Before I tell you what I saw in my crystal ball for 2026, keep this line in the front of your mind:

“… the big trends mostly right will not always lead to the outcome that you anticipate.”

— Mackenzie Market Outlook

And here’s the warning label I want on this entire post: adjusting your portfolio is healthy. Replacing your portfolio is usually a mistake. In other words, tweak—don’t flip the table.

The key remains the same: stay invested. Now let’s look at the first theme that matters most for 2026—the one that’s quietly pulling the whole economy into its orbit.

The big themes that will shape 2026

A word of caution about trends

After reading about AI, nuclear, copper, and grids, you might be tempted to go all-in on the “obvious winners.” The problem is that “need” doesn’t always equal “profit.”

We’ve seen this movie before. A theme becomes real, money floods in, valuations stretch, and suddenly there are more losers than winners—especially for investors who arrive late and pay any price.

The 2026 mindset I want you to adopt is simple:

- Stop chasing the shiny front layer

- Start focusing on the companies that enable the trend

- Prefer businesses that were already strong before the trend became fashionable

That’s how you benefit from the theme without becoming its exit liquidity.

AI isn’t just tech anymore — it’s macro

If 2024–2025 was the market “discovering” AI, 2026 is the market realizing something bigger:

AI is now macro.

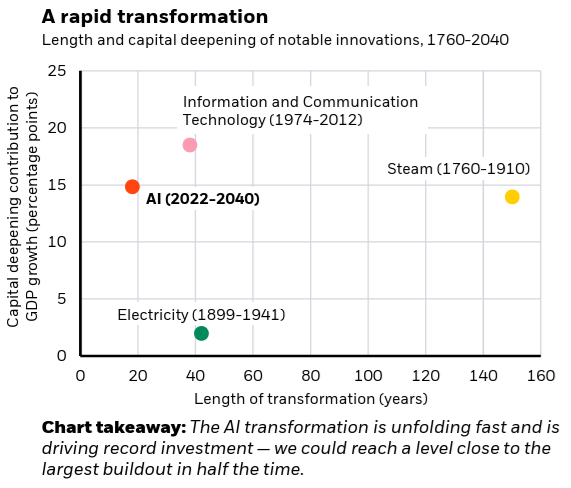

It drives capital spending, energy demand, grid strain, industrial bottlenecks, market concentration, and (yes) valuations. BlackRock’s 2026 outlook basically treats AI capex as a key driver of growth rather than a sector story.

AI buildouts require:

- new data centers

- transmission lines and grid upgrades

- copper, aluminum, steel

- electricity (a lot more than people were planning for)

- financing (massive amounts of it)

That’s why the opportunity set is broader than “buy a tech darling and hope.” This is moving money into industrials, utilities, materials, energy, and finance—the plumbing behind the dream.

And here’s the part most people miss: this looks and feels like a capex bull market. BlackRock explicitly references multi-trillion-dollar AI capex intentions over the second half of this decade.

“Is it a bubble?”

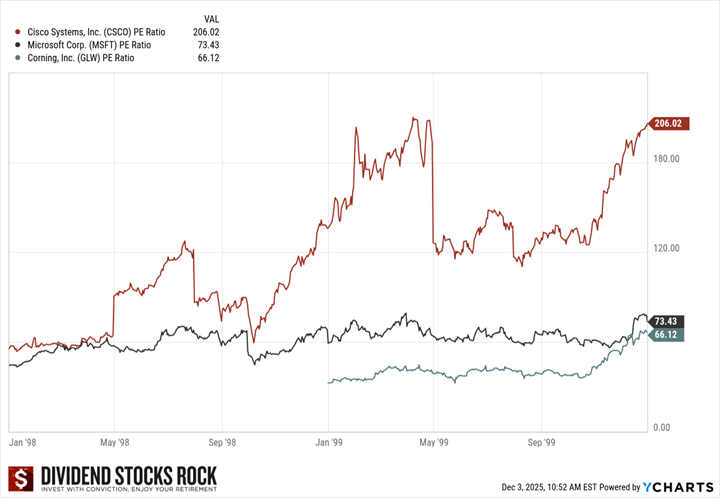

This is a rare moment when valuation matters. Two groups drove the dot-com bubble:

- Pets.com and other empty “Dot-Com” businesses showing clicks and page views, but nothing else.

- Established tech giants that spent billions on the internet infrastructure.

We can see both today—cash-burning AI names on one side, and profitable tech leaders investing heavily on the other.

The difference is valuation. In 2000, multiples were extreme (Cisco above 200x earnings; Microsoft and Corning above 65x).

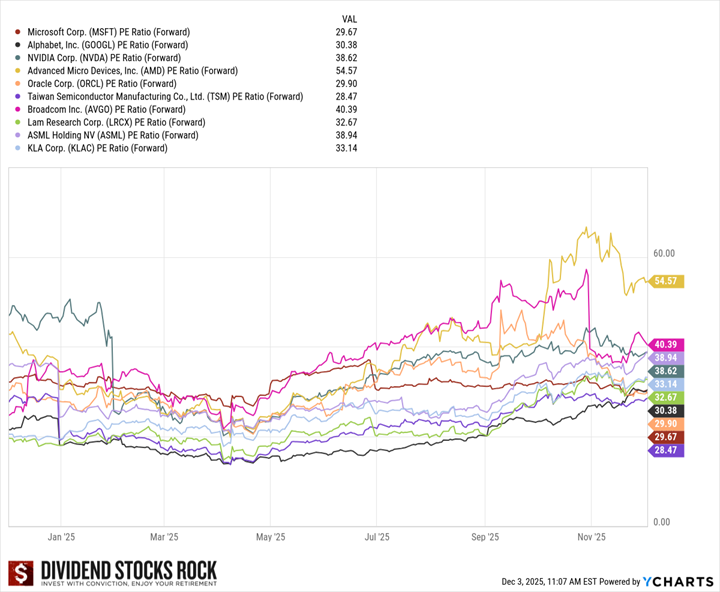

Today’s AI leaders are richly valued, but generally nowhere near dot-com extremes (with a few stretched cases like AMD on the chart), and many sit closer to ~30x forward earnings.

So yes, bubble risk exists—mostly if hype and spending run too far—but there’s still room for growth into 2026. That’s why I stick with quality businesses that were strong before AI, using AI as an extra growth tailwind rather than the only thing holding up the dividend triangle.

If you’re reading this and thinking, “Okay, I get the theme… but what do I do with it?” you’re asking the right question.

Watch the 2026 Themes Webinar Replay

That’s exactly what I cover in the webinar replay on the 2026 investment themes. In it, I walk through the charts you’ve seen here, explain the risks (including the valuation/bubble discussion), and then shift into the practical side:

- How I’m approaching 2026 without overreacting

- The portfolio adjustments I prioritize

- My favorite picks for the year, and why they fit the dividend growth mindset

Watch the replay here: (insert link + image to come)

Before We Get to Energy…

The big takeaway is that AI isn’t just a tech story anymore. It’s a macro force that’s driving a capex cycle across the economy—and it’s already reshaping what wins and what struggles.

But this is where things get interesting. When the economy starts spending at this scale, it creates bottlenecks. And the first bottleneck is obvious: energy.

In Part 2, I’ll walk through the “real-world” themes that AI is accelerating—power and grids, infrastructure and reshoring, the rise of private capital, and even the return of gold as a serious macro trade—without turning your portfolio into a trend-chasing machine.

Leave a Reply