Can Canadian stocks be better than US ones? It is well-known that the US market offers a broader diversification and a better overall performance. But what happens when you put two companies in the same sector and with similar business models head-to-head? Which market wins? Let’s discover the answer using four stock battles: JPM vs RY, UNP vs CNR.TO, NEE vs BEPC, CASY vs ATD.TO.

Start your stock research on the right foot! Download the FREE Dividend Rock Stars List!

Start your stock research on the right foot! Download the FREE Dividend Rock Stars List!

You’ll Learn

- The oligopoly they evolve in often makes Canadian banks better options than US ones. But let’s see what happens if we put two classics head to head: Royal Bank (RY) vs JP Morgan Chase (JPM). First, let’s describe their business model.

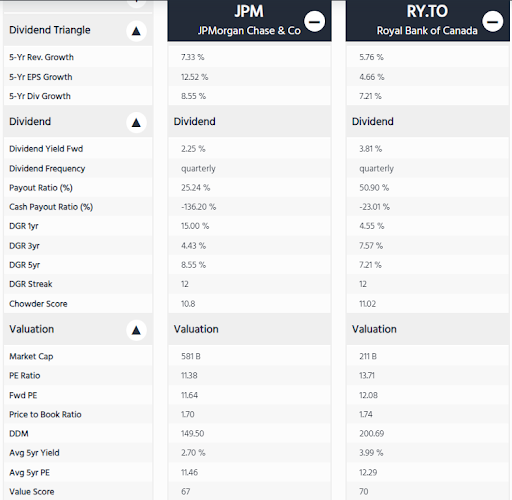

- Looking at the revenue, EPS, and dividend growth metrics for the past 5 years, JPM offers more growth. Do you come to the same conclusion looking at the trends?

- While Royal Bank offers a better yield, JP Morgan has a more stable payout and attractive PE ratio. Does it give JPM an advantage?

- The industrial sector is a good one for finding contenders in both markets. Our next battle is between Canadian National Railway (CNR.TO) and Union Pacific (UNP). Mike starts by describing them.

- There’s not much difference between the yields and the payout ratios. However, CNR’s dividend triangle looks much better than UNP’s, right?

- Lastly, both companies show PE ratios higher than their average, indicating they might be overvalued. So, which one is winning here?

- Moving on to utilities, we will look at two companies with excellent ratings of 4. However, NextEra Energy (NEE) and Brookfield Renewable (BEPC) are not in the same industry. What else describes them?

- It’s hard to conclude when BEP has a stronger revenue trend, but NEE shows better EPS, and both have excellent dividend growth trends. What’s Mike take on this?

- BEP has a very attractive yield for income-seeking investors and seems to show a better entry point than NEE. However, we have to consider debt levels for these capital-intensive businesses. In the end, which is the winner?

- We will put Mike’s beloved and dearest convenience store to the test! Alimentation Couche-Tard (ATD.TO) and Casey’s General Stores (CASY) are fighting for the battle. First, let’s examine the differences between their business models.

- CASY shows higher revenue and EPS growth. Its dividend growth is also very impressive. Is CASY the next ATD.TO?

- What conclusion can you make in terms of risks and valuation? All things considered, is ATD winning the battle?

- Mike ends the episode by summarizing what each market can bring to one’s portfolio and what matters most when comparing stocks.

Related Content

Get access to the most appreciated Stock Comparison Tool with Dividend Stocks Rock!

These 10 Stocks show double-digit dividend triangles, representing amazing dividend growers like Tractor Supplyhttps://thedividendguyblog.com/wp-content/themes/leia-en/imagenes/2024/08/JPM-vs-RY.png (TSCO)!

The Best Dividends to Your Inbox!

Download our Dividend Rock Star List now and do not miss out on the good stuff! Receive our Portfolio Workbook and weekly emails, including our latest podcast episode!

Follow Mike, The Dividend Guy, on:

Have Ideas?

If you have ideas for guests, topics for The Dividend Guy Blog podcast, or simply to say hello, then shoot me an email.

This podcast episode has been provided by Dividend Stocks Rock.

Leave a Reply