In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and drove to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built this portfolio publicly since 2017 to make a real-life case study. I decided to invest 100% of this money in dividend growth stocks.

In August 2017, I received $108,760.02 in a locked retirement account. This means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to tell you to follow my lead. I just want to share how I manage my portfolio monthly with all the good and the bad. I hope you can learn from my experience.

After using the SM for over two years, I have given my strategy more thought and will apply a few modifications.

Performance in Review

Let’s start with the numbers as of November 4th, 2024 (in the morning):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $289,129.68

- Dividends paid: $5,050.36 (TTM)

- Average yield: 1.75%

- 2023 performance: +20.69%

- SPY= +26.19%, XIU.TO = +11.87%

- Dividend growth: +1.7%

Total return since inception (Sep 2017 – November 2024): 165.84%

Annualized return (since September 2017 – 85 months): 14.80%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 14.44% (total return 160.00%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 10.48% (total return 102.60%)

What’s Mike’s Portfolio

In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and drove to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built and managed this portfolio publicly since 2017 to make a real-life case study.

In August 2017, I received $108,760.02 in a locked retirement account. This means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to tell you to follow my lead. I just want to share with our members how I manage my portfolio with all the good and the bad that inevitably occur each month. I hope you will learn from my experiences.

More Thoughts on the Smith Manoeuvre

Those who have followed me for a while know I started withdrawing $500 monthly from my HELOC (Home Equity Line of Credit) to invest in the stock market. The idea is to use leverage to boost my investment returns over the long haul.

The principal behind leverage is to invest at a higher expected return than the interest you pay. For example, if you expect to generate a 7% return on your investment (don’t be greedy) and pay a 5% interest rate on the loan, you create a spread (7% – 5%) of 2%. That 2% compounds for several years; eventually, your investment portfolio is much larger than your loan.

You can also deduct the amount paid for the interest from your income (if you are in Canada). Still, the rules are a bit different in Quebec, where I can only deduct the interest paid from the portfolio’s income.

Since my Smith Manoeuvre strategy began, I have focused on creating a portfolio that would generate about 4% to 5% yield. However, you know very well that I prefer to focus on quality companies showing a strong dividend triangle (revenue, EPS, and dividend growth trends).

The yield is secondary to me as I believe investing in thriving companies is a better strategy than investing in mature and struggling ones (why do you think a company offers a yield above 5%? It’s not out of generosity!).

I started the SM in March 2022, but I had to pause the withdrawals between August 2022 and February 2023 as I needed to stabilize my financial situation after spending too much time and money traveling!

After using the SM for over two years, I have given my strategy more thought and will apply a few modifications.

The number 1 reason for doing the SM

It may surprise you, but I don’t have the leverage to make more money. Yes, it’s the goal, but I started the SM strategy to increase my savings rate. When I came back from my sabbatical year in 2017, I had to rationalize my budget as most of my money was directed toward Dividend Stocks Rock.

To this date, it’s the best-performing investment I’ve ever made. However, this also means that I haven’t invested new capital in my other accounts since 2017.

Starting to withdraw $500 monthly from my HELOC was a great way to force me to pay an additional $6,000 annually in capital on my debt to transfer it into my brokerage account. To this day, I have invested $13,000 from my HELOC.

Knowing me, I would have simply paid the interest on my debt and reinvested that $13K in DSR if I wasn’t doing the SM. While investing in a business is a smart move (most of the time), it’s also important to “pay yourself first” and put money to work outside the business in case it does not meet expectations.

As you can see, even as an entrepreneur, diversification is key!

Where’s my portfolio standing now?

Before making my changes in October, my SM was doing well, but it wasn’t exactly tied to my investment strategy. I made a compromise to increase my dividend yield so that I could deduct the interest I paid.

Still, it went well, as the market has been on fire since early 2023. I have a few small losers (Nutrien, Telus, Canadian Tire). From this short list, I would have only bought Telus if it was not for the yield. On the other hand, I’m making a very strong return on Great-West Lifeco, Capital Power, National Bank, and Exchange Income Form.

I also made a good short-term trade by buying Canadian Western Bank after the acquisition announcement.

Overall, the SM has been a success on both sides so far:

- I’ve restarted to add capital periodically to my investment portfolio.

- The portfolio performance has done better than the interest I’m paying on the loan.

Please note that short-term performance doesn’t mean much. Two to three years is not enough to say if a strategy works or not. I’m on this journey for decades to come, so I’m not going to get too excited about short-term results.

So, what’s the problem?

The problem is that I’m uncomfortable looking at some of my positions. I’m not a fan of buying companies that are “okay” to get a higher yield. I keep saying that one should not put tax optimization first as it becomes a tax obsession instead. I prefer to focus on my strategy and then optimize for taxes.

It’s not the end of the world right now since this account isn’t that big. I still see this as “play money” that won’t significantly impact my financial goals or retirement. However, I must consider what will happen when this account grows to be $50,000 or $100,000 or more.

Therefore, I must change a few items to make it look like the rest of my portfolio.

I’m changing the rules

I will still invest $500 per month in my portfolio and report my SM monthly update. However, I will gradually sell companies without a strong dividend triangle and focus on quality moving forward.

This means my portfolio yield will likely decrease and be lower than what I pay in interest. However, as interest rates are also decreasing, I expect the difference won’t be terrible.

I’m modifying my strategy to be more consistent with the rest of my portfolio and because I believe in investing in thriving businesses. If it means I’ll generate more capital gains and less in dividends, I’m happy to do so as long as the total return is increased.

3 trades this month

I sold my investment in Canadian Western Bank (CWB.TO) within a few months, as the “easy money” was made. I didn’t intend to keep this one that long anyway.

I then bought 20 shares of Alimentation Couche-Tard (ATD.TO) and 6 shares of Franco-Nevada (FNV.TO). Both companies have a low yield, but they also offer great upside opportunities.

ATD has been hurt by the last 3 quarters and the chatter around the acquisition of 7-Eleven. This story creates much distraction, which is usually good when looking for an entry point.

I have shared my thoughts on ATD latest quarter in the short episode below:

As for FNV, the company took a big hit since the closure of the Cobre Panama mine. However, there is great interest in gold these days, and FNV will continue to receive generous royalty payments from other mines. There is a good chance the Cobre Panama mine will reopen at one point as it is a major economic actor for the country. I’m taking a guess on this one, but that’s also the purpose of doing leverage: if you don’t take risks, the returns won’t be good enough.

Again, remember it’s a small account, and I have a very high risk tolerance. Leveraging is not for everyone.

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 12 companies spread across 8 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 4.14% with a 5-year CAGR dividend growth rate of 9.08%.

Here’s my SM portfolio as of November 4th, 2024 (in the morning):

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.TO | Consumer Staple | $1,456.90 |

| Brookfield Infrastructure | BIPC.TO | Utilities | $1,143.00 |

| Canadian National Resources | CNQ.TO | Energy | $1,731.96 |

| Capital Power | CPX.TO | Utilities | $1,597.76 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $1,057.07 |

| Exchange Income | EIF.TO | Industrials | $1,749.12 |

| Franco-Nevada | FNV.TO | Materials | 1,101.00 |

| Great-West Lifeco | GWO.TO | Financials | $800.53 |

| National Bank | NA.TO | Financials | $1,455.96 |

| Nutrien | NTR.TO | Materials | $921.57 |

| Telus | T.TO | Communications | $1,336.82 |

| TD Bank | TD.TO | Financials | $1,069.46 |

| Cash (Margin) | -$125.67 | ||

| Total | $15,295.48 | ||

| Amount borrowed | -$13,000.00 |

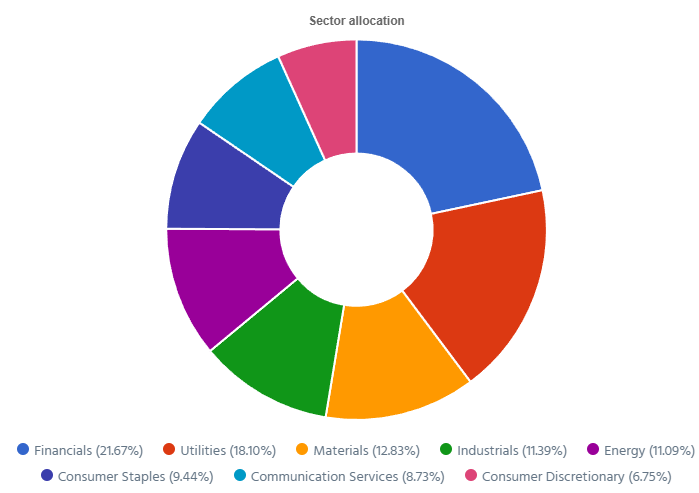

Let’s look at my CDN portfolio. Numbers are as of November 4th, 2024 (in the morning):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.TO | Cons. Staples | $21,752.25 |

| Brookfield Renewable | BEPC.TO | Utilities | $11,078.52 |

| CCL Industries | CCL.B.TO | Materials | $11,394.60 |

| Fortis | FTS.TO | Utilities | $10,107.81 |

| Granite REIT | GRT.UN.TO | Real Estate | $9,603.84 |

| National Bank | NA.TO | Financials | $15,974.42 |

| Royal Bank | RY.TO | Financial | $11,025.95 |

| Stella Jones | SJ.TO | Materials | $12,775.00 |

| Toromont Industries | TIH.TO | Industrials | $7,8776.48 |

| Cash | $259.84 | ||

| Total | $111,848.71 |

My account shows a variation of -$184.65 (-0.2%) since October’s income report.

I used my USD and CAD cash to buy more of Toromont Industries (TIH.TO). On October 10th, I bought 17 shares at $131.91.

We will focus on this part today since there are many results on the U.S. side.

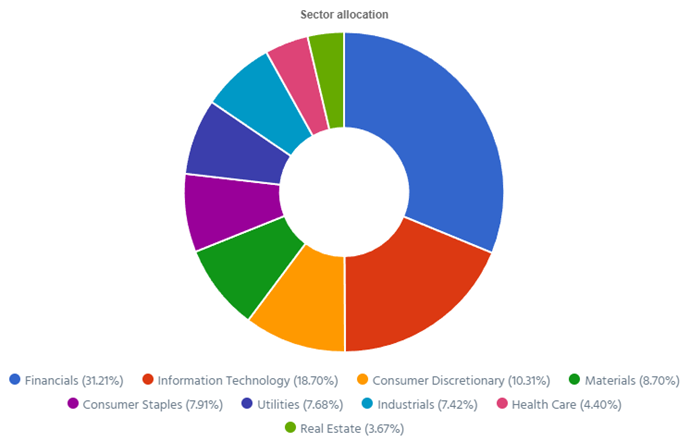

Here’s my US portfolio now. Numbers are as of November 4th, 2024 (in the morning):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $8,871.86 |

| Automatic Data Processing | ADP | Industrials | $11,020.95 |

| BlackRock | BLK | Financials | $13,764.80 |

| Brookfield Corp. | BN | Financials | $18,628.33 |

| Home Depot | HD | Cons. Discret. | $11,914.20 |

| LeMaitre Vascular | LMAT | Healthcare | $9,674.00 |

| Microsoft | MSFT | Inf. Technology | $19,225.82 |

| Starbucks | SBUX | Cons. Discret. | $9,167.82 |

| Texas Instruments | TXN | Inf. Technology | $10,218.25 |

| Visa | V | Financials | $14,596.75 |

| Cash | $0.35 | ||

| Total | $127,083.13 |

My account shows a variation of +$674.92 (+0.5%) since October’s income report.

Apple’s iPhones are still as popular as candies at Halloween!

Apple reported a good quarter, with revenue up 6% and EPS up 12%. This growth was led by strong iPhone sales, which reached new highs in the September quarter, and an all-time record in Services revenue at $25 billion. The iPhone 15 series played a crucial role in revenue, especially with new carbon-neutral Apple Watch models, further bolstering demand. Gross margins reached 46%, reflecting Apple’s effective cost management amid a challenging macroeconomic environment. For the holiday quarter, Apple expects revenue to grow similarly, with strong demand in Services projected to continue.

Automatic Data Processing shows a perfect dividend triangle

Automatic Data Processing reported another solid quarter with revenue up 7% and EPS up 12%, beating the analysts’ expectations. The growth was driven by both its Employer Services which was up 7% to $3.26 billion, and its Professional Employer Organization (PEO) Services also rising 7% to $1.57 billion, highlighting strong demand across ADP’s core services?. The EPS growth reflects ADP’s effective cost management and revenue retention, which also supported a 13% rise in adjusted EBIT to $1.23 billion and an increase in EBIT margin by 130 basis points to 25.5%.

In this video, I use ADP as an example of the importance of the dividend triangle and business growth in general.

BlackRock has reached a record $ 11.5 trillion in assets under management!

BlackRock reported a good quarter with revenue up 15% and EPS up 5%which beat the analysts’ expectations. Revenue growth was driven by favorable market conditions, organic base fee growth, and higher performance fees. The company’s total assets under management (AUM) reached a record $11.5 trillion, up $2.4 trillion from the prior year, benefiting from $456 billion in net inflows and positive market movements. This includes record quarterly net inflows of $221 billion, marking 8% annualized organic growth across various client and product segments.

LeMaitre Vascular is killing it!

LeMaitre Vascular reported another impressive quarter with revenue up 16% and EPS surged by 49%. The revenue growth was driven by strong sales across its vascular product lines, particularly in grafts, patches, and carotid shunts with notable regional performance increases of 24% in Asia-Pacific, 22% in EMEA, and 12% in the Americas?. The EPS jump was driven by increased sales volume and a gross margin improvement to 67.8%, driven by price adjustments and manufacturing efficiencies. The company also reported an increase in cash reserves by $10.8M which reached a total of $123.9M (LMAT has zero debt).

Microsoft disappoints with Azure’s 30%+ growth

Microsoft is not slowing down with revenue up 16% and EPS up 10%, beating analysts’ expectations. Revenue growth was led by strong performance in its cloud and productivity segments, including Azure and Dynamics 365, and increased Microsoft 365 subscriptions. This quarter saw robust adoption of AI-enhanced products, particularly across Azure and Microsoft 365. Ironically, the company was disappointed with Azure’s growth outlook for the next quarter, which is expected to be 31% to 32% in constant currency. The main focus will continue to be AI and cloud. MSFT also increased its dividend by 10%!

Starbucks is in transition

Starbucks reported a disappointing quarter as revenue declined 3% and EPS dropped 25%. The decline reflects challenges in both their North American and Chinese markets, where U.S. comparable store sales dropped 6%, mainly due to a 10% reduction in transaction volumes despite a 4% increase in average ticket size. In China, comparable store sales fell 14% with both lower average ticket and transaction counts. Cost pressures and slower sales in key markets impacted the EPS explaining a further drop. So, SBUX is working on a new plan; “Back to Starbucks”, designed to revitalize customer engagement and streamline operations?.

Texas Instruments is weakening

Texas Instruments reported another weak quarter (revenue down 8% and EPS down 22%). The downturn in revenue was largely attributed to weaker demand in the consumer electronics sector, particularly impacting the Embedded Processing segment, while automotive and industrial applications provided some stabilization. At DSR, we have downgraded TXN to a PRO rating of 3. The dividend triangle has been weakening since 2022, but the stock price is trading on strong momentum. We don’t see much growth potential in 2025 and the company seems to trade at a higher PE ratio than usual. The financial metrics don’t seem to follow the stock price trend.

Visa is the double-digit stock!

Visa reported another killer quarter with revenue up 12% and EPS up 16%. Revenue growth was driven by strong consumer spending and a continued rebound in cross-border transactions. With processed transaction volumes up 9% and cross-border volume seeing double-digit growth as international travel demand remained robust?. The EPS performance reflects a combination of higher transaction volumes and operational efficiencies. Net income was notably buoyed by increased payments activity across credit and debit products globally. Visa expects to see ongoing momentum in cross-border and e-commerce volume. The company increased its dividend by 13.5%!

Visa and many other of my holdings were part of our Best 10 Stocks to Buy Now and Hold Forever podcast 2-episode series!

Best 10 Stocks to Buy Now and Hold Forever – Part 1 [Podcast]

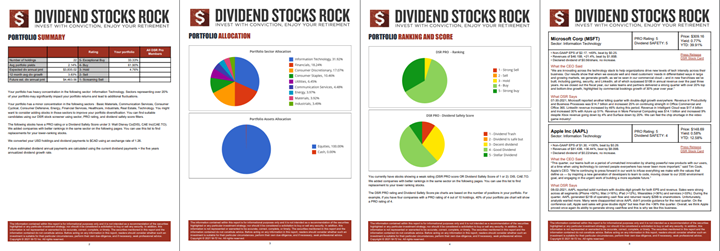

My Entire Portfolio Updated for Q3 2024

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of October 4th, 2024.

Download my portfolio Q3 2024 report.

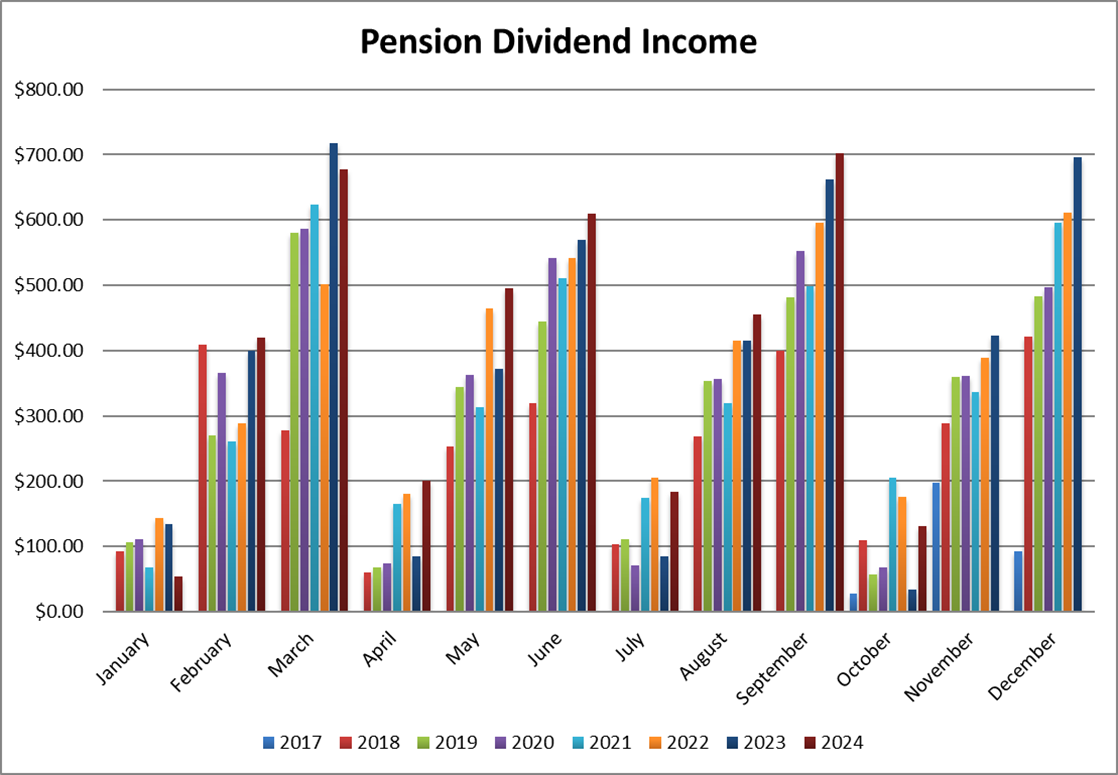

Dividend Income: $131.97 CAD (+286% vs October 2023)

The increase in percentage looks huge but it’s just because I added Toromont Industries and Automatic Data Processing to my portfolio. Before that, it was just a very bad month in term of dividend payments!

This was a very slow month regarding dividends, but I can see my total trailing month (TTM) dividend crossing the $5,000 annual income level! Not bad for a portfolio that started with $108K 7 years ago. ?

Dividend growth over the past 12 months:

- Granite REIT: +3.10%

- Toromont: new

- Automatic Data Processing: new

- Currency: +2.06%

Canadian Holding payouts: $57.76 CAD.

- Granite REIT: $35.20

- Toromont: $22.56

U.S. Holding payouts: $53.20 USD.

- Automatic Data Processing: $53.20

Total payouts: $131.97 CAD.

*I used a USD/CAD conversion rate of 1.395

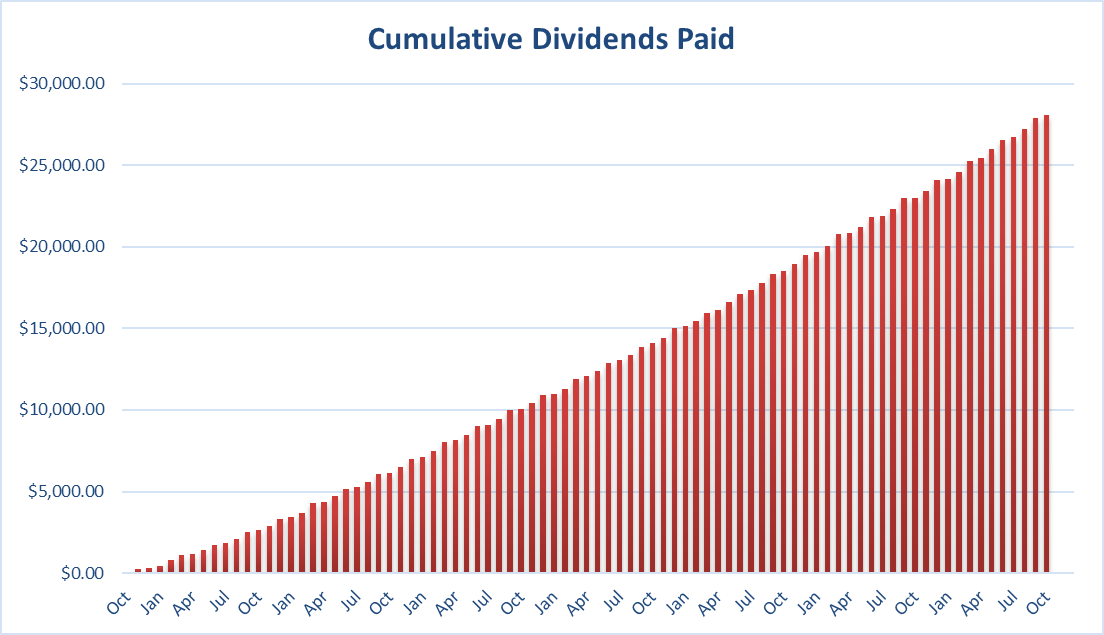

Since I started this portfolio in September 2017, I have received a total of $28,044.90 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

I was disappointed with Texas Instruments’ results. Their dividend triangle has been weakening since 2022. The company is cyclical, and I understand that. However, the stock price kept increasing, and the 2025 guidance isn’t great. In other words, we don’t expect growth in 2025, yet the price keeps going up.

I’m starting to wonder what will happen if we face a recession or a market correction… That’s why TXN was downgraded, and I think it might be a good time to take my gain and move to another stronger dividend grower. This is some food for thought for my year-end portfolio review!

Cheers,

Mike.

Leave a Reply