In September of 2017, I received slightly over $100K from my former employer, representing the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

This month, I did my portfolio yearly review. Which actions will I take?

Performance in Review

Let’s start with the numbers as of November 2nd, 2023 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $221,143.06

- Dividends paid: $4,505.79 (TTM)

- Average yield: 1.95%

- 2022 performance: -12.08%

- SPY= -18.17%, XIU.TO = -6.36%

- Dividend growth: +10.83%

Total return since inception (Sep 2017-Nov 2023): 112.52%

Annualized return (since September 2017 – 75 months): 12.82%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 12.26% (total return 106.02%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 8.59% (total return 67.35%)

Portfolio Yearly Review

This is a recurring question: Mike, how often do you make transactions in your portfolio?

My answer is “about once a year, max.”

I’ve spent so much time reading books, studying stocks, and experimenting with the stock market that I know I can trust my process above anything else. I don’t need to track stock price each quarter or since their last all-time-high. I know stocks go down and trading based on recent performance is a really bad idea.

I’ll repeat this: trading based on short-term stock performance is a really bad idea.

Ideally, I wouldn’t even trade once a year. But unfortunately, companies change, the environment evolves and the market is always different.

About two years ago, houses were being sold within a week and well over the asking price. My interest rate on my line of credit was around 3%. Algonquin was a dividend grower.

Yes, it’s frustrating, but things don’t remain the same. As investors, we must adapt and make necessary changes in our portfolio.

This includes making upsetting decisions. This is what I am about to do this year.

But first, let’s discuss my portfolio’s yearly revision process.

Monitor quarterly, act yearly

First, know that I solely use Dividend Stocks Rock PRO tools to monitor and analyze my portfolio. It’s a shameless plug, but I’ve built those tools to help people invest with more conviction, and I’m included in that group!

Each quarter, I generate my PRO report and read each company’s earnings review. I take mental notes of what is happening in my portfolio.

Disney & CAE are still not paying dividends.

Alimentation Couche-Tard, Apple, and Microsoft are steadily growing in value and becoming a much larger percentage of my total portfolio.

My exposure to the financial sector and technology sector is above 20%.

When I get to my yearly review, there will be no surprises. I will still come to the same conclusions (but Disney just reinstated a small dividend!). More on that later.

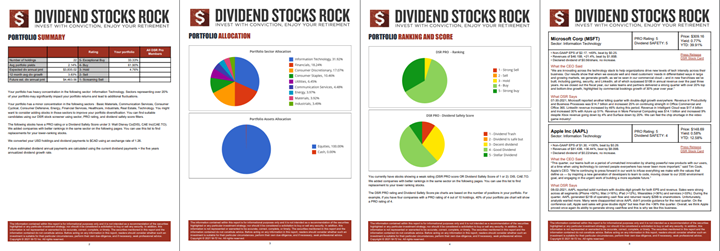

Sector allocation review

What I report monthly is my pension plan. However, I do have other portfolios for my retirement. Therefore, I never act on my pension plan’s sector allocation graph, but rather on my global view:

I’m slightly overweight in the Information Technology sector (26%). It’s not the end of the world, but I won’t be surprised if there is a tech crash that my portfolio won’t do well. As interest rates are likely to hit a plateau soon, chances are that it’s a good thing to be invested in tech stocks.

Stock allocation review

Once I’ve reviewed my sectors, I’m looking at my largest and smallest positions in my portfolio. I look at my top holdings as I want to minimize my exposure to risk. Having a stock at 10% of my portfolio is also having a stock that could cripple my portfolio by 5% assuming a 50% stock price drop. On the other hand, I look at my smallest positions too. Having a stock at 0.70% of my portfolio won’t move the needle one way or another. If it doubles, I won’t notice a 0.70% increase in my portfolio. If it crashes and burns, I won’t notice a 0.35% hit to my portfolio’s value.

My three largest positions are MSFT, ATD.TO and AAPL.

Again, I must look at my global view to determine if I must trim some of my winners. When I combine all my portfolios, I see that AAPL is back on top with 12% of my investments and ATD.TO is at 10.21%. During the holidays, I’ll have to sell some of each of them to relevel my portfolio.

My three smallest positions are Magna International (2.24%), CAE (2.37%) and Disney (2.47%). Not a big surprise there. When I look at my global view, they are all closer to 1% each. At this point, I could actively debate whether or not they deserve a spot in my portfolio at all.

Ratings review

The last step is to look at my ratings. I often say it, but I’ll say it again: No rating system is perfect and no one should ever buy or sell stocks based on some rating (DSR’s or any other rating system). Why? Because ratings are imperfect. They track certain metrics, ignore others, and give weight to more factors than others.

The purpose of a rating system is to raise red flags.

In my pension plan portfolio, I have three companies with weaker ratings. CAE and Disney as they don’t pay dividends and Magna at 3 due to its lower dividend increase in 2023. I don’t mind keeping Magna as they recently improved their margins and showed better numbers.

As for CAE and Disney, I have been contemplating moving on from them for too long already.

Making upsetting decisions

I haven’t pulled the trigger yet on either stock as I’m in the middle of several projects at DSR. I always put my membership first, even before my own portfolio. I know I’ll have time to think clearly during the Holidays, but I’m 90% sure I’ll sell CAE and Disney.

At the end of November, Disney brought its dividend back with a small $0.30/share declaration. The question is: Do I really want to keep wondering if Disney should fit in my portfolio when it’s less than 2% of my global investments and only 2.5% of my pension plan?

Let’s be realistic: Disney could go bankrupt tomorrow and I wouldn’t even feel it in my portfolio.

So, what’s the point of holding a few questionable shares anyway?

Selling those two companies will be upsetting, nonetheless. It’s upsetting because I still believe in my investment thesis. CAE is not doing that badly and I’ll be selling with a small profit. Disney is not doing that great and I’ll be selling at a small loss.

It’s upsetting to sell companies where you have had strong faith in their prospects. It’s also upsetting to acknowledge that, so far, they have not met my expectations in my portfolio.

However, spending so much time thinking about such a tiny portion of my portfolio isn’t efficient. By selling both companies, I’ll lose about $200 in total and I’ll have cash to reallocate in more productive ways. That money will be invested in support of my investment strategy which is to find dividend growers. I will strengthen my portfolio and improve my conviction in my portfolio.

I will also trim a few basis points from my top winners. I did that in the past with great results (such as selling shares of Apple and Microsoft at their peak value of 2021 to buy Activision Blizzard three weeks before Microsoft offered $95 a share to buy it!).

Trust the process

By trimming Apple (~3%) and Microsoft (maybe ~1%), I’ll reduce my exposure to tech stocks and I’ll sell shares at a very high price. I’ll also sell a few shares of Alimentation Couche-Tard (~2%).

By combining those transactions with the proceeds from CAE and Disney, I’ll have enough to enter into two new positions in my portfolio.

Again, I’m upset that I will have to sell CAE and Disney, but trusting my process is more important. The investment process is built on research and rationale. My “love” for stocks and my “beliefs” are nothing more than a story I tell myself. I must protect my portfolio from my emotions.

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 9 companies spread across 7 sectors. My goal is to build a portfolio generating 4-5% in yield across 15 positions. I will continue to add new stock monthly until I reach that goal. My current yield is 4.89%.

Adding 11 shares of Exchange Income Fund (EIF.TO) @ $45.88

Exchange income reported a mixed quarter as revenue increased by 17%, but EPS decreased by 11%. Revenue in the Aerospace & Aviation and Manufacturing segments grew by $51M and $50M, respectively. Aerospace & Aviation revenue growth (+14%) was supported by increased passenger traffic marking a return to normal passenger movements in the north and expanded routes along the East Coast. Manufacturing revenue growth (+22%) was supported by recent acquisitions. As earnings jumped by 13%, Adjusted EPS declined by 11% as the company raised capital by issuing more shares recently. The capital was used partially for acquisitions and the rest will be deployed on future long-term contracts.

Here’s my SM portfolio as of December 6th, 2023 (after the close):

| Company Name | Ticker | Sector | Market Value |

| Brookfield Infrastructure | BIPC.TO | Utilities | $876.40 |

| Canadian National Resources | CNQ.TO | Energy | $935.99 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $428.85 |

| Exchange Income | EIF.TO | Industrials | $1,018.16 |

| Great-West Lifeco | GWO.TO | Financials | $742.05 |

| National Bank | NA.TO | Financials | $563.52 |

| Nutrien | NTR.TO | Materials | $943.15 |

| Telus | T.TO | Communications | $972.42 |

| TD Bank | TD.TO | Financials | $1,151.64 |

| Cash (Margin) | $23.06 | ||

| Total | $7,655.24 | ||

| Amount borrowed | -$7,500.00 |

Let’s look at my CDN portfolio. Numbers are as of December 1st, 2023 (after the close):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | Cons. Staples | $27,617.87 |

| Brookfield Renewable | BEPC.TO | Utilities | $9690.48 |

| CAE | CAE.TO | Industrials | $5,514.00 |

| CCL Industries | CCL.B.TO | Materials | $8,058.40 |

| Fortis | FTS.TO | Utilities | $9,377.64 |

| Granite REIT | GRT.UN.TO | Real Estate | $9,021.44 |

| Magna International | MG.TO | Cons. Discre. | $5,260.50 |

| National Bank | NA.TO | Financials | $11,407.88 |

| Royal Bank | RY.TO | Financial | $7,991.10 |

| Cash | $619.05 | ||

| Total | $94,558.36 |

My account shows a variation of +$2,633.73 (+2.90%) since the last income report on November 2nd.

Here’s a quick review of companies that declared their earnings in November.

Alimentation Couche-Tard was quiet for once… but the dividend growth was outstanding!

It was a quiet quarter for Couche-Tard as revenue declined by 3% and adjusted EPS remained flat. Same-store merchandise revenues decreased by 0.1% in the United States, by 0.2% in Europe and other regions, and increased by 1.6% in Canada. Revenues were affected by lower fuel sales (Same-store Road transportation fuel volumes decreased by 1.5% in the United States, by 0.9% in Europe and other regions, and increased by 3.0% in Canada.). The company announced the acquisition of 112 MAPCO sites, accelerating our development in key markets in Alabama, Georgia, Kentucky, Mississippi and Tennessee. The company announced a massive dividend increase of 25%!

CAE is doing well, but is ignoring dividends

CAE reported a solid quarter with revenue up 10% and EPS up 42%. Civil Aviation revenue was up 13%. During the quarter, Civil delivered 11 full-flight simulators (FFSs) to customers and second quarter Civil training centre utilization was 71%. Defense and Security revenue was up 8%. Defense booked orders for $527.3 million and an additional $155.5 million of unfunded contracts this quarter. The company also announced that it will sell its Healthcare division for $311M. No mention of a dividend being declared.

CCL Industries isn’t moving the needle

CCL Industries reported modest growth this quarter with both revenue and EPS up 2%. Sales growth was driven by acquisitions (+2.6%), favorable currency translation (+5.4%), and partially offset by an organic sales decline of 6%. In other words, CCL reported negative sales growth of -3.4% in neutral currency (not that good!). Management highlighted soft demand in the market and customers reducing their inventories to justify the lower organic sales. However, productivity gains pushed EPS higher. CCL expects to go through a few tough quarters ahead. This explains the pressure on the stock price. It could end-up being a nice opportunity!

Granite REIT keeps growing fast

Granite REIT reported another solid quarter while its stock price continued to feel pressure. Revenue was up 18% and AFFO per unit was up 12%. AFFO was driven by acquisition and also by favorable currency fluctuation (for $0.06/unit). The REIT also announced a 3.125% distribution increase, congratulations! The AFFO payout ratio was at 73% this quarter vs 80% a year ago. The REIT increased its number of properties by 9 vs. last year and still shows a very solid occupancy rate (95.6%). It’s exposure to Magna International is now down to 25% (from 26% last year).

National Bank is definitely the best!

National Bank reported the best results among the Big Six with revenues up 11% and EPS up 17%. The bank also increased its dividend by 4% (its second dividend increase this year). Provisions for credit losses increased from $87M to $115M (+32%), but it wasn’t enough to slow down the small bank. By segments: P&C net income was down 14%, affected by higher non-interest expenses and PCLs. Wealth Management was down 20%, also affected by higher expenses and PCLs. Where did their growth come from? Financial Markets at +40%! Growth was fueled by global market revenues and investment banking activities. US & Intl was up 10%, driven by Credigy’s strong performance.

Royal Bank isn’t doing bad either

Royal Bank’s results were saved by their Capital Markets and Insurance segment. The bank reported flat EPS and revenue up 3.7%. Total PCL of $720M increased $339M or 89% from a year ago, primarily reflecting higher provisions in P&C and Capital Markets. Results by segment: P&C -2%, driven by higher PCLs, but supported by higher volume growth (+7%). Wealth Management was down 74%, driven by impairment losses related to City National. Insurance was up 8% on lower claims and Capital Markets were up 36%, driven by lower taxes (this won’t be recurring). Royal Bank offered a second dividend increase this year of 2.2%.

Here are more details on Canadian Banks Q4-2023 Earnings:

Here’s my US portfolio now. Numbers are as of November 2nd, 2023 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $14,343.00 |

| BlackRock | BLK | Financials | $10,588.90 |

| Brookfield Corp. | BN | Financials | $12,402.88 |

| Disney | DIS | Communications | $4,166.10 |

| Home Depot | HD | Cons. Discret. | $9,588.60 |

| Microsoft | MSFT | Inf. Technology | $20,598.05 |

| Starbucks | SBUX | Cons. Discret. | $8,432.00 |

| Texas Instruments | TXN | Inf. Technology | $7,760.50 |

| Visa | V | Inf. Technology | $12,822.50 |

| Cash | $508.81 | ||

| Total | $101,211.34 |

My account shows a variation of +$6,731.81 (+7.13%) since the last income report on November 2nd.

Here are the last companies to report earnings in November:

Brookfield Corp. is steady

Brookfield reported an okay quarter as revenue increased by 5%, but distributable earnings per share remained flat. Insurance solutions distributable earnings were up 14% as insurance assets increased to ~$50B. The average investment portfolio yield was 5.5%, about 200 basis points higher than the average cost of capital. It continues to track towards reaching $800M of annualized earnings by the end of 2023. Operating businesses earnings declined by 8% but funds from operations were supported by a stronger performance from the renewables and infrastructure segments. The Asset management segment was up 13% and BN ended the quarter with $120B to invest.

Disney’s dividend is back – barely

Disney reinstated its dividend! But don’t hold your breath as we are talking about only $0.30 per share. Revenue was up 5% and EPS jumped from $0.30 to $0.82. The company is on track to hit $7.5B in annualized cost savings, some $2B better than expected. Disney + added 7M subscribers and reached the 150M mark. Domestic Disney+ average monthly revenue per paid subscriber increased from $7.31 to $7.50 due to higher advertising revenue. Revenues by segment: Entertainment, $9.52B (up 2%); Sports, $3.91B (flat); Experiences, $8.16B (up 13%). Operating income by segment: Entertainment, $236M (vs. year-ago loss of $608M); Sports, $981M (up 14%); Experiences, $1.76B (up 31%).

Home Depot – short term pain

Home Depot reported declining numbers as revenue was down 3% and EPS was down 10%, but it was in line with management’s expectations. Comparable sales were down 3.1%. Average sales per ticket fell 0.3% to $89.35, while sales per retail square foot were down 3.7% to $595.71. Customer transactions were down 2.4%. Comparable sales in the U.S. fell 3.5% vs. -3.7% consensus. During the quarter, Home Depot (HD) noted that it saw continued customer engagement with smaller projects, and experienced pressure in certain big-ticket, discretionary categories.

Here’s my full investment thesis and review on Home Depot:

My Entire Portfolio Updated for Q3 2023

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of October 3rd, 2023.

Download my portfolio Q3 2023 report.

Dividend Income: $422.69 CAD (-81% vs November 2022)

That was a normal month with regular increases across the board. I received dividends from six companies, all higher than last year. Here are the details of my dividend payments.

Dividend growth (over the past 12 months):

- Granite: +3.2%

- National Bank: +10.87%

- Royal Bank: +14.26

- Texas Instruments: +4.84%

- Apple: +4.35%

- Starbucks: +7.54%

- Currency: flat

Canadian Holding payouts: $245.30 CAD.

- Granite: $34.13

- National Bank: $123.42

- Royal Bank: $87.75

U.S. Holding payouts: $131.45 USD.

- Texas Instruments: $65.00

- Apple: $18.00

- Starbucks: $48.45

Total payouts: $422.69 CAD.

*I used a USD/CAD conversion rate of 1.3495

Since I started this portfolio in September 2017, I have received a total of $23,417.23 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

I have not exercised any trades yet, but you know they will come. I’ll put the final touches to my portfolio in the coming weeks when the market will hopefully be calmer (as will be my life!). I like to reflect and take action on my investments with a good cup of coffee in hand when I can also be looking at the snow falling outside.

There never needs to be a rush to make decisions. The key is to determine a specific time of the year to make trades and act accordingly.

Again, trust the process.

“The purpose of setting goals is to win the game. The purpose of building systems is to continue playing the game. True long-term thinking is goal-less thinking. It’s not about any single accomplishment. It is about the cycle of endless refinement and continuous improvement. Ultimately, it is your commitment to the process that will determine your progress.”

– James Clear

Cheers,

Mike.

Hello Mike =- I have two questions

(1) In your SM portfolio, besides your yield objective of 4-5% , do you have a market value growth and dividend growth objective or expectation ?

(2) Your CAD portfolio is about $94K and your US portfolio is about $101K – if you had the same amount in cash right now and ready to invest today, would you choose the same stocks and weight ? would you buy them all at once ?

Thanks.

Hello Jose!

Sorry for the late reply, I took some days off 😉

#1 I plan all my account growth using 6.5%. It’s conservative, but that’s the point 🙂

#2 I would invest in equally weight positions (this is how I invested the lump sum amount the first time) about 50-50 CAD-USD and all in one shot. But that’s just me 🙂