In September of 2017, I received slightly over $100K from my former employer, representing the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

Performance in Review

Let’s start with the numbers as of April 5th 2024 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $245,539.73

- Dividends paid: $4,490.67 (TTM)

- Average yield: 1.83%

- 2023 performance: +20.69%

- SPY= +26.19%, XIU.TO = +11.87%

- Dividend growth: +1.7%

Total return since inception (Sep 2017 – April 2024): 125.76%

Annualized return (since September 2017 – 79 months): 13.17%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 13.64% (total return 132.10%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 9.49% (total return 81.67%)

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 10 companies spread across 7 sectors. My goal is to build a portfolio generating 4-5% in yield across 15 positions. I will continue to add new stock monthly until I reach that goal. My current yield is 5.13%.

Doubling down on Telus (T.TO) (adding 23 shares)

The goal of this portfolio is to spice up things a little and make plays on higher yielding stocks.

- I can use the interest paid to reduce my dividend income.

- There are some interesting long-term plays where companies like Telus could get back on track and generate solid returns.

Since Telus is on my buy list, I’m good with eating my own cooking. Watch my recent video about Telus and BCE to get my full analysis.

Here’s my SM portfolio as of April 5th, 2024 (before the bell):

| Company Name | Ticker | Sector | Market Value |

| Brookfield Infrastructure | BIPC.TO | Utilities | $895.00 |

| Canadian National Resources | CNQ.TO | Energy | $1,193.83 |

| Capital Power | CPX.TO | Utilities | $556.05 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $936.95 |

| Exchange Income | EIF.TO | Industrials | $1,542.72 |

| Great-West Lifeco | GWO.TO | Financials | $717.23 |

| National Bank | NA.TO | Financials | $674.82 |

| Nutrien | NTR.TO | Materials | $990.21 |

| Telus | T.TO | Communications | $1,319.74 |

| TD Bank | TD.TO | Financials | $1,134.70 |

| Cash (Margin) | $13.22 | ||

| Total | $9,974.47 | ||

| Amount borrowed | -$9,500.00 |

Let’s look at my CDN portfolio. Numbers are as of April 5th, 2024 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | Cons. Staples | $22,179.82 |

| Brookfield Renewable | BEPC.TO | Utilities | $8,485.62 |

| CCL Industries | CCL.B.TO | Materials | $9,452.80 |

| Fortis | FTS.TO | Utilities | $9,052.80 |

| Granite REIT | GRT.UN.TO | Real Estate | $9,600.00 |

| Magna International | MG.TO | Cons. Discre. | $4,961.60 |

| National Bank | NA.TO | Financials | $13,608.87 |

| Royal Bank | RY.TO | Financial | $8,890.05 |

| Stella Jones | SJ.TO | Materials | 11,700.44 |

| Cash | $906.79 | ||

| Total | $98,838.73 |

My account shows a variation of -$925.73 (-1%) since the last income report on March 1st.

Couche-Tard created a commotion!

It was a rare disappointing quarter for ATD and the stock price dipped by more than 5% on earnings day due to revenue being down 2.2% and EPS was down 12.2%. Total merchandise sales increased slightly by 1.6%, but fuel revenues were down 2.6% mostly driven by weak performances in Canada (-8.3%) and in the U.S. (-7.2%). There is a sign the economy is slowing down. The earnings decrease is primarily driven by lower road transportation fuel gross margins in the U.S. and softness in traffic as a portion of the customers remain impacted by challenging economic conditions. Management’s focus is on their most recent acquisition to generate synergies ASAP.

I’ve shared my thoughts more in depth in this Moose on The Loose Episode:

Here’s my US portfolio now. Numbers are as of April 5th, 2024 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $6,755.60 |

| Automatic Data Processing | ADP | Industrials | $9,176.62 |

| BlackRock | BLK | Financials | $11,089.26 |

| Brookfield Corp. | BN | Financials | $13,754.30 |

| Home Depot | HD | Cons. Discret. | $10,730.40 |

| LeMaitre Vascular | LMAT | Healthcare | $6,377.00 |

| Microsoft | MSFT | Inf. Technology | $19,640.36 |

| Starbucks | SBUX | Cons. Discret. | $7,447.70 |

| Texas Instruments | TXN | Inf. Technology | $8,426.50 |

| Visa | V | Financials | $13,700.00 |

| Cash | $667.63 | ||

| Total | $107,765.37 |

My account shows a variation of -$2,936.13 (-2.65%) since the last income report on March 1st.

There wasn’t much news about this part of the portfolio this quarter. Last month I was up $3K, but this month I’m down $3K. It’s just the market dance ?. I’m making a mental note about BlackRock though. The company has reported two small dividend increases in the past couple of years. If it continues this way, I will have to sell my position and focus on companies with a stronger dividend triangle. I’m not in a hurry, but I’ll keep that in mind for early 2025 (when BLK usually announces its dividend increase).

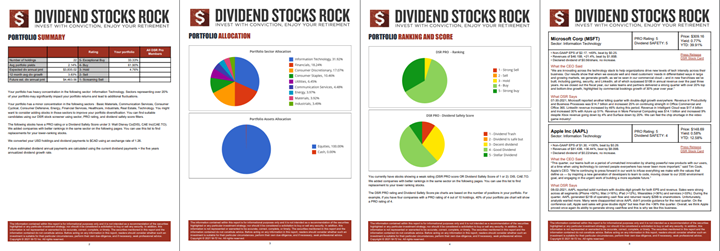

My Entire Portfolio Updated for Q1 2024

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of January 10th, 2024.

Download my portfolio Q1 2024 report.

Dividend Income: $677.05 CAD (-5.6% vs March 2023)

My dividend payout is slightly smaller than last year as I previously held Enbridge, a generous dividend payer. The loss of ENB’s dividend was partially offset by dividend increases along with new dividend payers in my portfolio with stronger dividend triangles, but weaker yields.

Brookfield Corporation, CCL Industries (I literally used ENB’s proceeds to buy CCL) and LeMaitre Vascular are the new dividend payers this quarter.

Dividend growth (over the past 12 months):

- Fortis: +4.4%

- Magna: +0.7%

- Granite: +3.1%

- CCL: new

- BEPC: +19.74% (added more shares)

- Visa: +15.56%

- Microsoft: -5.75% (sold some shares)

- Home Depot: +7.66%

- Blackrock: +2%

- LeMaitre: new

- Brookfield: new

- Currency: +0.0179%

Canadian Holding payouts: $345.17 CAD.

- Fortis: $100.89

- Magna: $44.19

- Granite: $35.20

- CCL: $40.60

- BEPC: $124.29

U.S. Holding payouts: $243.80 USD.

- Visa: $26.00

- Microsoft: $35.25

- Home Depot: $67.50

- Blackrock: $71.40

- LeMaitre: $16.00

- Brookfield: $27.65

Total payouts: $677.05 CAD.

*I used a USD/CAD conversion rate of 1.3613

Since I started this portfolio in September 2017, I have received a total of $25,263.93 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

After doing this monthly update I realize I still have almost $2K in cash to reinvest in my portfolio! While it’s not a big amount, this money must be put to work! I’m getting close to making a decision on Magna International as it’s my smallest position in this portfolio (about 2%). I’ll be considering either selling the position or adding the full $2K to it.

While Magna Intl is an interesting play, there are a few Canadian stocks on my “wish list”. You’ll have to read my next update to find out what I’ll do with this dilemma!

Cheers,

Mike.

I love your willingness to honestly share details with your readers. It is essential food for thought, and so inspiring to see what can be accomplished with a dividend strategy. You are a treasure!