In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and drove to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built this portfolio publicly since 2017 to make a real-life case study. I decided to invest 100% of this money in dividend growth stocks.

In August 2017, I received $108,760.02 in a locked retirement account. This means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to tell you to follow my lead. I just want to share how I manage my portfolio monthly with all the good and the bad. I hope you can learn from my experience.

Avoiding Stock Price

Over the years, many members have sent me emails on the day their stock dropped by 10% or more. They typically ask me why the stock suddenly crashed. It could have been related to bad news, revised guidance, a DOJ lawsuit, etc.

I was more than once surprised to not know about the event before researching it, even when it was a stock I owned!

I’ll explain to you why later on in this article, but let’s first look at the results.

Performance in Review

Let’s start with the numbers as of September 1st, 2025 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $314,694.70

- Dividends paid: $5,211.00 (TTM)

- Average yield: 1.66%

- 2024 performance: +26.00%

- VFV.TO= +35.24%, XIU.TO = +20.72%

- Dividend growth: +12.22%

Total return since inception (Sep 2017 – September 2025): 189.35%

Annualized return (since September 2017 – 94 months): 14.53%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 16.08% (total return 221.50%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 11.97% (total return 142.50%)

I Don’t Look at My Stock Prices (!?!)

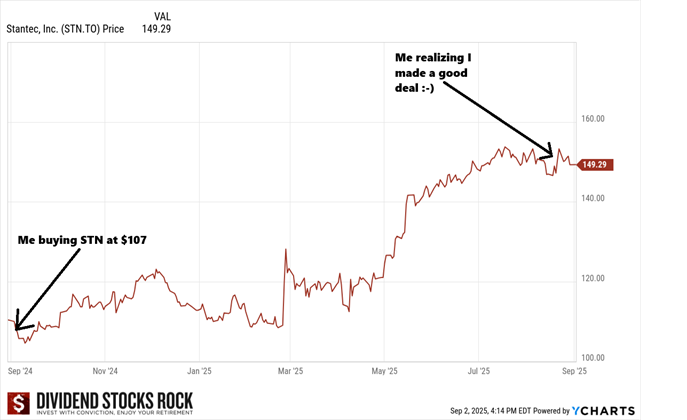

This summer, John, a PRO member, asked me how I decided to add Stantec (STN.TO) to my portfolio in September of last year at a price close to “perfection.”

When I looked at the stock price on that day, I realized it had risen by more than 30%, and I had purchased my shares at almost their lowest price over the past 12 months. Before that email from John…

I had not noticed the price I paid for the stock, and I had not noticed the current price either!

Avoiding stock price & stock return monitoring makes me a better investor

You already know that I don’t give much attention to the stock price of a company I want to buy. After completing my analysis, I will look at the average dividend yield and PE ratio over the past 5 years vs. the current metrics. But besides that, I don’t do technical analysis nor wait to buy at a “better price”.

I’ve always believed that the “best price” is whatever the price is “today”. After 22 years of investing, I could say that this belief has served me well most of the time!

This reflex cuts through the paralysis by analysis like a knife into a mango in Costa Rica. It makes my investment process straightforward and easier to execute.

But I realize that I don’t look at “today’s price” when I buy pretty much all the time!

Over the years, many members have sent me emails on the day their stock dropped by 10% or more. They typically ask me why the stock suddenly crashed. It could have been related to bad news, reviewed guidance, DOJ lawsuit, etc.

I was more than once surprised to not know about the event before researching it even when it was a stock I owned!

Is it because I’m not on top of things?

Quite the opposite.

I miss most big movements because I don’t stare at the daily fluctuation. However, I still monitor my portfolio quarterly with great attention.

Therefore, I avoid acting on emotions (the day you lose $5,000 on a stock is not the day you want to decide to act on those emotions).

I also cut through the noise, as short-term fluctuations don’t affect my mindset. You would be surprised to count the number of times some stocks go up or down by 10% in a year! Just for fun, Stantec moved by more than 10% over a few months (from peak to bottom or vice versa) 4 times in the past 12 months!

I can make decisions based on financial metrics and my investment thesis, as opposed to giving too much weight to short-term price volatility.

Plus, let’s be honest, once the stock is down 10%, it’s a bit late to react anyway! I can’t trade faster than BlackRock.

What I do instead of looking at the stock price

You probably know I’m a soccer coach in my free time. In soccer, you have eleven players on the field. If each of them plays their role, you’ll have a good game. Sometimes, your star player will underperform (or get injured!), but other players often stand up and compensate.

Will I be disappointed if my top scorer gets a yellow card and misses two empty nets in a game that we win 3-2? No, because other players have no doubt taken over and compensated.

As I report my pension plan monthly, you can be assured that I’m aware of whether my portfolio is doing well or not. However, I spend little to no time on individual positions. I’d rather look at my total portfolio performance instead of individual stock performance.

My portfolio is a team, and while some players let me down occasionally, the core will always make me smile over the course of the season.

I will look at my stock price performance briefly with my PRO report and then do a full review (including stock price performance) at the end of the year.

This process enables me to be more “stoic” in facing my portfolio. Most of the time, we make mistakes because our emotions drive our decisions. Not looking at the stock price is effectively protecting me from the noise ?.

Smith Manoeuvre Update

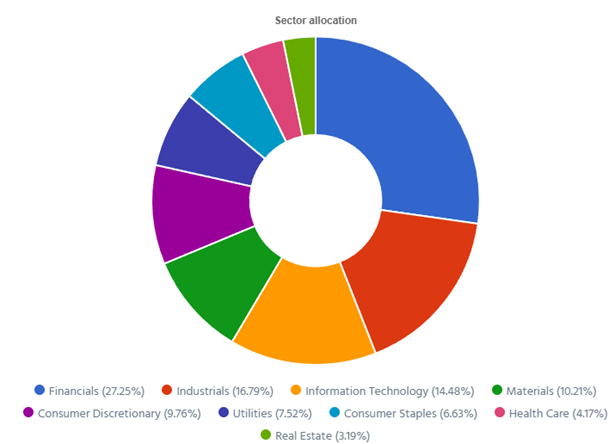

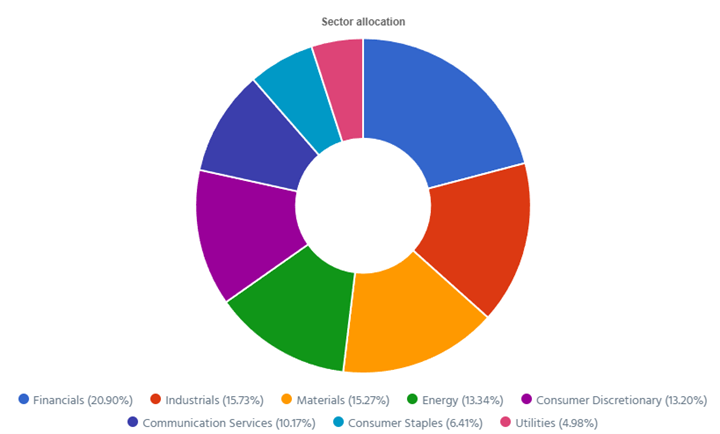

Slowly but surely, the portfolio is taking shape with 14 companies spread across 8 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 3.03% with a 5-year CAGR dividend growth rate of 10.92%.

- The portfolio value is now at $23,990.76

- The portfolio debt is at $19,750.

- The annual income is $728.04

- To report my Smith Manoeuvre, I export the Excel data from my DSR PRO dashboard.

Smith Manoeuvre Portfolio Summary

Here’s my SM portfolio summary as of September 1st , 2025 (before the bell):

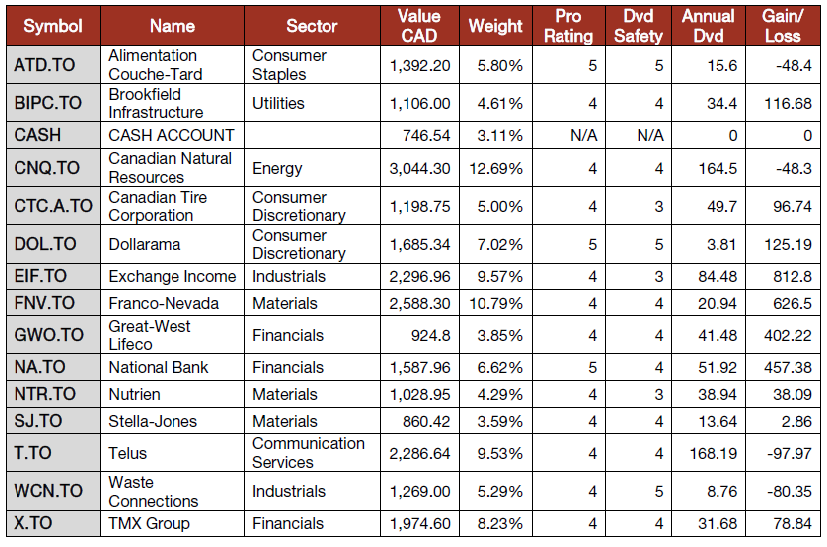

Adding more shares of Great-West Lifeco (GWO.TO)

Great-West was among the first companies I added to my portfolio when I started the SM portfolio. This purchase will give it a little boost to be up to par with other positions. I’m trying to maintain a portfolio that is as equally weighted as possible.

My friend Nelson and I covered Canadian insurance companies’ stocks (including GWO.TO) in a recent Moose on the Loose Podcast. Listen below:

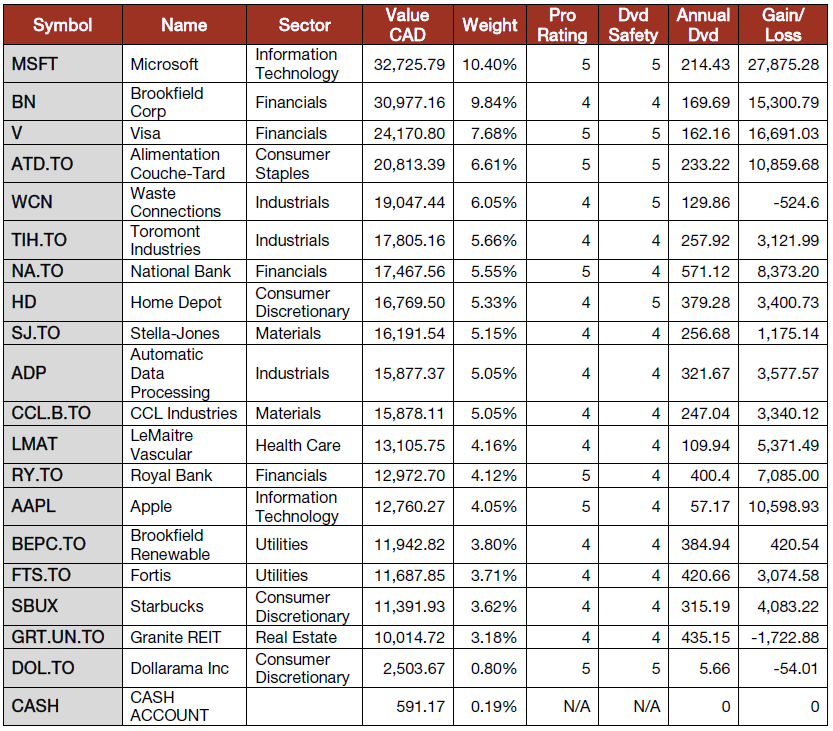

Pension Portfolio Summary

Here’s my pension plan portfolio summary as of September 1st, 2025 (before the bell):

Total value: $314,694.70 (+$4,459.85 or +1.44% from last month).

There were still some companies reporting earnings in August.

Alimentation Couche-Tard’s fuel tank is running low.

Alimentation Couche-Tard reported a weak quarter. Revenue was down 5%, but EPS fell 6%. Sales were hurt by weak fuel revenue while same-store merchandise revenues increased by 0.4% in the U.S., 3.8% in Europe and other regions, and 4.1% in Canada. The decrease in adjusted EPS is primarily driven by lower road transportation fuel gross margins in the United States, the impacts of inflation on operating expenses and of strategic investments on depreciation. During the quarter, ATD closed the acquisition of 270 company-owned and operated convenience retail and fuel sites operating under the GetGo Café + Market (“GetGo”). At least, the 7-eleven saga is finally over.

Read the full ATD.TO stock analysis here:

National Bank did great… but investors didn’t like it

National Bank reported another strong quarter with revenue up 21% and adjusted EPS up 15%. The Personal & Commercial Segment was up 5%, fueled by the acquisition of CWB but partially offset by lower interest margins and higher PCLs. The Wealth Segment was up 12% on higher fees. The Capital Markets Segment was +5%, driven by corporate and investment banking revenues, while the U.S. & International Segment was up 13% on higher revenue and lower PCLs (lower for Credigy, partially offset by higher at ABA bank). PCLs increased by 36% to $203M for the quarter and by 146% to $1B for the first 9 months of the year.

Home Depot has built better quarters in the past

Home Depot reported an okay quarter with revenue up 5% and EPS up 2%. Company comparable sales increased 1% with the U.S. up 1.4%, where the average ticket rose about 1.4% while comparable transactions declined 0.4%, and foreign exchange reduced total company comparables by roughly 40 basis points. Management said momentum in smaller home improvement projects continued in the first half, which, alongside modestly positive comps, was the key top-line driver for this quarter. Adjusted operating margin was 14.8% versus 15.3%, reflecting higher SG&A. For 2025, Home Depot still expects approximately 2.8% total sales growth, and about 1.0% comparable sales growth.

CCL Industries labelled more revenue

CCL Industries reported a good quarter with revenue up 5% and EPS up 8%. Growth was a mix of organic (2%), acquisitions (1%) and a 1.8% positive FX impact. By segment, CCL was up 7.9%, Avery was down 3.9%, Checkpoint was up 4.6% and Innovia was down 0.7%. Growth was broadest at the CCL segment, which delivered 4.7% organic sales growth, while Checkpoint rose on MAS product strength. Avery declined on softer back-to-school shipments and tariff costs, and Innovia was essentially flat overall amid stronger Americas results offset by European start-up costs. Profitability improved with operating income up 6.1%, aided by strong contributions from CCL, Checkpoint and Innovia.

Complete stock review is available here:

Royal Bank is the king of banks

Royal Bank reported a robust quarter with revenue up 16% and EPS up 18%. By segment: Personal banking was up 22% on higher revenue and interest margins. Commercial banking was up 2% as revenue growth was partially offset by higher PCLs. Wealth was up 15% on higher fees due to growing AUM. Insurance was up 45%, due to improved life insurance claims experience. Capital Markets increased 13% on higher revenue in Global Markets and Corporate & Investment Banking. Total PCLs increased $222M (+34%) to $881M, primarily due to higher provisions in Capital Markets, Commercial Banking and Personal Banking. PCLs have increased 40% in the first 9 months of 2025 vs. 2024.

I have covered the Canadian banks’ Q3-2025 quarter in the video below:

Dollarama isn’t selling cheap

Dollarama reported another solid quarter with revenue up 10% and EPS up 14%. Comparable store sales in Canada for the second quarter of fiscal 2026 increased by 4.9%, consisting of a 3.9% increase in the number of transactions and a 0.9% increase in average transaction size. The company has also completed the acquisition of The Reject Shop (395 stores in Australia) which will contribute to growth moving forward. Management won’t provide comps for Australia while they optimize operations. Share of Dollarcity net earnings rose to $38.3M for the April-June 2025 period with strong operations and store growth from 658 locations; the first Dollarcity store in Mexico opened recently.

My Entire Portfolio Updated for Q3 2025

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of September 10th, 2025.

Download my portfolio Q3 2025 report.

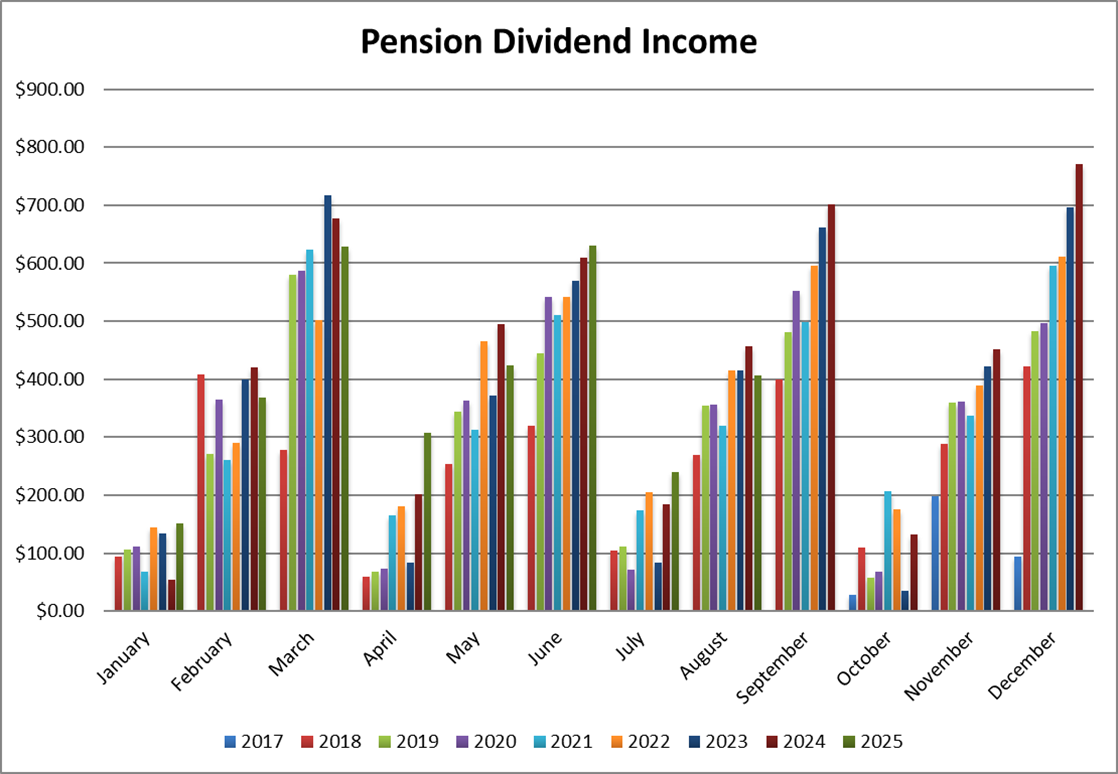

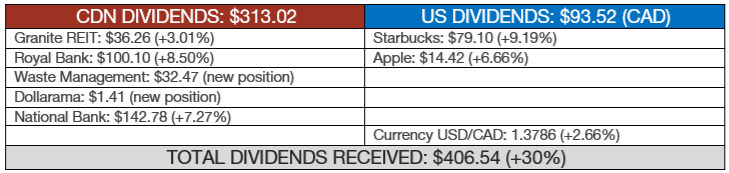

Dividend Income: $406.54 (-10.86% vs August 2024)

August is down 11% vs. last year mostly related to the sale of my shares in Texas Instruments that paid a $65 USD dividend last year. Most of my holdings are now showing mid-single digit dividend increases vs. last year.

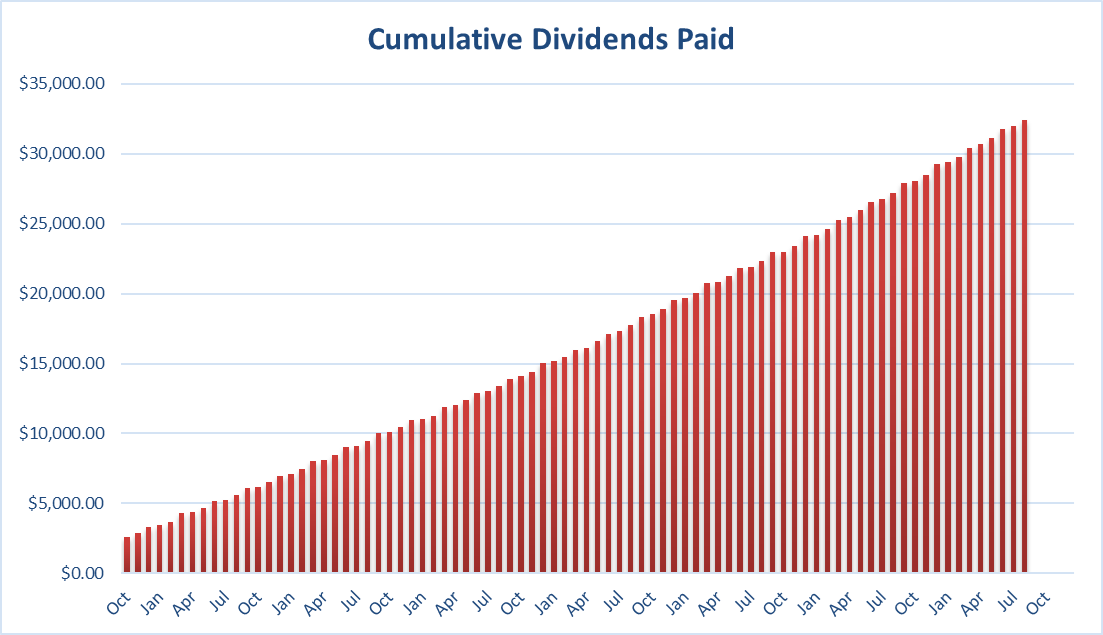

Since I started this portfolio in September 2017, I have received a total of $32,421.17 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

The month of September will include several dividend payments. I should have enough cash (over $1,000) to add to my position in Dollarama (DOL.TO). I don’t expect doing any other transactions for my pension account, but I’m thinking of selling my position in Canadian Tire to increase DOL.TO in my Smith Manoeuvre account. As I already mentioned in a previous update, my goal is to build a full position in DOL.TO (roughly 3% of all my portfolios). Slowly but surely!

In the meantime, I stay fully invested.

Cheers,

Mike.

Leave a Reply