In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and we drove all the way to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built and managed this portfolio publicly since 2017 to create and track a real-life case study.

In August 2017, I received $108,760.02 in a locked retirement account. Locked means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to suggest you follow my lead. My purpose was solely to share with our members how I manage my portfolio with all the good and the bad that inevitably takes place each month. I hope you have learned and will continue to learn from my experiences managing this portfolio.

Reviewing All My Stocks 2026

New year, new me, but same old dividend growth strategy! At the start of the year, I thought I would share my expectations and perceptions for each of my pension plan holdings. I significantly underperformed the market in 2025 (7.34% vs 20.50% for my benchmark). However, it means little as I don’t invest for 12 months, but for 40 years. Since inception, I’m still on track to match the market while not chasing returns. I prefer to have control of over my portfolio and be fully confident in my holdings instead of wondering how Mr. Market will react to waking up the next morning. Let’s review each position!

But first, the results!

Performance in Review

Let’s start with the numbers as of January 5th, 2025 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $324,300.60

- Dividends paid: $5,227.59 (TTM)

- Average yield: 1.61%

- 2025 performance: +7.34%

- VFV.TO= +12.18%, XIU.TO = +28.88%

- Dividend growth: +1.5%

Total return since inception (Sep 2017- November 2025): +198.18%

Annualized return (98 months): 14.31%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 16.23% (total return 241.80%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 12.84% (total return 168.30%)

Automatic Data Processing (ADP) – Industrial

ADP is still my favorite “quiet compounding machine”. Payroll is sticky, and the real magic is the mountain of recurring fees that keeps showing up like clockwork. What I expect going forward is steady mid-single-digit growth with margin discipline, plus the usual upside when employment stays healthier than the headlines suggest. The main thing I’m watching is wage and hiring momentum, because ADP can feel it in the numbers before economists do. I don’t mind ADP’s poor short-term performance as the dividend triangle metrics are stellar.

Alimentation Couche-Tard (ATD.TO) – Consumer Staples

Couche-Tard keeps doing what Couche-Tard does. It turns boring convenience retail sales into a cash engine with discipline and scale. What I expect is continued resilience in margins and cash generation with management staying opportunistic on tuck-in deals while keeping the balance sheet in check. Let’s be honest, as they are long overdue for announcing a major acquisition! The big swing factor is fuel spreads and FX noise, but the long game is still about traffic, merchandise, and relentless execution.

Broadcom (AVGO) – Information Technology

Broadcom is the newest addition to my portfolio. I’ve been praising this company for 10 years (since 2016) so it’s about time I got a piece of the cake! I love AVGO’s proven growth-by-acquisition strategy. The company enjoys a steady income flow from its RF filters sales (improving smartphone connections), and it has surfed on the AI tailwinds as its chips facilitate faster and less energy-consuming calculations. Even if AI doesn’t turn out into this well of profitability expected by many, everyone needs more efficient computers.

Brookfield Renewable Corp (BEPC.TO) – Utilities

Brookfield Renewable is where I go for the long runway, contracted cash flows plus a developer’s mindset with management that thinks in decades. Ironically, I share the same mindset when it comes to investing, patient investors win. BEPC should continue to thrive if AI is at the center of this bullish narrative. However, I don’t fancy myself thinking price swings are over!

Brookfield Corp (BN.TO) – Financial Services

Brookfield is my “financial octopus” with lots of arms, lots of fee streams, and a talent for buying when others are nervous. What I expect is more focus on fundraising, fee-related earnings, and disciplined deployments tied to power, data, and real assets, especially where AI infrastructure needs real-world shovels. The company owns the entire infrastructure behind the energy demand from the rise of AI. BN owns power plants, renewable energy, power grids, pipelines, real estate, data center and cloud services. They are well-positioned to ride this wave. The stock can trade like a mood ring, but the business is built for patient compounding.

CCL Industries (CCL.B.TO) – Basic Materials

CCL is the kind of company that makes money on things you touch every day, like labels, packaging, and specialty materials, with a surprisingly global footprint. What I expect is continued steady execution and selective bolt-on deals with earnings driven more by operational discipline than heroic forecasts. The risk is that it can feel cyclical when industrial demand cools, even if the long-term story stays intact.

Dollarama (DOL.TO) – Consumer Discretionary

Dollarama is my “inflation pressure valve” stock. When households feel squeezed, the value retail outlet becomes a habit. What I expect is continued strong traffic and same-store sales, plus a long, slow integration story in Australia that will not be linear. DOL is executing its flawless playbook when it comes to expansion: opening a determined number of stores each year (now in Canada, Mexico, Central America and Australia!). The organic growth should continue along the same line. The biggest risk is simply lapping tough comparables and any margin noise from freight or wage pressure, but the model has proven it can adapt.

Here is a recent video about Dollorama’s growth

Fortis (FTS.TO) – Utilities

Fortis is still the portfolio’s seatbelt with regulated assets, visible capex, and a dividend policy that’s designed to be boring in the best way. I like to say that I can put FTS in a black box and open it in 10 years without any worry. What I expect is steady rate base growth and more updates around the multi year capital plan with modest earnings growth doing the heavy lifting. The main risk is rate sensitivity as utilities can get tossed around when bond yields jump even if the fundamentals barely move.

Granite Real Estate Investment Trust (GRT.UN.TO) – REITs

Granite is my “frustrating investment with good numbers”. At least GRT had a good year in 2025! Nonetheless, I’m roughly breaking even on this investment while my total portfolio is almost up 300%… The REIT owns high quality industrial real estate with a management team that leans conservative. What I expect is continued emphasis on occupancy and rent spreads plus steady distributions that reflect the underlying cash flow discipline. The key risk remains refinancing and cap rates, but Granite has been actively managing through the rate regime.

Here is a podcast episode about My Top 2 Canadian REITS

Home Depot (HD) – Consumer Discretionary

Home Depot is the housing cycle thermometer, and right now that thermometer is reading “slow turnover, cautious homeowners.” What I expect is a gradual thaw as rates eventually ease and projects come back, with Pros and repair and maintenance doing more of the work than big remodel dreams. 2026 should be a better year for the world’s largest home retailer. The risk is that the housing slump lasts longer than anyone wants, and HD can look stuck in place for a while, even if it’s building future demand quietly.

LeMaitre Vascular (LMAT) – Healthcare

LeMaitre is one of my favorite small compounders. It’s not flashy, but it keeps shipping specialized vascular tools into a growing market. I like the niche of selling equipment to surgeons and the robust balance sheet along with double-digit dividend increases! What I expect is continued organic growth with strong profitability, and management staying disciplined on product focus rather than chasing shiny distractions. The risk is always hospital purchasing cycles and procedure volumes, but the recent margin profile shows how powerful the niche can be when the execution is tight.

Microsoft (MSFT) – Information Technology

Microsoft is still the empire of recurring revenue, and AI is becoming an add on engine across the whole stack. I first bought it for its subscription-based business and its cloud opportunity (Azure). Now the cloud is growing even faster thanks to AI! What I expect is continued Azure momentum and Copilot adoption, with near-term margin pressure as they keep investing heavily in AI infrastructure. The risk is that “capacity and spend” headlines spook the market, but long-term, this is exactly how moats get deeper.

National Bank (NA.TO) – Financial Services

National Bank is my favorite Canadian Bank. The bank is not just my favorite because I worked there for 13 years, but because it constantly reports strong numbers. It’s always in the top 2 or 3 among the Big 6 in all metrics (revenue growth, EPS growth, dividend growth, dividend payout ratio). The bank acquired Canadian Western Bank in early 2025 and ended the year by acquiring Laurentian Bank’s banking book of business. I expect another year of flawless execution.

Royal Bank (RY.TO) – Financial Services

RBC is Canada’s largest bank and my second favorite behind NA. I like the size, the scale and the diversification (50% of its revenue doesn’t come from classic banking activities). What I expect is continued strength in wealth and capital markets plus the usual focus on credit quality as the economy digests higher rates. The risk is not one bad quarter. It’s the slow creep of credit costs if unemployment rises, but RBC has the balance sheet and earnings power to manage cycles.

Stella-Jones (SJ.TO) – Basic Materials

Stella-Jones is the kind of business that looks dull on the surface, but then you realize rail ties and utility poles are long lived necessities. What I expect is steady demand in the core categories with pricing and project timing doing most of the quarter-to-quarter dance. The risk is that volume can soften in parts of the cycle, but the “infrastructure replacement” drumbeat usually keeps playing.

Toromont Industries (TIH.TO) – Industrial

Toromont is my “Canada builds things” proxy, and I like having that exposure when the industrial cycle cooperates. For those expecting like me that more investment in infrastructure is coming, TIH should be in a great position to surf this tailwind. What I expect is continued strength from CIMCO and solid product support with equipment sales more dependent on mining and construction timing. The risk is a choppier capex environment, but the aftermarket and service side helps smooth the ride.

Visa Inc (V) – Financial Services

Visa is the toll booth on global commerce, and toll booths do not need to be exciting to be insanely profitable. What I expect is continued growth in payments volume and cross border activity with pricing power showing up through the cycle. The risk is regulatory noise and occasional macro slowdowns, but the cashless trend keeps pushing the river in Visa’s direction.

Waste Connections (WCN.TO) – Industrials

Waste Connections is my “boring, beautiful monopoly by route density”, once you own the pickup routes, the economics get very sticky. What I expect is steady revenue growth, disciplined pricing, and continued shareholder returns, including the dividend growth they’ve been showing. The risk is acquisition integration and commodity volatility around recycling, but the core hauling business tends to be remarkably dependable.

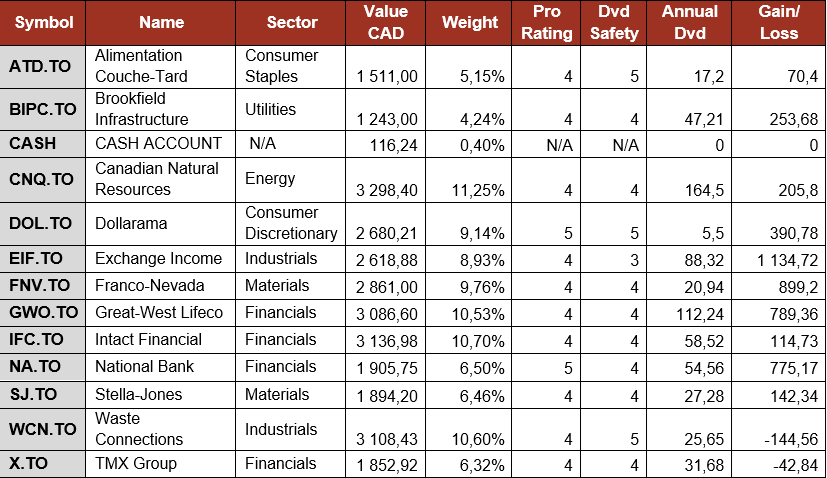

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 12 companies spread across 7 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 2.23% with a 5-year CAGR dividend growth rate of 11.59%.

- The portfolio value is now at $29,313.61

- The portfolio debt is at $23,000.

- Monthly contribution is set at $1,000/month.

- The annual income is $653.60, and the projected income is $729.33

- To report my Smith Manoeuvre, I export the Excel data from my DSR PRO dashboard.

Smith Manoeuvre Portfolio Summary

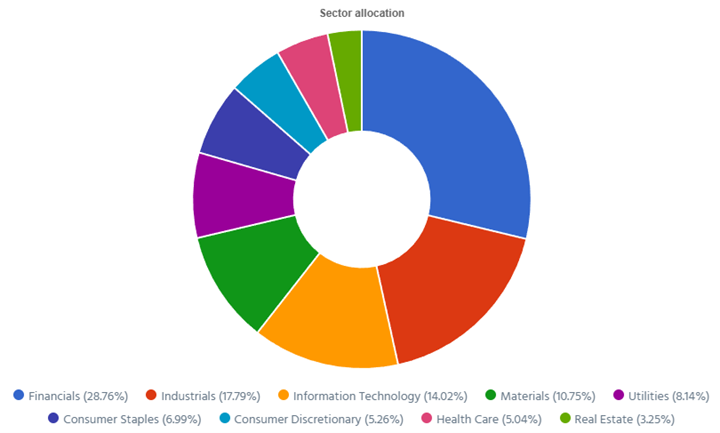

Here’s my SM portfolio summary as of January 5th, 2026 (before the bell).

$1,000 per month starting in January

I will start 2026 by adding $1,000 to some of my smallest positions. For example, I added $1,000 in Great West (GWO) with my January contribution.

The point will be to balance the portfolio and then move forward. I also have a few stocks in mind to add next year!

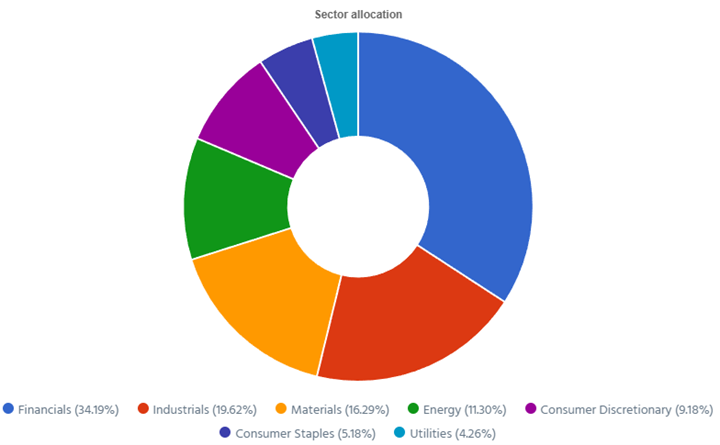

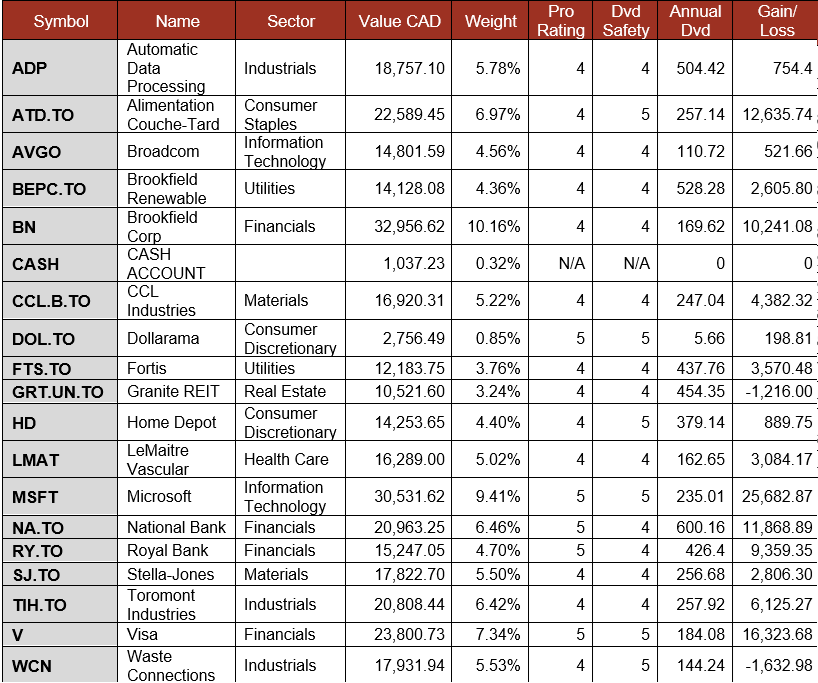

Pension Portfolio Summary

Here’s my pension plan portfolio summary as of January 5th, 2026 (before the bell).

Total value: $324,300.60. $323,127.52 (+$1,173.08, +3.6% from last month).

My Entire Portfolio Updated for Q3 2025

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of January 5th, 2026.

Download my portfolio Q4 2025 report.

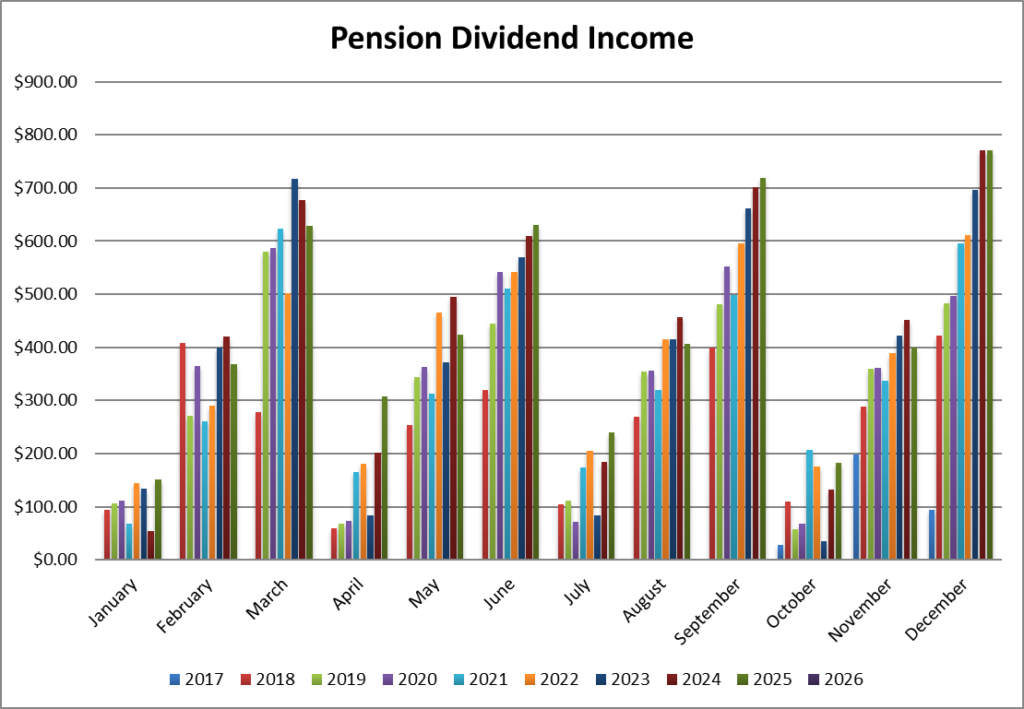

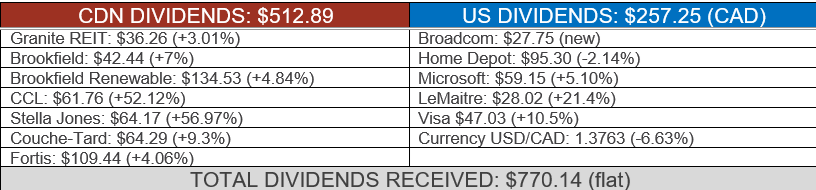

Dividend Income: $770.14 (FLAT VS. DECEMBER 2024)

My dividend payment is flat year over year mostly due to a currency USD/CAD decrease of 6.6%. All my stocks paid a higher dividend vs last year.

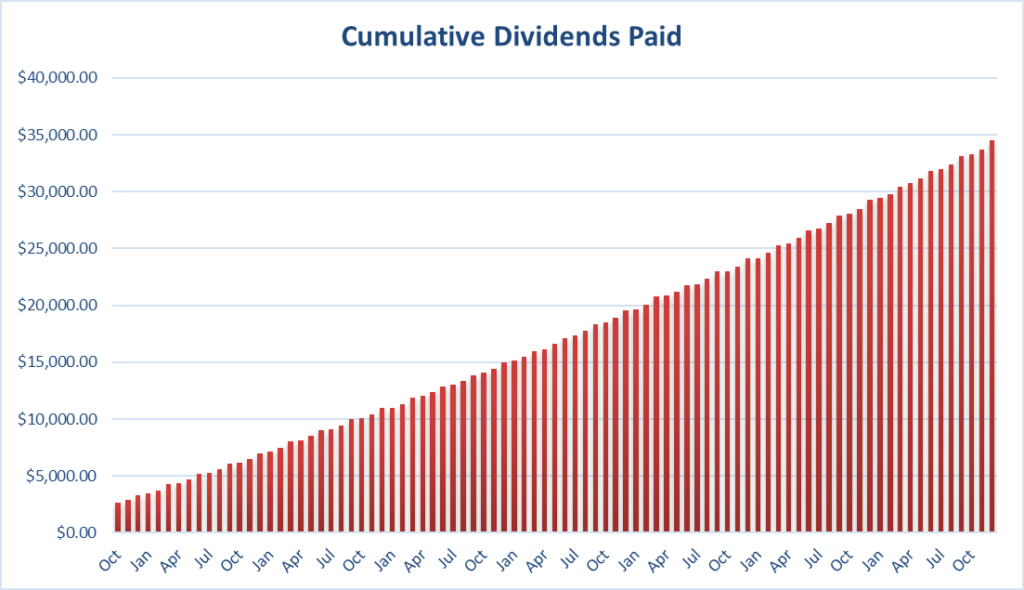

Since I started this portfolio in September 2017, I have received a total of $34,439.59 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

I’m starting strong in 2026 with the increase of my monthly contribution to my Smith Manoeuvre account. I already have over $1,000 in cash in my pension account, thanks to several dividend payments. I’ll be looking to buy more income-producing assets in January!

Cheers,

Mike.

Leave a Reply