In Part 1, we established the big shift for 2026: AI has stopped being “just tech” and become a macro force. It’s driving a capex wave that touches everything—investment spending, supply chains, financing, and the physical constraints of the economy.

Now we move to the ripple effects. Because once you accept that AI is macro, the next questions are obvious: Where does the money go next? What breaks first? And which parts of the economy get rebuilt because they have to?

Here are the themes I’m watching most closely as we enter 2026.

Energy, baby (because AI eats electrons)

The themes that follow are all connected to AI in some way. The rising need for energy didn’t start because of AI, but AI turned it into a pressing issue. Annual power demand growth has roughly doubled in recent years—from about 2% to about 4%. If that pace continues, we’ll need twice today’s generating capacity within 20 years.

The strain won’t show up evenly. Some regions will feel it far more than others, and supply chains are already stretched. AI is a major (and cyclical) driver of this surge, and it comes with a real-world tension: data centres competing with homes and critical industries for the same electrons.

What this supports is a two-step reality:

- Near-term: we need more “reliable, available” energy sources (oil & gas still matter).

- Long-term: we need massive investment to build a stronger, more dependable power structure.

This can fuel a strong bull case across multiple sectors:

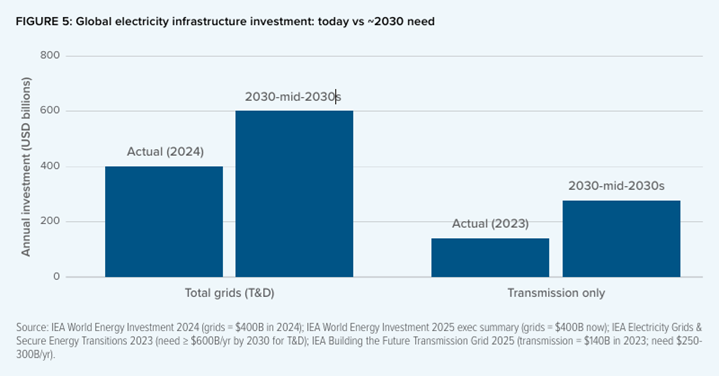

- Utilities: grids are underbuilt and need upgrades (transmission, distribution, reliability)

- Basic materials: copper and aluminum are structurally scarce inputs

- Energy: natural gas becomes a practical bridge for intermittent renewables

- Utilities + materials: Uranium benefits from reliability concerns

Infrastructure, reshoring, and the “world rebuild.”

Call it whatever you want—every firm has its own label—but the message is the same: the world is rebuilding. Factories are coming back to North America. Infrastructure budgets are rising. Governments are pouring money into grids, semiconductors, ports, rail, mining, and energy systems.

Why now? Because we finally realized the system we built was fragile.

- Supply chains snapped.

- Energy became a weapon.

- AI workloads demand more power than we can currently generate.

I’ve been talking about North American infrastructure needing major investment for years, and the flow of money hasn’t stopped. Governments also like this theme for a simple reason: it stimulates the economy. If you want to boost GDP and create jobs, infrastructure spending is an easy lever to pull.

Where investors often look first is construction—and yes, that can be a winner. But the opportunity set is broader than “builders”:

- Industrial firms tied to construction, building products & equipment

- Engineering firms, which I particularly like because they touch projects end-to-end:

- concept and planning

- design

- construction administration

- commissioning and maintenance

- decommissioning and remediation

Many of these businesses are already showing substantial backlogs. That’s the kind of signal I pay attention to.

And don’t overlook transportation companies. They’re facing economic headwinds right now, but a capex wave can be the catalyst that pulls them out of a rut.

Private markets & alternative asset managers

Another way to benefit from this rebuilding cycle is through the financing side.

The biggest problem with large infrastructure and reshoring projects is that they don’t generate cash flow immediately. To invest in them and manage them, you need specialists in patient capital. That’s where alternative asset managers come in.

From a portfolio perspective, this can also be a diversifier: alternative assets aren’t always driven by what the stock market is doing week to week. Over long periods, you can expect returns in the neighborhood of 5–7% above inflation.

A major shift is that private credit, private infrastructure, and mid-market private equity are no longer “alternatives.” They’re increasingly becoming how the capex boom gets financed, especially because:

- Banks are constrained

- Governments can’t fund everything on their own

- Companies want flexible terms that traditional banks don’t offer

That said, I’m more cautious with the rise of private equity. That’s probably my old banker side talking, but I prefer stricter, regulated lending rules over the more “cowboyish” approach.

The issue isn’t that these businesses can’t be good. The issue is that some deals are:

- Bundled into complex structures

- Difficult to evaluate quickly

- Only understood after something breaks

I do own Brookfield, and I’ve always been clear on the tradeoff: strong platforms, real opportunity—plus complexity risk. My favorite players in this category remain Brookfield (BN/BAM) and Blackstone (BX).

Proceed with caution.

Gold and the debasement trade

This part genuinely surprised me—not because gold exists, but because of how openly big firms are now talking about it.

For years, gold lived in the background as a hedge—something you kept around like a first aid kit. You hope you never need it, but it feels irresponsible not to have one. That tone has changed. Gold is acting like it got invited onto the main stage, and it’s performing better than most people expected.

The reason is simple: currency debasement is no longer a fringe concern. It’s becoming mainstream.

This isn’t just retail investors looking for a store of value. Central banks are buying gold too—not because it’s fashionable, but because the math behind government finances is getting uncomfortable:

- Deficits keep growing

- Debt servicing costs keep rising

- Political pressure on central banks increases

- Credibility in certain currency regimes gets thinner around the edges

Gold becomes the asset investors reach for when the numbers don’t add up the way they used to.

The key point here isn’t fear. It’s incentives. Countries holding massive reserves don’t want to rely entirely on U.S. dollars—especially when trade relationships are tense and geopolitical alliances are shifting. Diversifying into gold reduces dependency on any single currency and adds a store of value with no counterparty risk.

Does this change how you build a dividend portfolio? Not really. We’re not swapping banks for bullion bars. But it does mean paying attention to companies that benefit from this backdrop:

- Gold producers with strong balance sheets

- Royalty companies with steadier cash flows

- Miners that generate real profits rather than dreams

And the same rule applies as always: if you find one with a strong dividend triangle, it can make sense as a “wave” position, not as the foundation of your portfolio.

Want the full 2026 playbook (and my favorite picks)?

Reading about themes is helpful, but the real value is knowing what to do with them—without blowing up your strategy or chasing the latest headline.

That’s exactly what I cover in the webinar replay on the 2026 investment themes. In it, I walk through:

- My explanation of each major 2026 theme (AI as macro, energy constraints, infrastructure/reshoring, private markets, gold)

- My 2026 playbook: how to adjust a dividend growth portfolio without overreacting

- My favorite picks for the year, and why they fit the dividend growth mindset

If you want the complete picture—with the charts, context, and the practical next steps—watch the replay here

Final thoughts

If there’s one message I want you to keep from this series, it’s this: 2026 isn’t a year to reinvent your investing strategy. It’s a year to stay disciplined while big forces—AI-driven capex, energy constraints, infrastructure rebuilding, private capital, and currency debasement—push the market in new directions.

The best defense against noise is still a clear process:

“Know what you own and know why you own it.”

— Peter Lynch

Stay invested. Stay diversified. And keep upgrading quality.

Leave a Reply