Even the best retirement plan has cracks. Here’s how to spot them before they become costly.

“Everyone has a plan until they get punched in the mouth.”

— Mike Tyson

It’s a quote that applies to more than just boxing. It’s also the reality of retirement planning.

You can have a spreadsheet, a strategy, and all the confidence in the world—until life delivers an unexpected hit. A spike in inflation. A roof repair. An adult child needing financial help. Suddenly, your neat numbers don’t look quite so neat anymore.

But that doesn’t mean your plan is broken. It just means it’s alive. Like any living thing, it needs checkups, care, and the occasional adjustment to stay healthy. Here’s how to find the weak spots in your plan before they become real problems.

When the Market Punches Back

The fear of outliving your money is one of the biggest concerns for retirees. You’ve worked for decades, and the last thing you want is to wake up at 82—healthy, but broke.

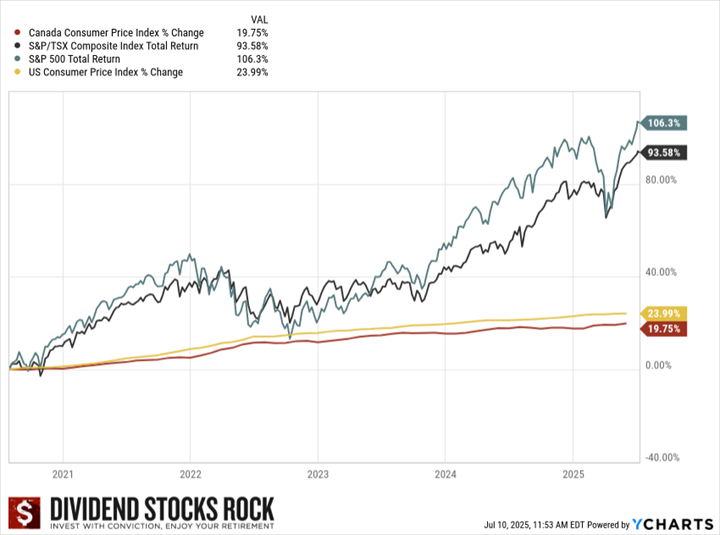

Market fluctuations, inflation, and over-optimistic assumptions can all threaten that security. Changing your expected return by just 1%—up or down—can dramatically alter the outcome of a 20-year plan.

Many investors err on the side of caution, choosing conservative assumptions to “be safe.” But that can go too far. If you’re too conservative, you might leave experiences—and joy—on the table.

Instead, think in terms of flexibility. Build an agile budget that adjusts with the markets:

- Spend a little more when your portfolio outperforms.

- Tighten up slightly after a tough year.

This dynamic approach keeps your plan resilient without forcing you to live in fear of every downturn.

And speaking of downturns—it’s not “if,” it’s when. Bear markets are part of investing, and you can expect several during your retirement. The key is to prepare, not panic.

Holding a cash wedge—a few years of spending money in high-interest savings or short-term bonds—lets you ride out the storm without selling investments at a loss. Meanwhile, a clear, consistent investment strategy gives your plan structure you can actually stick to.

The market will punch back from time to time. The question is whether your plan can absorb the hit—and keep moving forward.

Living Longer Than You Planned

When I started building retirement plans 15 years ago, most people assumed they’d live into their early 90s. Now, planning to live to 100 doesn’t seem far-fetched. And that’s great news—if your plan can handle it.

Longevity is a wonderful gift, but it’s also a risk. You might need your portfolio to last longer than you ever imagined, or you could face higher healthcare costs later in life.

Think of it this way: your retirement budget probably won’t shrink much between age 75 and 89—it’ll just shift. The “fun money” that once went to travel and dining will eventually go toward healthcare and support.

You can prepare for this by slightly adjusting your spending assumptions over time, or by setting aside a healthcare reserve for future needs.

Another often-overlooked risk is cognitive decline. Even if you manage your own portfolio today, it’s worth simplifying your investments so your spouse or family could easily step in later. Products like all-in-one ETFs or simple, rules-based portfolios can make that transition far smoother.

Finally, there’s survivor risk—what happens if one spouse passes earlier than expected? Review any pension or annuity benefits to see what continues after death. Some plans reduce or stop entirely, which could leave a serious income gap. Planning for that now can spare a lot of stress later.

Longevity isn’t a problem to fear—it’s a factor to plan for. A flexible, transparent retirement plan helps you enjoy those extra years rather than worry about them.

The Spending Curve You Can Control

The markets, inflation, and your lifespan are all somewhat unpredictable. But there’s one thing you can control: how you spend.

Many retirees struggle to find the right balance between enjoying life now and preserving assets for later. Some underspend because they fear running out of money. Others spend too freely in the early years and feel the pinch later.

One useful mindset is the “die with zero” approach. The goal isn’t reckless spending—it’s intentional living. Use your healthiest, most active years to make memories and enjoy the fruits of your hard work, while still keeping an agile budget that adjusts to market returns.

You can also anticipate unexpected expenses. Roof repairs, car replacements, or helping adult children—these things happen. Building a small emergency fund outside your main portfolio can protect your long-term plan from short-term surprises.

And when it comes to family support, think about when your help will have the biggest impact. Sometimes, giving your children or grandchildren financial help earlier—when they’re building their lives—can be more meaningful than leaving a large inheritance decades later.

The key is always the same: be intentional. Whether it’s spending, gifting, or saving, make decisions that align with your priorities instead of reacting to fear or guilt.

The Bottom Line

No retirement plan is perfect, because no life is perfect. Markets crash. Health changes. Plans evolve.

But that’s exactly why your plan should be flexible. You can’t predict every punch life throws—but you can make sure you stay standing after each one.

Retirement planning isn’t about perfection. It’s about resilience, clarity, and the confidence that you can handle whatever comes next.

Watch the Replay: 6 Retirement Upgrades That Will Make Your Plan Bulletproof

Want to go deeper? Watch the Retirement Loop Webinar Replay: 6 Retirement Upgrades That Will Make Your Plan Bulletproof.

Learn how to refine your strategy, adjust for surprises, and strengthen your plan so it lasts as long as you do.

Leave a Reply