Getting a lump sum to invest sounds like a good problem—and it is—but it can also feel like an anxiety-inducing puzzle. Maybe the money came from an inheritance, selling a cottage, cleaning up your portfolio, or simply letting dividends pile up for longer than you meant to. However it happened, the question remains: what do you buy, and when do you buy it?

Most investors get stuck because they’re trying to avoid regret.

- Buy today and the market might drop tomorrow.

- Wait for a pullback and the market might keep rising without you.

The solution isn’t a perfect prediction. It’s a plan that removes emotion from the driver’s seat.

A good lump-sum plan has two parts. First, you decide where the money will go. Then you decide how you’ll deploy it over time.

Where to Invest Your Lump Sum

Before you think about timing, you need clarity on what you’re buying. If you skip this step, market noise will fill the gap and you’ll end up reacting instead of executing.

Start by revisiting your investment goals. In plain terms, what do you want your portfolio to do for you?

- Some investors want maximum long-term growth and are comfortable with volatility.

- Others want income now, with steady dividend growth, so their income rises over time.

- Many want a blend of both.

Goals aren’t fixed, either. Earlier in the accumulation phase, it’s common to take more risk and lean into growth. As retirement gets closer, stability and reliability become more important.

Once you’ve clarified the goal, the structure becomes easier to define. You’ll have a better idea of your asset allocation—whether you want a stock-only portfolio or a mix that includes ETFs, bonds, or GICs/Certificates of Deposits.

You’ll also be able to set a sector allocation that makes sense for you, meaning the mix of economic sectors you want exposure to and the role each one plays.

Review your current portfolio

If you already have a portfolio, the lump sum becomes a powerful tool. Review what you own and identify areas that need reinforcement.

The most common issues fall into three categories:

- overweight positions

- lightweight positions

- and loser stocks

Overweight Sectors or Positions Issue

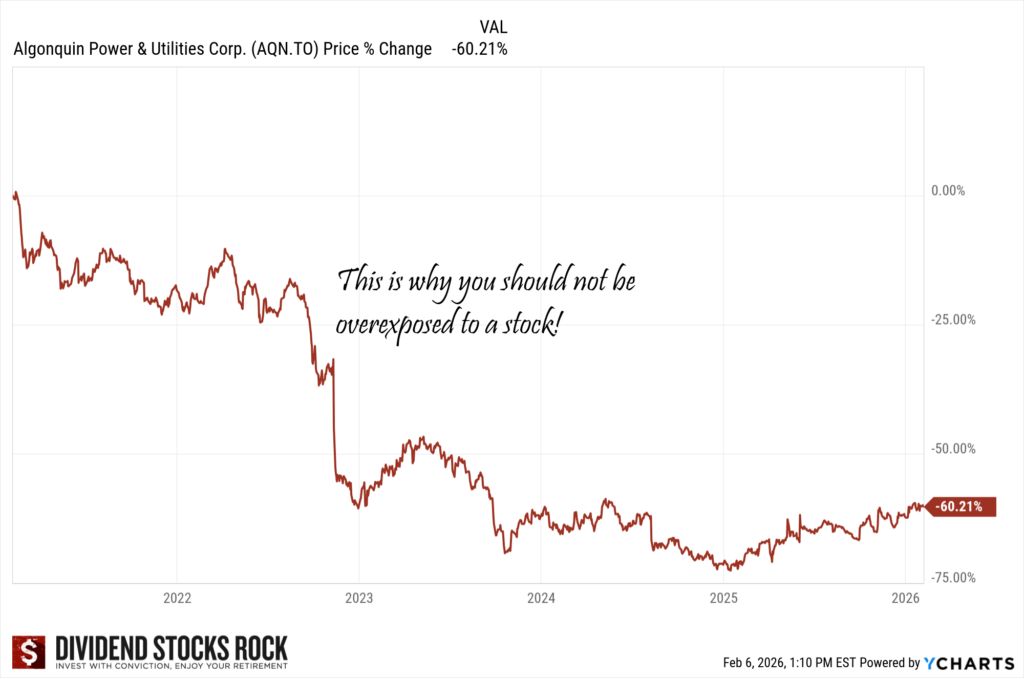

Overweight sectors or companies make a portfolio more vulnerable, because you can get hit by a problem that affects a single industry. Diversification isn’t about owning many names—it’s about avoiding one event ruining the year.

? If you are overweight, you can use the lump sum to add exposure elsewhere and rebalance, or you can trim a position that has become uncomfortably large.

If you’re near retirement or already retired, there’s an extra layer that many people miss. You shouldn’t only look at diversification by market value; you should also look at diversification by dividend income.

A smaller position in a high-yield stock can produce more income than a much larger position in a low-yield stock. If you rely on dividends to fund your lifestyle, income concentration can sneak up on you even when your portfolio looks diversified on paper.

Lightweight Positions Issue

Lightweight positions are the opposite issue. Those tiny holdings—one percent here, another percent there—rarely change your results. Even if they double, you won’t feel it.

If you truly like the company and still believe in the thesis, a lump sum is the perfect time to turn that “toe in the water” into a meaningful position. If you don’t have conviction or you barely follow the company anymore, it may simply be clutter.

Losers Issue

Then there are loser stocks. A stock that’s down 40% needs to rise about 66% just to get you back to even. That math is unforgiving.

Sometimes a stock is down for temporary reasons and it can recover, but holding a loser for years just to “break even” isn’t a strategy—it’s hope.

A lump sum is often the right time to conduct an honest review:

- Why is the stock down

- How long has it been down

- Is the business still strong enough to justify staying invested?

If not, selling and reallocating into something more resilient can improve your portfolio faster than waiting for a comeback that may never arrive.

Building a New Portfolio

If you don’t have a portfolio yet and the lump sum is your seed money, the process is similar.

- Start with goals

- Select a mix of sectors you understand

- Decide how many stocks you want to own

- You don’t need every sector in the market, but you do want enough diversity to avoid being overly dependent on one part of the economy.

As a general guideline, I prefer exposure to at least seven or eight sectors aligned with the portfolio’s objective. I’m also careful not to let a single sector become the entire story. Even within a sector, I prefer to diversify by industry.

Owning five companies that all behave the same way isn’t much protection. Here are quick steps to choosing between similar candidates:

- Start with the differences in their business models.

- If they still appear equally compelling, comparing their Dividend Triangle—revenue growth, earnings growth, and dividend growth—usually clarifies the decision.

- If not, dig deeper: Cash flow, debt ratios, payout ratios, etc.

When to Invest Your Lump Sum

Once you know what you want to buy, the emotional tug-of-war shifts to timing. This is where many investors freeze, because putting a large amount to work can feel like stepping onto a moving escalator. The market could drop right after you buy, and nobody enjoys seeing a new position immediately in the red.

The financial literature often says the best time to invest is “now,” because markets trend upward over time and money can’t compound if it’s parked on the sidelines.

That’s true, but it doesn’t automatically mean investing 100% in a single day is right for you. If doing so causes stress that leads to poor decisions later, the “optimal” plan becomes impractical.

Waiting for the perfect moment is the other common trap. It usually starts reasonably:

- You wait to see what happens next month.

- Then you wait for inflation or interest rates to improve.

- Then you wait for a pullback.

- Then you wait for political tensions to cool down or for the elections to occur.

- When the pullback finally arrives, you hesitate because it might fall further.

That pattern doesn’t protect your portfolio; it protects your anxiety.

A practical middle ground is to invest the lump sum in planned intervals over a defined period, such as six to nine months. This approach works because it removes the need to time the market.

If the market falls early, you average down with later purchases. If the market rises, you still got started and you’re averaging in.

Most importantly, you replace emotional decision-making with a schedule.

Make Your Plan and Buy

Here’s what that can look like in real life. Choose your time window—say six months—and decide in advance when you will invest. Then divide your planned purchases into equal parts.

A simple version looks like this:

- Invest one-third now.

- Invest one-third in three months.

- Invest the final third three months after that.

Before each buy date, take a few minutes to review the latest quarterly results and make sure nothing fundamental has changed.

? You’re not looking for perfection; you’re simply confirming the thesis is intact.

Get the “How to Buy” Email Series (Free)

If you like this framework, the next step is learning how to execute a buy with confidence.

When you join our free newsletter, you get access to our “How to Buy” email series, exclusive to subscribers.

It walks you through

- What to check before you buy

- How to build conviction without overthinking

- How to avoid the classic mistakes that turn good ideas into frustrating results.

Stop hesitating and take control! Join 20K+ Investors and receive your first email today!

Bonus: Download the Dividend Rock Stars list to start your stock research.

Final Thoughts

A lump sum feels intimidating because it concentrates a lot of emotion into one decision. But with a clear plan—what you’ll buy, how it fits your goals, and how you’ll deploy the money over time—you don’t need a perfect market call.

You just need a process you can stick with long enough to let your portfolio do its job.

Leave a Reply