stock price keeps on falling. In January, ADP raised its adjusted EPS growth outlook to 9%-10% and announced a $6B stock repurchase. Results were driven by the Employer Services segment (+6%), and PEO Services (+6% as well). A meaningful underlying tailwind also came from higher interest income on funds held for clients which increased 13% to $308.6M as average client funds balances rose 6% to $37.6B.

Brookfield Renewable is generating more dividends!

Brookfield Renewable also reported a strong quarter with revenue up 8%, FFO per share up 11% and a dividend increase of 5%. For the full year, FFO per share was up 9.8% and revenue was up 20%. Results were driven primarily by higher hydro revenue (+25%, helped by stronger generation in Colombia and improved North American hydro pricing/contracting), strong growth in distributed energy & storage (+46% or $73M vs. $50M) and sustainable solutions (23.6% or $178M vs. $144M). Windpower generation was slightly lower ($169M vs. $172M). Management reiterated a target of 10%+ FFO per unit growth per year with cash flow expected to grow by 12% to 15% per unit.

Microsoft falls on strong numbers

Microsoft reported a strong quarter with revenue up 17% and EPS up 24% which beat the analysts’ expectations. Revenue by segment: Productivity and Business Processes (+16%), Intelligent Cloud (+29%), and More Personal Computing (-3%). Still the stock lost about 11% on earnings day. The logic? Analysts wanted more (even though results were better than expected!).

The revenue growth was driven primarily by Intelligent Cloud (with Azure and other cloud services revenue up 39%) and Microsoft 365 Commercial cloud momentum inside Productivity and Business Processes. More Personal Computing declined mainly due to Gaming (offset partly by Search and Windows OEM). MSFT invested nearly $30B in CAPEX to support the pace of infrastructure build-out tied to AI and cloud demand.

Visa processes great results

Visa reported another strong quarter with revenue and EPS up 15% (beating analysts’ expectations). The revenue breakdown was service revenue (+13%), data processing (+17%), international transaction (+6%), and other revenue (+33% YoY), offset by client incentives of $4.27B (up 12%). Management attributed the growth to strong underlying activity metrics: payments volume +8%, cross-border volume excluding intra-Europe +11%, total cross-border up 12%, and processed transactions up 9%, supported by resilient consumer spending, a strong holiday season, and continued strength in value-added services plus commercial and money movement solutions.

My Entire Portfolio Updated for Q4 2025

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of January 5th, 2026.

Download my portfolio Q4 2025 report.

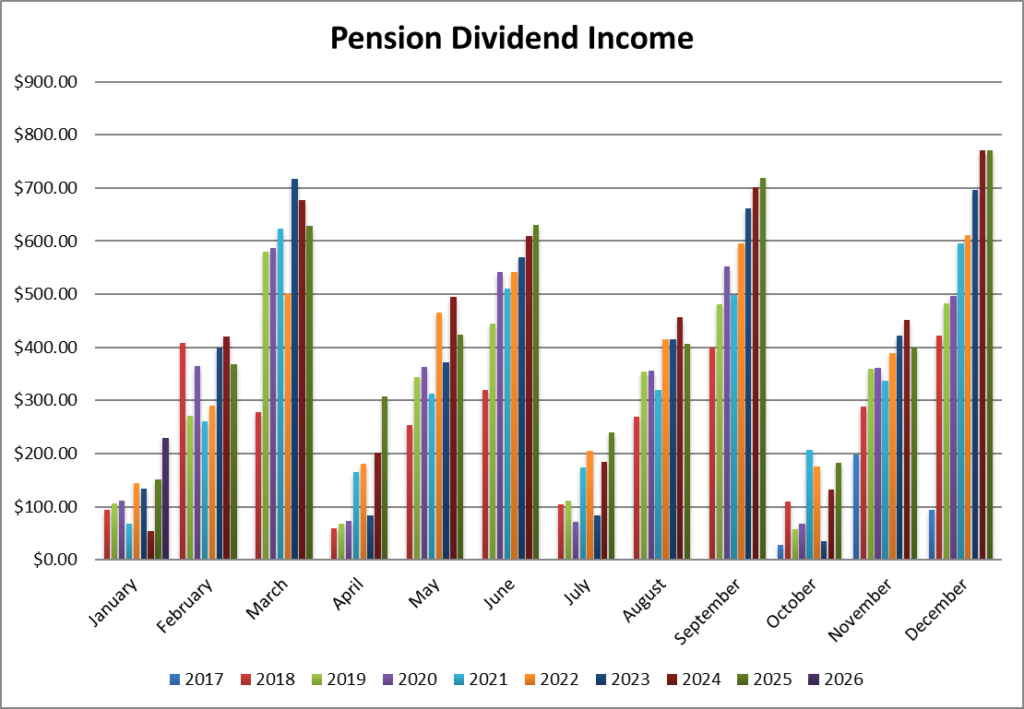

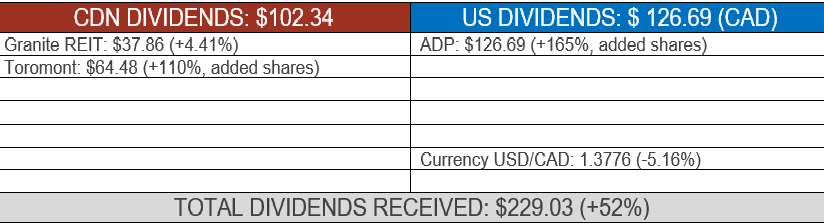

Dividend Income: $229.03 (+52% VS. JANUARY 2025)

I start the year with a nice bump to my dividend payments. I added shares and built 2 new positions in 2025 in ADP and Toromont and it’s now paying off.

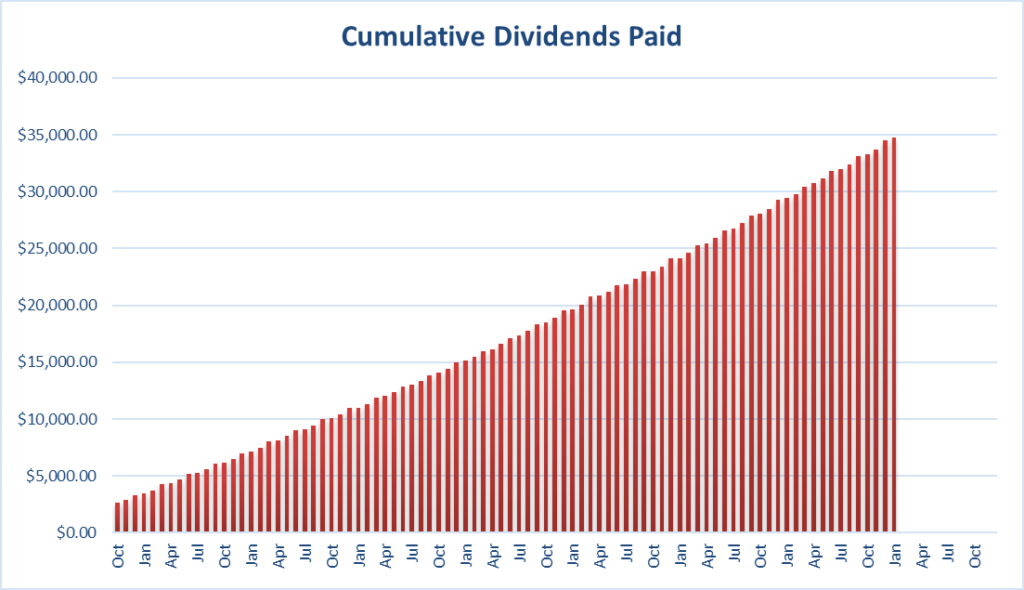

Since I started this portfolio in September 2017, I have received a total of $34,722.59 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

I hope you are not too rattled by the market these days. I often get emails from members wondering why stock ABC is down “today”. I rarely follow daily stock movements since the stock could recover (or drop after a jump) within a few weeks. Just look at how fast silver went up and then down and now going back up.

As you should be doing while driving your car into a curve, keep your eyes on the horizon, not on the turning line, and you’ll have a better perspective.

Cheers,

Mike.

Leave a Reply