Usually, when your arm itches, you simply scratch it a little bit with the tip of your finger and are fine a few minutes later. You simply move on and don’t even think about it. Unless it keeps itching and starts to drive you crazy. At what point would you “give-up” and jump in your car to go to the drugstore to get something strong to calm the itch?

This is about the same thing that could happen in your portfolio with underperforming stocks. Sometimes, you have 1 or more stocks that are not performing at the level you want. Surely it bugs you. But if your overall portfolio is doing well and you don’t lose too much with this particular stock, you may ignore the “problem” and get back to your life. But at one point, you will have to take care of it if the stock continues to drop. But when is the right time to get rid of an underperforming stock?

Do you use a specific metric to trigger your transaction such as Dividend payout ratio, ROE, sales or revenue growth?

Do you put stop sell at a specific price to avoid losing more than X%?

I have a more complex system to determine if I should sell a stock. I personally prefer doing a “case by case” scenario. This means that, once in a while, I stop what I am doing and pull out the numbers and look at the “bad guys”. This is when I decide if I should keep or sell the underperforming stocks. Curious about how I do it? Let’s take my current portfolio as an example. You can see my dividend holdings here (note: stocks prices are not often updated…). I currently have 4 major losers in my portfolio. Here’s the list as of Feb 21st:

VNP: -24.44%

BNS: -10.21%

ZWB: -12.73%

HSE: -6.05%

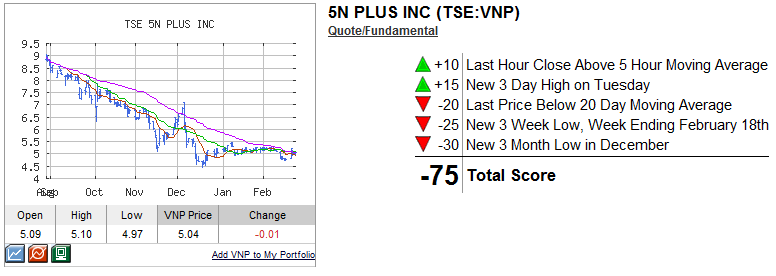

5 N Plus – VNP

The VNP drop in 2011 is a bit of a mystery to me. I agree that the price of rare metals has gone down and that VNP bought a European company during one of their biggest recessions. However, the stock is currently trading at a 9.57 P/E ratio and 6.40 forward P/E ratio. The integration of MCP is going well and their profits are surging. I still believe that rare metals is a great sector and VNP is definitely a leader in their field. I think the stock is very sensitive in regards to any news coming from Europe at the moment. For example, the stock surged 8% on Feb 21st, the same dayGreece settled another step with the Euro.

Decision: VNP is a keeper

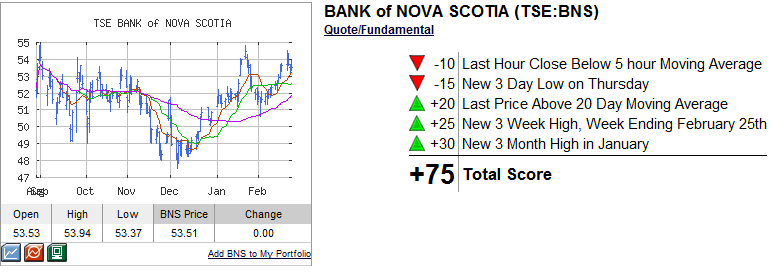

ScotiaBank – BNS

ScotiaBank has been the worst performing Canadian bank in 2011 and by far! I would have been better keeping all my cash in the National Bank (NA) which did great. But I wanted to diversify… I just didn’t pick the right stock for the moment ;-). However, I can’t say thatBNSdidn’t do well in 2011 with a record profit year. All indicators are up and management decided to not increase its dividend to pursue acquisitions. I like this idea since they will use their money to increase the value of the company through profitable projects. So while I’m annoyed by the drop, I’ll keepBNSfor now.

You can get a free Trend Analysis Report on any stocks here.

Decision: BNS is a keeper

Covered Call ETF – ZWB

At first, I thought the idea of a covered call ETF was a sexy addition to my portfolio: the point was to add a solid dividend paying tool that would be linked to Canadian banks. I liked the theory and how it was going to be applied in the real word (basically getting a premium dividend to hold the big 6). However, this was a new product and the theory wasn’t tested on the market. After a year, here’s the result: (click on the image to get a bigger screen):

All right, ZWB lost 10.21%… which is worse than all bank stocks besides BNS(man, I really have a talent to pick bad stocks sometimes ;-)). So I thought “wait! ZWB is paying a killer dividend, so I might be all right!”… wrong! Over the past year, ZWB had paid a total of $1.41/share in dividends (which makes a 8.90% dividend yield on its price of $15.84 a year ago). So the total return over a year was -1.31%… notTOO bad, but not AMAZING either. Especially when I look at individual stock returns.

When I think about it, searching for stability in my portfolio doesn’t make much sense. I’ve already addedJNJand KO for that reason. I think I should pursue more growth instead of trying to hide behind a huge dividend (which had decreased since I bought the stock!). I think I’ll sell ZWB in 2012. It’s just a matter of finding another interesting stock to buy prior to getting rid of the stock. Do you have any suggestions?

You can get a free Trend Analysis Report on any stocks here.

Decision: ZWB is about to get sold!

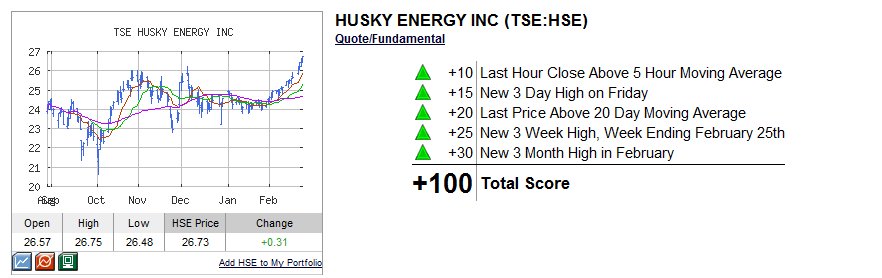

Husky Energy – HSE

Husky has failed to meet financial analyst expectations during the years prior to 2011. It is also true that the rocky oil prices don’t help. However, recent earnings reported early in February are comforting me.HSEshowed a 135% profit increase along with 9% production growth. But they recently announced they were expecting a flat year in 2012. They need to pursue maintenance work on 2 platforms and don’t expect much profit from natural gas. Man… no great news is coming a t all!

Nonetheless, I’ve decided to keepHSEfor 2 reasons.

1) The dividend payout is very high and the dividend payout is sustainable for now (roughly 85%)

2) The P/E ratio is pretty low (currently at 10.92). I’m pretty sure that the stock price won’t go down too much in this situation.

You can get a free Trend Analysis Report on any stocks here.

Decision: HSE is a keeper

Have you cleaned up your portfolio recently?

I’m curious to know what method you use to get rid of your underperforming stocks?

Good article. I would just buy good solid blue chip dividend payers, add to them on down days or DRIP, and keep them forever, unless fundamentals change dramatically. The power of compounding dividends!!

@Michel,

you are right, sometimes it’s worth it to be more patient with dividend stocks due to the continuous dividend raise!

I think BNS will be fine as well, Mike. I hope they increase their dividend this year though.

They do offer a discount when you reinvest dividends in its shares, and I feel like this dilutes the value of the shares each time. [I don’t have enough shares for the synthetic DRIP, and I’m too lazy for the real DRIP =) ]

Peter

You asked about a growth stock in place of ZWB. I really like Suncor (SU) and just bought it. It has a low dividend (1.31% yield I think) but the dividend has increased for the past couple years and I think they are in a good position to grow. You already have Husky though so it might be too much oil for you.

So far I haven’t gotten rid of any under performers. I have CPD which I bought for the yield but it has lost a bit. With the dividend I am fine to wait, but I do want to get rid of it when I find another dividend payer with growth potential and a good yield at a low price (might be waiting a while).

Thoughtful selling is highly correllated to thoughtful buying. If the company hasn’t shown a history of consistent profitability, then I’m not going to add it in the first place.

Now, that said, I have bought companies that have started to become less profitable over time, and the share price slides along with it. In those cases, I will let them go for a while, as long as it takes to get to at least a -20% loss. When the market punishes a stock when the company is being bad, that’s just the market doing it’s job. It’s being efficient. So I’ll buy more. And I’ll continue to do that in gradual amounts until the next bull market comes along, and then I’ll sell when the stock is irrationally priced too high. Because bull markets are not efficient.

Now I do have limits. If the company has taken a lot of debt on during it’s decline then it needs to go. There has to be some reasonable expectation that a recovery can happen. To just say that what goes down must come up is simply not true. In almost every case, I will cost average long before selling, and that strategy has never let me down.

Dg, your underperformers have downside, either being speculative, economically sensitive or out of favor sector. In not surprised these can go either way.

My portfolio has a few positions which all performed well. My one comparative loser was PAYX which has started to perform due to economic growth. Sometimes you need to wait.

I also focus on buying long term companies and will average down rather than selling. When I sell, it’s mostly because I am adjusting my sector exposure and usually it means I am selling at a profit.

For example, I just added to PWF in my TFSA since it was down due to the lifeco (GWO namely).

Personally, I prefer to own the 6 major banks on my own than going through ETF/mutual funds. I have more control over my decision to add and what I do with the dividends.

I sell when and if a stock loses 15% to 20% of it’s value from it’s high. Be it from a week ago or a year ago. I wait to a max of 20% if I feel the stock is a blue chip like a bank. I feel that if something is able to change the minds of investors in such a way that the price loses 15% or more, it must be something important, even if I do not know what it is.

These numbers are based on my past experience and I expect to be right 8 times on 10.

I will never let my holdings slide down 50% plus, like I did in 2007 to 2009.

@Nean,

how does it go so far with this strategy? Aren’t you afraid that you are letting money on the table when there is a global market crash when 2008 where every single stock (good or bad) dropped by 30-40%?

Tsk Tsk Mike

How did a non dividend paying stock, VNP, make it in to your portfolio?

It is just speculation then. You are betting on the market, or in this case, the price of metal hoping it will affect the share price.

Hey Richard,

I’m guilty of my “previous investor life” where I was taking a lot more risk that I do now ;-). I’m still convinced that this play will make money… It’s a solid company and metal prices will go up!

I just have to wait now